Codes in books and magazines on VAT

It is important not to confuse the codes in question with those that characterize the filling out of various accounting documents by VAT payers - books and magazines. The fact is that they use a different code - a number that corresponds to the name of one or another action of the taxpayer that has economic significance from the point of view of assessing the content of the accounting document, which in the prescribed manner can be transferred to the Federal Tax Service of the Russian Federation. This code facilitates the systematization and subsequent interpretation by tax service specialists of the contents of VAT accounting documents.

Codes in books and magazines: governing legislation

The list of relevant codes is also fixed by law. The main source of law in which they are given is Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/136, issued on March 14, 2016. Transaction codes in accordance with the specified source of law can be recorded:

— in purchase books that are used as part of VAT calculations, additional sheets to them;

- the sales book, as well as on the sheet supplementing it.

In addition, the noted legal act contains codes for the types of transactions that are necessary for the taxpayer to maintain a journal of invoices.

Codes in books and magazines: application

What can this or that code mean, the use of which is provided for by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/136?

For example, code 01, given in the above-mentioned Order of the Federal Tax Service of the Russian Federation, corresponds to transactions related to the release, transfer or acquisition of certain goods, services or work, including those provided by intermediaries, as well as property rights. It is assumed that the corresponding transaction code can be used in all types of books and journals used by the taxpayer.

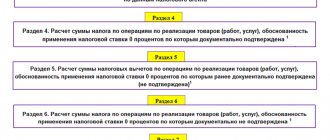

Let us now consider which transaction code in the VAT return can be recorded when filling out the corresponding reporting document for the Federal Tax Service of Russia. They can be classified based on their assignment to one of the 5 sections of the declaration - in fact, in this form, as we noted above, they are given in the main source of law regulating their application.

Where to get it from

The required transaction type code in the VAT return is entered in the following sections:

| Which sections of the declaration contain a line with an operation code? | |

| № | Who fills it out |

| 2nd | tax agents |

| 4–6 | when exporting |

| 7th | who does not have to pay VAT |

All codes under consideration must be taken from Appendix No. 1 to the Procedure for filling out a value added tax return (Federal Tax Service order No. ММВ-7-3/558 dated October 29, 2014).

Please note that from March 12, 2022, the composition of the codes was adjusted by order of the Russian Tax Service dated December 20, 2016 No. ММВ-7-3/696.

Examples of transaction codes in Section 1 of the VAT return

We can show various transaction codes for filling out a VAT return, which may be indicated in Section 1 of the relevant document, as an example in the following table.

| Code | Meaning |

| 1010800 | Corresponds to business transactions that are not subject to taxation |

| 1010801 | Corresponds to the operations reflected in clause 3 of Art. 39 Tax Code of the Russian Federation |

| 1010802 | Reflects the gratuitous transfer of real estate and infrastructure to state and municipal authorities |

| 1010803 | Corresponds to the transfer of privatized property |

| 1010804 | Reflects the performance of work or services by authorities within the framework of exclusive powers |

| 1010805 | Fixes the gratuitous transfer of fixed assets in favor of authorities, as well as state or municipal institutions and enterprises |

| 1010806 | Corresponds to transactions related to the sale of land plots |

| 1010807 | Reflects the transfer of ownership rights of a legal entity to its legal successor - one or more |

| 1010808 | Reflects the transfer of funds or real estate in order to replenish the capital of an NPO in the manner prescribed by federal legislation |

| 1010809 | Corresponds to transactions that are associated with the implementation by taxpayers in the status of organizers of the Olympic Games of various property rights |

| 1010810 | Complies with the provision of services related to permitting the passage of vehicles on toll public highways |

| 1010811 | Reflects the sale of products, the place of sale of which cannot be recognized as the territory of Russia |

| 1010812 | Reflects the sale of works or services, the place of sale of which cannot be recognized as the territory of Russia |

| 1010813 | Reflects the provision of services related to the free transfer of state and municipal property in favor of NPOs |

| 1010814 | Reflects the fact of performing work or providing services related to additional activities that are aimed at improving the situation on labor markets in the regions of the Russian Federation |

These are the features of entering the indicators under consideration into Section No. 1. Let us now study what transaction code in the VAT return can be recorded in Section No. 2 of the corresponding reporting document. Let's also make a small table for this.

