Your company has already entered into a leasing agreement and you have questions about how to reflect leasing in accounting? In this article you can find the necessary information and examples of accounting entries for various leasing transactions.

By Order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n, the Federal Accounting Standard FSBU 25/2018 “Lease Accounting” was approved. The standard is mandatory for use starting with reporting for 2022. If desired, the new standard may be adopted early.

The procedure for accounting for leasing given in this article is based on Order No. 15 of the Ministry of Finance of the Russian Federation dated February 17, 1997.

Leasing transactions depend on whose balance sheet the leased property is reflected in: the lessor or the lessee. The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement.

Accounting for leasing when reflecting property on the lessor’s balance sheet

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

Postings for VAT under a leasing agreement

Accounting for leasing transactions is regulated by the relevant order of the Ministry of Finance of the Russian Federation dated February 17, 1997 No. 15. The leased object can be recorded on the balance sheet of one of the parties: the lessor or the lessee. This procedure is fixed in the contract or in an additional agreement to it.

In accounting, it is usually shown in the fixed assets account. If the property is accounted for on the lessor’s balance sheet (account 01 “Fixed assets”), then the lessee reflects its value on off-balance sheet account 001 (“Leased fixed assets”).

Accounting for all payments under the leasing agreement is made on account 76, with separate analytics for payments: advance payment (for accounting for advances), current payments (monthly payments), redemption value (cost of property upon redemption). Next, all the nuances of accounting for the seller and buyer of leased property are taken into account.

VAT postings from the lessee

Under a leasing agreement, the lessee's property will be accounted for in an off-balance sheet account. He will not make depreciation deductions, since off-balance sheet accounts do not provide for changes in value before the transfer of ownership. Other transactions under the agreement are reflected in accordance with the documents provided by the lessor. Accounting entries:

- Debit 001 - the fixed assets received under the leasing agreement were placed in an off-balance sheet account.

- Debit 20 Credit 76 - payment under the leasing agreement is reflected in expenses (posting is done monthly).

- Debit 19 Credit 76 - VAT is reflected on the monthly lease payment.

- Debit 68 Credit 19 - VAT is accepted for deduction (monthly posting).

- Debit 76 Credit 51 - transfer of the obligatory lease payment.

After making all mandatory payments, the lessee reverses the amount from the off-balance sheet account, making an entry to credit 001. At the same time, the property is placed on the lessee’s balance sheet account (Debit 01 Credit 02 - the amount of the fixed asset minus VAT, since the amount of VAT on the property was accepted for offset against the issued lessor's invoices).

Postings for current lease payments

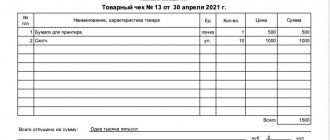

Dt 60 – Kt 51 – 236,000 (advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (offset of the advance payment) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 – Kt 76 – 29,276.27 (accrued leasing payment No. 1 – 34,546 minus VAT – 5,269.73)

Dt 19 – Kt 76 – 5,269.73 (VAT charged on lease payment No. 1)

Dt 20 – Kt 60 – 5,555.56 (part of the advance payment under the leasing agreement is credited – 6,555.56 minus VAT 1,000)

Dt 19 – Kt 60 – 1,000 (VAT charged against advance payment)

Dt 68 – Kt 19 – 6,269.73 (VAT submitted to the budget)

Dt 76 – Kt 51 – 34,546 (leasing payment No. 1 listed)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

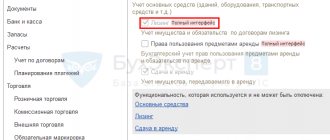

Nuances of accounting for leased property in 1C: Enterprise Accounting 8

Published 01/14/2019 12:39 Author: Administrator In this article we will look at the main nuances of accounting for leasing and reflecting related transactions in 1C: Enterprise Accounting 8 edition 3.0. When is leasing necessary, and what are its distinctive features? What accounts will be involved if the property is listed on the balance sheet of the lessor and the lessee? Are expenses for fuel and lubricants and insurance accepted for tax accounting purposes? How to reflect the repair of leased property and its repurchase for subsequent resale? Brief answers to all these questions await you in the article.

