How is the calculation of current income tax regulated?

The legislator pays serious attention to the calculation of income tax. The rules by which tax is calculated are contained in PBU 18/02. Changes to this document were made by the Ministry of Finance by order No. 236n dated 11/20/18. Income tax is reflected in the financial statements, in the income statement, so its form was also changed by order of the Ministry of Finance No. 61n dated 04/19/19.

Let us recall that the income tax of legal entities is direct, in other words, directly dependent on the final financial results of the work for the reporting period. It is accrued on the amount of profit, which is the difference between income and expenses, which is the object of taxation.

Important! Taxation is determined by the rules of Chapter. 25 Tax Code of the Russian Federation.

The reason for such close attention to tax calculation is obvious: in the country’s budget system it is one of the main income-generating factors. Income tax is equally important for federal and regional budgets.

The main difference from the previous edition of the PBU is the following: the current income tax is calculated in accordance with the Tax Code. Previously, it was calculated based on profit according to accounting data, adjusted for the amount of deferred tax liabilities, assets, permanent tax liabilities, and assets.

Now only the norms of the Tax Code of the Russian Federation are taken as a basis. The difference between accounting and tax accounting when calculating income tax is reduced to zero.

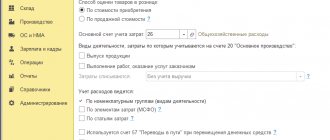

PBU 18/02 declares two options by which the amount of tax can be determined:

- according to BU data;

- according to the data reflected in the tax return.

Whatever method of calculation the taxpayer uses, the amount of the current income tax must be equal to the amount entered in the tax return.

Note! For a group of consolidated taxpayers (CGT), the tax is reflected in a separate account for the group as a whole. This account of settlements with members of the consolidated group is maintained in the accounting department of the responsible participant of the consolidated group (PBU 18/02, clause 22).

We have analyzed the general algorithm for calculating the current income tax and the documents regulating it. Let us now find out how to apply the formula for calculating the current income tax and reflect the amount in the income statement.

When is the deduction applied and what to do with income tax. VAT at estimated rate

VAT in a number of cases listed in paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, is calculated by the seller from the income received at an estimated rate of 10%/110% or 18%/118%. But the Russian Tax Code says unfavorably about the buyer’s ability to deduct this VAT, although in reality the situation is not so bad. Let us consider this situation using the example of an operation involving the assignment by a new creditor of the property right of a claim under a sales agreement.

According to paragraph 2 of Art. 155 of the Tax Code of the Russian Federation, the tax base upon assignment by a new creditor who has received a monetary claim arising from a contract for the sale of goods (works, services) is determined as the amount of excess of the income received by the new creditor upon subsequent assignment of the claim or upon termination of the corresponding obligation over the amount of acquisition costs the specified requirement. Based on clause 4 of Art. 164 of the Tax Code of the Russian Federation, a calculated rate of 18%/118% is applied to the specified tax base. Let us analyze whether the subsequent creditor who acquired this right will be able to deduct this amount of VAT.

Clause 1 of Art. 172 of the Tax Code of the Russian Federation establishes that when purchasing goods (work, services), property rights from Russian sellers, only the VAT amounts presented by the seller are subject to deduction from the buyer. In accordance with paragraph 1 of Art. 168 of the Tax Code of the Russian Federation presented are the amounts of VAT accrued by the seller in addition to (“above”) the cost of goods (work, services) sold, property rights or calculated from the amount (“from within”) the advance received. Therefore, strictly speaking, of all the cases when, according to paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, VAT is calculated not “from above” at a rate of 18% or 10%, but “from within” at a rate of 10%/110% or 18%/118%; only VAT calculated by the seller on the advance amount should be deducted. Consequently, the VAT calculated by the new creditor upon further assignment of the right of claim at the calculated rate cannot be accepted for deduction by the subsequent acquirer of the right.

A similar conclusion follows from the letter of the Ministry of Finance of Russia dated February 17, 2010 No. 03-07-08/40, which indicates the impossibility of deducting VAT charged by the original creditor to the new creditor.

However, this harmonious logic “collapses” (fortunately for taxpayers) when referring to clause 18 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137). In this paragraph, when listing cases in which the invoice is drawn up in one copy (and, therefore, the buyer who does not receive the second copy has no right to deduct VAT), only the operations from Art. 162 of the Tax Code of the Russian Federation, and the operations specified in Art. 155 of the Tax Code of the Russian Federation are not mentioned (as are the operations specified in paragraphs 3, 4. 5.1 of Article 154 of the Tax Code of the Russian Federation, when VAT is also calculated from the inter-price difference). Clause 19 of Section II was also formulated. Maintaining a purchase book by the buyer in Decree of the Government of the Russian Federation of December 2, 2000 No. 914.

