The operations of enterprises on the movement of non-cash funds in foreign currencies are systematized by account 52 “Currency accounts”. It opens in banking structures operating in Russia and other countries. The basis for the formation of turnover and balances on foreign currency accounts are statements from servicing financial institutions with a set of attached monetary settlement documentation. The regulatory function is assigned to PBU 3/2006. In accordance with accounting standards, enterprise assets are reflected in the form of foreign currency only in ruble equivalent.

Specifics of application of account 52 “Currency accounts”

Account 52 - Currency accounts The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) is intended to reflect accounting transactions with non-cash foreign currency funds.

Read about the Chart of Accounts in the article.

Current accounts on which such transactions are carried out can be opened in both Russian and foreign banks. This circumstance determines the allocation of two sub-accounts on account 52, intended for accounting for funds in banks:

- Russian - subaccount 52-1;

- foreign - subaccount 52-2.

The Guide to ConsultantPlus describes in detail the specifics of accounting for foreign currency transactions. If you do not have access to the K+ system, get a trial online access for free.

Just as for ruble accounts, for foreign currency accounts reflected in accounting account 52, the following are required:

- organization of separate analytics not only for banks, but also for each account opened in this bank;

- using bank statements and payment documents attached to them as a basis for carrying out an operation.

Features of accounting on account 52 are due to the fact that:

- a foreign currency account opened in a Russian bank is actually represented by two accounts: transit (in which the funds are kept until the recipient submits documents identifying the payment to the credit institution) and current;

- According to accounting rules, accounting transactions must be reflected in ruble equivalent, and this requires: keeping records in parallel in two currencies (foreign and rubles);

- mandatory recalculation of currency balances on the date of the transaction and on the reporting date;

At the same time, you should remember that there is a ban (clause 1 of Article 9 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ) on carrying out currency transactions between residents of the Russian Federation (with some exceptions). However, this does not mean that account 52 will show only settlements with non-residents and the results of recalculation of the ruble equivalent of foreign currency amounts.

Read about the rules that govern currency transactions in the Russian Federation in the publication “Currency transactions: concept, types, classifications.”

Analysis of indicators

According to current legislation, legal entities have the right to open any number of foreign currency accounts necessary to carry out their activities; the selected credit institution must be authorized by the Central Bank to conduct foreign exchange transactions.

Monitoring of non-cash funds receipts and their expenditures is carried out separately for each specific foreign currency account opened by the company.

Filling out records on the availability and movement of currency in accounting programs is carried out on the basis of bank statements requested from credit institutions. The statement and supporting payment and settlement documents for it display all completed transactions indicating the full details of the counterparties. Accounting Rules (3/2006) require mandatory translation of foreign currency into Russian rubles when recording transactions in accounting records. The transfer is carried out at the exchange rate of the Central Bank of the Russian Federation on the date of the transaction; the resulting exchange rate differences are reflected in the form of other income or expenses of the company.

Typical transactions for account 52

In the description of account 52 in the Chart of Accounts, almost all accounts appearing in the Chart of Accounts are listed as accounting accounts in correspondence with which postings are allowed. This suggests that foreign currency funds can be used for the same types of transactions as money stored in ruble accounts (subject to the ban on settlements with residents), that is:

- for payment of travel allowances and salaries;

- saving and increasing funds using special accounts;

- settlements with counterparties and payment of taxes;

- issuing loans and obtaining borrowed funds;

- settlements with founders and divisions.

However, from this entire set you can select those correspondence that characterize typical transactions for account 52. These are, for example:

- Dt 52 Kt 62 - receipt of funds from a foreign buyer;

- Dt 60 Kt 52 - payment to a foreign supplier or bank for services;

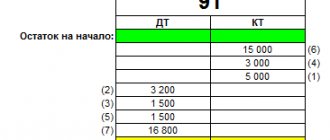

- Dt 91 Kt 52 and Dt 52 Kt 91 - a reflection of negative or positive exchange rate differences;

- Dt 57 Kt 52 and Dt 52 Kt 57 - accounting for the amount of foreign currency when selling or buying foreign currency;

- Dt 50 Kt 52 - withdrawal of currency for issuance to a business traveler abroad;

- Dt 58 Kt 52 - issuing a loan in foreign currency;

- Dt 52 Kt 66 (67) and Dt 66 Kt 52 - receipt and repayment of a foreign currency loan, as well as payment of interest on it (if interest is paid in foreign currency);

- Dt 52 Kt 75 and Dt 75 Kt 52 - making a contribution to the capital company by a foreign founder and paying dividends to him.

