ACCOUNTS RECEIVABLE: GENERAL CHARACTERISTICS

Enterprises engaged in economic and financial activities carry out settlements with counterparties.

If an enterprise has shipped products or performed work and services before funds (payments) are received in the current account, then a receivable arises. Accounts receivable is the debt of suppliers and contractors, employees of the enterprise, counterparties-customers who owe the given enterprise for goods, works, and services sold. Debtors can be both legal entities and individuals.

The essence of accounts receivable is that in accounting these debts are considered part of an asset, that is, in fact, they have not yet been paid, but are included in profit. Consequently, the state of accounts receivable affects the financial position of the enterprise.

The task of any enterprise is constant monitoring and analysis of accounts receivable. To solve this problem, you need to generate reports on the status of debts, their size and composition.

Composition of accounts receivable:

- debt on advances issued to suppliers for upcoming deliveries;

- debt on settlements with accountable persons;

- debt of contracting parties-buyers for payments for goods, work performed, services rendered;

- overpayment of taxes to the budget;

- calculations for “input” VAT;

- debt of insurance contributions from the social insurance fund (FSS), if the amount of benefits for sick leave and in connection with maternity exceeds the accrued insurance contributions;

- debt on loans issued;

- debt in settlements with persons who must compensate for damage;

- other debt to the company.

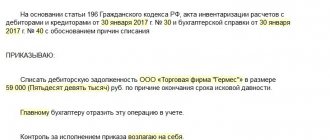

How to write off a “creditor”

Let us assume that on March 30, 2022, Guru LLC carried out an inventory of settlements with counterparties, as a result of which an accounts payable to Septima LLC was identified in the amount of 145,000 rubles. The statute of limitations on it expired on March 13, 2017.

Here is a sample accounting statement of accounts receivable for this situation:

| LIMITED LIABILITY COMPANY "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2022, accounts payable to the limited liability company "Septima" were identified (TIN 7722123 456, checkpoint 772201001, address: Moscow, Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2022 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-P. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires on March 13, 2022. Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income for income tax for the first quarter of 2022 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief Accountant____________Shirokova____________/E.A. Shirokova/ |

EXAMPLE OF ACCOUNTS RECEIVABLE ANALYSIS

Accounts receivable analysis can be carried out in the following sequence:

- Analysis of the structure, movement and condition of accounts receivable.

- Analysis of accounts receivable by timing.

- Determination of the share of receivables in the total volume of current assets, calculation of turnover indicators, assessment of the ratio of the growth rate of receivables to the growth rate of sales revenue.

- Analysis of the ratio of receivables and payables.

Analysis of the structure, movement and condition of receivables

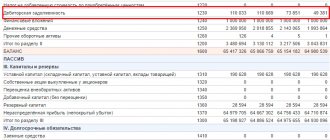

Let's consider the structure of short-term receivables of a healthcare institution over the course of one financial reporting year (Table 1).

From table 1 it follows that short-term accounts receivable at the end of 2022 decreased by 412,852 rubles. compared to its beginning.

Accounts receivable for works and services sold to customer-buyers constitute the largest share of the organization's total debt: 60.74% at the beginning of the year and 58.81% at the end.

The debt on advances issued to suppliers had a positive trend and decreased by RUB 73,194 at the end of the year.

Calculations for value added tax at the end of 2022 amounted to RUB 206,038. versus RUB 294,582 at the beginning of the year, reducing accounts receivable by 88,544 rubles.

The amount of social insurance receivables at the end of the year is RUB 126,782. The debt arose due to the excess of the amount of accrued benefits for temporary disability over the amount of insurance contributions to the Social Insurance Fund.

All accounts receivable indicators at the end of the year had positive dynamics.

Suppliers' accounts receivable

Let's consider the accounts receivable from suppliers in the context of each contract by amount and timing of occurrence, and find out the reasons for its formation.

During the period between payment to the supplier and shipment of goods to him, performance of work or provision of services, a receivable is formed and a financial obligation of the counterparty arises to repay this debt. This period can last several days or months, depending on the conditions agreed upon by the parties in the contract.

Settlements for advances issued to debtors and settlements with suppliers are linked. If an advance payment is made to the supplier for the upcoming delivery of goods (performance of work, provision of services), then the supplier’s receivables to the organization are formed in the balance sheet until the date of delivery of the goods.

If the supplier first supplied material assets (performed work, provided services), then the organization has accounts payable until payment is made.

Let's determine the amounts and terms of debt using the table. 2.

