The procedure for applying VAT on the sale of non-commodity goods - any movable and immovable property, vehicles, all types of energy - to the countries of the Eurasian Economic Union (Kazakhstan, the Republic of Belarus, Armenia, the Kyrgyz Republic) has its own characteristics. 1C experts tell you how to reflect in the 1C: Accounting 8 version 3.0 program the purchase and sale of non-commodity goods for export to the EAEU countries and confirm the zero VAT rate within 180 days after shipment.

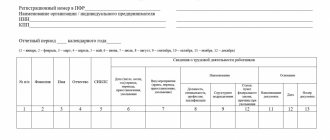

Special sections of the declaration

For exporters, the VAT declaration provides:

- section 4 – to reflect the tax in the case where the zero rate is confirmed;

- section 5 – to reflect tax deductions;

- Section 6 – to reflect tax when the zero rate is not confirmed.

In the same sections, report on exports to member states of the Customs Union. For the purposes of calculating VAT for Russian organizations, the following is equivalent to the export of goods:

- manufacturing of goods intended for export to countries participating in the Customs Union (clause 9 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- transfer of goods under a leasing agreement, which provides for the transfer of ownership to the lessee, as well as under trade credit or trade loan agreements (clause 11 of Appendix 18 to the Treaty on the Eurasian Economic Union).

Explanation of terms with links to legal regulations for code 1010292

What legal acts do you need to know in order to correctly reflect transactions under code 1010292 in the declaration:

- subp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation - determines that loan transactions, including interest on them, are not subject to VAT on the territory of the Russian Federation;

- pp. 44.2-44.5 Procedure for filling out a VAT return - decipher the procedure for reflecting information in the lines of section 7, dedicated to non-taxable transactions.

- The Civil Code of the Russian Federation and other legal acts - regarding the definition of the terms “money loan”, “securities loan”, “loan interest”, “repo operation”.

Section 4

In section 4, reflect export transactions for which the right to apply the zero rate has been confirmed. Indicate in it:

- on line 010 – transaction code;

- on line 020 – for each transaction code, the tax base for confirmed export transactions;

- on line 030 – for each transaction code, the amount of deductions of input VAT on goods (work, services) used to conduct confirmed export transactions;

- on line 040 - for each transaction code, the amount of VAT previously calculated for these transactions when the export had not yet been confirmed;

- on line 050 – for each transaction code, the recoverable amount of input VAT previously accepted for deduction when the export had not yet been confirmed.

Lines 040 and 050 of Section 4 must be completed if the organization was previously unable to confirm the export on time.

Fill in lines 070 and 080 when returning goods for which the right to apply a zero rate has not been confirmed. On line 070, reflect the amount of adjustment to the tax base, and on line 080, the amount of adjustment of tax deductions. These lines must be completed in the tax period in which the exporting organization recognized the return of goods (the parties agreed on the return).

If the price of exported goods for which a zero rate was confirmed has changed, indicate the adjustment amounts on lines 100 (if increasing) and 110 (if decreasing). Reflect the adjustment in the tax period in which the exporting organization recognized the price change.

On line 120, reflect the amount of tax to be reimbursed:

| Line 120 = (Lines 030 + Lines 040) – (Lines 050 + Lines 080) |

On line 130, reflect the amount of tax payable:

| Line 130 = (Lines 050 + Lines 080) – (Lines 030 + Lines 040) |

This is stated in section IX of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to reflect in section 4 of the VAT return the amount of VAT on the cost of services of a customs broker who carries out customs clearance for the export of goods? The broker works under a fee-based service agreement. Different VAT rates are established for exported goods

The amount of tax deduction for brokerage services must be distributed.

Customs brokerage services may be subject to VAT either at a zero rate or at a rate of 18 percent. The zero rate can only be applied if the broker provides services under a transport forwarding agreement when organizing international transportation. This was stated in the letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03-07-08/46977. In the situation under consideration, there is no such agreement, so the tax rate of 18 percent applies. Since the input tax presented by the broker simultaneously applies to goods subject to VAT at different rates, when filling out section 4, its amount must be distributed.

The fact is that section 4 reflects:

- with code 1011410 – operations for the export of goods for which the VAT rate is set at 18 percent;

- with code 1011412 – operations for the export of goods for which the VAT rate is set at 10 percent.

