How can an employee confirm expenses incurred?

The employee’s obligation to report in the prescribed form on the expenditure of funds issued to him by the enterprise is enshrined in law.

For this procedure, a special form AO-1 was adopted, approved by Resolution of the State Statistics Committee No. 55 of August 1, 2001. Clause 6.3 of Central Bank Directive No. 3210 dated March 11, 2014 states that the specified form is submitted for approval to the manager or accountant along with attachments to the employee’s advance report. The JSC must be accompanied by documents that reflect the fact of payment and a complete list of expenses incurred. Let's determine which checks can be accepted for advance reports from 2022:

- fiscal, generated on cash register;

- form of strict accountability;

- PKO receipt;

- commodity.

If a number of conditions are met, the employee has the right to attach only one of the specified forms to the report.

Advance report: what can be taken into account

The issuance of funds by an organization to a person in an employment relationship with it is standard business practice.

The money that the company, with the participation of the accounting department, transfers for reporting is accompanied by documentation confirming its intended use. Documents are carefully reviewed by regulatory authorities. The main question that worries employees responsible for the expense report: both accountants and accountable persons - what can be taken into account? Despite the abundance of explanatory letters, guidelines, guidelines and instructions, many issues remain controversial. An employee whose “hands” are entrusted with accountable funds is constantly forced to think about how to draw up documents confirming his expenses, and the accounting department has to check the submitted papers and checks line by line for compliance with tax laws. In general, the following rules apply to advance money:

- Funds are issued for business and operational needs and travel expenses.

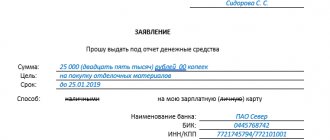

- The basis for issuing funds is the order of the manager. The manager makes a decision after the accountable person submits an application.

- After making the expenses for which the funds were allocated, it is necessary to reflect them in the report, attaching supporting documents within a certain time.

- The accountable person must submit an advance report with justification for expenses to the accounting department within three days after the official date of return from the business trip. This date is considered to be the date indicated on the return ticket or waybill if the employee uses a car.

- If an employee receives money for business needs, then he must submit an advance report within the time limits established by a special order of the head of the organization. As a rule, such an order is issued in the form of an annex to the accounting policies of the organization.

- Employees of the organization must be familiar with all administrative documents relating to the procedure for issuing money on account and submitting advance reports confirming expenses.

What documents are officially accepted as justification for expenses?

This issue creates the greatest difficulties for all participants in checking advance reports: both for the checking workers and for the reporting ones. According to the current established practice of tax audits, supporting documents are:

- cash register receipt;

- passenger tickets, boarding pass;

- sales receipts/invoices;

- receipts, strict reporting forms (SSR) and other forms on the basis of which one can draw a conclusion about the validity of expenses.

In practice, for each item on the list, the accountant may have certain requirements, and accountable persons may have questions.

Here are some examples

- Documents compiled in a foreign language must be translated into Russian.

Not all information specified in the document is subject to translation, but only that which is essential for accounting. - Is it possible to indicate dates in the expense report that fall on weekends or holidays?

If days on business trips are considered, they are indicated in the report as part of the total duration of the business trip, determined by the order and passenger tickets (waybills). For these days, daily allowances are paid as usual.If we consider the days when inventory items are purchased or any services are provided to the employee, then questions may arise related to the involvement of the employee in performing work duties on weekends. The procedure for working on weekends is established by the Labor Code of the Russian Federation and is controlled by the labor inspectorate. Therefore, it is better to avoid completing documents on weekends and, as expected, take a break from work. It is not recommended to invite business partners to a representative dinner on a weekend or holiday.

- An organization can independently develop an advance report form and approve it in its accounting policies.

The mandatory use of the unified form AO-1 has been abolished since 2013. In practice, many continue to use the old “verified” form, which has two sides (approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 N 55). The first side (title side) is filled out by the accountable person and the accountant, approved by the manager. The second (reverse) side is filled out by the accountable person and confirmed by his signature. On the second side, in the free lines, the accountable person lists all the documents that are attached to support expenses. - If funds were issued not in the form of cash (from the cash register), but via a corporate card to an account specially opened for such transactions, the procedure for filling out the advance report does not change.