Consequently, although formally - within the terminology of the Tax Code of the Russian Federation - VAT, calculated at the calculated rate for the assignment of rights and the sale of goods, the cost of which includes the tax presented upon their acquisition, is not considered “presented”, for the purposes of deduction it in these situations is conditionally regarded as "presented" The difference between situations when, according to Art. 154, 155 of the Tax Code of the Russian Federation, VAT is calculated on the difference between prices, and Art. 162 of the Tax Code of the Russian Federation is that in the first case we are talking about amounts that are revenue from sales, i.e. directly forming the tax base, and in the second - about amounts that are not directly revenue and therefore do not form, but only “increase” tax base.

Thus, for all subsequent assignments of rights of claim under a sales contract, the seller of rights draws up an invoice with the inter-price difference at the estimated rate in two copies, and the acquirer of rights (the next assignee and creditor), having received the second copy of the invoice, accepts the VAT indicated in it to deduction.

But for income tax purposes, does the seller of rights reduce his income (inter-price difference) by the amount of VAT calculated on it?

Example

The new creditor assigns the right of claim, the acquisition costs of which amounted to 10,000 rubles. for 11,000 rub. VAT calculated by the seller of rights will be 152.54 rubles. (1000 rub. x 18%/118%). What amount of income must the seller of rights show in the income tax return: 1000 rubles, or 847.46 rubles. (1000 rubles - 152.54 rubles?

Of course, 1000 rubles, because according to paragraph 1 of Art. 248 of the Tax Code of the Russian Federation, when determining income, the amounts of taxes presented in accordance with the Tax Code of the Russian Federation by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) are excluded from them.

Chapter 25 of the Tax Code of the Russian Federation does not define the meaning of the concept of “tax presented”, therefore it is necessary to refer to the wording of Art. 21 of the Tax Code of the Russian Federation, according to which VAT calculated at the estimated rate not on the prepayment amount is not considered claimed. And for the purposes of income tax, one cannot refer, as was the case with VAT, to the indirect hint of Resolution No. 1137 that in the event of an assignment of rights of claim, such VAT is considered as if presented.

However, reflecting income without excluding the amount of VAT from it does not lead to an increase in the tax base for income tax by the same amount, since it is simultaneously included in expenses taken into account for tax purposes. This is explained as follows.

In accordance with paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include amounts of taxes accrued in the manner established by the legislation of the Russian Federation, with the exception of those listed in Art. 270 Tax Code of the Russian Federation. In paragraph 19 of Art. 270 states that when determining the tax base, expenses in the form of amounts of taxes presented in accordance with this Code by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) are not taken into account. VAT, calculated at the estimated rate for income tax purposes, as determined by us, is not presented, therefore, being accrued in accordance with the law (i.e., meeting the requirements of clause 1, clause 1, article 164 of the Tax Code of the Russian Federation) , it is included in tax expenses and is presented in the tax return for corporate income tax. On the same basis, the courts allow including in expenses taken into account for the purposes of taxation VAT accrued by the organization “at its own expense” (i.e. not presented and, accordingly, not received as part of payment from the buyer) for unconfirmed exports, based on the results of a tax audit, and even under agreements for the gratuitous use of property (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 9, 2013 No. 15047/12 (with which the Ministry of Finance of Russia agreed in letter dated July 27, 2015 No. 03-03-06/1/42961 and less explicitly - the Federal Tax Service Russia in a letter dated December 24, 2013 No. SA-4-7/23263), AS of the Volga-Vyatka District dated May 7, 2015 No. A11-4982/2014, AS of the West Siberian District dated October 6, 2015 No. A27 -19625, FAS of the Far Eastern District dated 06/19/14, No. F03-2381/2014, AS of the Moscow District dated 12/9/15, No. A40-10526/15).

The above explanations regarding income tax are also valid for the situation of debt repayment by the debtor, in which the tax base is also defined as the amount of excess of the income received by the new creditor upon termination of the corresponding obligation over the amount of expenses for the acquisition of the specified claim (Clause 2 of Article 155 of the Tax Code of the Russian Federation ). At the same time, as the Ministry of Finance of Russia points out, the new creditor does not issue an invoice to the debtor, since there is no corresponding situation provided for in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, - there is neither shipment of goods (performance of work, provision of services), nor receipt of payment amounts, partial payment on account of upcoming deliveries of goods (performance of work, provision of services) (letter of the Ministry of Finance of Russia dated March 18, 2015 No. 03-07 -05/14390).

But, even if such an invoice had been issued, the debtor would still not have the right to a deduction on it, since he had already applied a deduction from the amounts payable at the time of acceptance for accounting of goods (work, services), property rights acquired from the first creditor.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Formula and calculation example

To calculate income tax (IPT), a simple formula is used:

NPR = Nb * Ns,

where Нb is the tax base, and Нс is the tax rate. The basic tax rate is a total of 20%: 3% to the federal treasury and 17% to the regional budget.

The most important thing is to determine the correct tax base.

Нb = income – expenses.

- The recognition of income is regulated by articles of the Tax Code of the Russian Federation: 249, 250, 251.

- Recognition of expenses is regulated by articles of the Tax Code of the Russian Federation: 253, 265, 270.