ConsultantPlus experts explained how to revalue the balance of funds in a foreign currency account. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Salary payments from a foreign currency account are possible for employees performing their functions abroad (Dt 70 Kt 52).

Read about the nuances of accounting for currency transactions in the material “Accounting for currency transactions (PBU, postings).”

How to work with count 52

In PBU, account 52 is classified as active and is used to reflect amounts in foreign currency held by the company. The use of the account is most relevant for organizations involved in the sale of goods or provision of services to foreign citizens. Operations can be different, for example, buying or selling currency, registering a transaction with payment in dollars or euros.

To carry out the necessary settlement transactions, the company must open a foreign currency account with a bank. Employees of a financial institution provide the company with two accounts at once:

- current currency account, which reflects the funds received for exported goods or services provided;

- transit currency account, which is used to pay invoices received from a foreign counterparty.

Funds in the transit account remaining in the payment field are necessarily transferred by the bank to the current foreign currency account (automatically).

Results

On account 52, accounting of foreign currency funds available in accounts in Russian and foreign banks is carried out. In comparison with ruble accounts, currency accounting has a number of features due to:

- rules for opening an account;

- mandatory parallel reflection of currency amounts in rubles;

- the ability to buy and sell currency.

At the same time, for foreign currency accounts it is possible to use the same set of account correspondence as for settlements in rubles.

These possibilities will be limited by a ban on currency payments between residents. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Correspondence of account 57 with other accounts

In accounting, there are active, passive (passive determines the movement within the enterprise) and active-passive accounts. SCH-57 is an asset account, which means recording any income in debit, and expenses in credit. At the end of the accounting month, either a debit balance is formed, or the register is closed if money successfully arrives at the bank. Based on this, it is possible to determine the interaction of “Transfers in transit” for debit and credit.

Account 57 corresponds (debits) with the following registers:

- 50, 51, 52, describing intra-economic needs;

- 62, 64, 67, describing settlements with clients;

- 78 as calculation of dependent companies;

- 45 and 46, describing goods sold;

- 99 how to profit and loss when buying currencies.

Type of postings according to SCh-57 in the 1C environment

When closing the Account. 57 interacts with accounts 50, 51, 52, 64, 73. When money is credited to the required account, a posting is made confirming this.

Features of accounting

Account 57 is maintained on the basis of the current Chart of Accounts established by Order of the Ministry of Finance No. 94 of October 31, 2000. It corresponds with the following accounts: 50, 62, 79, 90-91 and others. Credit account 57 corresponds with accounts 50-52, 62, 73.

FOR YOUR INFORMATION! Maintaining account 57 is regulated by a number of regulatory documents. This, among other things, is the Directive of the Central Bank No. 3210 dated March 11, 2014.

Subaccounts of account 57 “On the way”

Subaccounts are needed for separate accounting of certain operations/actions. For example, these could be transactions with currency, depositing money in a certain way. Account 57 can be divided into these subaccounts:

- 01. Amounts sent to credit organizations are recorded here. These are transfers for which there is no confirmation yet in the form of a bank statement. Example – delivery of proceeds, collected funds. That is, money transferred to a bank account through collectors.

- 02. Actions to purchase currency. A subaccount is needed when there is a need for a difference between the purchase price and the Central Bank exchange rate.

- 03. The sub-account is used in trading to record acquiring transactions. For example, products are paid for through the terminal using special cards. In this case, the money will be credited to the company’s account account after some time. In this case, the owner of the terminal takes a percentage for the transfer.

- 21. Actions performed in currency.

If required, the accountant can create auxiliary subaccounts.

Credit and debit account 57

Account 57 is considered an active balance account. Its features are in two areas:

- Debit. Money allocated for enrollment.

- Credit. Subsequent transfer of money for its original purpose. In particular, this is the posting of funds to the cash desk, the receipt of money in foreign currency.

Postings are used to reflect certain transactions. They record certain actions/operations.

Standard postings to account 57

Entries on account 57 can be very diverse. However, we can highlight the most commonly used wiring:

- DT57/01 KT50. Revenue comes to the company's account with the bank at the end of the month. Primary – bank receipt.

- DT50-52 KT57. The money “on the way” arrived at the cash desk/banking institution.

- DT57/02 KT50. Directing proceeds to a banking institution through collectors.

- DT51 KT57/02. The money is credited to the account through the collection service.

- DT57/03, 04 KT51,52. Transfer of money for the purchase/sale of currency.

- DT57 KT62.76. Transfer from a debtor to pay a debt that has not yet been credited. When this transfer arrives at the company's account, you need to post it back.

