Contribution of the founder to the authorized capital

Each owner of the company is obliged to contribute his share of funds or property to the management company. When leaving the membership, a person (both an individual and a legal entity) receives his contribution back.

The appearance of another founder in the organization is also accompanied by his contribution to the management company.

The size of the Criminal Code is introduced by the Civil Code of the Russian Federation and other laws. For example, for an LLC a minimum of 10 thousand rubles is allowed. (Clause 1 of Article 14 of the Law of 02/08/1998 No. 14-FZ). Moreover, for an LLC, some nuances of the formation of a management company are observed:

- the minimum capital amount (10 thousand rubles) is formed by money;

- Criminal Code in terms of exceeding 10 thousand rubles. can be formed by property;

- property worth more than 20 thousand rubles. must be assessed;

- The management company must be fully formed no later than 4 months from the date of state registration of the company.

Here are the main entries for the formation of a management company.

Evaluation of financial investments

Financial investments are accepted for accounting at their original cost. The initial cost of financial investments acquired for a fee is the amount of the organization's actual costs for their acquisition, excluding VAT.

The actual costs of acquiring assets as financial investments are:

- amounts paid in accordance with the contract to the seller;

- amounts paid for information and consulting services related to the acquisition of these assets;

- fees paid to an intermediary organization or other person through which assets were acquired as financial investments.

The initial value of financial investments made as a contribution to the authorized capital of the organization is recognized as their monetary value, agreed upon by the founders of the organization, and received by the organization free of charge - their current market value on the date of acceptance for accounting

The initial cost of financial investments, the cost of which upon acquisition is determined in foreign currency, is determined in rubles by converting foreign currency at the rate of the Central Bank of the Russian Federation on the date of their acceptance for accounting.

The initial cost of financial investments at which they are accepted for accounting may change.

For the purposes of subsequent assessment, financial investments are divided into 2 groups:

- financial investments by which the current market value can be determined;

- for which their current market value is not determined.

In the first case, financial investments in the financial statements at the end of the reporting year are reflected at the current market value by adjusting the valuation as of the previous reporting date. The organization can make this adjustment monthly or quarterly.

The difference between the assessment at the current market value as of the reporting date and the previous assessment of financial investments is attributed to the financial results (as part of other income or expenses) of commercial organizations in correspondence with account 58 “Financial investments”.

In accounting, the results of quotation (revaluation) are reflected in the following entries:

- with an increase in market price: D-t 58 K-t 91;

- when the market price decreases: D-t 91 K-t 58.

Example

In April, Vesta CJSC purchased shares worth RUB 100,000 on the stock exchange. In April, entries will be made: shares paid for: D-t 76 K-t 51 - 100,000 rubles. shares accepted for accounting: D-t 58 K-t 76 - 100,000 rub. In May, the market value of the shares increased and at the end of May it amounted to 115,000 rubles. The price of shares has been adjusted: D-t 58 K-t 91 - 15,000 rubles. (115,000 - 100,000).

Financial investments for which the current market value is not determined are subject to reflection in accounting and financial statements as of the reporting date at their original cost (debt securities).

For debt securities (bonds, bills) that are not quoted on the stock exchange, the difference between the original and nominal value is written off to other income or expenses evenly over the period of their circulation.

When disposing of financial investments for which the current market value is not determined, the following valuation methods are used:

- at the initial cost of each accounting unit;

- at the average initial cost;

- at the original cost of the first financial investments acquired (FIFO method).

When disposing of financial investments for which the current market value is determined, their value is determined by the organization based on the latest assessment.

Examples of using valuation methods when disposing of financial investments (table).

1. Valuation method based on average initial cost.

The cost of securities being written off is determined by multiplying the number of securities being retired by the average initial cost of one security of this type.

The average initial cost of one security of a given type is calculated as the quotient of dividing the value of securities by their quantity, respectively, consisting of the value and quantity of the balance at the beginning of the month and of securities received in that month.