When does an organization need leasing?

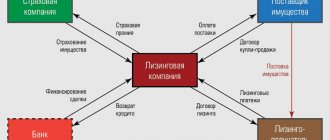

If the buyer organization does not have the opportunity to immediately purchase the property it is interested in, and the seller organization has no interest in leasing this property: there are transactions involving a third party who buys this property from the seller organization and leases it to the buyer organization.

This type of lease of real estate, vehicles or equipment is called finance lease or leasing.

When leasing, three parties are involved in contractual relations: the seller, the lessor and the lessee.

The lessor, using his own funds or borrowed funds at the order of the lessee, buys property from the seller and transfers it by installments. The property itself is of no economic interest to the lessor. The lessor has only a financial interest.

Let us recall the distinctive features of leasing (financial lease):

- ownership of the subject of the leasing agreement can pass to the lessee (this is not a mandatory condition of the leasing agreement);

- the property must be new;

- the contract is of a long-term nature; payments under the agreement are less than under a lease agreement;

- in case of prolonged downtime (accident, repair), the lessee pays leasing payments.

Leasing payments include:

— reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset;

— reimbursement of the lessor’s costs associated with the provision of other services provided for in the contract;

- lessor's income.

If the agreement provides for the transfer of ownership of the leased property, then the redemption value of this property is included in the agreement.

As a rule, during a transaction, two agreements are concluded: a leasing agreement (financial lease) and a purchase and sale agreement (for the redemption value of the leased asset).

In accounting, leasing payments are expenses for ordinary activities.

In tax accounting, leasing payments are classified as other expenses associated with production and sales.

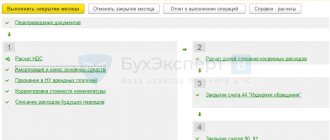

Let's consider some scenarios for reflecting leasing transactions in the 1C program: Enterprise Accounting, edition 3.0.

1. An organization has purchased a car on lease, the property is listed on the lessor’s balance sheet.

The lessee has the leased asset listed on his off-balance sheet account at the cost of the lessor's expenses for the acquisition of this property, excluding VAT. The lessor specifies the purchase price in the contract.

2. The organization purchased a car on lease, the property is listed on the balance sheet of the lessor. The organization transferred the advance for the 1st year of leasing in one payment.

Accepted for deduction of VAT from the advance invoice.

When accruing and writing off leasing payments, part of the advance VAT on the cost of leasing payments is repaid monthly.

Repayment of the advance payment by monthly accruals of leasing payments.

3. The organization purchased a car on lease, the property is listed on the balance sheet of the lessor. Accounting for fuel and car insurance costs.

Expenses for fuel and lubricants and car insurance, despite the fact that the car is on the balance sheet of the lessor, are accepted for tax accounting purposes (Articles 252,253, 264 of the Tax Code of the Russian Federation).

4. The organization purchased a car on lease, the property was listed on the lessor’s balance sheet. Selling a repurchased car.

The leased asset was written off off-balance sheet due to redemption.

For subsequent sale, the purchased property is capitalized as goods. Input VAT on the purchase price is taken into account based on the lessor's invoice.

5. The organization purchased a car on lease with subsequent purchase; the leased item is accounted for on the balance sheet of the lessee.

Detailed reflection of the accounting of the leased asset on the lessee's balance sheet in 1C: Enterprise Accounting, ed. We reviewed 3.0 in the article Accounting for the leased asset on the lessee’s balance sheet in 1C: Enterprise Accounting 8

Checkpoints:

1. “Leasing accounting” is maintained on account 76.07 “Rent payments”

2. The leased item is accepted for accounting at the contractual value, i.e. redemption price + cost of leasing payments.

3. In accounting, the leased asset is depreciated.

4. In tax accounting, the leased item is taken into account in the amount of purchase costs by the lessor.

5. The difference between the accounting book and the NU is temporarily taken into account (“temporary difference”) in account 01.K “Adjustment of the value of leased property.” This is the non-depreciable part of the cost of the leased asset.