They contain a list of income and expenses from sales, as well as non-sales expenses included in the tax base; costs and revenues that are not taken into account when calculating the tax base are listed.

Example : let the income from the sale of your own products with 20% VAT amount to 2,160,000 rubles. In addition, rental payments were received in the amount of RUB 360,000, including 20% VAT. Production costs amounted to 800,000 rubles. Salary including contributions amounted to 200,000 rubles. Depreciation charges - 30,000 rubles. Let's calculate the tax base.

Income:

- 2160000 / 1.2 = 1800000 rub. (excluding VAT) – from the sale of your products.

- 360,000 / 1.2 = 300,000 rub. (excluding VAT) – from the rental of premises.

Total income (1,800,000 + 300,000) = 2,100,000 rubles. Expenses: 800,000 + 200,000 + 30,000 = 1,030,000 rubles.

Nb = 2100000 – 1030000 = 1070000 rub. Income tax (IPT): To the federal budget - 1,070,000 * 3% = 32,100 rubles. To the regional budget - 1,070,000 * 17% = 181,900 rubles. Total: 181900 + 32100 = 214000 rub.

You can use calculations based on accounting data. In the general case, the formula for calculating the current income tax looks like this: NPR = +/- Conditional expense (income) +/- difference between NPR and IPA +/- Change in IT +/- Change in IT. Let's look at the meaning of the formula using explanations and calculations.

The basis of equality is the notional income tax expense. It is calculated by multiplying profit before tax by the tax rate (if a loss is received, this means conditional income).

Let, according to accounting data, profit before tax be 1,500,000 rubles. The conditional expense will be equal to 1,500,000 * 20% = 300,000 rubles. (taken with a + sign).

Permanent tax income (PTI, taken with a - sign) and constant tax expense (PTR, taken with a + sign) - these terms replace the previous ones - “permanent tax assets” (PTA) and “permanent tax liabilities” (PNO).

Let the sum of PND and PNR for the period + 3000 rubles. The size of this indicator for the formula is 3000 * 20% = 600 rubles.

Changes in deferred tax assets and liabilities are calculated similarly. The increase in deferred assets (ODA) is taken with a + sign, since they increase the tax of the current period. An increase in deferred tax liabilities (DTL), on the contrary, reduces the current tax and is accounted for as negative.

Accordingly, the decrease in IT over the period is taken with a minus sign, and the decrease in IT – with a plus. Let the accounting calculations show the total temporary difference IT for the period + 6000 rubles. There is no data on IT. Another 6000*20% = 1200 rubles will be added to the calculation. NPR = 300,000 + 600 + 1200 = 301,800 rub. – the amount of current income tax.

On a note! Regional authorities may introduce reduced rates for the relevant part of the tax. Preferential rates may be applied for some taxpayers, other rates (from 9 to 30% for certain types of transactions and payers).

How is current income tax reflected in accounting?

Maintaining correct accounting is the key to ensuring that taxable profit according to tax regulations and accounting accounting will coincide. The given accounting formula for the current income tax represents the sum of the data in the accounting accounts. The correctness of tax reflection in accounting can be checked.

Conditional expenses (income) are reflected in a separate subaccount of account 99. To control the data, they are checked against the turnover in this subaccount. To control PND and PNR, a separate sub-account is also opened for account 99. A negative difference between the sub-account turnover is shown by PND, and a positive difference - PNR.

IT represents the difference in debit and credit turnover on account 09; according to IT, account 77 provides the same information.

Current income tax is reflected in the income statement on line 2410.

A new form for the financial results report has been prepared, which will be relevant starting with the reporting for 2022. In addition to the usual current income tax, it takes into account the so-called deferred income tax. According to the legislator, this is the total change in IT and IT, except for transactions not included in the calculation of accounting profit. Deferred and current income taxes in the new form amount to the amount of income taxes for the period.

Briefly

- The general formula for the current income tax is the product of the tax base and the tax rate - 20% for two types of budgets (federal and regional).

- The tax base is determined by the difference between the organization’s income and expenses included in the calculation. It is allowed to determine the amount of tax based on tax or accounting data, as you choose.

- In the first case, the tax base is determined based on the articles of the Tax Code of the Russian Federation, and then multiplied by the rate.

- In the second case, the conditional expense (or income) is calculated by multiplying the accounting profit by the rate. Then the estimated difference between constant tax revenues and expenses is determined, and changes in IT and IT are taken into account. A 20% rate is also applied to these amounts and the conditional expense (income) is adjusted to the values obtained.

- Correct maintenance of accounting and NU should give the same result when calculating the current income tax in both cases.

Marketing job

In sub. 15 clause 1 art. 264 of the Tax Code of the Russian Federation there is information about such an expense item as “expenses for consulting and other similar services.” If you work with a marketer or other consultants, you can include their fees as an expense and reduce your income taxes.

It is important that the work of a marketer and the payment for the research he does relate to the direct activities of the company. Another nuance is the relevance of the research. If the company is on the rise, justifying the need to analyze the market, study competitors and find new strategies for increasing profits will be more problematic.