Each entry is made on the basis of the primary document. As a rule, these are bank papers (receipts, etc.). Let's look at the wiring that is used in specific situations.

Receipt of money to the company's bank account

When money is received into the account, these entries are used:

- DT50 KT90/01. Company revenue.

- DT57/02 KT50. Money accepted by the collector.

- DT51 KT57/02. The money is credited to the company's account.

- DT91/02 KT51. Bank commission for money transactions.

As is obvious, a subaccount appears in almost every posting. It is needed to detail the operation.

Acquiring accounting

Acquiring is payment by payment cards, that is, non-cash. Such transactions are reflected in accounting using these entries:

- DT50 KT90. The proceeds have been credited to the account.

- DT57 KT90. Fixation of revenue by bank transfer.

- DT90/03 KT68. VAT accrual on sales.

- DT51 KT57. Receipt of money by bank transfer, taking into account bank commission.

- DT91 KT57. Fixation of bank commission for non-cash payments.

The accountant must take into account the fact that the transactions were carried out in a non-cash manner.

Purchasing currency

The company can purchase foreign currency. In this case, the following wiring is used:

- DT57 KT51. Transfer of money for the purchase of currency.

- DT52 KT57. The currency was converted and credited to the organization’s account.

- DT57 KT91/01. Fixing a positive exchange rate difference.

- DT91/02 KT57. Fixing a negative difference between courses.

Primary documentation: accounting certificate, bank statements.

FOR YOUR INFORMATION! The primary document is needed to confirm the amounts recorded in the accounting records.

Using account 57 in foreign exchange transactions

If the operations of debiting rubles from an account, selling currency and crediting proceeds take more than one day, account 57 must be used.

Example of transactions when purchasing currency

Master LLC submitted an application to the bank to purchase currency and for these purposes transferred 600,000 rubles to it. The bank purchased currency on the stock exchange at a price of 60 rubles per dollar. The Central Bank exchange rate on this date was 58 rubles per dollar.

Postings

| Dt | CT | Operation description | Sum | Document |

| 57 | 51 | DS for currency purchases are listed | 600000 | Bank statement |

| 52 | 57 | The purchased currency is credited to the account (10,000 USD * 58 rubles per USD) | 580000 | Bank statement |

| 91 | 57 | The difference between the Central Bank rate and the acquisition rate is reflected ((60 rubles per USD -58 rubles per USD)*10000) | 20000 | Bank statement |

Example of an operation when selling currency

On October 1, Master LLC submitted an order to the bank to sell $1,000 on October 2. The Central Bank dollar exchange rate as of October 2 is 60 rubles/USD. On October 2, the bank sold the currency at the rate of 61 rubles/USD.

Postings:

| Dt | CT | Operation description | Sum | Document |

| 57 | 52 | The currency to be sold has been written off (at the Central Bank rate) | 60000 | Bank statement |

| 51 | 57 | The sales amount is credited at the bank rate (1000 * 61 rubles/USD) | 61000 | Bank statement |

| 57 | 91 | Other income reflected (exchange difference) | 1000 | Bank statement |

Account 57 in accounting. Transfers within the organization

To reflect cash flow, revenue for goods sold, and money transfers, account 57 is used in organizations for the following purposes:

- Topping up your current account. Funds are transferred to the organization's employees or collection services for crediting to the bank through the organization's cash desk.

- Cash withdrawal. Based on the issued bank receipt, funds can be credited to account 57 before the cash is posted to the cash desk.

- To transfer funds to the enterprise’s corporate card from current bank accounts.

- For acquiring operations.

Currently, the possibility of paying for goods by individuals using payment terminals is widespread. This form of payment is relevant not only for regular stores, but also for making purchases online.

Organizations using such methods, in addition to having specialized equipment, enter into agreements with banks for servicing payment terminals - acquiring. An authorized bank, an intermediary (acquirer), installs its own payment terminals in the institution, through which the population makes payments for purchased goods.

In such cases, funds are not immediately credited directly to the organization. The 57 count should also be used here.

Debit 57 - Credit 90 (36,000 rubles) - revenue from customer cards is reflected.

Debit 90 - Credit 68 (5491.53 rubles) - accrual for VAT sales.

Debit 51 – Credit 57 (35,460 rubles) – receipt of funds to the institution’s current account.

Debit 91 - Credit 57 (540 rubles) - bank expenses under the acquiring agreement.

If an organization is a VAT payer, tax must be charged on the full amount of revenue.

Read more about the accounts used in transactions in the articles: account 68 (accounting for calculations of taxes and fees), account 90 (accounting for the sale of finished products), account 91 (accounting for other income and expenses).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |