A little theory about filling out the RSV

The calculation form for insurance premiums (DAM) and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Procedure).

The calculation of the amounts of insurance premiums is reflected:

- in subsection 1.1 of Appendix No. 1 to Section 1 - for contributions to pension insurance;

- in subsection 1.2 of Appendix No. 1 to Section 1 - on health insurance contributions;

- in Appendix No. 2 to Section 1 - on social insurance contributions.

The RSV form reflects payments, both subject to insurance contributions and non-taxable.

- Payments subject to insurance premiums are listed in paragraphs 1 and 2 of Article 420 of the Tax Code of the Russian Federation. These payments are shown in lines 030 of subsections 1.1 and 1.2 of Appendix No. 1 and in line 020 of Appendix No. 2.

- Non-taxable payments are reflected in lines 040 of subsections 1.1 and 1.2 and 030 of Appendix No. 2. These are payments that are exempt from insurance premiums on the basis of Article 422 of the Tax Code of the Russian Federation.

- Payments that are the basis for calculating insurance premiums for compulsory pension, medical and social (at VNIM) insurance. These payments are reflected in lines 050 of subsections 1.1 and 1.2 of Appendix No. 1 and Appendix No. 2 to the calculation.

More on the topic:

Features of filling out the DAM for the 1st half of 2022

When to submit the calculation in 2022

The deadline for submitting the calculation is the same for all employers: the DAM is submitted no later than the 30th day of the month following the reporting period. They report 4 times a year, the information in the calculation is formed on an accrual basis: for 1 quarter, for six months, for 9 months and for the year.

Deadlines for submitting calculations in 2022:

- for the 4th quarter of 2022 (per year) - until 01/31/2022 (01/30 - Sunday);

- for the 1st quarter of 2022 - until 05/04/2022 (04/30 - Saturday);

- for the six months - until 08/01/2022 (07/30 - Saturday);

- 9 months - until 10/31/2022 (10/30 - Sunday);

- for 2022 - until 01/30/2023.

IMPORTANT!

In 2022, a new DAM form will be used for reporting insurance premiums. The current order of the Federal Tax Service on approval of the calculation will no longer be valid. More details: The Federal Tax Service will change the form of calculation of the DAM.

How to reflect an employee’s income from renting out a car in the RSV

If an employee is paid the remuneration stipulated by the contract under a car rental agreement, these amounts are not subject to insurance premiums on the basis of paragraph 4 of Article 420 of the Tax Code of the Russian Federation.

Payments and other remuneration within the framework of contracts related to the transfer of property for use are not recognized as the object of taxation of insurance premiums.

Amounts of remuneration paid to the employee under a vehicle lease agreement are not taken into account when filling out section 1 of the DAM.

But, when filling out section 3, subsection 3.1 of the calculation, you must indicate information about the employee (full name, gender, date of birth, etc.), since an employment contract has been concluded with him and he is an insured person. But remuneration paid to the employee under a vehicle rental agreement does not need to be reflected in subsection 3.2. Since, as mentioned above, these amounts are not subject to insurance premiums.

Filling out Section 3

To be completed in relation to all employees who received payments under employment and civil law contracts in the reporting period of 2022.

Procedure for filling out Section 3 of the DAM

| Line | What do they indicate? |

| 010 | Sign of cancellation of information about the insured person (indicate “1” when canceling previously submitted information about this insured person, as well as when adjusting data on lines 020-060). When filling out the RSV for the first time, this field is not filled in |

| 020-070 | Employee information: TIN, SNILS, full name, date of birth |

| 080 | Code of the country of which the employee is a citizen. For the Russian Federation - code “643”. The list of codes for other countries is given in the All-Russian Classifier of Countries of the World (OKSM). If the employee does not have citizenship, indicate the code of the country that issued him the identity document |

| 090 |

|

| 100 | Identity document code:

* See below for a complete list of codes |

| 110 | Employee's passport details. The number sign is not placed (the number is separated from the series by a space) |

| 120 | Numbers of three months of the last quarter: 1, 2, 3 |

| 130 | Insured person category code. It can be clarified in Appendix No. 7 to the Filling Out Procedure (for example, “NR” denotes persons who are covered by compulsory pension insurance, including those who are employed in a workplace with special (difficult and harmful) working conditions, for whom insurance premiums are paid according to the main tariff) |

| 140 | Monthly payment amount to employee |

| 150 | The base for contributions to compulsory pension insurance is within the limit (RUB 1,292,000 in 2020) |

| 160 | Amount of payments under the GPC agreement (if any) |

| 170 | The amount of contributions from a base not exceeding the limit of RUB 1,292,000. (for OPS) |

Block 3.2.2 is filled out only if in the reporting period of 2022 payments were made that were subject to contributions to compulsory pension insurance at an additional tariff.

