Tax agent status for personal income tax

Taxpayers for personal income tax (clauses 1, 2 of Article 207, Article 209 of the Tax Code of the Russian Federation) are individuals - tax residents of the Russian Federation who receive income from sources in the Russian Federation and abroad; and individuals - non-residents of the Russian Federation who receive income from sources in the Russian Federation. They pay personal income tax at their own expense.

A personal income tax agent is a person who is the source of payment of income to the taxpayer. He is obliged to calculate, withhold from the taxpayer and transfer the tax to the budget (clause 1 of article 24, clause 1 of article 226 of the Tax Code of the Russian Federation). Tax agents for personal income tax are, in particular, Russian organizations and individual entrepreneurs.

Individuals who are not registered as individual entrepreneurs paying income to individuals, including under civil contracts, are not recognized as tax agents. In this case, the responsibility for calculating and paying personal income tax falls on the taxpayer himself - the recipient of the income (letter of the Ministry of Finance of Russia dated July 13, 2010 No. 03-04-05/3-390).

Who are tax agents?

It is customary to single out only taxpayers and tax authorities. But there is another category - tax agents. This category includes Russian enterprises, representative offices of employers from other countries, individual entrepreneurs who have hired workers on their staff.

What responsibilities do tax agents have?

Like any other party to tax legal relations, agents have their own tax responsibilities both in relation to payers and authorities:

- Correct calculation of the amount of tax to be paid on time;

- Withholding tax from income received by an individual;

- Transfer of tax to the budget within the time limits established by law;

- Filing a personal income tax return indicating the amount withheld;

- If the counterparty is not able to withhold and transfer the tax in a timely manner, the tax agent must notify the Federal Tax Service about this within 1 month from the date on which he learned about it;

- Keep all documents that confirm the calculation, withholding and transfer of tax to the budget within the time limits established for such documents.

Income can be received both in cash and in kind. If the income was paid in kind, then the tax agent is relieved of the obligation to calculate, withhold and pay income tax. Such an obligation exists only if the income is received in cash.

Responsibility of tax agents

Since the agent has his own duties, he is also responsible for their failure to fulfill them. This type of liability is called tax liability.

The agent is responsible for the following actions:

- did not promptly inform the tax office of the fact that he could not withhold income tax from the taxpayer;

- Did not fully transfer the amount of tax for the taxpayer;

- Did not transfer the amount of income tax withheld from the taxpayer on time.

For offenses, the agent is held accountable under Art. 123 Tax Code of the Russian Federation. In addition, the agent is responsible for:

- Refusal to provide, at the request of the Federal Tax Service, certificates in form 2-NDFL (→ Sample of filling out certificate 2-NDFL), confirming the correctness of calculation, withholding and fact of payment of tax to the budget;

- Providing information about the income tax of hired taxpayers in incomplete or distorted form.

For these offenses, the agent is held accountable under Art. 126 of the Tax Code of the Russian Federation.

Rights and responsibilities of a tax agent for personal income tax

As a general rule, tax agents have the same rights as taxpayers. The tax agent for personal income tax is obliged (clause 3 of article 24, article 226, clauses 1, 2, 3 of article 230 of the Tax Code of the Russian Federation, part 1 of article 29 of the Federal Law of December 6, 2011 No. 402-FZ “On accounting"):

- correctly and timely calculate, withhold from taxpayers’ income and transfer taxes to the budget;

- inform the taxpayer and the tax authority about the impossibility of withholding personal income tax, the amounts of income from which tax was not withheld, and the amount of unwithheld tax no later than March 1 of the year following the year of payment of income from which tax was not withheld (the message is submitted in the form of a certificate included in calculation of 6-NDFL);

- issue a certificate of income and tax amounts to individuals who received income from a tax agent if they applied for its issuance;

- keep records of income accrued and paid to individuals in a calendar year, tax deductions provided to them, and amounts that reduce the tax base; personal income tax calculated, withheld and transferred from such income in independently developed forms of tax accounting registers, including for each taxpayer;

- in a timely manner, submit personal income tax reporting to the tax authority at the place of your registration (calculation of 6-personal income tax for the first quarter, half year, 9 months, year and information on the income of individuals and the amounts of calculated, withheld and paid personal income tax at the end of the year for each individual in the form certificates of income and tax amounts as part of the 6-NDFL calculation);

- submit to the tax authority the documents necessary to monitor the correctness of calculation, withholding and transfer of personal income tax;

- for 5 years, ensure the safety of documents necessary for the calculation, withholding and transfer of personal income tax;

- bear other duties provided for by the Tax Code of the Russian Federation.

Tax agents must perform their duties free of charge: collecting remuneration from taxpayers for this is not provided for by the Tax Code of the Russian Federation (letter of the Ministry of Finance dated 02/01/2011 No. 03-02-07/1-31).