1) Average initial cost of one security: (100,000 rubles + 50,000 rubles + 66,000 rubles + 96,000 rubles): 290 = 1075.86 rubles.

2) Value of the balance of securities at the end of the month: 130 X 1075.86 rubles. = 139,862 rub.

3) Cost of retiring securities:

312,000 rub. — 139,862 rub. = 172,138 rub., or

160 X 1075.86 rub. = 172,138 rub. 2. FIFO method.

Valuation of securities using the FIFO method is based on the assumption that they are sold within a month in the order in which they were received. The valuation of securities in balance at the end of the month is carried out at the actual cost of the most recent acquisition, and the sale price takes into account the cost of the earlier securities.

1) The cost of the balance of securities at the end of the month, based on the cost of recent purchases:

(80 X 1200) + (50 X 1100 rub.) = 15.1 000 rub.

2) Cost of retiring securities: RUB 312,000. — 151,000 rub. = 161,000 rub.

3) Unit cost of retiring securities:

161,000 rubles: 160 = 1006.25 rubles.

Contribution to the authorized capital: postings

Contributions to the company's capital company go through two stages of accounting entries: first, the value of the capital stock and the debt of each owner are entered, then calculations are made.

Formation of authorized capital

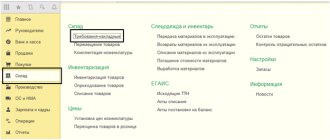

The management company is recorded on account 80 “Authorized capital”:

- the account credit accumulates;

- by debit – decreases.

Contributions from participants increase the capital, and settlements with them are reflected in account 75 “Settlements with founders”, therefore, when registering an enterprise, correspondence Dt 75.1 (by owners) Kt 80 is drawn up:

- reflecting the amount of authorized capital;

- and recording the debt of owners for contributions to the management company.

Accounting entry for contribution to the authorized capital

The founder repays his debt to pay for the share of the management company by contributing funds or property.

When paying in cash, correspondence Dt 50, 51 Kt 75.1 is drawn up (by owner).

Posting a cash contribution to the authorized capital is always relevant, because the minimum management company of an LLC is formed precisely from money.

When calculating property, Kt 75.1 corresponds with the Dt of such accounts:

- 04 – when contributing intangible assets;

- 07 – when transferring equipment that requires assembly before use;

- 08 – when making a contribution in the form of fixed assets;

- 10 – when contributing materials or raw materials;

- 11 – when contributing animals (relevant for the livestock sector);

- 21 – when contributing semi-finished products of the participant’s own production;

- 41 – when bringing in goods;

- 58 – when transferring securities or assigning the right to claim a debt;

- 97 – when granting the right to use assets.

Let's look at an example.

Example 1

Citizens of the Russian Federation Denisov I.V., Astafieva O.Yu. and Rybina T.E. registered Vash Otdykh LLC with an authorized capital of 90 thousand rubles. The shares in the management company are as follows:

- Denisov I.V. – 50% (RUB 45,000);

- Astafieva O.Yu. – 25% (RUB 22,500);

- Rybina T.E. – 25% (RUB 22,500).

Within the prescribed period, the management capital is fully paid as follows:

- Denisov I.V. contributed a personal computer, the cost of which is estimated at 45 thousand rubles;

- Astafieva O.Yu. contributed MFP worth 15 thousand rubles. and 7,500 rub. transferred to the bank account of Vash Otdykh LLC;

- Rybina T.E. deposited 22,500 rubles into the cash register.