Codes for completing Section 3

Financial assistance in the form of RSV

Financial assistance paid to employees in an amount of no more than 4,000 rubles is not subject to insurance contributions on the basis of subparagraph 11, paragraph 1 of Article 422 of the Tax Code of the Russian Federation.

Amounts of financial assistance provided by employers to their employees that do not exceed 4,000 rubles per employee per billing period are not subject to insurance premiums.

Accordingly, financial assistance not exceeding 4,000 rubles is reflected in Appendix 1 and Appendix 2 of the DAM on the following lines:

- 030 subsections 1.1 and 1.2 of Appendix No. 1;

- 040 subsections 1.1 and 1.2 of Appendix No. 1;

- 020 application No. 2;

- 030 application No. 2.

We fill out subsection 1.1 of Appendix No. 1

Rules for filling out subsection 1.1 of Appendix No. 1 of the RSV

| Line | What do they indicate? |

| 001 | Contribution payer tariff code. You can find it in Appendix No. 5 to the Filling Out Procedure. The codes used when filling out the DAM for the first half of 2022 are given below |

| 010 | From left to right - the total number of insured employees, regardless of whether they received income in the reporting period:

|

| 020 | From left to right - the number of employees who were paid income subject to compulsory pension contributions:

|

| 021 | If during the reporting quarter the employee's income exceeded the maximum base for contributions, show their number in the columns of this line. In 2022, the maximum base for contributions to compulsory pension insurance is RUB 1,292,000. |

| 030 | The amount of payments to employees subject to contributions to compulsory pension insurance:

This line does not include payments that are not subject to insurance premiums: dividends, material benefits, payments under lease agreements or upon the sale of property (Letter of the Federal Tax Service of Russia dated 08.08.2017 No. GD-4-11 / [email protected] , Letter of the Ministry of Health and Social Development dated 05/19/2010 No. 1239-19). Example of filling out page 030: |

| 040 | If any payments during the year were not subject to contributions to compulsory pension insurance, they are reflected in the columns of this line in the same order as we reflected contributions on page 030 |

| 045 | This line shows the amounts:

|

| 050 | Contribution base for half a year and April-June 2022. It is calculated using the formula: page 030 - page 040 - page 045 |

| 051 | Contribution base exceeding the maximum limit |

| 060 | The amount of calculated insurance premiums, calculated according to the formula: line 050 x tariff. Page 060 = page 061 + page 062 |

| 061 | The amount of insurance premiums calculated for the first half of 2022 from a base not exceeding the limit of RUB 1,292,000. Calculated using the formula: (050 - 051) x tariff |

| 062 | The amount of contributions calculated from a base exceeding the limit. Calculated using the formula: line 051 x per tariff |

Codes for filling out subsection 1.1 of Appendix No. 1

INSURANCE PAYER TARIFF CODES

| 01 | Payers of insurance premiums applying the basic tariff of insurance premiums |

| 06 | Payers of insurance premiums operating in the field of information technology |

| 07 | Payers of insurance premiums who make payments and other remuneration to crew members of ships registered in the Russian International Register of Ships for the performance of labor duties of a ship crew member |

| 10 | Payers of insurance premiums are non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying the simplified tax system and carrying out activities in accordance with the constituent documents in the field of social services for the population, scientific research and development, education, healthcare, culture and art (the activities of theaters, libraries, museums and archives) and mass sports (except professional) |

| 11 | Payers of insurance premiums are charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying the simplified tax system |

| 13 | Payers of insurance premiums who have received the status of project participants for the implementation of research, development and commercialization of their results in accordance with the Law of September 28, 2010 No. 244-FZ or project participants in accordance with the Law of July 29, 2017 No. 216-FZ |

| 14 | Payers of insurance premiums who received the status of participant in the free economic zone in accordance with Law dated November 29, 2014 No. 377-FZ |

