Personal income tax and types of financial assistance

The financial assistance that employers provide to their current or former employees in relation to the issue of taxation of personal income tax payments is divided into 3 types:

- the payment is not taxed regardless of its size;

- payment until it reaches a certain amount is tax-free;

- the entire payment is subject to tax.

Completely non-taxable include payments made as financial assistance in connection with the death of a current or former employee who has become a pensioner, or a family member of such employees (Clause 8 of Article 217 of the Tax Code of the Russian Federation).

A limitation in the form of a certain volume is established for financial assistance provided:

- to a current employee at the birth, adoption or adoption of each child in the first year of the relevant event - in the amount of 50 thousand rubles. for each child (clause 8 of article 217 of the Tax Code of the Russian Federation);

- for a current or former employee who has retired - the non-taxable amount of this amount is 4 thousand rubles. per year for each employee (clause 28 of article 217 of the Tax Code of the Russian Federation);

- persons who participated in the Second World War, worked during it or suffered during it are not subject to tax on an amount not exceeding 10 thousand rubles. per year for each recipient (clause 33 of article 217 of the Tax Code of the Russian Federation).

All other payments are subject to taxation from the first ruble.

The above rules apply regardless of whether assistance is provided in cash or in kind. The rate at which the tax on financial aid is calculated is 13% (Clause 1, Article 224 of the Tax Code of the Russian Federation).

Taxation of financial assistance

The main question that an accountant asks is whether financial assistance is subject to personal income tax?

Each type has its own distinctive characteristics and accounting features for determining the personal income tax base, as well as insurance premiums. The personal income tax and contribution base depends on the basis for which financial assistance was provided. It is indicated in the employee’s application. Taxation of financial aid follows the same principles. At the same time, monetary support from the employer is either completely tax-free or not taxed up to an amount limit, which depends on the basis.

Principles for entering data on financial assistance into 6-NDFL

Report 6-NDFL is intended to reflect information on personal income tax calculated and withheld by the tax agent (clause 2 of article 230 of the Tax Code of the Russian Federation, subclause 1.1 clause 1 of Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ). However, the obligation to calculate and withhold this tax does not arise in relation to income that is completely exempt from taxation. This, in particular, is indicated by the absence of the need to reflect such income in the declaration of Form 3-NDFL (clause 4 of Article 229 of the Tax Code of the Russian Federation).

Therefore, there is no need to enter into the 6-NDFL report data on financial assistance paid in connection with the death of an employee (current or former) or a member of his family, which is not subject to personal income tax, regardless of the amount.

The following payments must be included in the report:

- fully taxable;

- subject to personal income tax only when they reach a certain amount.

In the latter case, the non-taxable part of the income will act as a deduction, reducing the tax base.

The taxpayer’s obligation to enter into Form 6-NDFL information about income subject to personal income tax only when it reaches a certain amount does not depend on whether the limit established for payment is exceeded, since this report is filled out (as well as certificates in Form 2- Personal income tax, with which these forms 6-NDFL must be correlated) based on information entered in tax registers. Filling out tax registers requires organizing the accounting of income and amounts reducing the tax base in accordance with legally defined analytics reflected in the codes of income and deductions (clause 1 of Article 230 of the Tax Code of the Russian Federation).

Financial assistance as a type of income

Such support, unlike other types of income, does not depend on:

- from the employee’s activities;

- from the results of the organization’s activities;

- from the cyclical nature of work periods.

The grounds for receiving financial assistance can be divided into two: general and targeted. It is provided when any circumstances arise in the employee’s life:

- anniversary, special event;

- difficult financial situation;

- illness of an employee or close family member;

- death of an employee or close family member;

- birth of a child;

- emergencies;

- vacation.

A complete list of grounds for calculating financial assistance, as well as their amounts, are established by the regulatory (local) document of the organization. In some cases, for example, due to illness, the amount of financial assistance will be determined by the decision of the manager.

Codes used when accounting for financial aid

Codes for income subject to personal income tax and deductions applied to them were approved by Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] The correspondence of income to one of these codes clearly indicates the need to reflect it in reporting on personal income tax . The absence of a code among the codes characterizing financial assistance paid in connection with the death of an employee (current or former) or a member of his family is additional confirmation that there is no need to include data on such payments in the Form 6-NDFL report.

For two other types of payments (taxable in full or in part), codes are provided in Order No. ММВ-7-11/ [email protected] . Among the income (Appendix No. 1 to Order No. ММВ-7-11/ [email protected] ) they correspond to the following codes:

- 2710 - for financial assistance, which has no restrictions on its non-taxable part;

- 2760 - for financial assistance paid to a current or former employee who has retired;

- 2762 - for financial assistance paid in connection with the birth, adoption of a child;

- 2790 - for financial assistance to persons who participated in the Second World War, worked during it or suffered during it.

For the last three types of assistance that have codes, deduction codes are provided (Appendix No. 2 to Order No. MMV-7-11 / [email protected] ):

- 503 - for financial assistance paid to a current or former employee who has retired;

- 508 - for financial assistance paid in connection with the birth, adoption of a child;

- 507 - for financial assistance to persons who participated in the Second World War, worked during it or suffered during it.