Transaction codes are indicated on line 010 of section 4 of the VAT return. Line 020 of this section reflects the tax base for confirmed export operations, and line 030 - the amount of tax deductions for goods (work, services) used to carry out these operations.

Such instructions are contained in paragraphs 41.1–41.3 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Nothing is said about the reflection of tax deductions for goods (work, services) that simultaneously relate to transactions with codes 1011410 and 1011412 in the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. However, in order to correctly fill out the declaration, the amount of such tax deductions should be distributed proportionally to the tax bases for transactions with codes 1011410 and 1011412. To do this, use the following formulas:

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation __________________________________________ | × | The cost of goods sold for export not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The total cost of goods sold for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | – | The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

The amounts of tax deductions received after distribution should be reflected on line 030 of section 4 of the VAT return according to the corresponding transaction code.

An example of reflecting in section 4 of a VAT return the amount of VAT on the cost of brokerage services related to the export of goods specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation

Alpha LLC entered into a contract for the supply to Finland of:

- children's clothing made of natural sheepskin and rabbit (the VAT rate is set at 10% (paragraph 3, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation));

- products made of genuine leather and natural fur (VAT rate is set at 18%).

The total cost of the export contract is 16,000,000 rubles. At the same time, the cost of children's clothing is 3,200,000 rubles, the cost of products made from genuine leather and natural fur is 12,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 118,000 rubles, including VAT - 18,000 rubles.

Within the prescribed period, the organization collected all the necessary documents confirming the right to apply the zero tax rate. The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's clothing and products made from genuine leather and natural fur.

In section 4 of the VAT return, Alpha’s accountant indicated:

1) on the line with code 1011410 (sales of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 12,800,000 rubles;

- on line 030 (tax deductions) – 14,400 rubles. (RUB 18,000: RUB 16,000,000 × RUB 12,800,000);

2) on the line with code 1011412 (sales of goods specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 3,200,000;

- on line 030 (tax deductions) – 3600 rubles. (RUB 18,000 – RUB 14,400).

A medical institution is entitled to VAT relief

Services for physical therapy and sports medicine are also not directly mentioned in the list of diagnostic, prevention and treatment services. At the same time, the institution has the right to take advantage of benefits in relation to these services, often provided as part of pre-medical care). Physical therapy services relate to activities in the field of health care and correspond to the list of medical services for diagnosis, prevention and treatment. At the same time, the Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 15, 2008 N KA-A41/488-08 does not take into account the argument of the tax authorities about the inconsistency of the services listed in the license with the wording contained in OKUN *(1) and OKVED *(2), since this is not refutes neither the fact of provision of preferential services nor the right to apply the specified benefit. Also exempt from VAT are medical nutrition and drug treatment, which are classified as medical services (Resolution of the Tenth Arbitration Court of Appeal dated November 27, 2006 N 09AP-13927/2006-AK). At the same time, from the benefits provided by paragraphs. 2 p. 2 art. 149 of the Tax Code of the Russian Federation, an institution that has a license does not have the right to refuse, as this can be done in accordance with paragraph 5 of Art. 146 of the Tax Code of the Russian Federation in relation to the operations named in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, for example, in relation to the services of sanatorium and health resort organizations. But should the benefit be abandoned, especially by a budgetary institution that is not at all interested in increasing tax obligations to the budget? It is better to take care of the license and provide tax-exempt medical services.

Please note => How to register an apartment with the Russian Register

Section 5

Section 5 should be completed in the declaration for the period when the right to deduct VAT on export transactions (previously confirmed and not confirmed) arose. For example, if you previously collected documents and confirmed the zero rate, but did not fulfill the conditions for applying the deduction.

On line 010, indicate the year in which the declaration was submitted, which reflected transactions for the sale of goods. On line 020 - tax period code in accordance with Appendix No. 3 to the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Fill out Section 5 separately for each tax period, information about which is reflected in the indicators on lines 010 and 020.

Please indicate:

- on line 030 – transaction code;

- on line 040 - the tax base relating to already confirmed export transactions (i.e. for which Section 4 was submitted to the tax office, but which could not be accepted for deduction at that moment);

- on line 050 – the amount of input VAT related to confirmed exports;

- on line 060 - the tax base related to unconfirmed exports (i.e. for which Section 6 had already been submitted to the tax office, but which could not be accepted for deduction at that moment, for example, in the absence of an invoice);

- on line 070 – the amount of input VAT related to unconfirmed exports.

