Briefly about the separate division

A separate division of a company outside its main address is considered to be separate, where at least one person works for more than a month. Such a structural unit is not an independent legal entity, however, information about it is entered into the Unified State Register of Legal Entities. Until 2016, information about the EP had to be reflected in the charter, so organizations operating since then have to make changes to it when closing divisions.

A separate division does not have its own property; its head is appointed by the parent company. The task of branches and representative offices is to represent the main organization and act in its interests.

To close a separate office, you need to prepare documents, fire employees and register changes. This is done in several stages. We propose an algorithm for liquidating a separate division in 2020.

What is a separate division

The definition and current concept of a separate unit is enshrined in Article 55 of the Civil Code of the Russian Federation. This is a structural branch or representative office of a legal entity that is located outside the main location of the company. The separate branch is empowered to represent and protect the interests of the parent institution.

The allocated structural unit does not become a new legal entity. It does not have the corresponding rights and powers and is not endowed with property. The head of the branch is appointed by the directorate of the parent institution. The OP operates on the basis of the charter and regulations approved on behalf of the legal entity.

Article 11 of the Tax Code of the Russian Federation establishes that any structural division of a company in which stationary jobs are created (for a period of more than 1 month) is recognized as separate.

The creation is regulated by Federal Law No. 14-FZ dated 02/08/1998. Creation requires a decision from the owners of the company. The decision is made by voting. It is necessary to gather at least 2/3 of the total number of participants in order to consider the decision made. A similar procedure for closing a separate division in 2022 by voting is also provided.

Features of making a decision to close a unit

A legal entity has the legal opportunity to create separate divisions that will be located outside the territorial framework of the parent company. Such entities are provided with property from the head office; they can represent the interests of the parent company in the locality in which they are registered, but do not acquire the functions and characteristics of separate legal entities.

Civil legislation, namely Article 55 of the Civil Code of the Russian Federation, provides for two types of separate divisions - branches and representative offices. However, from the point of view of tax legislation, this list is not exhaustive; other separate divisions are added to it.

Opening or terminating the operation of separate divisions is the business position of the company’s management, which is based on the decision of the meeting of founders. If it was decided to liquidate a separate division, this must be reported to the Federal Tax Service of the Russian Federation. The message form is S-09-3-2.

Unlike form C-09-3-1, which concerns the opening of other separate divisions, form C-09-3-2 applies to all of these categories.

The form of the marked document must be drawn up regardless of whether information about the division was included in the constituent documents or not. If the information has been secured, then an additional completed form P13001 is submitted, and a fee is paid. In 2021, this amount is 800 rubles. After paying the fee, changes are made to the Unified State Register of Legal Entities.

Deciding to close

It all starts with the parent organization deciding to close a separate division. If this is a branch or representative office, then a decision is required from the owners of the parent organization. In limited liability companies, a general meeting of participants should be held for this purpose. The LLC Law does not directly require this, but a meeting must be held when opening such units. Accordingly, when closing, it is better to take care of the collective decision of the company’s owners.

At least 2/3 of the founders must vote for the opening of a separate division. Again, regarding its elimination, there are no requirements for the number of voters. Therefore, a simple majority vote will be sufficient.

How to close an OP that is not a branch or representative office? For this, a decision from the owners is not needed. That is, in an LLC there is no need to hold a meeting of participants - the decision of the head of the main organization will be sufficient.

After the decision is made, a decree or order is issued to terminate the activities of the separate division. It should indicate the date on which it ceases to be valid, designate the persons responsible for closure, and distribute responsibilities between them.

Making a decision to close a separate division

Decisions of the organization's management regarding the activities of the separate unit, including its closure, are usually formalized by order. Its content is arbitrary, but it must be drawn up in accordance with the rules of office work and include full information about the name and location of the closed area. Based on it, documents will be drawn up, which will subsequently be submitted to the tax authorities. When the operation of a branch or representative office of a company is terminated, a decision of the participants (shareholders) is required, on the basis of which changes will be made to the Unified State Register of Legal Entities.