6. Deferred VAT is generated because the invoice is not initially issued by the lessor. As lease payments are written off, deferred VAT will be deducted (the lessor provides invoices for lease payments).

7. The purchased property is registered as a fixed asset, inventory or goods, depending on the amount of the redemption value and further purposes of use.

The leasing payment strategy in this case will look like this:

6. The organization purchased a car on lease, the lessee entered into an insurance agreement for the leased item (car) with the condition of paying for repairs to a car service organization.

During repairs, you can maintain separate records of the leased item. The organization does not reflect repair costs in accounting.

In tax accounting in this case, neither income nor expenses arise (letter of the Ministry of Finance dated October 8, 2009 No. 03-03-06/1/656).

7. The organization purchased a car on lease, the lessee entered into an insurance agreement for the leased item (car) with the condition of insurance compensation.

Insurance compensation received from an insurance company is taken into account in accounting as part of other income (clause 9 of PBU 9/99); in tax accounting - in non-operating income.

8. About seasonal write-offs of fuel and lubricants

The organization is not obliged to standardize costs for fuel and lubricants and has the right to develop its own standards. Winter norms for the write-off of fuel and lubricants can be fixed by an order on a seasonal increase in fuel and lubricant standards and a control check report.

9. About the seasonal replacement of summer tires with winter ones.

Replacing summer tires with winter tires is confirmed by a seasonal tire replacement certificate (free form).

In tax accounting, both types of seasonal expenses are expenses for the maintenance of official transport (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

PS: Education is not a result, but a process. In order to learn new things, you often need to consciously leave old habits and stereotypes in the past. Yesterday's experience is valuable only to the extent that it helps create the future.

We thank you for being with us! Thank you for sharing our values!

Team "Accounting without worries".

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

-2 Anastasia 10/28/2020 10:29 Hello, please tell me, if under a leasing agreement the insurance of the leased property is at the expense of the lessee (the property is accounted for on the lessee’s balance sheet), the insurance policy is issued to the lessor, is it possible to take the lessee’s insurance into account?

Quote

-2 Tatyana 04/12/2020 03:18 Good afternoon! Thank you for the article

Quote

+3 Vasya 07/04/2019 15:43 Someone can simply write the entries for the following operation: The leased item died in an accident. It was returned to the lessor, and the insurance company received compensation. The Lessor compensated the Lessee for part of the losses under the leasing agreement. The leased item is on the balance sheet of the lessee. Standard accounting with Spanish b/c 76.07.01 76.07.02 76.07.09. Wiring only!!!!

Quote

-2 Irina 02/06/2019 22:40 Hello, Irina! According to the terms of the leasing agreement, the penultimate advance payment (D60.02-K51 = 150 0.00) was less than the lease payment for the current month (after postings D76.07.2-K60.02 = 1500.00 and D76.07.1-K76.07. 2=2000.00 and D19-K76.07.2=36 0.00) on account 76.07.2 the balance was 860.00. The payment for the last month is 3220.00 more than the lease payment of 2360.00. Now we have a balance on accounts 76.07.2 and 60.02. How to correctly account for these operations? Is it possible to use an accounting certificate or are there options for such accounting in 1C?

Quote

Update list of comments

JComments

Postings for the redemption of the leased asset

If there is a buyout price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting:

Dt 08 – Kt 76 – 1,000 (reflects the costs of purchasing the leased asset when transferring ownership to the lessee)

Dt 19 – Kt 76 – 180 (VAT is charged when purchasing the leased asset)

Dt 68 – Kt 19 – 180 (VAT submitted to the budget)

Dt 76 – Kt 51 – 1,180 (the amount of redemption of the leased asset has been paid)

Dt 01 – Kt 08 – 1,000 (the leased asset is accepted for accounting as part of own fixed assets)

Example of entries for accounting for a leased asset on the lessee's balance sheet

Let us assume that the receiving party, under the terms of the financial lease agreement, registers a woodworking machine. The total amount of payment under the agreement is RUB 3,233,200, including the redemption price - RUB 120,000. The indicated amounts include VAT at a rate of 20%, i.e. RUB 538,866.67. and 20,000 rub. Rental payments are transferred in equal amounts of RUB 129,717. and is designed for 24 months, at the end of which a redemption occurs. The depreciation period for the machine is 6 years (i.e. 72 months). The accelerating factor is not applied.