Payment of penalties for violation of tax payment deadlines from the tax agent’s own funds

If the tax payment deadlines are violated, the agent must pay a penalty. In general, charging penalties on the amount of unwithheld tax, as well as bringing the tax agent to tax liability are legal. Penalties are a way of ensuring the fulfillment of the obligation to pay taxes and fees. In addition, penalties are a legal restoration measure of state coercion, of a compensatory nature, for late payment of taxes to the budget and must be collected from the subject of tax legal relations who is charged with such an obligation. The official position of the tax authorities is that they have the right to collect penalties at the expense of the agent in cases where personal income tax is not withheld from the income of an individual (Letter of the Federal Tax Service of Russia dated July 25, 2006 N BE-6-04 / [email protected] , Resolution of the Presidium Supreme Arbitration Court of the Russian Federation dated May 16, 2006 N 16058/05). In the Resolution of January 12, 2010 N 12000/09 in case N A56-48706/2007, the Presidium of the Supreme Arbitration Court of the Russian Federation indicated that if the tax agent does not withhold personal income tax from the taxpayer’s income and the inspectorate is refused to collect a penalty from him, such a refusal will not ensure compensation to the state for damages from late and incomplete payment of taxes. Based on this, the court recognized the decision of the tax authority to collect penalties from the organization as lawful. The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 22, 2007 N 16499/06 in case N A47-16231/2005AK-25 states that a tax agent who has not withheld personal income tax from an individual must pay penalties at his own expense . This is due to the fact that the obligation to pay personal income tax to the budget rests with tax agents.

Payment of personal income tax at the expense of the tax agent

Can an employer pay personal income tax for its employee from its own funds?

Until January 1, 2022, the Tax Code directly prohibited the transfer of personal income tax at the expense of organizations and individual entrepreneurs that made payments to individuals. From January 1, 2022, payment of personal income tax at the expense of a tax agent is permitted in the event of additional assessment (collection) of tax based on the results of a tax audit in the event of unlawful non-withholding (incomplete withholding) of tax by the tax agent (clause 9 of Article 226 of the Tax Code of the Russian Federation). The specified norm can be applied, incl. and within the framework of Art. 226.1 Tax Code of the Russian Federation.

At the same time, the norm of paragraph 9 of Art. 226 of the Tax Code of the Russian Federation does not have retroactive force (clause 2 of Article 5 of the Tax Code of the Russian Federation). Therefore, the tax authorities have no grounds for collecting from the tax agent amounts of additional personal income tax, the obligation to withhold, calculate and transfer which arose before January 1, 2022.

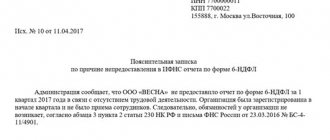

Personal income tax for last year was not withheld - the Federal Tax Service explained how to correct this error

The Tax Service, in Letter dated April 24, 2019 N BS-3-11/ [email protected], reviewed the situation: the employer this year identified personal income tax that was not withheld for 2022. An employee on whose income tax was not withheld continues to work for that employer. How to correct the error ─ is it necessary to inform the tax authority about the impossibility of withholding personal income tax, fulfilling the obligation under clause 5 of Art. 226 of the Tax Code of the Russian Federation?

The Federal Tax Service explained that the norms of paragraph 5 of Art. 226 of the Tax Code of the Russian Federation do not apply in this case ─ the tax agent had the opportunity to withhold personal income tax when paying income to the employee during the year, but he did not do so. The controllers recommended that the tax agent:

- withhold personal income tax when paying the employee’s current income and transfer it to the budget;

- submit for 2022 an updated calculation in form 6-NDFL and a corrective certificate in form 2-NDFL.

If the tax agent provides clarifying information before the tax authorities discover the error, there should be no fine (clause 2 of Article 126.1 of the Tax Code of the Russian Federation). If corrections are made at the direction of controllers, a fine cannot be avoided (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

Tax officials identify errors in 6-NDFL by comparing it with the calculation of insurance premiums. The control ratios of 6-NDFL are supplemented with an indicator interconnected with the RSV. Failure to comply may indicate an underestimation of the amount of accrued income (Letter of the Federal Tax Service of Russia dated March 20, 2019 N BS-4-11 / [email protected] ).

If in ZUP 3 the amount of such personal income tax is not automatically withheld at the next payment, then it can be withheld using the document Personal Income Tax Accounting Operation (Taxes and contributions - Personal Income Tax Accounting Operations - Personal Income Tax Accounting Operation).

More details in the publication - TECHNIQUES FOR CORRECTING PIT - EXAMPLE 2: UNRECOVERED PIT.