Codes for types of transactions in the VAT return in 2021

When filling out the declaration, use the seven-digit KVO codes, which are enshrined in Appendix No. 1 to the Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] The codes are divided into five groups for different operations, which:

- are not recognized as an object of taxation;

- are not subject to taxation;

- taxed at a rate of 0%;

- carried out by tax agents;

- associated with fixed assets.

Since 2022, by Order of the Federal Tax Service of the Russian Federation dated August 19, 2020 No. ED-7-3 / [email protected], the form of the VAT declaration has been changed. And at the same time, several new VAT quotas appeared in 2022:

- 1010831 - operations for the gratuitous transfer of property intended to prevent and prevent the spread of coronavirus to state and local authorities;

- 1011450 - transactions for the gratuitous transfer of real estate in favor of the Russian Federation;

- 1011451 - operations for the gratuitous transfer of property into the ownership of the Russian Federation for scientific research in Antarctica;

- 1011207 - banking operations for the execution of bank guarantees, issuance of sureties, provision of services related to the installation and operation of the client-bank system, receipt of amounts from borrowers to compensate for insurance premiums;

- 1011208 - operations for the provision of services for the management of solid waste, provided by regional operators;

- 1011209 - operations for the gratuitous provision of services for the provision of air time or print space;

- 1011210 - operations for the sale of food products produced by hospital canteens, as well as the sale of food products produced by public catering establishments and sold to hospital canteens;

- 1011211 - operations for the provision of public services in the social sphere;

- 1011212 - operations for the sale of exclusive rights to inventions, utility models, industrial designs, microcircuit topologies and know-how, as well as the rights to use them on the basis of a license agreement;

- 1011446 - operations for the provision of services provided during international air transportation at international airports of the Russian Federation according to the list of the Government;

- 1011452 - operations for the provision of domestic air transportation services, provided that all route points are located outside the territory of Moscow and the region;

- 1011453 - operations for the provision of services for the transportation of goods by sea vessels within the territory of the Russian Federation for the purpose of their further export abroad;

- 1011454 - operations to provide icebreaker assistance to sea vessels transporting goods for the purpose of their further export abroad.

Keep tax records for VAT in the cloud service Kontur.Accounting. In our program, you can assign a QUO for each operation, and then it will be automatically entered into tax registers and declarations. We give all newcomers free access for 14 days.

Examples of transaction codes in Section No. 2 of the declaration

| Code | Meaning |

| 1010200 | Reflects transactions that may not be subject to value added tax |

| 1010201 | Reflects the provision by the lessor of certain premises in favor of citizens of other states or foreign companies |

| 1010202 | Corresponds to the implementation of services related to the accreditation of operators who carry out technical inspections in accordance with the legislation of the Russian Federation |

| 1010203 | Corresponds to the implementation of services for technical inspection by operators in accordance with the legislation of the Russian Federation |

| 1010211 | Reflects the implementation of medical services provided by legal entities or individual entrepreneurs operating in the field of medicine |

| 1010221 | Reflects services related to care for the sick, citizens with disabilities, and the elderly, if this care is provided in accordance with a medical report |

| 1010225 | Corresponds to the transfer of ownership rights represented by a contribution under an agreement within an investment partnership, as well as when one of the partners receives a share when dividing assets |

| 1010226 | Corresponds to services related to the organization of gambling |

| 1010227 | Reflects services related to the trust management of pension investments in accordance with the legislation of the Russian Federation |

| 1010228 | Reflects transactions related to the assignment of claims within the framework of obligations arising on the basis of financial legal relations in the process of forward transactions |

| 1010229 | Reflects various operations carried out by clearing companies |

| 1010231 | Corresponds to services related to the supervision and care of children in kindergartens, clubs, sections, studios |

| 1010232 | Corresponds to sales of food products that are directly produced by canteens established by educational and educational organizations |

| 1010234 | Corresponds to services related to archive management, which are carried out by specialized organizations |

| 1010235 | Corresponds to sales of services related to the transportation of passengers on public transport |

These are the features of reflecting indicators in Section No. 2 of the reporting document under consideration. Let's move on.