The entries for accepting an object for accounting are as follows:

- Dt 08 Kt 76 “Rental obligations” - RUB 2,694,333.33. — the machine is included in the capital investments;

- Dt 19 Kt 76 “Rental obligations” - 538,866.67 rubles. — VAT related to the accounting value of the machine is allocated;

- Dt 01/leasing Kt 08 - RUB 2,694,333.33. — the machine is put into operation.

The following entries are made monthly:

- Dt 20 Kt 02/leasing - RUB 37,421.29. - according to accrued depreciation;

- Dt 76 “Lease obligations” Kt 76 “Debt on leasing payments” - 129,717 rubles. — upon accrual of the next rental payment;

- Dt 76 “Debt on leasing payments” Kt 51 - 129,717 rubles. — on payment of the next rental payment (including VAT 20% RUB 21,619.50);

- Dt 68 Kt 19 - 21,619.50 rub. — on accepting VAT deductions for the next payment.

After 24 months, the entire amount of the rent reflected in the contract (except for the purchase price) will be paid (129,717 rubles × 23 = 2,983,491 rubles, 24th month 129,709 rubles), and the corresponding VAT will be taken into account in deductions (21,619.50 rubles × 23 = 497,248.50 rubles, 24th month 21,618.17 rubles). As a result, in the credit of account 76 “Rental obligations” only the purchase price will be recorded (3,233,200 – 3,113,200 = 120,000 rubles), and in the debit of account 19 the corresponding VAT amount (538,866.67 – 518,865.67 = 20,000 rubles) Both of these amounts will be closed as a result of:

- accruals for payment of the cost of redemption - Dt 76 “Rental obligations” Kt 76 “Payment of redemption” - 120,000 rubles;

- making a payment on it - Dt 76 “Payment of ransom” Kt 51 - 120,000 rubles;

- application of VAT deduction - Dt 68 Kt 19 - 20,000 rub.

At the time of redemption, account 01 will reflect the object worth RUB 2,694,333.33, and account 02 will reflect the associated depreciation of RUB 898,111.11. (2,694,333.33 / 72×24). These amounts with transactions that change their analytics within accounts 01 and 02 should be shown as part of the OS, which are their own:

- Dt 01/own Kt 01/leasing - RUB 2,694,333.33;

- Dt 02/leasing Kt 02/own - RUB 898,111.11.

Depreciation charges with the same posting (Dt 20 Kt 02, but with updated analytics for account 02) and in the same amount (RUB 37,421.29) will be accrued for another 48 months (72 - 24).

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”.

The accrual of leasing payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Depreciation on the leased asset is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

Postings from the lessee, if the car is accounted for on its own balance sheet

The concluded leasing agreement can specify 2 options for accounting for the car: on the balance sheet of the lessor (hereinafter, for brevity, we will call it LD) and on the balance sheet of the lessee (hereinafter referred to as LP). The same accounting rules apply to a leased car as for other leased property.

Any leasing agreement contains nuances related to the possibility of purchasing the subject of the agreement and the procedure for forming and paying its redemption value:

- at the end of the contract, as a rule, the car becomes the property of the LP, but in some cases it may not be transferred and returned to the LP;

- the purchase price can be paid separately at the time specified in the contract (usually at the end of the leasing agreement), or can be included in periodic payments (monthly or quarterly).

