Is personal income tax withheld and paid on sick leave?

The answer to the question of whether sick leave is subject to personal income tax is contained in paragraph 1 of Art.

217 Tax Code of the Russian Federation. Temporary disability benefits are excluded from the list of payments not subject to personal income tax. Since the document confirming the employee’s incapacity for work is a certificate of incapacity for work, personal income tax is calculated from the sick leave. Let us recall payments that are not subject to personal income tax (Clause 1, Article 217 of the Tax Code of the Russian Federation):

- lump sum maternity benefit;

- monthly allowance for child care up to 1.5 years;

- monthly compensation for child care up to 3 years old.

A ready-made solution from ConsultantPlus will help you calculate and pay sick leave to employees, including in unusual and difficult situations. Get trial access to the K+ system and immediately see expert recommendations. It's free.

To whom and at whose expense is sick leave paid?

According to Article 2 of Law No. 255-FZ of December 29, 2006, temporary disability benefits are mandatory paid only to employees hired under an employment contract. Is sick leave subject to personal income tax in the case of payments to performers providing services under a civil contract? No, because these individuals cannot qualify for sickness compensation from the employer and the Social Insurance Fund, respectively, and tax withholding does not occur due to the lack of a tax base.

The benefit for the first three days of illness of an employee is paid at the expense of the employer, the remaining days until the restoration of working capacity or the establishment of disability - at the expense of the Social Insurance Fund. Insurance premiums are not charged on the benefit amount. The employer must accrue the money within 10 days from the date of presentation of the certificate of incapacity for work, and transfer it along with the payment of the next salary.

Will income tax be taken from sick leave in 2022 or not?

Are sick leave subject to personal income tax? Yes, and the personal income tax rate for this type of payment has not changed: in 2022, as before, it is 13%.

Since sick leave is subject to personal income tax in full, the tax base for calculation is the amount of temporary disability benefits in full (letter of the Ministry of Finance of Russia dated June 17, 2009 No. 03-04-06-01/139).

Important! From 2022, the employer accrues and pays sick leave only for the first 3 days and only pays personal income tax from this amount. The remaining portion of the benefit is paid directly to the employee by the Social Insurance Fund. He also withholds personal income tax from her and transfers the benefit to the employee’s card (or in another way) minus the tax. In cases where the FSS issues 100% of the benefit, it withholds tax from the entire amount. For more information, see our memo on the new rules for paying benefits from 2022.

Accountants sometimes have doubts whether to withhold personal income tax from sick leave as when assessing wages, or are there differences? Please note that deductions here are carried out in a special manner, different from deductions from an employee’s salary.

The difference is that sick pay is included in taxable income in the month of payment (clause 1 of Article 223 of the Tax Code of the Russian Federation). There are also differences in the procedure for paying personal income tax from sick leave to the budget. But more on that below.

In business practice, there are circumstances in which employees working at the enterprise fell ill after concluding civil contracts with them. A reasonable question arose: is personal income tax paid on sick leave for such employees? It should be borne in mind that employees with whom civil contracts have been concluded should not be paid sick leave. Accordingly, there is no need to accrue or pay personal income tax.

Certificate of incapacity for work when caring for a patient

The amount of the benefit depends on the insurance period of the person receiving sick leave and his average earnings . Only persons who have had insurance coverage for more than 8 years can apply for full compensation of average earnings. With an insurance period of 5 to 8 years, the benefit is calculated based on 80% of average earnings, less than 5 - 60%.

However, some employers provide the possibility of paying additional benefits from their own funds.

Are taxes withheld?

In accordance with the Tax Code of the Russian Federation, the income of an individual is subject to taxation, unless otherwise provided by law. Payments of sick leave benefits are not exempt from personal income tax .

The tax is levied at a rate of 13%. Individuals who are not tax residents in Russia pay a tax of 30%.

Are there any insurance premiums?

The Tax Code of the Russian Federation provides that state benefits are not subject to insurance contributions . Since, as a general rule, incapacity for work to care for a sick child is compensated from the Social Insurance Fund from the first day of his illness, the benefit received by the employee may not be subject to insurance contributions (you can find out who pays for sick leave for child care - the Social Insurance Fund or the employer here ).

In this case, additional payments, the amount of which is established by the employer, are subject to insurance contributions in full.

Other deductions

When calculating personal income tax for child care disability benefits, the same standard tax deductions apply as when calculating income tax.

Standard “child” tax deductions apply for children under 18 years of age, as well as for each full-time student under the age of 24 years. The amount of tax deductions is :

- 1,400 rubles each for the first and second child;

- 3,000 rubles for the third and each subsequent child.

For disabled children under the age of 18, as well as disabled people of group I or II under the age of 24, studying full-time, the tax deduction is:

- 12,000 rubles - for parents and adoptive parents;

- 6,000 rubles - for guardians, trustees or adoptive parents.

What period and date of personal income tax withholding are established for sick leave and vacation pay?

The deadline for paying sick leave tax is no later than the last day of the month in which the benefit was paid.

The withheld personal income tax must be shown in the 6-NDFL report. ConsultantPlus experts explained how to determine the date of actual receipt of sick leave income for calculating 6-NDFL. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

By the way, a similar procedure and payment deadline is provided for personal income tax on vacation pay: the tax should be withheld and transferred to the budget no later than the last day of the month when the vacation pay was issued.