See also:

- Control ratios for 6-NDFL have been updated

- Are you late with your personal income tax payment? - the fine can be avoided

- In what form should a 2-NDFL adjustment be submitted for previous periods?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The salary for forced absence was paid in court: the Federal Tax Service explained the procedure for its reflection in 6-NDFL and the DAM The Federal Tax Service of Russia in Letter dated January 14, 2019 N BS-4-11/228 responded to...

- The Federal Tax Service has clarified with which document an individual can confirm the right to deduct personal income tax for material benefits from saving on interest. As a general rule, material benefits from saving on interest for...

- The Federal Tax Service clarified when allowances for shift work are not subject to insurance contributions. In the Letter of the Federal Tax Service of the Russian Federation dated 06.06.2019 N BS-3-11/ [email protected] it is explained that...

- The Federal Tax Service has explained what to do with “Covid” tax residents at the end of 2022. We are talking about those residents who, from 01/01/2020...

Salary payment below the industry average

Not all companies can pay their employees high salaries. But if the average monthly salary per employee is paid below the average level for the type of economic activity in a constituent entity of the Russian Federation, it is possible to include the organization in the plan of on-site tax audits (clause 5 of section 4 of the Concept of the planning system for on-site tax audits, approved by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] ). The mere fact of paying a salary below the regional average will not necessarily lead to the appointment of an on-site tax audit. But if the tax agent meets some other selection criteria for conducting such an audit or the tax inspectorate has information about his other violations, then the likelihood of an audit is high.

Also, tax authorities can call a company-tax agent for personal income tax to give explanations in connection with the payment (withholding and transfer) of personal income tax to them (clause 4, paragraph 1, article 31 of the Tax Code of the Russian Federation).

And after a desk audit, the inspectorate may send a request to provide explanations or make corrections to the calculation of 6-NDFL (clause 3 of Article 88 of the Tax Code of the Russian Federation). If the fact of a violation is established, after consideration of the explanations, a decision by the tax authority may follow to carry out other tax control measures in order to identify a possible understatement of the tax base (clause 1.7 of the Appendix to the title page No. 1.1 to the Control ratios for calculating 6-NDFL from the letter of the Federal Tax Service of Russia dated March 23, 2021 No. BS-4-11/ [email protected] ).

The law does not establish fines or obligations to maintain wages equal to or higher than the industry average. Administrative liability is established only for the payment of wages below the minimum wage or minimum wage in the region (Parts 6, 7, Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Additional personal income tax accruals do not depend on the level of average wages. Tax will be assessed additionally only if it is established that the taxpayer has paid “shadow” wages or if any errors are identified that resulted in incomplete payment of personal income tax.

And the tax agent is no longer threatened with a summons to the interdepartmental commission on the legalization of the tax base and the base for insurance premiums. By letter of the Federal Tax Service of Russia dated July 7, 2020 No. BS-4-11/ [email protected], letters of the Federal Tax Service of Russia dated July 26, 2017 No. ED-4-15/ [email protected] and dated June 19, 2019 No. BS-4-11/ [ email protected] , which provided explanations about the work of the commissions. Previously, taxpayers were called to give explanations in connection with their payment (withholding and transfer) of personal income tax and insurance premiums (clause 4, clause 1, article 31 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated July 25, 2017 No. ED-4-15 / [email protected ] , no longer valid). The subject of consideration of the commissions was the correctness of the formation of the tax base and the base for calculating insurance premiums, as well as the completeness of payment of personal income tax and insurance premiums by taxpayers (tax agents, payers of insurance premiums). In this case, taxpayers - tax agents paying wages below the average level for types of economic activity in the region - were subject to selection for consideration at the commission meeting. Particular attention was paid to tax agents paying wages below the regional subsistence level.

With the cancellation of these letters from the Federal Tax Service of Russia in the tax authorities, these commissions have been abolished. They may remain or continue to be formed by local governments of constituent entities of the Russian Federation, since they are not under the leadership of tax authorities.

And the tax authorities switched to a risk-based approach: the activities of the commissions were transferred to the form of automated control ratios of reporting submitted by employers, followed by an analysis of “tax gaps” and corresponding work with taxpayers (tax agents).

Responsibility of the tax agent for personal income tax

Failure to fulfill (improper performance) of the duties of a tax agent for personal income tax may result in tax, administrative and criminal liability.

Tax liability

A fine is a measure of liability for committing a tax offense (tax sanction). The size of the fine depends on the type of violation.

A tax agent may be fined for non-payment (non-withholding, incomplete withholding, incomplete and (or) late payment) of personal income tax. The amount of the fine is 20% of the amount of tax subject to withholding and (or) transfer (clause 1 of Article 123 of the Tax Code of the Russian Federation). By decision of the tax authority and (or) the court, the amount of the fine can be reduced by at least 2 times, but not to zero (clauses 1, 4 of Article 112, clause 3 of Article 114 of the Tax Code of the Russian Federation).