Standard accounting entries if the LP accepts the car on its balance sheet will look like this:

| Contract provisions | Dt | CT | Posting Contents | Note |

| The car becomes the property of the LP. The redemption cost is included in payments | 08 | 76/ Lease obligations | The car is accepted on the balance sheet and the total amount of debt to the LD is reflected | The posting is made for the total payments under the agreement, for the entire period of its validity, minus VAT |

| 19 | 76/ Lease obligations | Input VAT is reflected (on the entire amount taken into account by the previous posting) | ||

| 01/ Property under lease | 08 | The vehicle was put into operation as part of the OS | ||

| 76/ Lease obligations | 76/ Leasing payments | Reflects periodic payment under the agreement | The posting is made for each period for which payment is provided in the contract. For example, monthly. Transaction amount - the entire amount of the next payment, including VAT | |

| 76/ Leasing payments | 51 (50) | Periodic payment paid | ||

| 68 | 19 | Accepted for VAT deduction | In terms of the “closed” lease payment for the expired period under the agreement. IMPORTANT! The advance payment for the purchase price listed as part of the payment is not taken into deduction until the actual purchase of the car. Therefore, in this case, it is recommended to make 2 invoices: for the deduction for the contractual payment and for the advance payment for the purchase | |

| 20 (25, 26, 44) | 02 | Vehicle depreciation accrued | From the month following the month of commissioning. | |

| The car becomes the property of the LP. The purchase price is not included in the lease payments and is paid separately at the end of the contract | 08 | 76/ Lease obligations | The car was accepted on the balance sheet and the debt under the contract to LD was reflected | The posting is made for the total amount of payments under the contract, including the cost of redemption, excluding VAT |

| 19 | 76/ Lease obligations | Input VAT reflected | ||

| 01/ Property under lease | 08 | The vehicle was put into operation as part of the OS | ||

| 76/ Lease obligations | 76/ Leasing payments | Periodic payment reflected | The posting is made for each period for which payment is provided in the contract. For example, monthly. Transaction amount - the entire amount of the next payment, including VAT | |

| 76/ Leasing payments | 51 (50) | Payment of LD periodic payment | ||

| 68 | 19 | Accepted for deduction of VAT on periodic payments | ||

| 20 (25, 26, 44) | 02/ Depreciation of leased property | Vehicle depreciation accrued | From the month following the month of commissioning. |

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, leased property is recognized as depreciable property.

The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition.

For profit tax purposes, the monthly depreciation amount is determined based on the product of the original cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups.

Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

Tax accounting

Receipt of leased property

If, under the terms of the leasing agreement, the leased asset is taken into account on the balance sheet of the lessee, it includes the leased asset in the appropriate depreciation group (clause 10 of Article 258 of the Tax Code of the Russian Federation).

The initial cost of the property that is the subject of leasing is recognized as the amount of expenses of the lessor for its acquisition, construction, delivery, production and bringing it to a state in which it is suitable for use, with the exception of amounts of taxes that are subject to deduction or taken into account as part of expenses in accordance with the Tax Code of the Russian Federation (paragraph 3, clause 1, article 257 of the Tax Code of the Russian Federation).

Depreciation

The initial cost of fixed assets is included in expenses through depreciation charges (clause 3, clause 2, article 253 of the Tax Code of the Russian Federation). When calculating depreciation, the lessee has the right to apply a special coefficient to the basic depreciation rate, but not higher than 3 (clause 1, clause 2, article 259.3 of the Tax Code of the Russian Federation).

Leasing payments

In addition to depreciation deductions, expenses in the form of lease payments minus the amount of depreciation on leased property accrued in accordance with Chapter. 25 of the Tax Code of the Russian Federation (paragraph 2, paragraph 10, paragraph 1, article 264 of the Tax Code of the Russian Federation).

Redemption of leased property

Upon expiration of the leasing period, the organization can acquire ownership of the leased asset by paying the redemption price.

Then the initial cost of the purchased asset will be equal to its redemption price specified in the leasing agreement (excluding VAT) (clause 1 of Article 256, paragraph 2 of clause 1 of Article 257 of the Tax Code of the Russian Federation).

When calculating depreciation, an organization can use the remaining useful life of an acquired asset (Clause 7, Article 258 of the Tax Code of the Russian Federation).

Value added tax (VAT)

If, under the terms of the leasing agreement, the leased asset is taken into account on the balance sheet of the lessee, the total amount of VAT payable under the agreement to the lessor is reflected in the debit of account 19 “Value added tax on acquired assets” and the credit of account 76 “Settlements with various debtors and creditors” , subaccount “Rental obligations”.