The legislation does not limit the amount of amounts that an organization can issue for reporting; they can be very significant, but even the smallest amounts issued must be taken into account in the advance report. At the same time, it is necessary to remember the legally established standards for cash payments between legal entities and individual entrepreneurs - no more than 100 thousand rubles under one agreement. If you need to purchase goods or materials in large quantities, the accountable person must take care in advance to agree with counterparties on the conclusion of contracts for each batch that does not exceed the specified limit for cash payments. This restriction does not apply to non-cash payments.In practice, restrictions on the issuance of amounts for reporting are established by corporate rules, which are defined in the company’s internal policies.

Cash and sales receipts - how to accept them?

Most often, reporting employees have difficulties with issuing cash receipts - from stores, points of sale of tickets for public transport, gas stations (if you need to travel on company business by car) and travel documents in the form of strict reporting forms.

If other documents (invoices/sales receipts) are attached to cash receipts, then there will be no problems and they can be accepted for accounting. Any documents can be attached to the advance report. Moreover, these documents must confirm not only the fact of payment for material assets, but also the fact of their receipt.

A cash receipt only confirms the fact of payment, so it is not enough to confirm the fact of purchase of goods (work, services).

The regulations on cash registers determine that a cash register receipt is a primary accounting document printed by a cash register on paper, confirming the fact of a cash payment and (or) payment using payment cards between the user and the buyer (client), containing information about these settlements registered cash register software and hardware that ensure proper accounting of funds during settlements.

Currently, the use of cash register technology is undergoing significant changes. The transition to a new order, modern and technological, will allow information about each purchase to be transferred online to the tax office, and buyers will receive and save cash receipts on their mobile devices.

A mandatory element of the new cash register receipt is a QR code, thanks to which any buyer can check the legality of the purchase being made.

It must be remembered that in some cases it is allowed to issue not a cash receipt, but a strict reporting form (SSR).

The cash receipt and strict reporting form must contain, except in cases established by law, the following mandatory details:

- serial number for the shift;

- date, time and place (address) of settlement;

- name of the organization or surname, name, patronymic of an individual entrepreneur;

- taxpayer identification number;

- the taxation system used in the calculation;

- sign of calculation (receipt of funds from the buyer - receipt, return to the buyer of funds received from him - return of receipt, issuance of funds to the buyer - expense, receipt of funds from the buyer issued to him - return of expense;

- name of goods, works, services, payment, disbursement, their quantity, price per unit taking into account discounts and markups, cost taking into account discounts and markups, indicating the value added tax rate;

- the calculation amount with a separate indication of the rates and amounts of value added tax at these rates;

- form of payment (cash and (or) electronic means of payment), as well as the amount of payment in cash and (or) electronic means of payment;

- position and surname of the person who made the settlement with the buyer (client), issued a cash receipt or strict reporting form and issued (transferred) it to the buyer (client);

- registration number of cash register equipment;

- serial number of the fiscal drive model;

- fiscal sign of the document;

- the address of the website of the authorized body on the Internet, where the fact of recording this calculation and the authenticity of the fiscal indicator can be verified;

- subscriber number or email address of the buyer (client) in case of transfer of a cash receipt or strict reporting form in electronic form;

- the email address of the sender of the cash receipt or strict reporting form in electronic form in the event of transfer of a cash receipt or strict reporting form in electronic form to the buyer (client);

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message.

| When purchasing a paper railway ticket (we accept one of the options): | When purchasing an e-ticket: |

| Either a train ticket with the details of a cash receipt printed on it, or a QR code. In this case, a cash receipt is not required; Or a train ticket and a cash receipt, if the ticket does not contain receipt details or a QR code. | Control coupon of an electronic travel document with receipt details or QR code; Control coupon of an electronic travel document and a cash receipt, if the document does not contain receipt details or a QR code. |

The organization's posting of inventory items purchased for it by an employee is carried out on the basis of primary accounting documents, in particular an advance report, sales receipts, as well as documents confirming the fact of payment - KKM checks, receipts for a cash receipt order (see letter from the Federal Tax Service dated June 25. 2013 N ED-4-3/ [email protected] ).