Let's make the wiring:

| Operation | Dt | CT | Amount, rub. |

| Formation of a management company (reflection of debts of owners) | 75.1 (Denisov I.V.) | 80 | 45 000 |

| 75.1 (Astafieva O.Yu.) | 80 | 22 500 | |

| 75.1 (Rybina T.E.) | 80 | 22 500 | |

| Transferred to the PC as a contribution to the management company | 08 | 75.1 (Denisov I.V.) | 45 000 |

| Transferred to MFIs as a contribution to the management company | 10 | 75.1 (Astafieva O.Yu.) | 15 000 |

| Contribution of funds to the authorized capital to the current account of LLC “Your Holiday” | 51 | 75.1 (Astafieva O.Yu.) | 7 500 |

| Posting a contribution to the authorized capital through the cash desk | 50 | 75.1 (Rybina T.E.) | 22 500 |

Increase the authorized capital

At the initiative of participants or in connection with the requirements of the law, the management company can grow due to:

- profit (Dt 84 Kt 80);

- accepting new founders or increasing the shares of previous ones (Dt 75.1 Kt 80).

Example 2

At the end of 2022, Vash Otdykh LLC made a profit, part of which increased the authorized capital of the company by 20 thousand rubles.

Further, in 2022, the owners decided to increase the capital capital due to additional contributions from Astafieva O.Yu. and Rybina T.E., who deposited cash into the cash register - 22,500 rubles each. each.

Let's arrange the postings:

| Operation | Dt | CT | Amount, rub. |

| Growth of the management company due to the positive financial result of 2019 | 84 | 80 | 20 000 |

| Increasing the authorized capital due to additional contributions | 75.1 (Astafieva O.Yu.) | 80 | 22 500 |

| 75.1 (Rybina T.E.) | 80 | 22 500 | |

| Contribution of authorized capital to the cash desk: postings | 50 | 75.1 (Astafieva O.Yu.) | 22 500 |

| 50 | 75.1 (Rybina T.E.) | 22 500 |

Based on the results of operations, the authorized capital of Vash Otdykh LLC amounted to 155 thousand rubles.

On the contribution of additional property to a subsidiary

Answer From the statement of the question, we can assume that the subsidiary has the organizational and legal form of LLC.

The legal status of the LLC is regulated, in particular, by the provisions of the Federal Law “On Limited Liability Companies” dated 02/08/98 No. 14-FZ (hereinafter referred to as Law No. 14-FZ).

Since the question does not contain information that the contribution of property will entail an increase in the authorized capital, when answering we will consider contributions to the property of the LLC that do not entail an increase in the authorized capital.

Thus, in accordance with paragraph 1 of Article 27 of Law No. 14-FZ, company participants are obliged, if provided for by the company’s charter, by decision of the general meeting of company participants to make contributions to the company’s property. Such an obligation of the company's participants may be provided for by the company's charter when the company is founded or by introducing amendments to the company's charter by decision of the general meeting of the company's participants, adopted unanimously by all the company's participants.

Contributions to the company's property do not change the size and nominal value of the shares of company participants in the authorized capital of the company

(Clause 4 of Article 27 of Law No. 14-FZ).

Thus, the provisions of Law No. 14-FZ provide for the possibility of making a monetary contribution to the property of an LLC, which does not entail a change in the size and nominal value of the shares of participants

.

In addition, an LLC participant has the right to provide financial assistance to the LLC in a manner not provided for in Article 27 of Law No. 14-FZ, in order to increase the value of net assets.

Note that the procedure for recording a transaction related to making an additional contribution to an LLC, which does not entail a change in the size and nominal value of shares, is not directly regulated by accounting legislation.

In our opinion, in this case the general rules governing the recording of the Organization's expenses that do not give rise to an asset apply.

So, by virtue of paragraph 2 of the Accounting Regulations “Expenses of the organization”, approved. By Order of the Ministry of Finance of the Russian Federation dated 06.05.99 No. 33n (hereinafter referred to as PBU 10/99), an organization’s expenses recognize a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, for with the exception of reduction of deposits by decision of participants (owners of property).

Paragraph 3 of PBU 10/99 establishes that the following assets are not recognized as expenses of the organization:

— contributions to the authorized (share) capitals of other organizations, acquisition of shares of joint-stock companies and other securities not for the purpose of resale (sale).