| 15 | Payers of insurance premiums who have received the status of resident of the territory of rapid socio-economic development in accordance with Law dated December 29, 2014 No. 473-FZ |

| 16 | Payers of insurance premiums who have received the status of resident of the free port of Vladivostok in accordance with Law No. 212-FZ dated July 13, 2015 |

| 17 | Payers of insurance premiums are organizations included in the unified register of residents of the Special Economic Zone in the Kaliningrad Region in accordance with Law No. 16-FZ dated January 10, 2006 |

| 18 | Payers of insurance premiums are Russian organizations engaged in the production and sale of animated audiovisual products produced by them, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products |

| 19 | Payers of insurance premiums who received the status of a participant in a special administrative region in accordance with Law dated 03.08.2018 No. 291-FZ |

Advance payment under a civil contract in the form of DAM

Based on paragraph 1 of Article 420 of the Tax Code of the Russian Federation, payments in favor of individuals, including under civil contracts, are subject to insurance premiums. Contributions for compulsory social insurance in case of temporary disability and in connection with maternity are not accrued for benefits under the GPA on the basis of subparagraph 2 of paragraph 3 of Article 422 of the Tax Code of the Russian Federation.

A civil contract may provide for prepayment, including as a separate stage. Moreover, according to Article 424 of the Tax Code of the Russian Federation, the date of payments is determined as the day of accrual.

Thus, calculating insurance premiums from an advance payment and reflecting this amount in the DAM is possible only if payment is made for work performed, payment for a stage. Calculating contributions from an advance payment will not be a violation of the law.

The organization is obliged to accrue and pay contributions at the time of payment of remuneration after signing the act.

In the DAM form, payments under civil contracts are reflected on lines 030 of subsections 1.1 and 1.2 of Appendix No. 1. At the same time, they do not need to be reflected on line 020 of Appendix No. 2.

Important news on the topic:

Control ratios for DAM updated again

How to fill out for the 1st half of 2022

The calculation using the DAM form contains data on insurance premiums for compulsory insurance (medical, social, pension). Information is provided for the last quarter and for the entire period since the beginning of the year.

When filling out the report for the half-year of 2022, it is necessary to reflect information on contributions for the 2nd quarter (April, May, June) and for the first 6 months from January to June inclusive.

The employer needs to fill out the following sheets of the DAM form for the first half of the year:

- title page - the first page, which traditionally provides general information about the policyholder and the report being submitted;

- section 1 - summary information on insurance amounts payable to the budget for the half-year and for the 2nd quarter with monthly detail;

- section 2 and the appendix to it - only the heads of peasant farms are filled out;

- section 3 - all policyholders fill in with personalized data about each insured person.

There are also 9 appendices for the first section; everyone needs to fill out at least the first two, the rest if you have the appropriate data:

- 1 - contains two subsections, which provide the calculation of contributions for compulsory pension and health insurance for the half-year and for the 2nd quarter with monthly detail, based on payments made to insured persons;

- 2 - calculation of social contributions for temporary disability and maternity for six months and for the last 2 quarter;

- 3 - the page was previously filled out only if there were maternity payments and sick leave, since in 2022 there was a transition to direct payments from the Social Insurance Fund, this section does not need to be filled out even if employees have sick leave. Sick leave paid by the employer for the first 3 days of illness at his own expense is reflected in Appendix 1 and 2 as payments not subject to insurance premiums;

- 4 - the page is filled out only when benefits are paid in excess of the established amounts for compulsory social insurance (payments from the federal budget to victims of the disaster at the Chernobyl nuclear power plant, Mayak PA, nuclear tests, radiation accidents;

- 5 - the page is filled out by those persons who have the right to reduced contribution rates based on paragraphs. 3 p. 1 art. 427 Tax Code of the Russian Federation (IT companies);

- 6 - the sheet is filled out only by those policyholders who have the right to reduced premiums based on paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation (non-profit organizations on the simplified tax system, carrying out social service activities in the field of education, science, medicine, culture, art);

- 7 - the sheet is filled out only by persons entitled to reduced contributions on the basis of paragraphs. 15 clause 1 art. 427 Tax Code of the Russian Federation (animation industry);

- 8 - sheet for reflecting information for applying the tariff from paragraph. 2 pp. 2 p. 2 art. 425 of the Tax Code of the Russian Federation (contributions to VNIM in relation to foreign workers and stateless persons);

- 9 - sheet for reflecting payments to students.