To notify of the closure of a branch or representative office, it is necessary to send to the inspectorate at the location of the organization an application for deregistration of a separate division in 2022 in form No. S-09-3-2, approved by Order of the Federal Tax Service No. MMV-7-6 / [email protected] dated 06/09/2011. Three days are allotted for this from the moment the company’s management decided to cease the operation of the branch.

What needs to be done to close

The instructions directly depend on the status of the separate unit. If it is recognized as a branch or representative office, and information about it is included in the constituent documents, then the closure procedure becomes more complicated. If the OP of an organization is closed without a dedicated balance sheet and current account, the procedure is simpler.

Liquidation of a division and liquidation of an organization are completely different procedures. For example, when liquidating an activity, a liquidator is appointed, a notice is published in the media, work with creditors to pay off debts, lay off employees, and approve the liquidation balance sheet. And only after fulfilling all the mandatory conditions, they contact the Federal Tax Service with a request to deregister.

Main actions, or what is needed to close a separate division in 2022:

- Make the appropriate decision by a majority vote of the participants.

- Issue an order to liquidate the OP.

- Notify employees about the termination of the OP's activities.

- Pay the state fee if information about the branch or representative office was reflected in the constituent documents.

- Exclude information about the branch or representative office from the constituent documentation.

- Submit a notice of closure to the Federal Tax Service.

Step 1. Make a decision

The decision to terminate activities through a branch or representative office is made by the owners of the organization. An LLC holds a general meeting of participants (if there are several of them). The question of liquidating the OP is put to a vote. To resolve it positively, a simple majority of votes is sufficient. During the meeting, minutes are drawn up on the basis of which changes will be recorded. If there is only one owner, he makes the sole decision to close a separate division.

Another separate division is closed by decision of the head of the organization. Therefore, the first step when eliminating a simple OP is skipped.

Step 2. Issue an order

Based on the decision made, the head of the organization must issue an order or instruction. The document indicates the date from which the unit should be considered closed. It is selected in such a way that all personnel issues are resolved by that time. In addition, the order lists the employees who are assigned responsibilities for closing the OP, and also specifies their areas of responsibility.

Step 3. Notify employees

Based on the order, personnel are notified of the upcoming dismissal in writing two months in advance. Each employee must receive a corresponding notice against signature. A transfer to another OP (for example, if it is in a different locality) must be notified within the same period. Of course, the employee has the right to express disagreement.

Step 4. Preparing documents for the tax office

The next stage is the preparation of a standardized notification about the closure of a separate division in the Federal Tax Service. To do this, use the KND form 1111052. Form C-09-3-2 was approved by Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] (as amended on 10/19/2018).

If an organization has decided to liquidate a branch or representative office, information about which is included in the constituent documents, then it will have to fill out an additional tax form. This is form P13001. Only the title page and sheet K, consisting of two pages, are filled out in the form. The company will have to pay a state fee of 800 rubles for registration of changes made to the constituent documents.

Please note that step-by-step instructions on how to close a separate division in 2022 also include notification of extra-budgetary funds. If a branch, representative office or OP was registered with the Social Insurance Fund and the Pension Fund of the Russian Federation, then it is necessary to submit notifications to controllers from extra-budgetary funds.

Step 5. Submit reports and pay taxes

The next stage of cessation of activity is payment of taxes and fees to the budget and reporting. After the date of deregistration of the enterprise, it is necessary to fulfill the taxpayer’s obligations in full.

What to take and when:

- Send the 6-NDFL calculation to the Federal Tax Service for the quarter in which the OP was deregistered. The deadline is normal. There is no need to submit zero 6-NDFL reports for the following reporting quarters. Details are in the Letter of the Federal Tax Service dated May 22, 2019 No. BS-4-11/ [email protected]

- Submit 2-NDFL certificates for employees of a liquidated OP within the usual time frame. If employees have moved to other branches of the company, then prepare two 2-NDFL certificates. One - for income received in a closed OP, the second - at a new place of work.

- Fill out the calculation of insurance premiums and the calculation of 4-FSS with an accrual total from the beginning of the year, until the date of optimization of the OP. In your calculations, include all payments accrued to employees during the period of operation of the representative office (before the date of liquidation).