In the case we are considering, the contribution to the property of the LLC is not a contribution to the authorized capital of the LLC, therefore, the exception provided for in paragraph 3 of PBU 10/99 does not apply.

According to paragraph 4 of PBU 10/99, the expenses of an organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into:

— expenses for ordinary activities;

- other expenses.

Expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses are also considered expenses the implementation of which is associated with the performance of work or the provision of services (clause 5 of PBU 10/99).

Expenses other than expenses for ordinary activities are considered other expenses

(clause 4 of PBU 10/99).

Taking into account the above, we believe that contributions to the property of the LLC, financial assistance to the LLC, carried out in order to increase the value of net assets, are recognized as other expenses in the accounting of the LLC participant organization.

A similar point of view is set out in the Letter of the Ministry of Finance of the Russian Federation “Recommendations to audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2007” dated January 29, 2008 No. 07-05-06/18

:

“Based on the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, in the accounting of a limited liability company, the contribution of a participant to its property in accordance with current legislation is reflected by this by the company by debiting the property accounting accounts in correspondence with the crediting of the additional capital account.

In the accounting of a participant in a limited liability company, when reflecting his contribution to the property of the company, one should be guided by PBU 10/99

».

Meanwhile, there is a different point of view expressed in the Recommendations of the BMC “Additional financial investments” dated 03.15.16 No. R-68/2016-KpR

(hereinafter referred to as the BMC Recommendations), according to which a contribution to the property of an LLC or financial assistance to an LLC made by a participant in the LLC is recognized as a financial investment.

Thus, in the BMC Recommendations

The following position was expressed:

"1. This Recommendation is applied by the owner of an equity instrument (shareholder, participant, owner, etc.) of another company to account for his additional investment in that company. For the purposes of this Recommendation, under additional investment

assistance is understood in the form of transfer of funds, other property, property rights or forgiveness of debts free of charge or in exchange for additional equity instruments of the recipient of the investment. The organization applies a uniform procedure for accounting for additional investments, regardless of the number of equity instruments of the investment recipient, changes in this number as a result of the investment, changes in the authorized capital (or its equivalent) of the investment recipient, and whether the investment is made in cash or in kind, unless this Recommendation relates accounting features directly to those circumstances. This Recommendation does not apply to investments in non-profit organizations.

2. The additional investment is recognized as a financial investment

, unless otherwise stated in paragraphs 4 - 6 of this Recommendation. At the same time, the organization re-analyzes and, if necessary, changes the accounting units of previously recognized financial investments, taking into account new circumstances based on clause 5 of the Accounting Regulations PBU 19/02 “Accounting for Financial Investments”.

3. In the case of making an additional investment in non-monetary means, the assessment of the financial investment recognized in accordance with clause 2 of this Recommendation is made in accordance with clause 14 of PBU 19/02 in accordance with Recommendation BMC R-8/2010-KpR “Initial assessment of financial investments, received under contracts providing for the fulfillment of obligations (payment) in non-monetary means.”

4. If the organization is not the only shareholder (participant, owner) of another company that is provided with an additional investment, such investment is included in the expenses of the current period to the extent that it is an actual redistribution of funds in favor of other shareholders

. When assessing such a part, one should proceed from the fact that redistribution in favor of other shareholders does not occur if all shareholders contribute funds in proportion to their shares without changing the shares, or the shares of those shareholders who contributed funds are increased in proportion to the amounts of funds contributed

[1]

.

5. If an organization has previously recognized a provision for impairment of a financial investment in a company to which an additional investment is provided, the organization may

(but is not obliged)

to include such an investment in reducing the specified reserve to the extent that the amount of transferred funds

, the value of transferred non-monetary assets, canceled liabilities (taking into account clause 3 of this Recommendation)

covers the amount of the reserve or is covered by the amount of the reserve

.

6. If an organization revalues at current market value a financial investment in a company to which an additional investment is provided, such investment in the amount of transferred funds, the value of transferred non-monetary assets, canceled liabilities (taking into account clause 3 of this Recommendation) is included in the reduction of income from revaluation of the specified financial investment (increase in depreciation expenses) for the reporting period in which the additional investment was provided.