After filling out the DAM calculation, you need to check the correctness of the format using the control ratios from the Letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11/2002.

Instructions for filling out for the 2nd quarter of 2022

The title page of the RSV form is filled in with the following information:

- TIN, checkpoint for organizations, only TIN for individuals registered as individual entrepreneurs, peasant farms, lawyers, notaries;

- number of the completed calculation page - 001;

- adjustment - 0, which means primary supply;

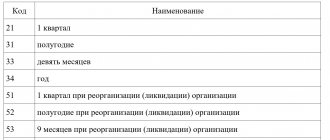

- 31 - period code for half a year;

- year 2021;

- four-digit number of the Federal Tax Service branch where insurance premium payments are submitted;

- the location code is determined in accordance with Appendix 4 to the Procedure for filling out the calculation (for example, for legal entities submitting a report at their location, you need to indicate 214, and for individual entrepreneurs submitting a report at your place of residence - 120);

- full name of the organization or full name of the individual entrepreneur/head of the peasant farm/lawyer/notary;

- average headcount - the value calculated according to the statistical rules for the 1st half of 2022 (new line in the DAM form), there is no need to fill out a report on the average headcount separately, the calculation rules can be used from the instructions for form p-4 from Rosstat order No. 711 dated November 27, 2019 ;

- OKVED2 is taken from this classifier;

- if in the first half of the year there was a reorganization, liquidation of an organization, deprivation of powers or closure of an OP, then you need to indicate the code, tax identification number and checkpoint of this organization or OP;

- phone number;

- number of completed pages of the RSV form;

- number of sheets attached to the calculation;

- information about the person certifying the correctness of the information provided for the half-year calculation.

An example of filling out a title page for the first half of 2021:

Section 1 contains summary data on all types of contributions for the half-year and for the last three months (April, May, June).

You need to fill out this section of the DAM form for the first half of 2022 in the following order:

| 001 | One of two types of payer is selected:

|

| 010 | OKTMO of the municipality in whose territory insurance premiums are paid. |

| 020 | KBC for transferring insurance premiums to OPS. |

| 030 | The amount of pension contributions payable for the 1st half of 2021 (cumulatively from the beginning of the year - from January to June inclusive). |

| 031, 032, 033 | Details of contributions to compulsory pension insurance payable for three months and 2 quarters (monthly). |

| 040-053 | By analogy with lines 020-033 for pension contributions, lines 040-053 are filled in for insurance contributions for compulsory health insurance (KBK, contribution in total for the half-year and for the 2nd quarter on a monthly basis). |

| 060-073 | Similar data for pension contributions at an additional rate of 10% (for payments in excess of the maximum base). |

| 080-093 | Data on additional insurance contributions for social security (KBK, information for half a year and in detail for three months of the last 2 quarters). |

| 100-113 | Information on contributions payable to VNiM (for half a year and for April, May, June). |

| 120-123 | The amount of the excess of benefits paid over the amount of contributions payable to VNiM is given (for half a year and monthly for the 2nd quarter). |

An example of filling out section 1 for the first half of 2021:

Appendix 1 contains the calculation of pension and health insurance contributions.

For the first half of 2022, this sheet of the DAM form must be filled out in the following order:

| 001 | The payer's tariff code is taken from Appendix 5 to the Filling Out Procedure. Example codes:

Important addition: if an organization (small enterprise) due to coronavirus has the right to apply a reduced tariff from 30% to 15% on insurance premiums for payments to employees above the minimum wage, then you need to fill out two Appendix 1 - the first for the main tariff with code 01, the second - at a 2-fold discount with code 20. |

| Subsection 1.1 to section 1 – contributions to compulsory pension insurance are calculated at a rate of 22% and 10% for payments over the limit. In each field, information is filled out in four fields - for the period as a whole (half year 2021) and for 3 months of the second quarter (April, May, June). | |

| 010 | Total number of employees (insured persons). |

| 020 | The number of employees in respect of whom payments were subject to pension insurance contributions (the first field is data for the half-year, the second - for April, the third - for May, the fourth - for June 2021). |