- Fill out the income tax return for a closed private enterprise both for the period of liquidation and for the following reporting periods, until the very end of the year. Submit the declaration report to the Federal Tax Service of the parent organization.

How to deal with employees

One of the main characteristics of an OP is the availability of equipped workplaces for a period of more than a month. It is impossible to close a division with employees - you must first fire them, transfer them or transfer them to work in another OP or the parent company. There are certain nuances related to the area in which the unit is located:

- The OP is located in the same locality as the organization itself. In this case, employment contracts usually do not indicate that the employee is hired to a specific department. If this is so, then his appointment to another OP in the same locality will not be considered a transfer, but a relocation. This can be done even without the employee’s consent. If there are no suitable vacancies, then he should be dismissed due to staff reduction (clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation).

If the contract states that the place of work is a specific unit in the same locality, then the employee can be transferred to another OP only with his written consent.

- The OP is located in another locality. The employment contract always reflects the place of work, including an indication of the unit and its location. If this OP is closed, the provision of the Labor Code on dismissal due to liquidation is applied (clause 2 of part 1 of Article 81 of the Labor Code of the Russian Federation).

When dismissal due to staff reduction or liquidation, staff must be notified in writing at least two months in advance. This is precisely what determines the duration of the procedure for closing a separate division.

What to do before writing an application

Before filling out the document, you need to pay the state fee for closing. It is 160 rubles.

If employees work for an individual entrepreneur, then it is necessary to notify them of the closure at least two weeks in advance. Preferably in writing. Otherwise it will be a violation of labor laws.

You also need to decide on how to submit your application. You can submit it to the local authority of the Federal Tax Service in paper form, by mail or electronically. But this cannot currently be done through the Public Services portal. The tax authority has its own website and a corresponding section in it. You can submit an application to close an individual entrepreneur there, but to do this you need to have your own digital signature. If there is no electronic seal, then you will have to do it the old fashioned way, in paper form.

Requirements for filling

The form will be familiar to those who have applied to open an individual entrepreneur. Requirements for filling:

- All letters must be entered on the form only in printed form.

- All letters must be capitalized.

- It is acceptable to fill only with a black pen, with maximum brightness of the shade. This is due to the fact that the completed document will be processed by machine.

- Each character (including periods, commas, colons, and spaces) needs its own cell.

- The information must completely match the data already available in the system. ID numbers, passports, OGRNIP, TIN and other data must not be distorted. A mismatch of at least one character results in cancellation of the document acceptance.

- Abbreviations and hyphenations are possible only in accordance with the rules of Russian spelling.

- Duplicate information is not welcome.

What documents will be needed for submission?

If you express a desire to terminate your activities as an individual entrepreneur, you will definitely need a Russian passport and, if available, a passport of a representative (trusted person). The latter can be a relative, friend, or a specialist hired for this purpose: lawyer, attorney, etc. You will also need notarized copies or originals of the TIN, OGRNIP of the legal entity.

Another important point is a fresh (no later than five working days from the date of application) extract from the Unified State Register of Individual Entrepreneurs. Without it, an application to close an individual entrepreneur cannot be accepted by the tax authority.

The cost of obtaining an extract in our country ranges from 200 to 500 rubles.

Instructions for filling out application C-09-3-2

The procedure for filling out the form is established by Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] If a company decides to liquidate several OPs at once, then you will have to fill out an application for deregistration of a separate division in 2022 for each.

The structure of the form requires filling out two pages. This is the title page or sheet 1, which reveals the identifying information about the parent institution. The second sheet reflects information about the closure of a representative office, branch or separate division.

Components of the application

Since 2013, a simplified form has existed. It includes the following fields to fill out:

- OGRNIP number;

- separately - last name, first name, patronymic;

- TIN number;

- to whom and how is the response to the completed paper issued: to the applicant, his authorized representative, in person or by mail;

- telephone;

- E-mail address;

- signature of the applicant or his authorized representative;

- position, signature and its transcript of the employee receiving the application.