Basis for conclusions

Additional investments can come in various forms. In accordance with clause 7 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), when forming the accounting policy of the organization on a specific issue of organizing and maintaining accounting, one method is selected from several allowed by the legislation of the Russian Federation and (or) regulatory legal accounting acts. In this regard, in order to select the most adequate approach to accounting for additional investments, it is advisable to consider a form of their implementation in relation to which the provisions of regulatory legal acts on accounting are directly applicable.

Of all the various forms of additional investment, the most obvious from the point of view of the applicability of current rules is an investment in a joint-stock company, carried out by its shareholder in the form of acquiring additional shares issued by such a company. In particular, in accordance with clause 3 of PBU 19/02, financial investments of an organization include, among other things, securities of other organizations. In accordance with clause 8, financial investments are accepted for accounting at their original cost. In accordance with clause 9, the initial cost of financial investments acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition.

If the recipient of the additional investment has a different legal form, the economic content of this operation will not change. In the same way, if the investment itself will be clothed in another legal form, be it a property contribution, gratuitous transfer of property, financial assistance, etc., including without issuing additional equity instruments and without changing the authorized capital of the recipient of the investment

, the economic content of the transaction from the investor’s point of view will remain the same as in the case of his purchase of additionally issued shares. In accordance with paragraph 6 of PBU 1/2008, the accounting policy of the organization must ensure that the facts of economic activity are reflected in the accounting records based not so much on their legal form, but on their economic content and business conditions (the requirement of priority of content over form). In fulfilling this requirement, the organization must apply to an additional investment of any form the same approach that it would apply to the acquisition of additionally issued shares, except in cases where the specific conditions of the investment indicate a different economic content. In this regard, other things being equal, an additional investment should be recognized as a financial investment, regardless of the legal form of its implementation. This conclusion is further confirmed by the last sentence of paragraph 7 of PBU 1/2008, according to which accounting provisions are applied to develop an appropriate method in terms of similar or related facts of economic activity, definitions, recognition conditions and procedures for assessing assets, liabilities, income and expenses .

In accordance with clause 18 of PBU 19/02, the initial cost of financial investments at which they are accepted for accounting may change in cases established by law and these Regulations. The interpretation of this norm may be different, depending on which approach is taken by default: “what is not prohibited is permitted,” or “what is not permitted is prohibited.”

In the first interpretation, the emphasis is on the fact that clause 18 does not prohibit changing the initial value of financial investments, including in cases not mentioned in this clause. Based on this, the formation of the initial cost of a financial investment can be continued if the organization makes additional investments. In the situation under consideration, an analogy can be drawn with the resumption of the formation of the initial value of a fixed asset during its modernization or reconstruction. The second interpretation is based on the fact that clause 18, naming cases of possible changes in the initial value of financial investments, thereby indirectly prohibits changing this value in any other cases. Based on this, if the formation of the initial value of a financial investment has already been completed once, then it is not allowed to resume its formation in the future

.

Meanwhile, the applicability of clause 18 of PBU 19/02 (regardless of its interpretation) in the situation under consideration depends on the answer to the question of whether we are talking about a change in the initial cost of a previously recognized financial investment or whether it is more appropriate to talk about the recognition of a new financial investment. In this regard, it should be noted that in accordance with clause 5 of PBU 19/02, the accounting unit for financial investments is selected by the organization independently in such a way as to ensure the formation of complete and reliable information about these investments, as well as proper control over their availability and movement. Depending on the nature of the financial investments, the order of their acquisition and use, the unit of financial investments can be a series, batch, etc. homogeneous set of financial investments. This definition lacks even the most minimal imperative. And this is no coincidence. Identification of accounting units in relation to financial investments is always conditional. Depending on the specific circumstances when resolving various accounting issues of the same financial investments - during their recognition, revaluation, impairment, write-off, etc. - their accounting units may be completely different.