| 021 | The number of employees whose total income for the first 6 months of 2022 exceeded the maximum base for OPS = RUB 1,465,000. Contributions on the excess amount are calculated at a reduced rate of 10% instead of 22%. |

| 030 | Accrued income to employees for half a year and for months of the 2nd quarter. |

| 040 | Income not subject to pension contributions, according to Article 422 of the Tax Code of the Russian Federation. This field also includes sick leave benefits paid to employees for the first three days of illness, since they are not subject to contributions. |

| 045 | The amount that reduces the basis for calculating contributions is expenses accepted for deduction on the basis of clause 8 of Article 421 of the Tax Code of the Russian Federation. |

| 050 | The base for calculating insurance pension contributions at a rate of 22% is calculated as the difference between the indicator of line 030 and lines 040 and 050 (030 - 040 - 045). |

| 051 | The basis for calculating insurance pension contributions at a rate of 10% (over the limit = 1,465,000). |

| 060 | The total amount of contributions from the entire amount of income paid for half a year and for three months of the 2nd quarter is calculated as the sum of the indicators of lines 061 and 062 (061 + 062). |

| 061 | Insurance premiums at the basic rate are calculated as the product of line 050 and the rate of 22% (050 * 22%). |

| 062 | Insurance premiums at an additional rate are calculated as the product of line 051 and a rate of 10% (051 * 10%). |

| Subsection 1.2 to section 1 – contributions for compulsory health insurance are calculated at a rate of 5.1%. The information is provided for the entire billing period - half of 2022 and in the context of 2 quarters on a monthly basis. | |

| 010 | Total number of employees. |

| 020 | Number of employees whose payments were subject to contributions. |

| 030 | Payments to employees for half a year, April, May, June. |

| 040 | Payments not subject to contributions under clauses 1 and 2 of Art. 422 of the Tax Code of the Russian Federation. |

| 045 | Deductible expenses under clause 8 of Art. 421 Tax Code of the Russian Federation. |

| 050 | Base for calculating contributions = line 030 – line 040 – line 045. |

| 060 | Contributions from the base from line 050 = 050 * 5.1%. |

An example of filling out Appendix 1 to Section 1 of the DAM form for the first half of 2022:

Appendix 2 of the DAM calculation reflects the amounts of payments and insurance premiums for disability and maternity, which are used to pay for sick leave and maternity benefits (VNiM).

This application is filled out in the same way as Appendix 1; information is also provided for the entire six-month period and for three months of the 2nd quarter.

| 001 | The code is taken from app. 5 to the Procedure for filling. For payers at the basic rate of 2.9% - code 01. For those who apply several tariffs, you need to fill out a separate Appendix 2 for each. |

| 002 | Select one of two options for the payment of sick leave benefits:

|

| 010 and 015 | The number of employees

|

| 020 | Total payments to employees for the half-year and for the 2nd quarter on a monthly basis. |

| 030 | Payments not subject to contributions under Art. 422 of the Tax Code of the Russian Federation, including sick leave benefits for the first three days paid by employers to employees. |

| 040 | Payments in excess of the limit (limit base for contributions to VNiM = 966,000 rubles). For payments above the specified amount, a 0% rate is applied. |

| 050 | Base for insurance deductions = 020 – 030 – 040. |

| 060 | Insurance premiums from the base = 050 * 2.9%. |

| 070 | Persons who have switched to direct payments do not fill out this field. |

| 080 | The line is not filled. |

| 090 | Contributions to VNIM payable - corresponds to the calculated contributions from field 060, provided that there is no data in fields 070 and 080. The attribute is indicated as “1” if the amount from field 090 is greater than or equal to 0, otherwise the attribute “2” is indicated. |

An example of filling out Appendix 2 of the DAM form for the first half of 2022:

The third section of the calculation is filled out personally for each insured person, regardless of whether contributions were deducted during the billing period or not. The number of completed pages with section 3 must be equal to the number of employees (insured persons). Section 3.2.1 reflects data taxed at the basic compulsory pension rate.