Such instructions are contained in section X of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Transactions exempt from taxation

Agreements for services provided that were not previously submitted; invoices; payment documents confirming payment for services provided (in the absence of payment documents, indicate how payment is made for services for the provision of residential premises for use); documents confirming that the residential premises provided for use belong to the company (if previously submitted, indicate the number and date); other documents confirming the legality of using the above VAT benefit The court noted that the taxpayer’s lack of obligation to calculate and pay VAT to the budget on transactions that are not subject to taxation is expressly provided for in Art. 149 of the Tax Code of the Russian Federation. Such sales, which are not recognized as subject to VAT, are not taken into account when forming the tax base for VAT, while tax benefits according to Art. 56 of the Code apply only to certain categories of taxpayers. Therefore, in the opinion of the court, it is necessary to distinguish benefits from cases when the object of taxation does not arise and, accordingly, the taxpayer is not obliged to submit documents confirming the legality of reflecting in Section 7 of the specified transactions that are not subject to taxation as part of the desk tax audit.

16 Jan 2022 marketur 1145

Share this post

- Related Posts

- Income tax benefit if wife is on maternity leave

- Who receives preferential medications?

- Is a supervised child paid if the mother is alive?

- Benefit for paying for a summer cottage

Section 6

Section 6 is intended to reflect transactions for which the deadline for submitting documents confirming the right to apply the zero VAT rate has expired.

The duration of this period is 180 calendar days. For exported goods, the 180-day period is counted:

- from the date of shipment (for deliveries to countries participating in the Customs Union) (clause 5 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- from the date of placing goods under the customs export procedure (for deliveries to other countries) (clause 9 of article 165 of the Tax Code of the Russian Federation).

In relation to work (services) related to the export of goods (import of goods into Russia), the procedure for determining the 180-day period depends on the type of work (service).

On line 010, enter the operation code. For each transaction code, fill in lines 020–040.

On line 020 reflect the tax base.

On line 030, indicate the amount of VAT calculated based on the tax base on line 020 and the VAT rate (10 or 18%).

Line 040 reflects the amounts of tax deductions:

- input VAT paid to the seller;

- VAT paid when importing goods into Russia;

- VAT paid by the tax agent when purchasing goods, works, services.

Fill in lines 050–060 only on the first page, and put dashes on the rest.

On line 050, reflect the total amount of VAT (the sum of all lines 030 for each transaction code).

For line 060, enter the summed indicator of lines 040 for each transaction code.

If the buyer returned some of the goods to the exporter, fill in lines 080–100:

- on line 080 – the amount by which the tax base is reduced;

- on line 090 – VAT adjustment (the amount by which the calculated VAT is reduced);

- on line 100 – the amount of VAT that needs to be restored (previously accepted for deduction).

If you increase or decrease the price, fill in lines 110–150:

- on line 120 - the amount by which the tax base is increased;

- on line 130 – the amount by which VAT is increased;

- on line 140 – the amount by which the tax base is reduced;

- on line 150 – the amount by which VAT is reduced.

Calculate the amount of VAT payable to the budget for line 160 as follows:

| Line 160 = (line 050 + line 100 + line 130) – (line 060 + line 090 + line 150) |

Calculate the VAT refund amount for line 170 as follows:

| Line 170 = (line 060 + line 090 + line 150) – (line 050 + line 100 + line 130) |

Please take into account the amounts of VAT payable (reduced) reflected in sections 4–6 when filling out section 1 of the VAT return (clauses 34.3, 34.4 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558) .

How to deal with operation codes?

Taxpayers who submit VAT returns to the inspectorate are often faced with the need to reflect the codes of certain transactions.

Codes are required to complete sections 2, 4-7. Find out what sections these are in the picture:

Codes are sets of 7 digits, each of which represents a specific operation. All codes are divided into 5 groups and are described in Appendix No. 1 to the Procedure for filling out a VAT return, approved. by order of the Federal Tax Service dated October 29, 2014 No. MMB-7-3/ [email protected]

Important! From the report for the 3rd quarter of 2022, the VAT declaration must be completed on a new form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

The figure below shows:

- the name of each group of operation codes;

- the range of codes provided for each group;

- link to the article of the Tax Code of the Russian Federation.

