What does checkpoint mean?

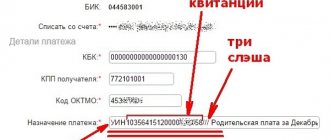

KPP is the reason code for registration with the Federal Tax Service. It was assigned to the organization when it was registered with the Federal Tax Service. The code is assigned to absolutely all companies. Since a bank is also an organization and a taxpayer, the checkpoint in the details is an important point.

This data is needed more for the tax service, but is also often prescribed when an organization enters into any agreements with counterparties. For standard bank transfers, bank checkpoints are rarely used. But if the submission form includes this field, then you need to fill it out.

How to prove the absence of code

Difficulties for businessmen often arise with counterparties and future partners. Banks, financial organizations and institutions rarely make complaints about the lack of details. The most problems arise with legal entities who do not understand why a businessman cannot provide data.

What is the difference between an individual entrepreneur and a private entrepreneur? Is there a private entrepreneur now?

Due to legal illiteracy, the business of entrepreneurs often suffers. If such a situation arises, the individual entrepreneur can explain the absence of a checkpoint based on the following regulations:

- Letter from the Ministry of Finance numbered 03-02-08-14. It provides clarification on the issue of code assignment. If the counterparty continues to insist, to confirm, he can be asked to read the links to regulations that are indicated in the document;

- Federal Law No. 129 - it establishes the rules for conducting registration actions in relation to businessmen. The document states that the value of the checkpoint can only be in the Unified State Register of Legal Entities. Entrepreneurs cannot have it, since they are registered under the Unified State Register of Entrepreneurs;

- Order ММВ7/6/435, which was issued by the tax service. The text of the document contains information that individual entrepreneurs do not receive checkpoints.

Important ! The checkpoint is assigned by tax authorities only in relation to persons who have received legal status. Therefore, it is illegal to demand a registration reason code from a businessman.

To summarize, we can say that the checkpoint is an important requisite that provides complete information about the company’s activities, but its presence is relevant only for legal entities, and it is not assigned to individual entrepreneurs.

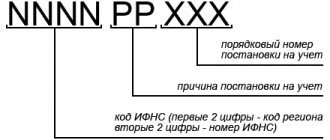

Decoding checkpoint

For a person, bank account details are an incomprehensible set of numbers. It seems chaotic and meaningless. But in reality, every number has some meaning. And each number series is part of the address. Everything here is the same as in ordinary life: we have a city, a street, a house, an apartment, a bank account, a correspondence. account, BIC, INN, KPP.

Each combination in the details is a group of numbers in which certain information is encrypted. For example, let’s look at the decoding of the abbreviation KPP Sberbank 773601001:

- the first two characters are the number of the Federal Tax Service, which registered the organization. The number is assigned to a specific region. For example, in the case of Sberbank it is 77, it is registered in the capital. But for its other territorial division, for example, Siberian Bank, the checkpoint number begins with the number 54. In fact, this is the region of tax registration; This is followed by the number of the specific Federal Tax Service in the region declared in the first days, which registered the company and assigned it a code. In our case - 36;

- the next two numbers indicate the reason for registration with the tax service. In our case, this is 01 - at the location of the organization. This is the most common reason among all organizations; the next three numbers are simply the serial number of the organization in the initially specified set of values (region, specific Federal Tax Service, reason for registration).

PPC is a unique type of banking information. There are no companies in the country that have the same meaning for this code.

Is it possible to invent a checkpoint yourself?

Many entrepreneurs, wanting to please their counterparties, independently come up with a checkpoint, which is subsequently fixed in the contract. When generating the code yourself, you need to find out the code of the region where the business activity is carried out and the tax service branch number corresponding to the registration address. Next, as a rule, the combination of numbers “01001” is indicated, which is assigned to most companies.

It is important to pay attention to the fact that this act is considered a gross violation of the rules established by the control authorities. Independent formation of a checkpoint by an individual entrepreneur may result in penalties . This procedure is fixed in the fourteenth article of the Federal Law. This means that in order to comply with the requirements of regulatory authorities, the entrepreneur must make a dash in the appropriate column.

The KPP is assigned by the tax authority upon registration of a legal entity, including along with the TIN, any legal entity also receives a KPP

It should also be mentioned that a self-generated digital value is invalid. This means that fixing invented codes in a document can deprive the official form of legal force . Thus, an attempt to satisfy the demands of the counterparty may result in the conclusion of an illegal transaction.

It is necessary to pay special attention to the fact that the tax registration reason code for individual entrepreneurs is not provided for by regulatory authorities. This means that the entrepreneur has the legal right to refuse to include it in the contract and other documents. Private entrepreneurs are also given the right to request the provision of this information from counterparties registered as legal entities. This step allows you to obtain insurance that guarantees the integrity of the agreement.

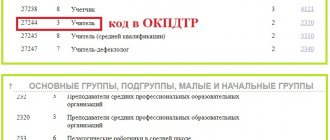

Possible reason codes for setting

The reasons for the setting may be different; a large classification has been identified. 01 - this is simply at the place of registration, but there may be other cases. The Tax Code reflects the decoding of codes, there are several dozen different cases. For example, an organization may register with a specific tax office for other reasons:

- 02 - at the location of the branch that will deal with tax issues, actually accounting;

- 03-05 - for a branch that does not deal with tax issues, for a representative office with and without such responsibilities;

- 06-08 - when registration was carried out at the location of the organization’s real estate;

- 10-29 - at the location of movable property;

- 33-34 - at the place of mining.

You will find a complete list of checkpoint codes and their exact decoding in the tax code or simply on the Internet. The maximum number of codes in the classification is 87. As you can see, there are many reasons for registration.

If the organization is relatively small, then it usually has one legal entity checkpoint. But if the company is large, has several representative offices, is represented in different regions, but each division can be assigned its own checkpoint account. For example, Sberbank is divided into 11 territorial divisions, and each has its own details.

Code of the largest taxpayers

Organizations with billion-dollar turnover have an additional checkpoint - its composition is slightly different. For clarity, let’s analyze the code of JSC FPC:

99-76-50-001

- 99 – the company was registered by the interregional Federal Tax Service as the largest taxpayer. This figure remains unchanged.

- 76 – the tax authority that registered the organization. The first digit does not change, the second indicates the number of a specific interregional inspection.

- 50 - a sign of the largest taxpayer. This value is constant.

- 001 – the organization was registered at its location.

If the company is registered in the region of a separate division, then the last values will be 002, 003, 004, 005, 031,032. At the location of property or vehicles - 006, 007, 008.