In this regard, the solution to one or another methodological issue in accounting for financial investments, in particular the choice of approach to accounting for additional investments, cannot be made dependent on the organization’s choice of unit of accounting for financial investments. Therefore, an additional investment must be tested against the criteria for recognizing an asset as a financial investment and (if they are met) recognized as a financial investment, regardless of the form of its implementation

, as well as whether the newly recognized financial investment is separated into a separate unit of accounting, or combined with the previously recognized financial investment into one unit of accounting. Otherwise, there are risks of the organization using fundamentally different approaches to accounting for facts of economic life that are homogeneous in economic essence, equally affecting the financial position, financial results and cash flows of the organization.

In terms of compliance with the conditions for accepting assets for accounting as financial investments established by clause 2 of PBU 19/02, in relation to additional investments, special attention should be paid to the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value ( in the form of the difference between the sale price (redemption) of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value, etc.).

In general, an additional investment leads to an increase in the value of the equity instruments of its recipient, and also increases the financial ability of the recipient to pay dividends or other forms of income to its shareholders (owners, participants). Thus, the specified criterion for recognizing a financial investment for the investor is met.

However, this criterion can only be partially met if the investor is not the only shareholder (participant, owner) of the recipient of the additional investment. If there are other shareholders, the increase in the financial capabilities of the recipient of the investment characterizes the ability of the financial investment to bring economic benefits to the benefit of the investor, provided that the remaining shareholders also contribute funds in proportion to their shares without changing the shares, or the shares of those shareholders who contributed funds are increased in proportion to the amounts of funds contributed . If the contribution of funds is not carried out on a proportional basis and the investor contributes more than the “fair” amount, then in terms of excess, his investment is an actual redistribution of funds in favor of other shareholders and does not lead to the ability of his financial investment to bring economic benefits in his favor.

Section VI PBU 19/02 provides for the creation of a reserve for depreciation of financial investments upon the occurrence of certain circumstances. Such a reserve is formed for the amount of the difference between the book value and the estimated value of the financial investment, when the second turns out to be lower than the first. If an additional investment is made in a company for which the investor has previously recognized an allowance for impairment, the resulting potential for additional economic benefits effectively represents compensation for previously lost benefits, rather than new benefits.

In this regard, it is logical to attribute the recognition of a new book value of a financial investment in connection with the implementation of an additional investment, first of all, to the repayment of a previously recognized reserve and only secondarily to the formation of a new initial value. Otherwise (without repaying the reserve), attributing the additional investment to the initial cost of financial investments will lead to an increase in their accounting value and thereby artificially create the need to continue to reserve for their depreciation. At the same time, continuing to reserve impairment makes it possible for the organization to subsequently restore the reserve if, in addition to the additional investment itself, other positive circumstances occur that cause an increase in the value of the financial investment. If the reserve has already been repaid through additional investment, then this opportunity in the future is lost. In this regard, it is advisable to leave the issue of recognizing an additional investment to repay the reserve for impairment of a financial investment at the discretion of the organization and regulate it with its accounting policies.

Section III of PBU 19/02 provides for revaluation at market value of those financial investments for which this value can be determined in the prescribed manner. Other things being equal, making an additional investment in a company results in an increase in the market value of that company's equity instruments.

. Such an increase is not necessarily equivalent to the amount of additional investment, since the market value is formed taking into account the totality of market factors. Income and expenses from the actual change in the market value of the financial investment will be the difference between the amount contributed and the degree of subsequent increase in market value.

An investor organization in its accounting may sequentially recognize the additional investment provided as a financial investment, and then reflect income or expense from changes in the market value of financial investments in the aggregate (financial investments previously recognized before the additional investment, and financial investments recognized in connection with the additional investment ). Meanwhile, paragraph 20 of PBU 19/02 requires that revalued financial investments be reflected in the financial statements at the end of the reporting year at their current market value. In this regard, additional investment can immediately

(without intermediate recognition of the new initial cost of financial investments)

be included in income and expenses for the revaluation of financial investments - reduce income or increase expenses

. This will not change the final indicators of the financial statements, but procedural accounting will be significantly simplified.”