If the applicant does not submit the document personally, but prefers to send it by mail, then there is a space on the paper for the notary’s marks. Any authorized person who has the right to certify a notarial act can also perform the functions of confirming a document.

Important point! You only need to sign in the presence of a tax inspector. If the application is sent by mail (and personal presence is not possible), then a notary must be present when signing.

For reliability, the TIN of the person who is the guarantor of the applicant’s authenticity is indicated. The last point is needed for insurance in case of judicial practice on issues of illegal closure of an individual entrepreneur. The entire lower quarter of the application is left for official tax service marks. There is no need to fill it out.

Filling out the fields of form S-09-3-2

This form is machine read, so if you are filling it out by hand, use a black ballpoint pen and write the information in block capital letters. One cell is designed for only one character, so several characters in one field will be an error. Messages with errors and corrections will not be accepted.

Forms submitted electronically must be certified by an electronic signature. The person with the right to sign is either the head of the company (code 3) or an authorized representative (code 4).

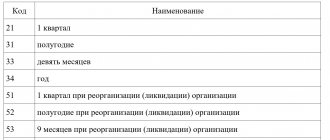

Page numbers are indicated in four-digit format, i.e. the title page is 0001, and the first page of the application is 0002. The application can be given on as many pages as the number of representative offices that are planned to be closed. This figure is reflected at the beginning of the document.

The number of closed OPs is equal to the number of pages in the application and is 1 less than the total number of pages in the message:

Note! The checkpoint of the main legal entity is indicated on the first page, and the division to be closed is indicated in the appendix. Always check the data matches so you don't accidentally close a running compartment. In case of an error, you can submit an application to the Federal Tax Service, but there is no guarantee that it will be considered.

The data on the OP must match those indicated in form S-09-3-1 when opening a representative office. Remember the basic principles of filling out documents submitted to tax and other government agencies: one cell - one character.

If the checkpoint of the branch and the TIN of the authorized person are missing, you do not need to fill in the corresponding fields.

Step 1. Fill out sheet 1

Start filling out the header of the title page of application C-09-3-2. Indicate the TIN and KPP of the parent organization. This is important; in the header of the document we indicate the details of the company that is closing a separate branch or branch.

The tax authority code is the four-digit code of the territorial branch of the Federal Tax Service to which the application is submitted. The Federal Tax Service code is determined by the location of the head office.

Name and OGRN - indicate the details of the organization closing the representative office. That is, we enter the name of the institution itself and its OGRN.

Number of separate divisions - indicate the number of OPs for which the decision to liquidate (close) was made. For example, if a company is optimizing one branch, then indicate one in the field. If two or more representative offices are closed, then indicate the appropriate value. If several OPs are liquidated at the same time, you will have to draw up a separate application for each entity.

Indicate the number of sheets of the completed form. If there are attachments, then enter the number of pages in the appropriate form. For example, if the registration is handled by a trusted representative, then a copy of the power of attorney will have to be attached to the application. Then in the line “Number of attachments” we will indicate the number of pages on which the power of attorney is drawn up.

Next, fill out the information block about the applicant’s representative. Usually this is the head of the head office or his trusted representative. Select the desired code from the proposed options. We indicate 3 - if the application was signed by the general director himself. Enter code 4 if the message is submitted by a representative.

Enter your full name. applicant. Please enter your middle name if available. We indicate the personal INN of the director or representative if the applicant has a tax certificate issued by the Federal Tax Service. We enter the contact phone number and email address in the standard mode.

If a sample for filling out a message about the closure of a separate division is submitted by an authorized representative, then register the details of the power of attorney on the basis of which the authorized representative acts.

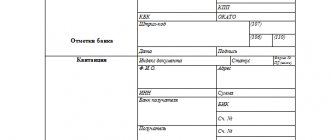

Leave the right side of the block blank. This section of the cover page is prepared by the receiving tax inspector.

Step 2. Design sheet 2

We proceed to filling out the second sheet of application C-09-3-2. We fill out the header in the same way - indicate the tax identification number and checkpoint of the company’s head office. Next to it we indicate the page number, in our case - 0002.