The list of codes valid in 2022 can be downloaded in this material.

What happens if you don’t put the transaction code in the declaration? It will not pass logical control, and the controllers will not accept it. Therefore, it is necessary to understand the codes and correctly reflect them in the declaration, if the need arises.

Next we will tell you more about individual codes.

Sections 8 and 9

In section 8, enter information from the purchase book for those transactions for which the right to deduction arose in the reporting quarter.

In section 9 of the declaration, indicate information from the sales book. For more information on the procedure for filling out sections 8 and 9, see How to draw up and submit a VAT return.

If changes have been made to the purchase book or sales book, you will need to fill out Appendix 1 to sections 8 and 9.

An example of filling out a VAT return for export transactions

Alpha LLC is registered in Moscow and is engaged in the production of furniture (OKVED code 36.1). The organization did not carry out any transactions on the domestic market that should be reflected in the VAT return for the first quarter of 2016.

Alpha has a long-term contract for the supply of furniture of its own production to Finland.

In January 2016, under this contract, Alpha supplied:

- children's beds (VAT rate - 10%) (paragraph 5, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation) - in the amount of 7,800,000 rubles;

- wooden cabinets (VAT rate - 18%) - in the amount of 10,000,000 rubles.

The total cost of the export contract was 17,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 141,600 rubles, including VAT - 21,600 rubles.

In February 2016, the organization collected all the necessary documents confirming the right to apply a zero tax rate, and accepted for deduction the amount of input VAT presented to it when purchasing materials for the manufacture of export products:

- from the cost of materials for children's beds - 57,800 rubles;

- from the cost of materials for wooden cabinets - 89,350 rubles.

The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's beds and wooden cabinets. The amount of VAT accepted for deduction for each product item is:

- for cabinets - 12,135 rubles. (RUB 21,600 × RUB 10,000,000: (RUB 7,800,000 + RUB 10,000,000));

- for beds – 9465 rub. (RUB 21,600 × RUB 7,800,000: (RUB 7,800,000 + RUB 10,000,000)).

In February 2016, Alpha received an invoice for transportation costs (cost - 118,000 rubles, including VAT - 18,000 rubles) for an export transaction completed in November 2015. Then the organization sold products worth RUB 2,360,000. (including VAT – 360,000 rubles). A package of documents confirming the application of a 0 percent rate for this operation was collected in December 2015; the amount of deduction for raw materials and supplies spent on the production of export products is reflected in the VAT return for the fourth quarter of 2015.

In addition, in February 2016, Alpha expired the period (180 calendar days) allotted for collecting documents confirming the application of the zero VAT rate for the export transaction completed in the third quarter of 2015. The organization’s accountant charged VAT at a rate of 18 percent on unconfirmed export proceeds. At the same time, he prepared an updated VAT return for the third quarter of 2015. In addition to the information previously reflected in the declaration, the accountant filled out section 6. In it, for the transaction with code 1010401, he showed the tax base (912,300 rubles), the accrued amount of VAT (164,214 rubles) and the amount of tax deduction (90,000 rubles).

The Alpha accountant began filling out the VAT return for the first quarter of 2016 with the title page. On it he indicated general information about the organization, as well as the tax office code and the code for the location of the organization - 214.

Then the accountant filled out section 4, in which he indicated:

1) according to code 1010410 (sale of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 10,000,000 rubles;

- on line 030 (tax deductions) – 101,485 rubles. (RUB 89,350 + RUB 12,135);

2) according to code 1010412 (sales of goods specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 7,800,000;

- on line 030 (tax deductions) – 67,265 rubles. (RUB 57,800 + (RUB 21,600 – RUB 12,135));

3) on line with code 120:

- RUB 168,750 – the amount of tax calculated for reduction under this section.

After this, the accountant filled out section 5. In it, he indicated the amount of VAT accepted for deduction on transport services in the amount of 18,000 rubles.

The accountant finished drawing up the declaration by filling out section 1. In it, he indicated the total amount of tax to be reimbursed under the declaration - 186,750 rubles. (RUB 168,750 + RUB 18,000).

The VAT return for the first quarter of 2016, signed by the General Director of Alpha Lvov, was submitted by the organization to the tax office on April 22, 2015.