The organization has the right to accept the specified amount for deduction as it receives invoices from the lessor (clause 1, clause 2, article 171 and clause 1, article 172 of the Tax Code of the Russian Federation).

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles.

In accordance with paragraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses over 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42 x 20% ).

Separately, it is necessary to say about accounting for the advance payment (down payment under the contract) . The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance (in the given schedule of leasing payments - for 236,000 rubles). In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

VAT from the lessee

Leasing payments include VAT, which, based on Art. Art. 171, 172 of the Tax Code of the Russian Federation, the enterprise can offset it from the budget. The monthly payment under the contract includes not only the redemption amount of the equipment, but also the services of the lessor. In this case, the amount of VAT to be offset will be higher than when applying for a loan from a bank. If supporting documents are correctly prepared, VAT on leasing is refundable in full.

However, in practice there are cases when the tax office tries to separate the VAT from the lease payment in the context of rent and payment of fixed assets. But the Ministry of Finance, in letters dated November 15, 2004 No. 03 - 04 - 11/ 203, dated November 23, 2004 No. 03 - 03 - 01 - 04/ 1/ 128, clarified the impossibility of such a division and confirmed the organization’s right to use the deduction in full . Since 2004, Russian arbitration courts have adhered to the same conclusion.

When the property under a leasing agreement is on the balance sheet of the lessee, VAT is deducted monthly. Based on the invoice, the deduction amount is entered into the purchase ledger.

Tax deduction for leasing

A tax deduction is an amount by which payments to the budget can be reduced. The deduction is mainly applied in relation to VAT. The amount of payment of value added tax is reduced by the amount of goods and materials received or services provided.

The leasing system is structured in such a way that the budget must always return VAT to the leasing companies. When paying suppliers for expensive property, they repay VAT on its full cost. After leasing the equipment, the company receives payments significantly less than its value. Thus, the VAT deduction on leasing from the lessor is always greater than the payment.

Reimbursement of VAT when leasing from a lessee in the case where the property is transferred to the recipient’s balance sheet is also fraught with problems. The condition for VAT reimbursement is the fact that inventory items are credited to the organization’s balance sheet or services are provided to it. In this case, companies constantly have VAT to reimburse under the leasing agreement until its expiration.

Problems of VAT refund from the budget arise in cases where the taxpayer cannot provide a complete package of documents or some of them do not comply with the requirements of the Tax Code of the Russian Federation.

Leased property must be fully involved in activities subject to VAT. Then the tax on rental payments is refunded in full. Sometimes an organization conducts its activities in several directions, including those that are not subject to VAT. In this case, the tax on leasing payments is subject to proportional distribution to all types of production. VAT on preferential activities is not deductible.

How to return VAT on leasing

When filling out a VAT return, VAT on leasing payments is subtracted from the amount of tax accrued on sales and advances. In the case when the amount of VAT deduction exceeds its amount payable, according to Art. 21 of the Tax Code of the Russian Federation, this amount can be submitted for reimbursement, that is, returned from the budget.

VAT refund on leasing is possible only if the following conditions are met:

- the invoice issued by the lessor complies with the requirements of Art. 169 Tax Code of the Russian Federation;

- there is confirmation of payment;

- the property is accounted for by the lessee;

- the fixed asset is used by the organization in activities subject to VAT.

To return the amount from the budget you must:

- Write an application to the Federal Tax Service for a refund in any form indicating the amount.

- Provide a leasing agreement, a certificate of acceptance and transfer of fixed assets, documents confirming payment of monthly payments.

- Record the refund amounts in the purchase ledger.

- Submit invoices, work completion certificates, completed in accordance with the law.

An enterprise may be denied a VAT refund if it is in the process of bankruptcy, if the payment under the agreement was made with bills of exchange, assignment agreements or with loans.

VAT on assignment

The assignment of a lease is an assignment. The need for this action arises in most cases due to the insolvency of the lessee. According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, the transfer of rights to property is subject to VAT.

In case of an assignment agreement, the tax base is established on the basis of Art. 154 Tax Code of the Russian Federation. The value is defined as the difference between the amount of the original contract and all payments under it, including advance payments.