Examples of codes in Section 3 of the declaration

Let's now study what transaction code in the VAT return can be recorded in Section No. 3. Again, let's look at examples of these indicators in a small table.

| Code | Meaning |

| 1010400 | Corresponds to transactions that are taxed at a zero rate |

| 1011410 | Transaction code 1011410 in the VAT return reflects the sale of products that are exported from Russia, but are not listed in clause 2 of Art. 164 Tax Code of the Russian Federation |

| 1011411 | Corresponds to the sale of goods that are placed in a free customs zone - again, not listed in paragraph 2 of Art. 164 Tax Code of the Russian Federation |

| 1010410 | Reflects sales of goods exported, as well as placed in a free customs zone by a person who represents the state determined in accordance with subparagraph. 1 clause 3 art. 284 Tax Code of the Russian Federation |

| 1010456 | Corresponds to the sale of goods exported, as well as placed in a free customs zone by persons who are recognized as interdependent |

| 1010457 | Reflect the sale of goods exported, as well as placed in a free customs zone by persons who have characteristics corresponding to the previous 2 codes |

| 1011412 | Reflects the export of goods listed in paragraph 2 of Art. 164 Tax Code of the Russian Federation |

| 1011413 | Reflects the placement in the free customs zone of products specified in Art. 164 Tax Code of the Russian Federation |

| 1010458 | Reflects the export of goods, as well as their placement in the free customs zone - if they are listed in Art. 164 of the Tax Code of the Russian Federation, by persons representing states who are determined in accordance with Art. 284 Tax Code of the Russian Federation |

| 1010459 | Reflects the export of goods, as well as their placement in the free customs zone, if they are listed in Art. 164 of the Tax Code of the Russian Federation, persons who are recognized as interdependent |

| 1010460 | Reflects the export of goods, as well as their placement in the free customs zone, given in Art. 164 of the Tax Code of the Russian Federation, persons determined in accordance with the 2 previous codes |

| 1010421 | Fixes the export of goods not listed in Art. 164 of the Tax Code of the Russian Federation, to the states of the Customs Union |

| 1010461 | Reflects the export of goods not listed in Art. 164 of the Tax Code of the Russian Federation, to the Customs Union by persons representing states determined in accordance with sub. 1 clause 3 art. 284 Tax Code of the Russian Federation. |

| 1010462 | Sale of goods not listed in Art. 164 of the Tax Code of the Russian Federation, in the states of the Customs Union by persons who are recognized as interdependent |

| 1010463 | Sale of goods not listed in Art. 164 of the Tax Code of the Russian Federation, in the states of the Customs Union by persons who are determined in accordance with the 2 previous codes |

VAT: exporters are recommended to indicate new codes in reporting

The Federal Tax Service of the Russian Federation, in its letter dated January 16, 2018 N SD-4-3/ [email protected], provided new codes for a number of transactions regarding the sale of raw materials and non-raw materials.

The Agency reminds that the zero VAT rate applies:

- when selling goods exported as part of re-export that were previously placed under the customs procedure of processing in the customs territory, as well as goods manufactured from them;

- when selling goods exported as part of re-export, previously placed under the customs procedures of a free customs zone, free warehouse, as well as goods made from them.

This norm is provided for in paragraphs four and five of subparagraph 1 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation.

However, the current procedure for filling out a VAT return does not contain the corresponding transaction codes.