From the foregoing, we can conclude that, in the opinion of BMC, an additional contribution to the property of an LLC, in the manner provided, inter alia, by Article 27 of Law No. 14-FZ, entails the recognition of a financial investment in accounting to the extent that increases the actual value of the share of the participant who made the corresponding contribution.

In addition, assumptions are made about the possibility of changing the value of a previously recorded financial investment if an organization revaluates it at its current market value, and the possibility of reducing a previously recognized reserve for depreciation of a financial investment, if such a reserve was created by the organization.

The primary basis for such conclusions for BMC is the ability of an additional contribution to bring economic benefits to the contributor in the future.

Let us note that the procedure for recognizing an asset as a financial investment for accounting purposes is regulated by the rules of the Accounting Regulations “Accounting for Financial Investments”, approved by Order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n (hereinafter referred to as PBU 19/01).

assets for accounting

As a financial investment,

the following conditions must be simultaneously met

:

— the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive cash or other assets arising from this right

;

— transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

— ability to bring economic benefits (income) to the organization in the future

in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value, etc.).

Clause 3 of PBU 19/01 establishes that an organization’s financial investments include: state and municipal securities, securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills); contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies)

; loans provided to other organizations, deposits in credit institutions, receivables acquired on the basis of assignment of claims, etc.

Thus, an asset is recognized as

, which must

simultaneously

satisfy the following conditions:

— the Organization has properly executed documents confirming the existence of the right to the asset or to receive another asset arising from this right;

— financial risks associated with the acquisition of the asset are transferred to the Organization;

— the asset is capable of generating economic benefits for the Organization in the future.

The concept of an asset is not defined by current accounting legislation.

By virtue of paragraph 4.4 of the Conceptual Framework for Financial Reporting adopted by the IASB in 2016, the elements directly relevant to the measurement of financial position are assets, liabilities and equity. They are defined as follows:

(a) The asset is a resource controlled by the entity

as a result of past events from which future economic benefits are expected to flow to the organization.

Thus, the characteristics of the asset are:

— organization control over resource

;

— the possibility of receiving future economic benefits from the resource.

In the case we are considering, the Organization - a participant in the LLC makes a monetary contribution to the property of the LLC, which does not change the size and nominal value of its share as a participant.

In this case, from the moment the additional contribution is made, the participating Organization does not have any control over the additional contribution, the ability to dispose of it, the possibility of transfer, alienation in isolation from the share that the Organization owns.

Based on the above, we believe that the Organization, in principle, does not have an asset

in connection with making an additional contribution to the property of the LLC,

which could be reflected on the balance sheet as an independent financial investment

,

due to the lack of control over the corresponding resource

.

In addition, one of the criteria for recognizing an asset as a financial investment is not met:

— documents evidencing an additional contribution to the property of the LLC (Charter, decision of participants to make additional contributions) do not confirm the existence of any rights of the Organization to own an additional asset.

Regarding the possibility of changing the value of a share previously reflected as a financial investment, we note the following.

In accordance with paragraph 18 of PBU 19/02, the initial cost of financial investments at which they are accepted for accounting may change in cases established by law

and these Regulations

.

Paragraphs 20 and 21 of PBU 19/02 provide for the following cases of changes in the value of a financial investment:

20. Financial investments for which the current market value can be determined in the prescribed manner are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date. The organization can make this adjustment monthly or quarterly.

21. Financial investments for which the current market value is not determined are subject to reflection in accounting

and in the financial statements

as of the reporting date at historical cost

.

The value of the LLC share refers to financial investments for which the current market value as of the reporting date is not determined, and therefore, we can assume that in the accounting of the Participating Organization as of the reporting dates, this asset is reflected at its historical cost.