Now we disclose information about the liquidated OP. We enter its checkpoint and indicate the name of the branch. Note that for some separate divisions a special name is not provided. If there is no name, put dashes in the field.

Next, enter the address of the location of the structural department. We indicate:

- index;

- region code;

- area;

- city;

- locality;

- street;

- number of the house, building and apartment.

If there is no information to fill out, then put dashes in the fields of application C-09-3-2.

Now you need to determine the category of the liquidated branch. If this is a branch, then indicate the code “1”. For the representative office to be optimized, select code “2”. When closing another OP - code “3”.

We enter the date of the decision to liquidate the OP in accordance with the order of the owners of the company. We certify the form with the signature of the applicant.

We fill out form c-09-3-2 to close a separate division

Form C-09-3-2 is used to close branches, representative offices and separate divisions of an organization. The new form S-09-3-2 is valid starting from December 25, 2022 and approved by Order of the Federal Tax Service of Russia dated September 4, 2020 No. ED-7-14/ [email protected] Form S-09-3-2 according to KND 1111052 is relevant for use in 2022.

How to fill out form C-09-3-2 when closing a separate division.

When filling out form S-09-3-2, on the Title Page we fill in the TIN and KPP of the organization.

We write the checkpoint in the header that is indicated for your organization, and not a separate division.

We also write page number 001 in the header

Tax authority code We indicate the code of the tax office where your company is currently registered.

Then fill in the full name of the organization, for example Limited Liability Company “Business Assistant”.

We fill in the OGRN of the company and the number of OP at the moment. If you don’t have open OPs right now, put dashes.

If 2 OPs are open, indicate the number of OPs as follows: 2—

This message is compiled on 2 sheets, with an attachment (we indicate the number of attached documents).

The number of sheets depends on how many separate divisions you cover simultaneously with one form.

When closing two sections, Sheet 2 is filled in for each of them, so the total number of sheets when closing two OPs will be 3 Sheets.

Below we indicate the signatory of the application. If this is a manager, put the number 1, write his full name, tax identification number, contact phone number and date.

If the form is signed by power of attorney, we also indicate the details of the power of attorney.

For a sample of filling out the title page about closing an OP, see below:

On the second page in the header we also indicate the TIN and KPP of the organization, and sheet number 002

In the field informs about the termination of activity (closing), we select what we are closing. If this is the closure of a separate division, put the number 3.

In the checkpoint3 field we write the checkpoint of our closed separate unit. This information can be taken from the Notice of registration of a Russian organization with the tax authority, which was issued to you when registering a separate division.

If there is a name for a separate division, indicate this information in the name field.

The date of the decision to terminate the activity is written as the date of closure of the OP.

At the bottom of the second page, I confirm the accuracy and completeness of the information indicated on this page: We sign and date it.

For a sample of filling out the second page about closing an OP, see below:

Which registration authority should I submit message C-09-3-2 about the closure of a separate division?

When closing an OP, Form S-09-3-2 is submitted to the tax office at the location of the parent organization.

Together with form C-09-3-2, an Order of the General Director on the closure of a separate division is submitted.

What is the best way to file Form C-09-3-2 to close a separate division?

Documents for closing a separate division can be submitted on purpose to the Federal Tax Service in 2 copies. The second copy with a mark will be given to you upon acceptance of the documents;

Or documents for closing an OP can be submitted using an electronic signature, signing the container with documents with the electronic signature of the manager;

Documents can also be submitted by mail in a valuable letter with a list of the contents;

When should documents be submitted to close a separate division?

The taxpayer is required to report the closure of a separate division within 3 (three days). In case of violation of the deadlines for notifying the Federal Tax Service about the closure of the OP, the tax office may fine your organization.

the new form C-09-3-2 from 2022 in Excel (excel) can be found to the right of the article by clicking on the link Download materials for the article.

Form C-09-3-2 dated 2022. You can download it for 100 rubles by clicking on the link.