In the DAM form for the first half of 2022, for each employee you need to fill out:

- general information about an individual - fields 030 - 110;

- information about the amount of payments and contributions for three months of 2 quarters (April, May, June) at the main tariff - the month is indicated by a number in order from 1 to 3, the category code is taken from the Appendix. 7 to the Procedure for filling out, the amount indicated is accrued before tax for the month, the base for contributions for the month (within the limit of 1,465,000 rubles from the beginning of the year), income under GPC agreements, the contribution calculated as the product of the base and the rate;

- information on contributions at the additional tariff for three months 2 quarters - the month is indicated digitally: April - 1, May - 2, June - 3; the code is taken from Appendix 8 to the Completion Procedure; base for contributions for the additional tariff (above the limit of RUB 1,465,000 from the beginning of the year); contributions calculated as the product of the base and the rate of 10%.

Important: The total base for contributions for the 2nd quarter of 2021 for all insured persons (the sum of the indicators of lines 150 of all completed sections 3) must be equal to the base calculated in subsection 1.1 of Appendix 1 of Section 1 (the sum of the indicators of columns 2-4 of lines 050 minus the sum of the indicators of column 2 -4 lines 051).

An example of filling out section 3 of the DAM form for the 2nd quarter of 2022:

and sample filling

.

.

Example of filling for small businesses

Small businesses that may apply reduced contribution rates in 2021 due to the coronavirus pandemic must fill out the DAM form, taking into account certain features.

This category has the right to pay contributions at the following rates:

- 30% of the amount of employee income within the minimum wage for the month (22% for compulsory health insurance, 5.1% for compulsory medical insurance and 2.9% for VNiM);

- 15% on income above the minimum wage (10% on compulsory health insurance, 5% on compulsory medical insurance, 0% on VNiM).

A reduction in tariff depending on the employee’s income must be taken into account when filling out Appendix 1 (subsections 1.1 and 1.2) and Appendix 2 to Section 1, which reflects the calculation of insurance premiums for compulsory medical insurance, compulsory medical insurance and VNiM.

In field 001 of the specified applications you need to reflect the payer's tariff code. Small businesses eligible for a tariff reduction must fill out:

- two subsections 1.1 (contributions to compulsory pension insurance) - one with basic tariff code 01 - reflect income within the minimum wage and contributions accrued from it; the second with tariff code 20 - incomes above the minimum wage and contributions accrued from them are reflected;

- two subsections 1.2 (compulsory medical insurance contributions) - one with code 01, the second with code 20;

- two Appendix 2 (contributions to VNiM) - one with code 01, the second with code 20.

In addition, in section 1, which provides summary data on the contributions to be paid, you must indicate the amounts obtained by adding up the assessments for the contributions of all completed applications.

In section 3 in personalized data you need to divide income

- within the minimum wage (12,792 in 2022) - the code of the insured person is HP;

- above the minimum wage - MS code.

Below is an example of filling out the DAM form for small businesses.

Initial data: The organization has one employee - director Petrov Petrovich. The enterprise is a small business entity and charges contributions according to two tariffs: the basic one for income within the minimum wage and the reduced one for income above the minimum wage.

| Director – Petrov Petr Petrovich | |||||

| 1st half of the year | April | May | June | ||

| Income | 600 000 | 100 000 (12792 + 87208) | 100 000 (12792 + 87208) | 100 000 (12792 + 87208) | |

| Contributions to OPS | From income within the minimum wage | 16 885,44 | 2 814,24 (12792 * 22%) | 2 814,24 (12792 * 22%) | 2 814,24 (12792 * 22%) |

| With income above the minimum wage | 52 324,80 | 8 720,80 (87208 * 10%) | 8 720,80 (87208 * 10%) | 8 720,80 (87208 * 10%) | |

| Contributions to compulsory medical insurance | Within the minimum wage | 3 914,40 | 652,40 (12792 * 5,1%) | 652,40 (12792 * 5,1%) | 652,40 (12792 * 5,1%) |

| Above the minimum wage | 26 162,40 | 4 360,4 (87208 * 5%) | 4 360,4 (87208 * 5%) | 4 360,4 (87208 * 5%) | |

| Contributions to VNiM | Within the minimum wage | 2 225,82 | 370,97 (12792 * 2.9%) | 370,97 (12792 * 2.9%) | 370,97 (12792 * 2.9%) |

.

How to fill out the RSV if there were no payments to employees

In accordance with the Procedure for filling out the DAM, which was approved by order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11 / [email protected] , companies that have not made payments to employees must fill out and submit the DAM in a simplified manner.