The presence of deduction codes makes it possible to reduce the amount of income arising from the payment of financial assistance, which is characterized by a non-taxable limit:

- for its entire amount, if the non-taxable limit is not exceeded;

- by the amount of the limit if the payment amount exceeded this limit.

In the first case, the tax accompanying the payment will be zero.

Taxed over the limit

This applies to support that is of a general nature by providing:

- birth, adoption, establishment of guardianship rights - in the amount of no more than 50,000 rubles for each child when paid within 1 year after birth;

- the amount of partial compensation for sanatorium and resort vouchers in the Russian Federation in the amount of up to 4,000 rubles (taking into account the type of assistance, for example, to support the health of children due to severe environmental and climatic conditions, etc.);

- anniversary, special event (wedding) - up to 4,000 rubles;

- support for an employee in a difficult life situation, vacation - up to 4,000 rubles.

Let us remind you that the limit of financial assistance for the birth of a child is 50,000 rubles per parent. Such clarifications were given by the Ministry of Finance of the Russian Federation in letter dated 08/07/2017 No. 03-04-06/50382. Previously, officials considered the set amount to be the limit for both parents or guardians.

IMPORTANT!

When calculating personal income tax, a deduction for financial assistance on a general basis up to 4,000 rubles is provided once, regardless of how many times the support is provided.

Filling out 6-NDFL if there are financial aid payments

Entering data on financial assistance into 6-NDFL is subject to the general rules established by Appendix No. 2 to the Order of the Federal Tax Service of October 14, 2015 No. MMV-7-11/ [email protected]

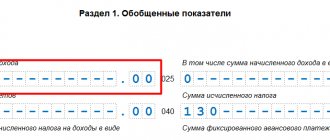

Summary information on financial assistance for the reporting period should be shown in the sheet of section 1, intended for accruals at a rate of 13% (clause 3.1 of Appendix No. 2 to Order No. MMV-7-11 / [email protected] ). For each payment of financial assistance, its amount and the amount of the applicable deduction (if it is established for the type of assistance provided) are included in the total figures given in Section 1 on lines 020 and 030, respectively. The tax calculated in this case will be included in the total amount on line 040.

The fact of tax withholding will be recorded on line 070. Payment of financial assistance made to a former employee will increase the number of income recipients reflected on line 060.

In section 2, the issuance of financial assistance will be reflected either in its own special set of lines 100-140, or together with another payment if the dates for them coincide:

- receiving income (line 100);

- tax withholding (line 110);

- deadline for paying tax to the budget (line 120).

The date of receipt of income in the form of financial assistance should be considered the day (clause 1 of Article 223 of the Tax Code of the Russian Federation):

- actual payment of funds (subclause 1);

- actual transfer of assistance provided in kind (subclause 2).

Tax on financial assistance is withheld per day (clause 4 of article 226 of the Tax Code of the Russian Federation):

- her payments in money;

- issuance of other income in cash, from which tax can be withheld if financial assistance is provided in kind.

The day indicating the deadline for transferring tax for financial assistance is the first working day following the day of payment of income from which the tax is withheld (clause 6 of Article 226, clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

The amount of the paid financial assistance on line 130 should be given in its full amount, including the withholding tax (clause 4.2 of Appendix No. 2 to Order No. MMV-7-11 / [email protected] ). If there is no tax to be withheld (the amount on line 140 is zero), then the dates on lines 110 and 120 are reflected in the format “00.00.0000” (Letter of the Federal Tax Service of Russia dated May 17, 2016 No. BS-4-11 / [email protected] ).

Let's sum it up

- With regard to personal income tax, financial assistance that employers pay to their current or former employees is divided into 3 types: non-taxable, non-taxable until the payment reaches a certain amount, fully taxable. The limit at which the payment becomes taxable may vary depending on the intended purpose of the financial assistance. The tax rate does not depend on the purpose or type of assistance and is always 13%.

- Data on payments that are not subject to taxation are not entered into 6-NDFL. But in this report it is necessary to show information about financial assistance that is fully taxed on personal income, and assistance in respect of which personal income tax is charged only when its amount exceeds the established limit. In the latter case, the amount of payment in 6-NDFL is always given in full, and the non-taxable part of it serves as a deduction.

- Analytics of income and deductions applied to them, on the basis of which data from tax registers are generated, serving as a source of information for personal income tax reporting, is based on a legally approved list. The types of income and deductions in this list are coded. Including financial aid and deductions applied to it, it has its own codes.

- In 6-NDFL, the payment of financial assistance will be reflected in both sections of the report: both among the summary data (section 1) and in relation to specific payment dates (section 2). In section 2, information about financial assistance can be combined with data from other payments if all 3 dates coincide (receipt of income, tax withholding, deadline for paying it to the budget). If the tax on financial aid is not subject to withholding, then the zero indicator in the set of lines 100-140 will indicate not only its value, but also the date of tax withholding and the deadline for transferring it to the budget.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up