At the same time, part 2 of Art. 9 of Law N 402-FZ defines a list of mandatory details that any primary accounting document must contain. Namely:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and is responsible (responsible) for the correctness of its execution, or the name of the position of the person (persons) responsible for the accuracy of the execution of the event;

- signatures of the persons provided for in paragraph 6 of this part, indicating their surnames and initials or other details necessary to identify these persons.

Invoices submitted for reporting must be drawn up on behalf of the organization, and not the individual employee, otherwise the costs for them will be difficult to attribute to the company’s costs.

In 2016, the Supreme Court of the Russian Federation indicated (determination of the Supreme Court of the Russian Federation dated 03/09/2016 No. 302-KG16-450) that primary documents are recognized as executed in violation of the requirements of the law and are not accepted for accounting in the following cases:

- lack of information in them necessary to identify the persons who signed them;

- when the name of the purchased goods is not clearly indicated (for example, “household expenses, office supplies, household chemicals, building materials, expenses, children’s New Year’s gifts”);

- there is no date of compilation;

- The columns “quantity” and “product price” are not filled in;

- The seller's signature is missing.

If the transaction performed is subject to VAT, then invoices must be attached to the documents for the purchase of goods, works, and services.

The type and content of invoices are regulated by Article 169 of the Tax Code and Decree of the Government of the Russian Federation No. 914 (dated February 2, 2000).

Business trip: what can be taken into account?

Documents that confirm the expenses of business travelers usually include:

- round-trip tickets for air, railway, and bus transport, cash receipts for the issuance of bed linen;

- confirmation of travel expenses to train stations/airports located outside cities, in hard-to-reach areas;

- documents from the place of residence - hotel bills, strict reporting forms or cash receipts;

- travel insurance policies;

- documents confirming payment of other travel-related fees;

- documents on payment for obtaining visas.

To confirm payment for the use of a passenger taxi, a cash receipt or receipt in the form of a strict reporting form is issued. The specified receipt must contain the required details:

- name, series and number of the receipt for payment for the use of a passenger taxi;

- name of the freighter;

- date of issue of the receipt for payment for the use of a passenger taxi;

- cost of using a passenger taxi;

- last name, first name, patronymic and signature of the person authorized to carry out settlements.

In the receipt for payment for the use of a passenger taxi, it is allowed to place additional details that take into account the special conditions for the transportation of passengers and luggage by passenger taxis.

Thus, the driver of a passenger taxi is obliged to give the passenger at the end of the trip either a cash receipt printed by cash register equipment, or a receipt in the form of a strict reporting form, which must contain the established details.

The package of documents must necessarily contain an order to go on a business trip and boarding passes in the case of air travel.

Let's sum it up

The advance report is checked by the accounting department for the intended use of funds, the presence of primary documents confirming the expenses incurred, and the correctness of their execution.

The verified expense report is approved by the head of the organization or another person with appropriate authority. Based on the data of the approved advance report, the accounting department writes off accountable amounts in the prescribed manner.

BDO Unicon Outsourcing employees are always ready to tell you what difficulties you may encounter when filling out an advance report, what can be taken into account and how to draw up documents. The company offers a full range of consultations and professional services for personnel records and employee settlements.

Documents confirming expenses

Form of strict accountability

Some categories of sellers issue strict reporting forms when providing services. The employee, in support of his expenses, provides the document that he received from the seller, for example, a check for a taxi in an advance report or a strict reporting form. In order to use a strict reporting form to confirm expenses incurred, it is generated on special automated equipment, similar to a cash register, and contains mandatory details, which are named in Article 4.7 of Law 54-FZ.

It is important to know that from February 1, 2022, enterprises and individual entrepreneurs applying special tax regimes are required to include in the strict reporting form the name of the service provided or work performed and their quantity.

Sales receipt

A sales receipt without a cash register attached to the advance report can be accepted as expenses in 2022 if it was issued by the seller - an individual entrepreneur on PSN in relation to the types of activities specified in clause 2.1 of Art. 2 of the Law on the Application of CCP.

It is necessary to check that the sales receipt contains all the required details:

- formation date;

- Document Number;

- name and TIN of the seller (for an individual entrepreneur - full name);

- a complete list of paid goods and their quantity;

- the amount of accountable funds paid to the seller in rubles;

- position and full name of the employee who issued the product form.

