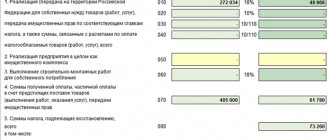

When filling out a VAT report, the payer of this tax is inevitably faced with the need to determine the transaction code. In the 2022 VAT return, this value is used in sections 2, 4-7. These sections are not always filled out, but only in situations where the taxpayer had relevant operations during the reporting period, namely, if an individual entrepreneur or company acted as a tax agent for VAT, carried out export operations, or were exempt from paying tax. These cases require marking the corresponding transaction type codes in the VAT return.

Transaction codes in the VAT return by section

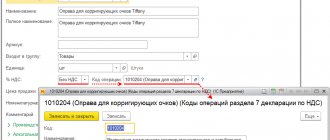

Value added tax transaction codes that must be noted when filling out the report are given in Appendix No. 1 to the procedure for filling out the declaration, approved in the Federal Tax Service order No. MMV-7-3 of October 29, 2014 / [email protected] This appendix is formatted in a table, which in turn contains several sections. They provide the encoding, a decoding of the type of transaction, as well as an indication of the specific article of the Tax Code, which provides for the rule for assessing VAT for a particular case.

What non-taxable VAT transactions are included in section 7

Incorrect reflection of non-taxable transactions in section 7 of the Declaration does not bear any responsibility for taxpayers, since this information does not affect the amount of tax. But the lack of separate accounting leads to a ban on deducting input VAT or including it in expenses when calculating income tax. When imposing taxes, legislators give relief to socially significant enterprises, industries with priority development, public projects, international agreements, etc. This is expressed in non-taxation, the use of various deductions, and a reduction in the tax rate.

15 Jan 2022 marketur 900

Share this post

- Related Posts

- Cash Compensation from the State 2019

- Benefits for honored masters of industrial training

- Chernobyl Laws for Family in Russia

- Employment contract between the general director and director

Transactions without VAT

The code format combines operations of the same category. Thus, transaction code 1010800 in the VAT return combines transactions that are not recognized as an object of taxation on the basis of paragraph 2 of Article 146 of the Tax Code. This is section 1 of the code table, while the transactions themselves are recorded in section 7 of the VAT Declaration. More specifically, this could be, for example, transaction code 1010806 in the VAT return - operations for the sale of land plots or shares in them (subclause 6, clause 2, article 146 of the Tax Code of the Russian Federation) or the transfer of property rights of an organization to its legal successor (subclause 7 clause 2 of article 164 of the Tax Code of the Russian Federation) with code 1010807.

Group codes 1010200 are transactions exempt from VAT based on the provisions of Article 149 of the Tax Code. This is, for example, transaction code 1010204 in the VAT return - the sale of domestic medical goods, such as essential and vital medical goods, prosthetic and orthopedic products or glasses and lenses for vision correction, or transaction code 1010245 - services for the sale of general or vocational educational programs provided by non-profit educational organizations. This group of codes is highlighted in the appendix to the order of the Federal Tax Service in section 2, and is used when filling out section 7 of the tax report.

Let's highlight a few more codes in this section:

- transaction code 1010274 in the VAT return - trade in scrap and waste of ferrous and non-ferrous metals;

- transaction code 1010211 in the VAT return - provision of medical services, with the exception of cosmetic, veterinary and sanitary-epidemiological services (except for those financed from the budget);

- transaction code 1010256 in the VAT return - implementation of exclusive rights to inventions, utility models, industrial designs, programs for electronic computers, know-how, etc.;

- transaction code 1010288 in the VAT return - transfer of works, goods, services or property rights free of charge as part of charitable activities;

- transaction code 1010243 in the VAT return - Sale of shares in the authorized (share) capital of organizations;

- transaction code 1010292 in the VAT return - loan transactions.

A medical institution is entitled to VAT relief

Services for physical therapy and sports medicine are also not directly mentioned in the list of diagnostic, prevention and treatment services. At the same time, the institution has the right to take advantage of benefits in relation to these services, often provided as part of pre-medical care). Physical therapy services relate to activities in the field of health care and correspond to the list of medical services for diagnosis, prevention and treatment. At the same time, the Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 15, 2008 N KA-A41/488-08 does not take into account the argument of the tax authorities about the inconsistency of the services listed in the license with the wording contained in OKUN *(1) and OKVED *(2), since this is not refutes neither the fact of provision of preferential services nor the right to apply the specified benefit. Also exempt from VAT are medical nutrition and drug treatment, which are classified as medical services (Resolution of the Tenth Arbitration Court of Appeal dated November 27, 2006 N 09AP-13927/2006-AK). At the same time, from the benefits provided by paragraphs. 2 p. 2 art. 149 of the Tax Code of the Russian Federation, an institution that has a license does not have the right to refuse, as this can be done in accordance with paragraph 5 of Art. 146 of the Tax Code of the Russian Federation in relation to the operations named in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, for example, in relation to the services of sanatorium and health resort organizations. But should the benefit be abandoned, especially by a budgetary institution that is not at all interested in increasing tax obligations to the budget? It is better to take care of the license and provide tax-exempt medical services.

Please note => Second hearing a day and a half in pre-trial detention

Export operations with zero rate

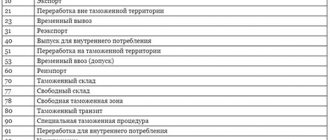

The next group of codes - 1010400 or section 3 of the table - are export transactions taxed at a tax rate of 0 percent based on various paragraphs of Article 164 of the Tax Code. If a company or individual entrepreneur committed them during the reporting period, then the relevant information will be indicated in sections 4-6 of the VAT report.