Filling out C-09-3-2 using UK Business Assistant

If you need to close a separate division in 2022, but do not have time to understand all the intricacies, you can entrust this work to the specialists of Law Firm Business Assistant. To order, write to email or WhatsApp or call +7 925 589-44-20 or email

PROMOTION: COMPLETING FORM C-09-3-2 to close a separate division - 500 rubles.

When working, we enter into an agreement for the provision of legal services; payment can be made in cash or by bank transfer.

Reviews about the company YK Business Assistant can be found in Yandex on our organization’s page. If necessary, you can visit our office, located in the very center of Moscow.

How to fill out form P26001

Application P26001 is filled out according to the same rules for all registration forms:

- When filling out by hand, all letters must be printed in capital letters and written in black ink. Each symbol has a separate familiar place; empty cells are filled with dashes.

- When using a computer, only 18-point Courier New font is allowed. The font color is also black, the letters are capitalized, but dashes in empty cells are optional in this case.

- In paragraph 2, you must select the method of receiving documents on deregistration (in person, by mail or through an authorized representative).

- Application P26001 is not signed in advance. The applicant's signature must be certified by an employee of the Federal Tax Service or a notary.

Where to apply

Application P26001 for termination of business activity is submitted to the official registration authority. Usually this is a special tax office that deals with registration procedures. You can find the contacts of this Federal Tax Service through the website nalog.ru. In addition, multifunctional centers in your region accept applications.

Along with the completed application, the entrepreneur submits a receipt for payment of the state duty for 160 rubles and his passport for identification. Article 22.3 of the Law “On State Registration of Legal Entities and Individual Entrepreneurs” specifies another necessary document - confirmation of the submission of information about the policyholder to the Pension Fund of the Russian Federation.

However, in practice, it is not necessary for an entrepreneur to contact the Pension Fund when deregistering from tax registration. The law makes a reservation that if this document is not presented, then the tax inspectorate itself will receive the necessary information about the payment of contributions upon an interdepartmental request.

Please note: the closure of an individual entrepreneur differs from the liquidation of an LLC in that an entrepreneur has the right to deregister even if there are arrears in taxes and contributions.

It is also not necessary to notify your counterparties of the termination of business activities. Business debts, if any, will have to be paid in any case, but as an ordinary individual.

Options for submitting documents for termination of business activities are as follows:

- Personal visit by the entrepreneur to the tax office or MFC;

- Postal item by valuable letter, in this case application P26001 must be certified by a notary;

- Submitting documents through a proxy (friend, relative, lawyer). To do this, you must not only certify the application itself with a notary, but also issue a power of attorney for the representative.

- Through the Federal Tax Service website, certifying the application with a qualified electronic signature.

5 working days after submitting form P26001, the entrepreneur will be deregistered, and a corresponding entry will be made in the Unified State Register of Entrepreneurs.

Deadlines and features for submitting form C-09-3-2

Message C-09-3-2 is submitted no later than three days after the decision to close the branch was made . A copy of this decision, as well as an identification document of the manager (power of attorney for the representative) is attached to the document. We remind you that late submission of the form will result in a fine for each day of delay.

If it is not the OP, but a branch that is being liquidated, you should, among other things, attach to the message a copy of the decision to amend the charter document, form P13002 or a notice of changes to the Charter and form P14001.

After the documents have been submitted, it will take 3-5 days to receive notification of the closure of a separate unit.

Form S-09-3-2: how to fill out correctly

The rules for filling out Form S-09-3-2 are enshrined in Order of the Federal Tax Service of the Russian Federation No. ММВ-7-6 / [email protected] dated 06/09/2011. The document consists of two parts. The first page is the title page, which displays information about the parent company. The second page is intended to record information about the division being closed.

First you need to fill out the title page. You must indicate the registration codes TIN and KPP. It is important that the details of the parent company are indicated in the header. Next, the code of the fiscal structure division is written. This code consists of 4 digits and is determined by the actual location. Next, the OGRN number and the number of branches of the company for which the decision to close was made is noted. That is, if the company is going to close one representative office, then “1” should be indicated, if three, then “3”.

If a company closes several branches at once, it will be necessary to draw up separate statements for each of them.