In practice, the opposite situation often occurs when an employee brings a cash receipt without a sales receipt for the expense report in 2021. If the form attached to the expense report is drawn up on an online device and contains information about the purchased goods or services provided and their quantity, then you have the right to accept it to confirm the expenses incurred. Thus, based on Letter of the Ministry of Finance of Russia dated February 18, 2019 No. 03-03-06/1/10344, the answer to the question of whether a sales receipt is needed if there is a cash receipt for an advance report in 2021 is no, if the fiscal document is properly prepared .

What information should be contained in cash and sales receipts?

According to legal requirements, primary documents confirming expenses must indicate:

- Title of the document;

- serial number for the shift;

- date, time, place of the operation;

- name of company;

- TIN, taxation system;

- calculation sign;

- listing of goods/services and their cost;

- payment format for goods/services;

- Seller's name;

- cash register details;

- document serial number;

- website address where document authenticity can be verified;

- QR code.

If the cash receipt does not contain a list of goods, then it is not enough for the advance report, and in this case it must be supplemented with a sales receipt that details the purchase.

By the way, a cash receipt is prone to fading quickly, so it is better to make a copy of it immediately or save a photo in the Hamilton Expense Report app.

The sales receipt does not have a standard form, but must contain all the required details for primary documents, except for the number and seal - they are optional. Even if there is an error in the document, it can be accepted for accounting. However, before this, it is recommended to send a request to the website or address of the seller of the product/service to clarify whether the document presented was actually issued by them.

When submitting cash receipts and sales receipts at the same time, their dates and amounts must match exactly.

Is it possible to confirm expenses with a PKO receipt?

Another way to confirm expenses incurred by the employee is to provide a cash receipt receipt received from the seller.

To accept a cash receipt order:

- compiled strictly according to the KO-1 form;

- The seller's seal is affixed to both parts of the document;

- in the “Amount” column, the value is written first in numbers and then in words.

Since the cash receipt order does not disclose information about the purchased product (service), an invoice or act should be provided along with it along with the advance report.

Normative base

Federal Law No. 192-FZ dated 07/03/2018 “On amendments to certain legislative acts of the Russian Federation”

Letter of the Ministry of Finance No. 03-03-06/1/10344 dated 02/18/2019 “On confirmation of expenses for income tax purposes with a cash receipt”

Directive of the Bank of Russia No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”

Starting from July 2022, according to Art. 1 of Law No. 192-FZ of July 3, 2018, if goods are purchased for an organization or individual entrepreneur, the electronic fiscal cash receipt (FKCH) must contain the buyer’s TIN data, customs declaration number, country of origin of the goods and the amount of excise tax. It is allowed to be used as an appendix to the advance report - as stated in the letter of the Ministry of Finance No. 03-03-06/1/10344 dated 02/18/2019.

In this case, the paper receipt confirming the expenses is signed by the seller as the responsible person. Additional information required for reporting in accordance with Art. 1 of Law No. 192-FZ dated July 3, 2018 and letter of the Ministry of Finance No. 03-01-15/75371 dated October 19, 2018, are displayed in the fiscal document if goods are purchased on behalf of a company or individual entrepreneur. Without this data, the Ministry of Finance believes (letter No. 03-03-07/74934 dated September 30, 2019), the FCC does not have the right to justify the “economic feasibility of the fact of economic activity.”

IMPORTANT!

Organizations and individual entrepreneurs on OSN, STS and UTII that provide services to the population, instead of filled out strict reporting forms, are now required to issue FKCH to recipients of services.

Electronic cash document

In modern conditions, paper document flow is being replaced by electronic one. This trend also affected settlement transactions. The employee has the right to report expenses incurred using electronic forms. According to clauses 2, 3, 3.1 of Art. 1.2 of the Law on the Application of CCP, such a document must be printed. Also, the electronic check provided by the employee in the advance report should be checked on the official website of the tax inspectorate or in a special application of the Federal Tax Service, and the result of the check should be attached to the JSC.

Additional check details

In some cases, the provisions of Art. 4.7 provide additional mandatory check details. Thus, according to clause 3, payment agents (subagents) who are engaged in accepting payments from citizens must indicate on the check:

- the amount of your remuneration;

- your contact phone numbers, as well as the phone numbers of the supplier and payment acceptance operator.