In this regard, the Federal Tax Service recommends using the following codes in the VAT return:

- 1011432 - sale of non-commodity goods exported under the customs procedure of re-export;

- 1011433 - sale of non-commodity goods exported under the customs procedure of re-export, in transactions with persons whose place of registration (residence, residence) is a state or territory included in the list of offshore companies of the Ministry of Finance;

- 1011434 - sale of non-commodity goods exported under the customs procedure of re-export, in transactions with persons recognized as interdependent;

- 1011435 - sale of non-commodity goods exported under the customs procedure of re-export, in transactions with persons recognized as interdependent and whose place of registration (residence, residence) is a state or territory included in the list of offshore companies of the Ministry of Finance;

- 1011440 - sale of raw materials exported under the customs re-export procedure;

- 1011441 - sale of raw materials exported under the customs procedure of re-export, for transactions with persons whose place of registration (residence, residence) is a state or territory from the list of offshore companies of the Ministry of Finance;

- 1011442 - sale of raw materials exported under the customs procedure of re-export, in transactions with persons recognized as interdependent;

- 1011443 - sale of raw materials exported under the customs procedure of re-export, in transactions with related parties whose place of registration (residence, residence) is a state or territory from the list of offshores of the Ministry of Finance.

Please note that the codes listed above apply to goods not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation. Let us remind you that this norm contains a list of goods for the application of the VAT rate of 10%.

For goods falling under paragraph 2 of Article 164 of the Tax Code, other codes are given:

- 1011436 - sale of non-commodity goods exported under the customs procedure of re-export;

- 1011437 - sale of non-commodity goods exported under the customs procedure of re-export, for transactions with persons whose place of registration (residence, residence) is a state or territory from the list of offshore companies of the Ministry of Finance;

- 1011438 - sale of non-commodity goods exported under the customs procedure of re-export, in transactions with persons recognized as interdependent;

- 1011439 - sale of non-commodity goods exported under the customs procedure of re-export, in transactions with persons recognized as interdependent and whose place of registration (residence, residence) is a state or territory from the list of offshore companies of the Ministry of Finance.

In addition, the Federal Tax Service provides additional codes for reflecting transactions (taxable in accordance with paragraph 7 of Article 164) in the purchase book, sales book and invoice journal:

- sale of raw materials exported under the customs export procedure, taxation of which is carried out at a rate of 18% - recommended transaction type code 37;

- sale of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% - recommended transaction type code 38;

- sale of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 10% - recommended transaction type code 39;

- implementation of works or services (listed in subparagraphs 2.1 - 2.5, 2.7 and 2.8 of paragraph 1 of Article 164 of the NKRF) in relation to raw materials (non-raw materials) goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% - recommended transaction type code 40.

The letter also notes that until amendments are made to the procedure for filling out the VAT return, the listed transactions are reflected on line 010 or 020 of section 3 of the declaration.

In 1C:Enterprise 8, these recommendations of the Federal Tax Service will be supported with the release of the next updates. For deadlines, see “Monitoring Legislative Changes.”

Filling out Section No. 3 of the declaration: nuances

There are a number of nuances that characterize working with Section No. 3 of the reporting document under consideration. It is important, when filling it out, to take into account each of the formulations that reflect the meaning that certain indicators have - for example, transaction code 1011410 in the VAT return. The correctness of specifying the relevant details guarantees the correct reflection of information about the taxpayer in the registers of the Federal Tax Service of the Russian Federation.

When filling out this Section of the declaration, you should take into account the explanations given by the Federal Tax Service of the Russian Federation in the Order that established the corresponding codes. So, if a company exports by filling out VAT reporting and indicating the transaction code in it, in the VAT return, if we talk about Section No. 3, the tax bases for all relevant operations must be recorded if they are legally taxed at a zero rate. The procedure for determining its value can be established in federal sources of law, as well as in international treaties.

These are the features of reflecting information in Section No. 3 of the reporting document under consideration. Let us now study what this or that transaction code may mean in the VAT return in Section No. 4. We again use the format of a small table for these purposes.

| Code | Meaning |

| 1011700 | Reflects transactions carried out by tax agents |

| 1011711 | Corresponds to the sale of goods and services by foreigners who are not registered as taxpayers |

| 1011712 | Corresponds to the sale of works and services by foreigners who are not registered as taxpayers |

| 1011703 | Reflects the provision by authorities of various types of state and municipal property for rent |

| 1011705 | Corresponds to the sale on the territory of the Russian Federation of various types of confiscated property sold in accordance with court decisions, ownerless things, treasures, valuables for purchase, as well as those transferred to the authorities by right of inheritance |

| 1011707 | Reflects the sale of goods, work and services by foreigners on the basis of civil law agreements |

| 1011709 | Reflects the payment of VAT by persons in the status of tax agents, which are given in clause 6 of Art. 161 Tax Code of the Russian Federation |

Let us now study what the transaction type code in the VAT return in Section No. 5 can mean. We use a small table in the same way.