The number of sheets supplied is noted below. If there are attachments, it is also important to indicate how many pages are attached. For example, if a document is submitted by a representative to the Federal Tax Service of the Russian Federation, then, at a minimum, a notarized power of attorney must be attached.

Then information about the representative is recorded. Most often, this is the director of the entire enterprise or its attorney. In the first case, you should indicate code 3, in the second, code 4. You should also enter the full name and TIN of the representative. Contact information is entered in standard form.

In the specially designated field, note the date of execution of the document. The applicant’s “living” visa should also be put on.

If the interests of the enterprise are represented by the director's attorney, you will additionally need to enter the details of a notarized power of attorney in the name of the entity. The representative must have the original document when visiting the structure.

Next you should move on to the second sheet. The section header contains the same general information as on the first page (TIN, KPP), as well as the sheet number (2nd). Then you need to briefly note the information about the unit being liquidated. If the organization has a specific name, it must be entered. If not, put dashes.

Then indicate the address of the location of the separate units. It is necessary to note the index, code of the subject of the federation, city, street, house and apartment number. If any of these positions are missing, dashes should be added.

Next, write down the category of the unit that is being closed. If this is a branch, it should be o, if it is a representative office - “2”, and if this is another type of division, then “3”.

Below is the date the decision to close is made. This date must be identical to the date of the closure order. Finally, the document must be endorsed by the “living” signature of the manager.

Important nuances

A receipt for payment of the state fee (RUB 160) must be attached to the application (on a paper clip or stapler). If the closure of an individual entrepreneur is carried out in person, and the signature on the completed form is placed in the presence of a tax inspector, then you do not need to use the services of a notary.

The processing time for the application is no more than five working days from the date of application. You can find out about the status of a specific application online through the website of the federal tax service. A valid tax return is required. It is necessary to submit it, even if it is zero. But the legal subtlety of this point is that this can be done both before filing an application to close an individual entrepreneur and after.

Sources

- https://www.regberry.ru/registraciya-ooo/zakrytiye-obosoblennogo-podrazdeleniya

- https://gosuchetnik.ru/bukhgalteriya/instruktsiya-zakryvaem-obosoblennoe-podrazdelenie

- https://assistentus.ru/forma/s-09-3-2/

- https://www.malyi-biznes.ru/izmeneniya-ooo/obosoblennoe-podrazdelenie-organizacii/kak-zakryt-obosoblennoe-podrazdelenie/

- https://assistentus.ru/forma/r26001-zayavlenie-o-zakrytii-ip/

- https://gosuchetnik.ru/shablony-i-formy/instruktsiya-zapolnyaem-zayavlenie-o-zakrytii-obosoblennogo-podrazdeleniya-po-forme-s-09-3-2

- https://www.regberry.ru/registraciya-ip/kak-zapolnit-zayavlenie-na-zakrytie-ip-v-2018-godu

Nuances of submitting form C-09-3-2

It is important to submit Form C-09-3-2 to the Federal Tax Service of the Russian Federation within the first 3 working days from the closing date. All papers must be sent to the local branch of the structure where the parent company is registered. You can send the documentation package in the following ways:

On a personal visit. It is important for the applicant to carry identification;- Through an authorized person. In this case, the attorney should have with him a passport (copy or original) and the original power of attorney. In this case, the power of attorney must be issued by the head of the parent company and certified by a notary;

- In electronic version. To do this, you will need a pre-issued electronic signature of the head of the enterprise. Otherwise, the Federal Tax Service of the Russian Federation will not accept the documentation, since it will not be confirmed, and therefore will not have legal force;

- Through your personal account of the official Internet portal of the Federal Tax Service of the Russian Federation. This will require a pre-issued electronic signature of the head of the enterprise, as well as registration on the marked website.

If all submitted documentation is completed correctly and does not contain errors, within 10 working days from the date of receipt, the tax inspector makes a written decision regarding the closure of a separate division. In some situations, an on-site inspection is additionally prescribed. If one has been appointed, the manager will receive a notification approving the closure of the unit only after the inspection is completed.