According to the data in Table. 2 accounts receivable at the end of 2018 amounted to RUB 174,530. Debt by date :

- up to 30 days - 58,179 rub. This is explained by the fact that according to the contract, communication services and utilities are provided in the next month after prepayment. Accounts receivable for materials—RUB 24,755.66, deliveries are made within 30 days after prepayment;

- from 31 to 60 days - 27,751 rubles;

- from 61 to 180 days - RUB 88,600. (for a laboratory device, which, according to the supply agreement, Medtechnika LLC must be shipped and delivered at the end of the first quarter of 2019).

There are no overdue debts.

Accounts receivable for works and services sold to customers-buyers

According to the table. 1 shows that in the structure of accounts receivable, the largest share has debt associated with the sale of material assets, performance of work, and provision of services.

The debt arises at the time of shipment of goods, performance of work, provision of services and is repaid at the time of payment by the customer-buyer. The supporting document is the act of completed work ( services ); when goods are released, it is the invoice . Payment terms are regulated by a bilateral agreement and calendar plan.

To analyze accounts receivable for work performed, we will create a table. 3 and evaluate the state of the “receivable” by size and timing of occurrence.

As can be seen from table. 3, accounts receivable at the end of the first half of 2022 amounted to RUB 809,773.

The debt was incurred in the amount of 40,600 rubles, the debt was due for four months. The work was completed on 03/03/2019 in full in the amount of 81,200 rubles, and payment was made only partially (40,600 rubles).

Debt for - 60,200 rubles. The work was completed on March 28, payment was not made. Accounts receivable have a maturity of three months.

Accounts receivable with a maturity of two months are registered with two counterparties:

- Shopping center "KOR" - 128,435 rubles;

- instrument-making enterprise - 27,174 rubles.

Debts owed to other counterparties range from one week to a month.

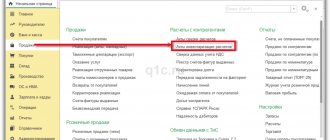

Invoices are generated on the basis of an agreement concluded between the customer and the contractor. To monitor the fulfillment of obligations, each contract is reviewed (the required one is found in the 1C program). In the found agreement, several invoices are opened, presented to the customer for a certain period. For each of them, you can determine the period, the invoice amount, as well as the status of the current contract - implementation and payment. Each contract stipulates the terms of execution and payment (Table 4).

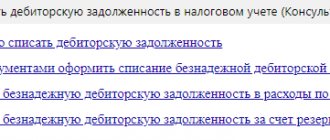

Based on an assessment of the debt period for each customer, the organization must collect receivables.

Overdue debt occurs when the counterparty does not fulfill contractual terms, that is, does not pay on time.

NOTE

The likelihood of debt repayment depends on the period of delay in payment. To receive money from a counterparty, you need to work with receivables from the first day of delay.

Structuring accounts receivable through its end-to-end analysis according to the timing of its occurrence allows us to assess possible non-payments. In accordance with this method, all accounts of purchasing customers must be classified according to the timing of receivables :

- the maturity date has not yet arrived;

- overdue debt up to 30 days;

- overdue debt from 31 to 60 days;

- overdue debt from 61 to 90 days;

- debt overdue for more than 90 days.

The normal period of delay depends on the type of activity of the organization.

The first 30 days are considered working delay. During this period, you need to negotiate with counterparties, find out the reasons for non-payment of the debt, refer to the agreement and calendar plan, and negotiate the terms of repayment of receivables.

If the term under the contract has expired, you should remind about the need to pay the debt: send a letter to the customer, send reminders about debt repayment by email. If the counterparty is in financial difficulties, you need to obtain a letter of guarantee from him regarding the obligation to pay.

If the counterparty is in no hurry to pay or violates the payment schedule, then planned services for the subsequent period can be suspended.

In case of non-payment, it is necessary to prepare documents to prove the debt - an act of reconciliation of mutual settlements, sign it bilaterally, and obtain written recognition of the receivable from the buyer-debtor . If it is impossible to resolve controversial issues, documents acknowledging the debt will confirm the fact of the debt in court.

If the debtor counterparty does not take any action to pay the debt and the debt cannot be repaid, the institution’s lawyer should prepare a statement of claim and submit it to the arbitration court.

Accounts receivable from accountable persons

Cash is issued in advance to accountable persons (financially responsible employees) for carrying out business transactions. In this case, a receivable debt arises to the organization.

FOR YOUR INFORMATION

The list of employees entitled to receive funds for reporting business expenses is fixed in the order of the organization.

Accountable persons must account for the amounts disbursed and return the remaining money to the cashier. This allows you to control the targeted spending of funds.

In accordance with the rules for conducting cash transactions, the accountable person, no later than three working days after the end of the period for which the advance was issued, must submit an advance report to the accounting department or return the funds to the institution's cash desk. The debit balance is closed at the end of each month. An exception may be amounts issued to employees for travel expenses.