Procedure for filling out Section 7 of the VAT return

When filling out Section 7 of the tax return, column 1 indicates the transaction codes given in Appendix No. 1 to the Procedure.

When reflecting operations in column 1:

According to paragraph 6 of Article 88 of the Tax Code of the Russian Federation, when conducting a desk tax audit, the tax authority has the right to demand that the taxpayer provide, within five days, the necessary explanations about the transactions (property) for which tax benefits have been applied, and (or) request, in the prescribed manner, from these taxpayers documents, confirming their right to such tax benefits.

In order to increase the efficiency of VAT administration, while simultaneously reducing the volume of required documents, the Federal Tax Service of Russia, in a letter dated January 26, 2017 No. ED-4-15 / [email protected] , sent recommendations for conducting desk tax audits of VAT tax returns that reflect transactions not subject to VAT taxation (exempt from taxation) in accordance with paragraph 2 and paragraph 3 of Article 149 of the Tax Code of the Russian Federation and falling under the concept of a tax benefit, taking into account paragraph 1 of Article 56 of the Tax Code of the Russian Federation and paragraph 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33.

If the taxpayer submits explanations in the form of a Register according to the proposed form, then the volume of required documents is significantly reduced and is produced using the risk-based approach set out in Appendix No. 2 to this letter.

If the taxpayer fails to submit the Register or if the Register is not submitted in the recommended form (if it is impossible to identify supporting documents, it is impossible to correlate them with the benefits used, it is impossible to comply with the requirements of this letter, the transaction amount is not indicated in the register), the documents are requested without using a risk-based approach.

Transaction codes in Section No. 5

| Code | Meaning |

| 1011800 | Reflects transactions related to transactions on various real estate objects |

| 1011801 | Corresponds to a property that has been completed as part of capital construction carried out by contracting firms |

| 1011802 | Corresponds to a property that was completed as part of capital construction carried out by a person for his own use |

| 1011803 | Reflects a property purchased under civil law agreements |

| 1011805 | Corresponds to the modernization or reconstruction of a particular property |

These are the transaction codes of Section 4 of the VAT return. It may be noted that the reflection of relevant indicators is also provided for in the structure of Section No. 7 of the reporting document under consideration. It will be useful to study this nuance in more detail.

What codes are recorded in Section 7

In accordance with the norms of the Ministry of Finance of the Russian Federation, the following transaction codes of section 7 of the VAT declaration can be applied: 1010823; 1010800. These codes can be used until the competent authorities develop new ones and include it in the Declaration Procedure. In a similar way, not only Section 7, which is present in a document such as a VAT declaration, is regulated. Transaction codes under Sections 5 and 6 are regulated within the framework of the procedures provided for in subsection. 9.2 clause 1 art. 164 of the Tax Code of the Russian Federation have also not yet been developed separately. Therefore, code 1011417 can be used instead. It can also be used to reflect the corresponding transactions in Section No. 4 of the VAT return.

Filling out Section 7 of the VAT return in “1C: Accounting 8” (rev. 3.0)

We will consider the procedure for accounting for VAT on non-taxable transactions, filling out Section 7 of the VAT return and the register of supporting documents using the following example.

Example

The organization TF-Mega LLC, which applies the general taxation system, carried out the following operations in the second quarter of 2022:

The sequence of operations is given in Table 1.

Setting up accounting policies and accounting parameters

A taxpayer carrying out transactions subject to VAT and transactions not subject to taxation must make the appropriate program settings.

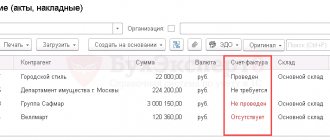

After making the settings in the tabular part of the accounting system documents Receipt (act, invoice) with the type of transaction Goods (invoice), as well as with the type of operation Goods, services, commission, a column for VAT accounting method will appear on the Goods tab. This column displays information about the selected method of accounting for input VAT, which can take the following values:

For accounting system documents Receipt (act, invoice) with transaction type Services (act), information about the method of accounting for input VAT will be reflected in the Accounting Invoices column.