According to Art. 174 of the Tax Code of the Russian Federation, a new party to the agreement can claim VAT for deduction on the amount of remaining payments under the leasing agreement if there is an invoice.

VAT on early repayment of leasing

When purchasing leased property early, accounting features arise for both the lessee and the lessor and they depend on whose balance sheet the object was recorded on.

If the parties have agreed that the lessor accounts for fixed assets on its balance sheet, then early repayment requires postings in the following sequence:

- The lessor writes off the initial cost of the asset, depreciation charges, and residual value; carries out other sales for the amount of early repayment; allocates VAT for payment to the budget.

- The lessee reflects the transfer of ownership; calculates the amount of early payments based on the invoice, indicating the FPR (deferred expenses) on the account, and allocates VAT from it. In this case, the VAT amount is set for reimbursement, and the amounts according to the terms of the contract are debited from the RBP account to the cost accounts.

If the parties have agreed that the lessee takes fixed assets into account on its balance sheet, then early repayment is recorded as follows:

- The lessor transfers the asset to the lessee, charges early payments, issues an invoice, and charges VAT to the budget.

- The lessee performs the actions described in two paragraphs above.

In both described cases, the transaction is not an advance payment and VAT is offset from the budget or paid on the basis of an invoice.

Postings upon receipt of the leased asset

Dt 60 – Kt 51 – 236,000 (advance paid under the leasing agreement)

Dt 08 – Kt 76 (Settlements with the lessor) – 1,253,945 (debt under the leasing agreement is reflected without VAT)

Dt 19 – Kt 76 (Settlements with the lessor) - 225,710.10 (VAT reflected under the leasing agreement)

Dt 01 – Kt 08 – 1 253 945 (a car received under a leasing agreement is accepted for registration)

Dt 76 – Kt 60 – 236,000 (advance paid at the conclusion of the leasing agreement is credited)

Dt 68 (Income tax) – Kt 77 – 40,000 (deferred tax liability reflected)

Dt 68 (VAT) – Kt 19 – 36,000 (VAT submitted on advance payment)

Postings for current lease payments

Dt 20 – Kt 02 – 26,123.85 (depreciation on the car has been calculated)

Dt 76 (Settlements with the lessor) - Kt 76 (Settlements for lease payments) - 34,546 (leasing debt reduced by the amount of the lease payment)

Dt 76 “Calculations for leasing payments” – Kt 51 – 34,546 (leasing payment transferred)

Dt 68 (VAT) – Kt 19 – 5,269.73 (VAT is presented on the current lease payment)

Dt 68 (Income tax) – Kt 77 – 630.48 (deferred tax liability reflected)

Postings within 12 months after the end of the leasing agreement

Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85 (depreciation accrued on the car)

Dt 77 – Kt 68 (Income tax) – 5,224.77 (reflected decrease in deferred tax liability)

There is also a method in which the initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, on account 76, when the property is accepted for accounting, only the debt for the value of the property is reflected.

Leasing payments are accrued monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

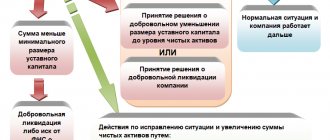

Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting leasing payments, is a very complex task that requires good knowledge of the specifics of accounting for leasing operations and the peculiarities of the wording in the leasing agreement and primary documents.

Accounting for a leasing agreement with the lessor

Let's look at an example of leasing transactions on the lessor's balance sheet . Let the property purchased for leasing be on the balance sheet of the lessor. Let's take the numbers again from the example above.

Let's assume that the leased object was purchased by the lessor for 450,000 thousand rubles. (including VAT 75,000). useful life 60 months. Depreciation is calculated using the straight-line method and amounts to RUB 6,250. ((450,000 - 75,000) / 60 months)