A tax agent may be released from liability if the following conditions are simultaneously met (clause 2 of Article 123 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 08/02/2021 No. EA-4-15/ [email protected] ):

- the 6-NDFL calculation is submitted to the tax authority within the prescribed period;

- the 6-NDFL calculation correctly reflects the amount of personal income tax that must be withheld and transferred to the budget, without underestimation;

- the tax agent transferred the tax arrears and penalties before learning that the tax authority had discovered the debt or ordered an on-site personal income tax audit for the same period.

Also, the tax agent is exempt from liability in the following cases:

- when independently identifying an error and submitting updated documents before the tax agent learns that the tax authority has discovered that the information contained in the documents submitted by it is unreliable (clause 2 of Article 126.1 of the Tax Code of the Russian Federation);

- upon independent detection of untimely payment (incomplete payment) of personal income tax and the transfer of debt and penalties before the completion of the desk audit, as well as before drawing up an act based on its results (letter of the Federal Tax Service of Russia dated 02.08.2021 No. EA-4-15 / [email protected] ).

The tax agent will be fined if the personal income tax arrears arose due to a gross violation of the rules for accounting for income and/or taxable items. The fine will be 20% of the amount of arrears, but not less than 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation). A tax agent can be held liable:

- for a gross violation of accounting rules, which led to an understatement of the tax base and the emergence of arrears for personal income tax (clause 3 of Article 120 of the Tax Code of the Russian Federation);

- for non-payment (incomplete payment) of tax (clause 1 of Article 123 of the Tax Code of the Russian Federation).

It is not possible to fine a tax agent at the same time according to the specified standards. Otherwise, the tax agent will be punished twice for the same illegal act, because The main qualifying feature of the offense is considered by both norms to be understatement of the tax base, which resulted in non-payment or incomplete payment of personal income tax. A similar position is given in the Determination of the Constitutional Court of the Russian Federation dated January 18, 2001 No. 6-O when comparing the norms of paragraph 3 of Art. 120 and art. 122 of the Tax Code of the Russian Federation.

In addition to the fine for failure to transfer (late transfer) to the budget of the personal income tax withheld from the taxpayer, the tax agent will be charged penalties (Article 75 of the Tax Code of the Russian Federation, clause 2 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). Penalties are accrued for each calendar day of delay in tax payment, starting from the day following the tax payment established by law until the day the obligation to pay it is fulfilled, inclusive. The amount of penalties for non-payment of personal income tax is calculated based on the amount of arrears, the number of days of delay and the rate for calculating the penalty. The amount of penalties accrued on arrears cannot exceed the amount of the arrears themselves.

Administrative responsibility

For the commission of administrative offenses, in particular, such types of punishment as a warning, an administrative fine, and disqualification are provided.

For a gross violation of accounting rules, which led to an understatement of the personal income tax amount by at least 10%, an official of the tax agent may be held liable in the form of (part 1, 2 of article 15.11 of the Code of Administrative Offenses of the Russian Federation):

- for a primary violation - a fine from 5,000 to 10,000 rubles;

- in case of repeated violation - a fine of 10,000 to 20,000 rubles. or disqualification for a period of 1 to 2 years.

Also, an official of a tax agent may be held administratively liable for failure to submit within the prescribed period (refusal to submit to the tax authorities, submission in incomplete/distorted form) documents and information necessary for tax control (for example, calculation of 6-NDFL, tax registers). accounting for personal income tax calculation). The fine is from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

At the same time, the Tax Code of the Russian Federation does not establish the liability of a tax agent for failure to issue a certificate of income and tax amounts to individuals who received income from a tax agent if they applied for its issuance (clause 3 of Article 230 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 21, 2016 No. 03-04-05/36096). Issuing such a certificate to the employee as a work-related document within 3 days from the date of receipt of the application from him is the responsibility of the employer (Part 1 of Article 62 of the Labor Code of the Russian Federation, letter of the Ministry of Finance dated June 21, 2016 No. 03-04-05/36096). Failure by the employer to issue a certificate to the employee may be regarded by the State Labor Inspectorate as a violation of labor legislation, the responsibility for which is established by Parts 1 and 2 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- in case of a primary violation - a warning or a fine on the official from 1,000 to 5,000 rubles; for individual entrepreneurs – from 1,000 to 5,000 rubles; for organization – from 30,000 to 50,000 rubles;

- in case of repeated violation - a fine on the official from 10,000 to 20,000 rubles. or disqualification for a period of 1 to 3 years; for individual entrepreneurs – from 10,000 to 20,000 rubles; for organization – from 50,000 to 70,000 rubles.