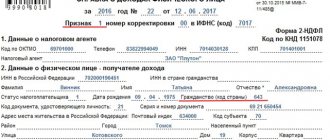

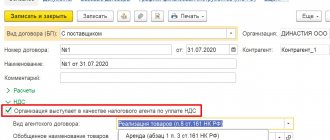

Rice. 1. Indication of the transaction code not subject to VAT

After this, in the Transaction Code field that opens, you must indicate the code of the exempt transaction in accordance with Appendix No. 1 to the procedure for filling out the VAT tax return, approved. by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 20, 2016).

Since the Register of Supporting Documents provides for the indication of not only the transaction code, but also the type (group, direction) of a non-taxable transaction, the required value of the type (group, direction) can be entered by opening the appropriate form for the selected transaction code (Fig. 1). Let us recall that the indication of the group (type, direction) in the absence of regulatory clarifications is established by the taxpayer independently, based on his own ideas and ease of use.

The procedure for filling out Section 7 of the VAT tax return and the need to submit the Register of supporting documents depends on whether the transaction is:

In this regard, it is necessary to put the following flags in the form that opens for the corresponding operation code:

Accounting for non-taxable transactions

In accordance with subparagraph 1 of paragraph 3 of Article 169 of the Tax Code of the Russian Federation, when performing transactions that are not subject to taxation (exempt from taxation), invoices are not drawn up. Therefore, the accounting system document Invoice issued is not generated, and, therefore, the Issue an invoice button under the tabular part of the Sales document (act, invoice) is not used.

After posting the document, the following accounting entries are entered into the accounting register:

Since imported frames for glasses are sold, entries on the number of frames indicating the country of origin and the customs declaration number are entered in the debit of the auxiliary off-balance sheet account of the customs declaration.

The shipment of frames for corrective glasses to the buyer of LLC "Style" (operations: 2.3 "Shipment of frames for corrective glasses to the buyer of LLC "Style""; 2.2 "Write-off of the cost of goods sold") is registered in the program using the document Sales (act, invoice) with the type of operation Goods (invoice) in a manner similar to that given for the sale of goods by Trading House LLC (operations 2.1 and 2.2).

When performing transactions, the place of implementation of which is not recognized as the territory of the Russian Federation, invoices are not drawn up (letters of the Ministry of Finance of Russia dated 04/16/2012 No. 03-07-08/107, dated 02/17/2009 No. 03-07-08/36). Therefore, the accounting system document Invoice issued is not generated, and, therefore, the Issue an invoice button under the tabular part of the Sales document (act, invoice) is not used.

After posting the document, the following accounting entry is entered into the accounting register:

Since in relation to transactions the place of implementation of which is not recognized as the territory of the Russian Federation, the Register of supporting documents is not formed, no entry is made into the Documents register for non-taxable transactions.

Accounting for rental services

The organization TF-Mega LLC rented office space from Delta LLC in the second quarter of 2022.

Since the service for renting office space relates to the entire activity of the organization, i.e., both operations subject to VAT and operations not subject to taxation, the amount of VAT claimed by the lessor must be distributed (clause 4 and clause 4.1 of Article 170 of the Tax Code of the Russian Federation ). To do this, in the document Receipt (act, invoice) in the Accounts column of the tabular section, set the VAT accounting method to Distributed.

After posting the document, accounting entries will be generated:

Entries with the type of movement Receipt with the event Presented by VAT by the Supplier and with the type of movement Expense with the event VAT are subject to distribution to the amount of VAT presented by the lessor and subject to distribution are entered into the VAT register presented.

At the same time, for the tax amount written off in the VAT register, an entry is made in the Separate VAT accounting register with the type of movement Receipt.

To register an invoice received from the lessor (operation 3.3 “Registration of the lessor’s invoice for the second quarter of 2017”), you must enter, respectively, the number and date of the incoming invoice in the Invoice No. and from the Receipt document (act, invoice) fields. invoices and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document.