Situation: when do you need to submit a VAT return for export transactions?

Submit sections of the declaration provided for export operations as part of the general tax return.

Starting from January 1, 2015, submit VAT returns to the inspectorate no later than the 25th day of the month following the expired tax period (clause 5 of Article 174 of the Tax Code of the Russian Federation). The expired tax period should be understood as the quarter in which the organization collected documents confirming the right to apply the zero tax rate. Submit supporting documents at the same time as your declaration.

To collect documents confirming the right to apply the zero VAT rate, the organization is given 180 calendar days:

- from the moment of release of goods in the export procedure to countries that are not members of the Customs Union;

- from the moment of shipment of goods to a country that is a member of the Customs Union.

This period is established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation, paragraph 5 of Appendix 18 to the Treaty on the Eurasian Economic Union.

The end of the 180-day period allotted for collecting documents is not associated with the established deadline for filing the declaration, but with the tax period in which this period expires. If the complete package of supporting documents is collected by the organization within a period not exceeding 180 calendar days, reflect export transactions in section 4 of the VAT return for the tax period in which the day the documents were collected falls. Regardless of the fact that this day is not the end of the tax period.

For example, the 180-day period allotted for collecting documents expires on November 20, 2015. In fact, the documents necessary to confirm the right to a zero VAT rate were collected on October 15, 2015. In this case, the right to apply a zero tax rate must be declared in the VAT return for the fourth quarter of 2015, which must be submitted no later than January 25, 2016. If the documents had been collected at least a day later (November 21, 2015), then the organization would not have had any grounds to reflect the export operation in the declaration for the fourth quarter.

This conclusion is confirmed by letters of the Ministry of Finance of Russia dated April 17, 2012 No. 03-07-08/108, dated October 6, 2010 No. 03-07-15/131 and dated June 3, 2008 No. 03-07-08/137 .

Who is entitled to VAT benefits?

VAT benefit codes refer to the budget classification of taxes, fees and non-tax payments paid to the budget. They are a combination of seven numbers. Each type of tax benefit has its own code. Let's give an example of several VAT tax incentive codes.

- Postal products (postcards, envelopes, stamps, with the exception of copies of philatelic value).

- Medical products included in the list of the Government of the Russian Federation. It includes prosthetic and orthopedic products and raw materials for their production; goods intended for preventive measures or used for the rehabilitation of people with disabilities; any type of corrective optics (lenses, glasses, frames).

- Coins made from any precious metal that are considered official means of payment in the Russian Federation or abroad, except for specimens of numismatic value.

- Products of folk crafts of artistic value, except those that fall under the category of excise goods.

- Maintenance and repair services for household appliances and medical devices, including spare parts and other consumables required to restore functionality, during the warranty period at no additional charge.

- All types of repair and restoration, scientific research and archaeological field work aimed at preserving historical monuments and buildings belonging to religious organizations.

- A set of scientific, research, experimental, technological and design work carried out with budgetary funds, including those aimed at creating new types of products/technologies.

- Precious metals, including ore, scrap, production waste. Precious stones, including rough diamonds.

- Products produced by canteens of medical institutions, schools, kindergartens or catering organizations that sell their products in such institutions.

- Services of medical institutions, except for organizations providing services in the sanitary and epidemiological field, cosmetology and veterinary medicine.

- Transportation of citizens by sea, river, and railway motor transport within urban and suburban transport, excluding taxi services, including minibuses, subject to the implementation of activities at current tariffs, including all provided benefits.

- Works and/or services in the field of fighting forest fires.

- Maintenance and air navigation services for air traffic vessels provided within Russian airports.

- All types of work/services, including survey and classification, for servicing sea, river and mixed types of vessels at moorings in the port or during pilotage.

- Sale of subscriptions and entrance tickets to organizations that operate in the field of physical education and sports services, as well as rental of sports grounds for specialized events.

- Providing residential space for use and selling it, regardless of the form of ownership and division into shares, including the transfer of shares when selling apartments in apartment buildings.

- Implementation of inventions, technological models, databases, software products, microcircuits and other intellectual goods and know-how.

- Sales of scrap metal of any type.

- Transfer of goods/services for the purpose of subsequent advertising, costing no more than 100 rubles.

Please note => Study abroad after 9th grade