In this case, we believe that the Organization has no grounds for changing the value of the financial investment in connection with making an additional contribution in accordance with paragraph 21 of PBU 19/02.

In addition, paragraph 4 of Article 27 of Law No. 14-FZ directly establishes that contributions to the company’s property do not change the size and nominal value of the shares of company participants in the authorized capital of the company.

Consequently, the current legislation in this case also does not provide for the possibility of changing the value of a financial investment in the form of a share of ownership of the authorized capital in an LLC if the participant makes an additional contribution to the property of the LLC.

Thus, in our opinion, neither the provisions of paragraph 21 of PBU 19/02, nor the provisions of paragraph 18 of PBU 19/02 make it possible for

a participant, in the case of making an additional contribution to the property of an LLC, to change the value of the financial investment previously reflected in the form of the initial cost of the share in the LLC

.

With regard to the possibility of choosing one of the most adequate methods of reflecting transactions in accounting, which is mentioned in the BMC Recommendations, we note the following.

In the Accounting Regulations “Accounting Policy of the Organization”, approved. By Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n (hereinafter referred to as PBU 1/2008), changes were made that came into force on August 6, 2022.

In particular, clause 7 was changed and clause 7.1 was added.

Thus, by virtue of paragraph 7 of PBU 1/2008, accounting for a specific accounting item is carried out in the manner established by the federal accounting standard. If, for a specific accounting issue, the federal accounting standard allows for several accounting methods, the organization selects one of these methods, guided by paragraphs 5, 5.1 and 6 of these Regulations.

Clause 7.1 of PBU 1/2008 establishes that if, for a specific issue of accounting, the federal accounting standards do not establish methods of accounting, then the organization develops an appropriate method based on the requirements established by the legislation of the Russian Federation on accounting, federal and ( or) industry standards. In this case, the organization, based on the assumptions and requirements given in paragraphs 5 and 6 of these Regulations, uses the following documents sequentially:

a) international financial reporting standards;

b) provisions of federal and (or) industry accounting standards on similar and (or) related issues;

c) recommendations in the field of accounting.

Consequently, from 08/06/17, PBU 1/2008 introduced the specified ranking in the order of application of documents regulating accounting rules:

1. Federal accounting standards;

2. IFRS standards;

3. Provisions of Federal standards on similar issues;

4. Recommendations (in the case under consideration, correspond to the specified Guidelines).

In the case we are considering, in our opinion, in relation to the operation of making an additional contribution to the property of the LLC, in principle there is no variability, i.e. There are not several ways to reflect such an operation.

In this case, in our opinion, the provisions of PBU 10/99 are applicable, from which one can draw an unambiguous conclusion about the procedure for reflecting this operation in accounting.

Based on the foregoing, we believe that the application of the BMC Recommendations, which the organization has the right to follow in the last instance in accordance with clause 7.1 of PBU 1/2008, in the case we are considering, will be unjustified on the grounds that federal accounting standards make it possible to reflect the transaction we are considering in as part of other expenses.

We also draw your attention to the fact that the Ministry of Finance of the Russian Federation in Letter dated October 13, 2017 No. 07-01-09/66961

did not answer a similar question

about the possibility of reflecting an additional contribution to the property and/or financial assistance of an LLC participant as a financial investment.

Summarizing the above, we note once again that, in our opinion, making an additional contribution to the property of an LLC is subject to reflection in the accounting records of an LLC participant as a other expense at the time of making a decision to make such a contribution

. In this case, there is no separate asset in the form of a financial investment.

College of Tax Consultants, October 25, 2022

[1] For example, a parent organization that solely makes an additional investment in a subsidiary in the presence of its other shareholders, recognizes as a financial investment only the part of the investment corresponding to its share in the capital of the subsidiary, and recognizes the remaining part, corresponding to the share of minority shareholders, as expenses of the current period.

Answers to the most interesting questions on our telegram channel knk_audit

Back to section