If the check was generated during settlements between legal entities and individual entrepreneurs, then in addition to the basic mandatory details it must indicate (clause 6.1, article 4.7):

- buyer's name;

- his TIN;

- country of origin of the goods;

- Number of customs declaration;

- excise tax amount.

Important: these details must be on the receipt even when the purchase is made through an accountable person by proxy.

On their own initiative, companies and individual entrepreneurs have the right to add optional details to checks. For example, advertising texts: information about promotions, discounts and other similar information. This is not a violation and does not affect the correctness of the document.

Taxcom offers its clients branding of receipts . Your company logo, address, links to the website and corporate color in the electronic receipt so that the client remembers you and comes back again. Try it for free - we'll give you 100 receipts on your first order!

Try it

“Believe and look back!” Or how suppliers can deceive

Often the culprit of violations in settlements with accountable persons is not the employees who compiled the advance report, but unscrupulous suppliers and contractors. They intentionally or through negligence invalidate supporting documents.

Tip: Create a detailed memo for accountable persons. Indicate which details and exactly how they must be filled out for each type of supporting document. Separately mark documents that cannot be accepted from sellers of goods and services (for example, receipts, certificates, statements, etc.). Periodically conduct seminars for accountable persons.

The main risks for the accountable person and his company from the seller:

- Failure to issue a cash or sales receipt;

- Using an old-style cash register (this is especially true since 2017);

- Issuance of non-fiscal cash receipts due to the use of cash registers that are not registered with the tax authority;

- Issuing checks of any form with partially missing mandatory seller details;

- Lack of submitted reports on the website of Rosstat of the Russian Federation (this casts doubt on the legality of the fact of purchase and acceptance of VAT amounts for deduction);

- Absence of signatures, seals or references to the power of attorney of the accountable person in the documents;

- Issuance of strict reporting forms with incomplete details and other violations.

Why do you need to attach supporting documents to the report?

Since 2014, the procedure for conducting cash transactions and making cash payments is determined by the instructions of the Central Bank of the Russian Federation No. 3210-U dated 03/11/14 and No. 3073-U dated 10/07/13, according to which persons who received funds in advance for the purchase of goods or services for an organization or individual enterprises are required to report to the accounting department, justifying expenses using supporting documents.

Law No. 54-FZ and amendments introduced by Law No. 313-FZ dated October 1, 2020 determine which checks can be accepted for advance reports from 2022. Payment by company employees of its external expenses from the accountable funds received by them requires compliance with the regulations established by law, both when issuing them by the accounting department and when preparing reporting documentation. In case of violation of the rules, the spent funds of the Federal Tax Service have the right not to be counted for tax purposes.

ConsultantPlus experts discussed the procedure for filling out and submitting an advance report. Use these instructions for free.

If the QR code is not on the receipt, how to accept such expenses?

The specified QR code is a mandatory requisite for a cash receipt (Clause 1, Article 4.7 of Law No. 54-FZ). If it is printed, it means that the online cash register fully complies with the requirements of the law. In this situation, there is no question of accepting as expenses the amount confirmed by a correct check.

But there are times when there is no QR code on the receipt. The Ministry of Finance of the Russian Federation explains in its letter No. 03-03-06/1/78500 dated October 14, 2019 that documents confirming payments made attached to the advance report, if executed in violation of the legislation of the Russian Federation, are not subject to inclusion in expenses when calculating income tax . The requirement for compliance of documents confirming expenses is stated in Article 252 of the Tax Code of the Russian Federation (clause 1). By analogy, such amounts do not participate in tax reduction under the simplified tax system (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Thus, a cash receipt without a QR code cannot be used to confirm expenses incurred in tax accounting. The reason is that the QR code is a mandatory requirement. And its absence is a violation of the legislation of the Russian Federation.

On the other hand, there are some entrepreneurs and legal entities who are by law exempt from the use of CCT or have the right to defer its application. Some of them issue a sales receipt, BSO or an old-style cash register receipt (without a QR code) as confirmation of payment and do not violate the law (more details in THIS ARTICLE). What to do in this case? Controversial points remain.