The purchase and commissioning operations are as follows:

| Debit | Credit | Sum | VAT |

| 08 | 60 | 375 000 | OS object received from the supplier |

| 19 | 60 | 75 000 | input VAT reflected |

| 60 | 51 | 450 000 | the object has been paid to the supplier |

| 68 "VAT" | 19 | 75 000 | input VAT is accepted for deduction |

| 03 “Material assets (MT) in the organization” | 08 | 375 000 | OS object is accepted for accounting |

| 03 “MCs transferred for temporary possession” | 03 “MC in the organization” | 375 000 | the equipment is transferred to the lessee |

| 20 (23,25,26…) | 02 | 6 250 | depreciation accrued |

Accounting for leasing payments:

| Debit | Credit | Sum | Content |

| 51 | 62 | 150 000 | an initial payment has been received from the lessee |

| 76 AB | 68 "VAT" | 25 000 | VAT allocated from advance payment |

| 51 | 62 | 25 000 | received monthly payment from the lessee |

| 62 | 90 | 25 000 | revenue is reflected in the amount of the monthly payment |

| 90 "VAT" | 68 "VAT" | 4 166,67 | VAT charged |

| 68 "VAT" | 76 AB | 1 041,67 | VAT refunded on prepayment |

Now let’s consider the process of buying out leased property from the lessor, if he is also the balance holder of this property.

| Debit | Credit | Sum | Content |

| 51 | 62 | 1 500 | the redemption value of the property was credited to the account |

| 02 | 03 | 150 000 | the amount of accrued depreciation is written off |

| 91 | 03 | 225 000 | the residual value of the leased object was written off (375,000 - 150,000) |

| 62 | 91 | 1 500 | income from the redemption price is taken into account |

| 91 | 68 "VAT" | 250 | VAT is charged on the redemption price |

Let's consider accounting with the lessor if the property is included on the lessee's balance sheet.

Acquisition, payment and commissioning are no different from the case when the lessor is the balance holder.

There is no need to accrue depreciation on the leased asset - based on the terms of the leasing agreement, it must be accrued by the lessee (clause 50 of the Guidelines for accounting of fixed assets). The transfer of the leased object to the lessee is usually reflected in the following order:

| Debit | Credit | Sum | Contents of operation |

| 97 | 03 | 375 000 | the leased object is transferred to the balance sheet of the lessee |

| 011 “Assets leased” | 375 000 | the cost of the leased asset is reflected in the off-balance sheet account |

In this case, the costs recorded on account 97 can be recognized as expenses for ordinary activities as income in the form of leasing payments is recognized through a reasonable distribution between reporting periods (for example, in proportion to leasing payments recognized in income) (clause 5, 19 PBU 10/99 “Expenses of the organization”).

The posting in the income generation period will be as follows: Dt 20 (23.25...) Kt 97.

Let's consider accounting for monthly lease payments:

| Debit | Credit | Sum | Content |

| 51 | 62 | 150 000 | an advance has been received |

| 62 | 90 | 150 000 | the advance is recognized in the amount of income |

| 90 "VAT" | 68 "VAT" | 25 000 | VAT charged |

| 20 | 97 | 75 000 | part of the cost of the leased object is recognized as expenses in proportion to recognized income (150,000 × 100 / 750,000 = 20% × 375,000) |

| 51 | 62 | 25 000 | monthly payment has been received into your account |

| 62 | 90 | 25 000 | income is recognized in the amount of the lease payment |

| 90 "VAT" | 68 "VAT" | 4 166,67 | VAT charged |

| 20 | 97 | 12 500 | part of the cost of the leased object is recognized as expenses in proportion to recognized income (25,000 × 100 / 750,000= 3.33% × 375,000) |

The redemption of leased property is registered with the following entries:

| Debit | Credit | Sum | Content |

| 62 | 90 | 1 500 | income is recognized in the amount of the redemption price |

| 90 "VAT" | 68 "VAT" | 250 | VAT charged |

| 20 | 97 | 75 000 | the initial cost of the leased asset not written off at the time of redemption is reflected (12,500 × 24 - 375,000) |

| 51 | 62 | 1 500 | the redemption price of the lease was credited to the account |

| 011 | 375 000 | the leased object is written off balance sheet |

If the redemption value is not separately allocated in the leasing agreement, then the redemption of the leased asset, subject to payment of all payments, is formalized by a single write-off from off-balance sheet account 011 “Fixed assets leased” in the amount of the lessor’s costs excluding VAT.