In the absence of payments to employees, the company submits the DAM, where the following is filled out:

- title page,

- section 1 without appendix,

- Section 3, which contains checks and zeros.

In section 1 of the DAM, in the “payer type” field, if no payments were made to employees, you must indicate “2”.

How to fill out the form in the RSV “Payment Sign” for benefits paid by the Social Insurance Fund to employees over 65 years of age?

Sick leave for older workers during the period of self-isolation due to the spread of COVID-19 was paid directly by the Social Insurance Fund. In this case, the organization did not make any payments. Therefore, the amounts of these benefits are not reflected in the DAM.

But the mere fact that benefits due to the epidemic were paid by the Social Insurance Fund does not affect the procedure for filling out the DAM.

Field 002 “Payment Attribute” of Appendix 2 of the DAM must be filled out as regulated by clause 10.2 of the Filling Procedure, which was approved by Order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11/ [email protected]

- “1” is indicated by companies that operate in a region where a mechanism for direct benefit payments has been introduced and the Social Insurance Fund pays benefits to employees directly.

- “2” is indicated by those organizations that operate in regions where the offset payment system is still in effect.

How can SMEs fill out the “tariff code” in the DAM form after the introduction of a reduced tariff?

Small and medium-sized enterprises that have received the right to apply a reduced tariff of 15% since April 2020, instead of the previously valid 30% tariff, must fill out two appendices for reporting for the first half of 2022 - 1 and 2 to section 1 of the DAM with different codes.

More on the topic:

The affected companies reflect the zero rate of insurance premiums in the DAM for the six months

According to clauses 5.4 and 10.1 of the Filling Out Procedure, which was approved by Order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11/ [email protected] , if during the reporting period the organization applied several tariffs for contributions, then as part of the DAM you need to fill out as many applications as 1 and 2 to section 1, how many tariffs were applied.

In one application you need to indicate the tariff code “1”, which means payments subject to contributions at general tariffs.

In the second, you need to indicate the tariff code “2”, which means payments subject to contributions at reduced rates.

Explanations for tariff codes were given in the letter of the Federal Tax Service dated 04/07/2020 No. BS-4-11/ [email protected]

Important on the topic:

How to “reset” the contributions paid in the 2nd quarter?

Read in the berator “Practical Encyclopedia of an Accountant”

What tariff codes of the payer and categories of insured persons should be used when filling out the DAM in connection with the temporary zeroing of contributions in the 2nd quarter of 2022?

“Calculation of insurance premiums” for the 2nd quarter of 2022: sample filling

To more clearly show how to fill out the calculation for the 2nd quarter of 2021 (more precisely, for half a year), we will use the data from the example.

Example

LLC "Lyudmila" employs 2 people. Since the organization is included in the register of SMEs, the enterprise, along with the basic aggregate tariff of 30%, applies a reduced tariff for SMEs of 15%.

In 2022, director Sidorov Alexander Petrovich was paid in the amount of his salary, 25,000 rubles. monthly, of which in each month:

- RUB 12,792 (amount within the minimum wage) were taxed at the basic tariff (code “01”);

- amount above the minimum wage - 12,208 rubles. (25,000 – 12,792), was taxed at a reduced rate (code “20”).

The chief accountant Elena Vasilievna Nefedova received a salary of 20,000 rubles. per month (except for June), of which monthly:

- RUB 12,792 taxed at the basic rate (“01”);

- for amounts over the minimum wage - 7208 rubles. (20,000 – 12,792), a reduced tariff of “20” was applied.

In June, Nefedova was ill; for the first 3 days of illness, the company paid her 2,500 rubles on a certificate of incapacity for work. This amount was not subject to contributions and was reflected in payments at the basic rate. In total, in June the chief accountant was accrued 17,500 rubles, of which:

- at tariff “01” 15,292 rubles are reflected, of which the taxable amount is 12,792 rubles, the non-taxable amount is 2,500 rubles;

- at the “20” tariff - 2208 rubles. (17,500 – 12,792 – 2500).

Thus, the total tax base was:

- at tariff “01” for 25,584 rubles. per month (12,792 + 12,792);

- at the “20” tariff in April and May for 19,416 rubles. (12,208 + 7208), in June - 14,416 rubles. (12 208 + 2208).

The accountant entered all the data and charges into the “Calculation of Insurance Premiums”, a sample of which is given below.