Examples of “code-operation” linkages in this case include the following:

- transaction code 1010410 in the VAT return - sale of goods exported under the customs export procedure;

- transaction code 1010421 in the VAT return - sale of goods to the territory of the EAEU member states;

- transaction code 1010425 in the VAT return - offer of transport and forwarding services within the framework of international transport;

- transaction code 1010447 in the VAT return - adjustment of the tax base and tax deductions in connection with the return of goods, refusal of work or services for which the right to apply a zero VAT rate was previously confirmed;

- transaction code 1011422 in the VAT return - sale of raw materials exported under the customs export procedure.

Transactions exempt from taxation

Agreements for services provided that were not previously submitted; invoices; payment documents confirming payment for services provided (in the absence of payment documents, indicate how payment is made for services for the provision of residential premises for use); documents confirming that the residential premises provided for use belong to the company (if previously submitted, indicate the number and date); other documents confirming the legality of using the above VAT benefit The court noted that the taxpayer’s lack of obligation to calculate and pay VAT to the budget on transactions that are not subject to taxation is expressly provided for in Art. 149 of the Tax Code of the Russian Federation. Such sales, which are not recognized as subject to VAT, are not taken into account when forming the tax base for VAT, while tax benefits according to Art. 56 of the Code apply only to certain categories of taxpayers. Therefore, in the opinion of the court, it is necessary to distinguish benefits from cases when the object of taxation does not arise and, accordingly, the taxpayer is not obliged to submit documents confirming the legality of reflecting in Section 7 of the specified transactions that are not subject to taxation as part of the desk tax audit.

16 Jan 2022 marketur 1147

Share this post

- Related Posts

- Benefits for land transport and property taxes

- How are the 2019 traffic police exams taken now?

- How to include lunch in a contract if a person works in two professions at 05 rates

- Notarized power of attorney number

Operations of tax agents for VAT

If a company or individual entrepreneur is recognized as a VAT tax agent, then they must fill out section 2 of the VAT return. Tax agent operations are presented in section 4 and are combined by coding 1011700, as well as the provisions of Article 161 of the Tax Code. In such cases, codes may be used, such as, for example, code 1011711 - sale of goods of foreign persons who are not registered as taxpayers in the Russian Federation and sale of works and services of these foreign persons using non-cash forms of payment or code 1011703 - provision by government agencies authorities and management for lease of federal property, property of constituent entities of the Russian Federation or municipal property.

Who is entitled to VAT benefits?

VAT benefit codes refer to the budget classification of taxes, fees and non-tax payments paid to the budget. They are a combination of seven numbers. Each type of tax benefit has its own code. Let's give an example of several VAT tax incentive codes.

- Postal products (postcards, envelopes, stamps, with the exception of copies of philatelic value).

- Medical products included in the list of the Government of the Russian Federation. It includes prosthetic and orthopedic products and raw materials for their production; goods intended for preventive measures or used for the rehabilitation of people with disabilities; any type of corrective optics (lenses, glasses, frames).

- Coins made from any precious metal that are considered official means of payment in the Russian Federation or abroad, except for specimens of numismatic value.

- Products of folk crafts of artistic value, except those that fall under the category of excise goods.

- Maintenance and repair services for household appliances and medical devices, including spare parts and other consumables required to restore functionality, during the warranty period at no additional charge.

- All types of repair and restoration, scientific research and archaeological field work aimed at preserving historical monuments and buildings belonging to religious organizations.

- A set of scientific, research, experimental, technological and design work carried out with budgetary funds, including those aimed at creating new types of products/technologies.

- Precious metals, including ore, scrap, production waste. Precious stones, including rough diamonds.

- Products produced by canteens of medical institutions, schools, kindergartens or catering organizations that sell their products in such institutions.

- Services of medical institutions, except for organizations providing services in the sanitary and epidemiological field, cosmetology and veterinary medicine.

- Transportation of citizens by sea, river, and railway motor transport within urban and suburban transport, excluding taxi services, including minibuses, subject to the implementation of activities at current tariffs, including all provided benefits.

- Works and/or services in the field of fighting forest fires.

- Maintenance and air navigation services for air traffic vessels provided within Russian airports.

- All types of work/services, including survey and classification, for servicing sea, river and mixed types of vessels at moorings in the port or during pilotage.

- Sale of subscriptions and entrance tickets to organizations that operate in the field of physical education and sports services, as well as rental of sports grounds for specialized events.

- Providing residential space for use and selling it, regardless of the form of ownership and division into shares, including the transfer of shares when selling apartments in apartment buildings.

- Implementation of inventions, technological models, databases, software products, microcircuits and other intellectual goods and know-how.

- Sales of scrap metal of any type.

- Transfer of goods/services for the purpose of subsequent advertising, costing no more than 100 rubles.

Please note => What percentage of the salary goes to New Urengoy

Operations on fixed assets

These types of operations are presented in the final section 5 of the application with coding 1011800. There are only eight types of operations in this category, and they are regulated by Article 171.1 of the Tax Code, namely its paragraphs 1 and 6.

The essence of such operations is that the amounts of VAT on real estate previously accepted for deduction are subject to restoration and payment to the budget if, for example, the real estate began to be used in activities that are not subject to VAT. In this case, the previously arisen and realized right to deduction is lost on the basis of paragraph 2 of Article 170 of the Tax Code.

This type of accrual is reflected in Appendix 1 to Section 3 of the VAT declaration only once a year - in the 4th quarter and for 10 years from the date of commissioning of such an object.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.