According to the data in Table. 1 balance at the beginning of 2022 amounted to 8160 rubles. for travel expenses, since the employee was on a business trip during this period and did not account for the money received.

Social Security Receivables

The employer pays for the first three days of sick leave at his own expense, starting from the fourth day at the expense of the Social Insurance Fund. Child benefits are also paid at the expense of the Social Insurance Fund.

The amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, subject to payment to the Social Insurance Fund, is reduced by the payer of insurance contributions by the amount of expenses incurred by him for the payment of compulsory insurance coverage.

If the amount of benefits paid is greater than the amount of insurance premiums accrued for the same period, a debt is generated for the Social Insurance Fund . In this case, the institution contacts the fund and submits a report on receivables. Based on the submitted report, the Social Insurance Fund transfers funds to the institution, thereby repaying receivables.

In Table 1, social insurance receivables at the end of the year amounted to RUB 126,782 . It was formed as follows (Table 5):

- temporary disability and maternity benefits were accrued for December 2022 in the amount of 201,166 rubles;

- Contributions (2.9%) for social insurance were calculated from the wage fund:

RUB 2,564,960 (salary) × 2.9% = 74,384 rubles;

- receivables for social insurance contributions:

RUB 201,166 – 74,384 rub. = 126,782 rub.

VAT receivables

In accounting, when making advance payments, VAT amounts are accrued on previously received payments towards the upcoming sale of goods (work, services).

VAT transactions on advances received form accounts receivable until these advances are closed.

NOTE

VAT calculated on the amount of prepayment for future deliveries is subject to deduction in the tax period in which the goods (work, services) were shipped (clause 6 of Article 172 of the Tax Code of the Russian Federation).

After the shipment of material assets (work, services), VAT receivables from advances received are reduced.

Table 1 shows that accounts receivable for VAT calculations on advances received from customers at the beginning of the year amounted to 216,358 rubles, and at the end of the year it decreased to 160,940 rubles.

The accrual of tax presented to the institution by suppliers (contractors) on acquired non-financial assets (work performed, services provided) forms a VAT receivable .

Upon receipt of an invoice from the supplier, the VAT amounts are written off as a tax deduction, thereby clearing the VAT receivables.

According to the table. 1, accounts receivable for VAT payments for acquired material assets (work, services) decreased over the period by 33,126 rubles. (at the beginning of the year - 78,224 rubles, at the end of the year - 45,098 rubles).

Calculation of accounts receivable turnover indicators

To analyze accounts receivable, we calculate debt turnover indicators, which characterize the number of debt turnovers during the period and the average duration of one turnover (Table 6).

From Table 6 it follows that the duration of receivables turnover in the analyzed periods decreased. This indicates a reduction in the repayment period of accounts receivable and is a positive factor, since it leads to the release of funds from circulation.

The duration of the receivables turnover was:

- 2016 - 23,432 days (debt was repaid on average 15,364 times over a period of 360 days);

- 2017 - 22.467 days (turnover duration decreased by 0.965; debt was repaid on average 16.024 times);

- 2018 - 17,143 days (turnover duration decreased by 5,324 (17,143 - 22,467); on average repaid 21 times).

Estimation of the relationship between the growth rate of accounts receivable and the growth rate of revenue

Let's compare the growth rate of revenue with the growth rate of accounts receivable. An increase in accounts receivable is justified if it is accompanied by an increase in revenue.

The growth rate of accounts receivable in 2022 compared to 2016 was 99.5%, and the growth rate of revenue for the same period was 103.7%.

The growth rate of accounts receivable in 2022 compared to 2017 was 76.8%, the growth rate of revenue was 100.6%. The growth rate of revenue is higher than the growth rate of receivables.

Relative cash savings due to accounts receivable turnover amounted to:

- 2017 : RUB 79,234.17 × –0.965 = 76,476.63 rubles;

- 2018 : RUB 79,725.02 × –5.324 = 424,467.96 rubles.

Analysis of the ratio of receivables and payables

Let's consider another important indicator for assessing the financial condition of an enterprise - the ratio of receivables and payables over the past three years. To do this, we will use the table. 7.

From Table 7 it follows that in 2022 and 2022. the ratio of accounts receivable to accounts payable in an organization exceeds 1, that is, accounts receivable fully cover accounts payable . This is a positive factor, since the organization has the opportunity to pay off its obligations with creditors without attracting additional sources of financing.

If the coefficient is less than the standard value of 2, then the conversion of the liquid part of current assets into cash slows down.

The low growth rate of accounts receivable compared to the growth of accounts payable disrupts the liquidity of the balance sheet due to the possible inability to cover short-term liabilities with quickly salable assets. A situation arises of a shortage of solvent funds.