About the deadline for paying personal income tax

Temporary disability benefit – personal income tax and additional payment up to average earnings

If, when calculating temporary disability benefits, an additional payment is made up to average earnings, then the corresponding personal income tax on sick leave is paid in the general manner (Articles 217, 226 of the Tax Code of the Russian Federation). Both officials and judges came to this conclusion (letters from the Ministry of Finance of Russia dated 05/06/2009 No. 03-03-06/1/299, dated 02/12/2009 No. 03-03-06/1/60, dated 12/24/2008 No. 03- 03-06/1/720, resolution of the Federal Antimonopoly Service of the North-Western District dated 07.07.2008 No. A26-2542/2007).

Thus, to the question posed at the beginning of the article, whether personal income tax is withheld from sick leave, the answer will be unequivocal: undoubtedly, yes.

How to calculate correctly?

To correctly calculate personal income tax on temporary disability benefits in connection with caring for a sick child, you need to know:

- Average parent's earnings.

- Insurance experience.

- Duration of care for a sick child (how many days of sick leave is given to care for a child on an outpatient and inpatient basis?).

- The grounds for applying tax deductions are the total number of children in the family, the presence of disabilities in the children or their caregiver, etc. (read about how sick leave for caring for a disabled child is issued and accrued here).

Read more about how the calculation and accrual of funds and payment of sick leave benefits for child care take place here, and from this material you will find out whether such a newsletter is paid on weekends and holidays.

Disability benefits

Calculation of personal income tax must begin with determining the amount of disability benefits. To do this, you need to divide the average earnings by the number of working days in a calendar month and multiply by the duration of disability in calendar days. Depending on the insurance period, the result obtained is multiplied by a clarifying coefficient - from 0.6 to 1.0.

If child care occurs at the turn of two months, the amount of benefits for each month must be calculated separately. Let's say a certificate of incapacity for work was issued from April 30 to May 15, the benefit is calculated separately for April (1 day) and for May (15 days).

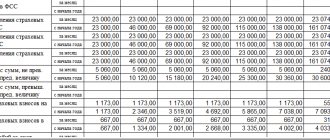

Let’s assume that our parent’s average earnings for April and May will be equal and amount to his usual salary - 50,000 rubles, and his insurance experience - 7 years (specifying coefficient - 0.8).

Let's calculate the benefit for April (21 working days):

(50,000 rubles: 21 days) x 1 day x 0.8 = 1,940 rubles. 76 kop.

For May (21 working days) the benefit will be:

(50,000 rubles: 21 days) x 15 days x 0.8 = 28,571 rubles. 42 kopecks

Deductions

It is advisable to calculate tax deductions specifically for temporary disability benefits if they are not fully compensated by other income, in particular, wages (for example, a certificate of incapacity for work was issued for a full calendar month or most of it).

From the point of view of tax legislation, this is not a violation, since the correctness of calculation of the total amount of tax and the timing of its payment are of greater importance, and not the sources of income from which it is paid.

The employer is given 10 calendar days to assign benefits from the date of receipt of sick leave , and payment must be made on the next pay day after the assignment of benefits. As a rule, this period should be enough to adjust the payment not to the advance payment, but to the final payment for the month.

In our case, in April the benefit will be 1,940 rubles. 76 kopecks, and wages - 47,619 rubles. 05 kop.

The parent has four children, one of them is disabled. The tax deduction will be 17,800 rubles. (2 x 1,400 + 3,000 + 12,000).

Since accrued wages completely exceed the tax deduction, when calculating the tax, the deduction can be completely attributed to wages.

For May, the benefits and wages will be equal and amount to 28,571 rubles each. 42 kopecks In this case, the tax deduction can either be divided in equal proportions, or completely attributed to the benefit or wages.

Sick leave benefits for both April and May will be paid at the beginning of June along with wages.

Tax

The amount of tax on temporary disability benefits depends on the amount of the benefit , the tax deduction applied and the tax rate.

When calculating personal income tax, the result obtained is rounded to full rubles: up to 50 kopecks - downwards, from 50 kopecks - up.

To simplify the calculations, we will attribute the entire tax deduction amount to wages. If our parent is a tax resident of the Russian Federation, the amount of tax withheld from the benefit will be :

- in April 1,940 rub. 76 kop. x 0.13 = 252 rubles;

- in May 28,571 rub. 42 kopecks x 0.13 = 3,714 rubles.

Results

Payment for sick leave, with the exception of maternity benefits, is subject to personal income tax, regardless of the source of its payment (employer or Social Insurance Fund).

The employer's personal income tax on sick leave benefits must be withheld upon payment and transferred to the budget no later than the last day of the month in which the benefits were paid. When paying benefits for sick days, starting from the 4th day, the Social Insurance Fund will withhold and transfer it to the budget independently. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for transferring personal income tax on sick leave

Until recently (until the beginning of 2016), income tax had to be paid within the specified time limits:

- until the day when the funds are transferred to the account of the person who provided the sick leave;

- in some situations (for example, when money is paid from proceeds) - no later than the day following receipt of income.

On May 2, 2015, Federal Law No. 113 was adopted, changing this procedure. Now the transfer of personal income tax is not tied to the day of actual payments; calendar dates are important. Fiscal authorities must receive the personal income tax payment by the end of the month in which the compensation was paid (Article 226 of the Tax Code of the Russian Federation).