As a result of posting the document Invoice received, an entry will be made in the information register Invoice Journal to store the necessary information about the received invoice.

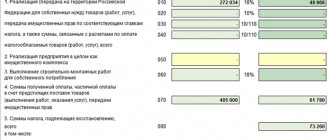

Rice. 2. VAT distribution. Calculation of sales revenue

To calculate the proportion of VAT distribution, you must execute the Fill command.

After executing this command in the program on the Sales Revenue tab, the amount of revenue (the cost of shipped goods (work, services, property rights)) from activities subject to VAT and from activities not subject to taxation (both exempt from taxation and from one, the place of sale of which is not recognized as the territory of the Russian Federation).

In the program, the proportion indicators for the second quarter of 2022 will be calculated as follows:

The automatic distribution of the amount of input VAT according to the calculated proportion will be reflected on the Distribution tab of the VAT Distribution document (Fig. 3).

Using the VAT Distribution Analysis button in the VAT Distribution document, you can generate a report and, if necessary, print it.

After posting the VAT Distribution document, the following entries will be made in the accounting register.

The amount of input VAT for the office space rental service will be transferred from the credit of account 19.04 with the third subaccount. Distributed to the debit of account 19.04 with the third subaccount:

Data for the purchase book on the amounts of tax to be deducted in the current tax period are reflected on the Purchased assets tab.

To fill out a document using accounting system data, it is advisable to use the Fill command.

The tabular part of the document will contain information about the purchased service for renting office space for the second quarter of 2017, for which the amount of input VAT presented by the lessor is claimed for deduction in the share calculated on the basis of the generated distribution proportion (Fig. 3).

Rice. 3. VAT distribution

After posting the document, an accounting entry is generated:

Formation of tax reporting

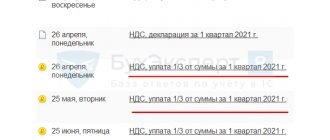

Rice. 4. Formation of records of Section 7 of the VAT return

To automatically fill out a document using accounting system data, you must execute the Fill command. When this command is executed, the program automatically:

If you need to expand the list of supporting documents for non-taxable (tax-exempt) transactions, then you need to click on the appropriate hyperlink in the Supporting Documents column and add the document to the list using the Add button. If there is a need to reflect any additional operation in Section 7 of the VAT return, you should:

After posting the document Formation of records of section 7 of the VAT declaration, the corresponding entries are made in the Register of Records of section 7 of the VAT declaration for the formation of this section of the declaration.

At the same time, expense entries are made in the VAT-exempt transactions register.

Thus, in Section 7 of the VAT return for the second quarter of 2017, the following indicators will be automatically filled in:

Section 7 of the VAT return for the second quarter of 2017

Data

Relevant transaction codes for the sale of frames for corrective glasses and the provision of advertising services to a foreign partner

Cost of goods sold (frames for corrective glasses) and advertising services provided

Cost of purchased frames for corrective glasses

The amount of input VAT on the service for renting office space related to the sale of frames for prescription glasses in the amount of RUB 6,571.82, as well as the amount of input VAT on additional costs associated with the purchase of frames for prescription glasses (for example, delivery costs) , in the amount of 573.47 rubles.

Let us remind you that according to clause 44.2 of the Procedure for filling out Section 7 of the declaration, when reflecting in column 1 transactions that are not recognized as an object of taxation, as well as transactions for the sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation, the indicators in columns 3 and 4 are not are filled in (a dash is placed in the indicated columns).

Filling out the Register of supporting documents is done by clicking the Generate button (Fig. 5).

Rice. 5. Compilation of the “Register of supporting documents” for the second quarter of 2022

Since the letter of the Federal Tax Service of Russia dated January 26, 2017 No. ED-4-15 / [email protected] does not contain specific instructions as to how exactly this register should be filled out (in general for the counterparty or in the context of each operation), the program implements transaction-by-operation filling .

By clicking the Print button, you can print this Register of supporting documents for sending to the tax authority. The electronic format for the Register is not currently approved.

Source