On-site tax audit in 2022: list of features

If you or your organization has become the object of attention of the tax authorities and received a notification of an on-site tax audit in 2021, you need to familiarize yourself with the features of such an audit:

- An on-site tax audit can be carried out only at the location of the taxpayer (except for the cases specified in paragraph 2, 3, paragraph 2 of Article 89 of the Tax Code of the Russian Federation);

- the main purpose of the audit is to establish whether taxes and insurance premiums were calculated correctly, and whether they were paid on time (clauses 4, 17 of Article 89 of the Tax Code of the Russian Federation);

- the main document confirming the start of an on-site tax audit is the decision to conduct it (clause 1 of Article 89 of the Tax Code of the Russian Federation);

- the period under review cannot exceed 3 years (clause 4 of Article 89 of the Tax Code of the Russian Federation);

When a tax audit can cover a period exceeding 3 years, read the materials “A repeated on-site audit can be “deeper” than 3 years” and “Can the current year be checked along with the previous three?”

- a taxpayer cannot be audited more than once for the same taxes for the same period;

There are several situations - exceptions when the Tax Code allows repeated inspections. All of them are described here. Let us note a new one that has appeared since 07/01/2021 - this is the submission of clarification on VAT or excise taxes with an increase in the amount of tax to be reimbursed (clause 10 of Article 89 of the Tax Code of the Russian Federation as amended by Law No. 470-FZ dated December 29, 2020).

- only one on-site inspection can be carried out per calendar year (with the exception of when the decision to repeat the inspection is made by the head of a higher tax authority of the Federal Tax Service of the Russian Federation);

- an on-site inspection cannot be assigned in relation to a special declaration (clause 2 of Article 89 of the Tax Code of the Russian Federation), which an individual has the right to voluntarily submit to the Federal Tax Service about the property he has (real estate, transport, deposits in banks or in the authorized capital of organizations), as well as about foreign companies controlled by him.

Scheduled tax inspections for 2018–2019: list of organizations

Does the inspectorate plan tax audits? Certainly! There is a whole concept of such planning (approved by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] ). It also contains criteria using which taxpayers themselves can try to assess the risk of being included in the tax audit plan. There are 12 such criteria in total. Among them:

- tax burden is below the industry average;

- continued loss;

- large VAT deductions;

- low salaries;

- migration between inspections, etc.

The more matches, the higher the risk of being included in the checklist.

Criteria, of course, are a useful thing. But still they only provide the likelihood of a tax audit. It is much better to know about it for sure, for example, to the nearest quarter. Therefore, the desire to find the schedule of tax audits of your Federal Tax Service and look into it is common to almost every taxpayer.

Is it possible? And if possible, how to do it?

Read this article and you will know whether it is realistic to spy on a tax audit plan.

And we will continue to talk about tax audits further. What are they?

The right of the Federal Tax Service to an on-site inspection

It is legally determined that the right to conduct an on-site tax audit has the tax authority to which the taxpayer belongs territorially. Although there are exceptions that apply to the largest taxpayers and separate divisions.

Also important are the date of registration as a taxpayer with a particular tax authority and the date of amendments to the accounting register.

Thus, if, when changing location, the corresponding changes are not made to the Unified State Register of Legal Entities in a timely manner, then an on-site tax audit will be carried out by the tax authority at the previous location. If such a situation arises due to the fault of the tax inspectorate in connection with violation of registration requirements and deadlines, then an on-site tax audit will also be carried out by the inspectorate at the old place of registration (Resolution of the Federal Antimonopoly Service of the Volga District dated May 29, 2013 No. A65-25327/2012).

Other Federal Tax Service Inspectors do not have the right to order inspections of taxpayers located outside their jurisdiction. Thus, the tax authority, which only registers real estate and transport, but not the taxpayer himself, cannot assign the latter an on-site tax audit.

According to what criteria does the Federal Tax Service select taxpayers to conduct an on-site audit, ConsultantPlus experts told. Get a free trial and learn from authoritative content.

Decision to conduct an on-site tax audit

As noted above, the start of an on-site tax audit is preceded by the preparation of the main document giving the right to conduct a control event - the decision to conduct an on-site tax audit and, accordingly, its delivery to the inspected legal entity or individual.

This document should be given special attention, as it is the basis for implementing a set of control measures. Often, incompetent inspectors neglect the duty to timely serve and familiarize taxpayers with the decision, but this is a serious mistake and can be used by the persons being inspected as an argument when confirming a violation of procedural norms.

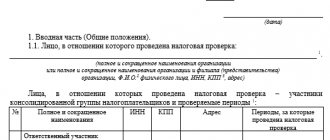

The decision to conduct an on-site tax audit has the right to be made only by the tax authority to which the taxpayer being audited territorially belongs. This document reflects information about the subject of control, the subject of the audit (list of taxes being audited), the audit period and the composition of the audit team. The decision must be signed by the head of the tax office or his deputy.

Documents for tax audit

We have already said that during a desk tax audit, reclaiming is allowed only in strictly limited situations, and during an on-site audit there is no escape from it. In both cases, submitting documents upon request is your absolute responsibility, and refusal is subject to a fine.

Considering the importance of this procedure, we have dedicated a separate section .

Do you know in what form to submit the requested documents to the Federal Tax Service? How can I properly certify them before sending them? You will find all recommendations in this section of our website.

For example, read this publication and find out when documents can be submitted as scanned copies.

This note will tell you when documents can be submitted electronically.

Here is the answer to the question of in what cases it is permissible to submit documents in the form of a binder.

And in this article we provide detailed explanations from the Ministry of Finance on how to correctly form such a file and certify it.

All this is extremely important during a tax audit. After all, tax officials may consider incorrectly certified copies of documents as unrepresented and fine you. If the volume of required documentation is large (and during tax audits, as a rule, this is the case), the amount of the fine will be significant. There is no need for you to spend extra money.

What else is important to know when making a claim? Recently, the Tax Code provides for a ban on re-requesting from a taxpayer documents that he has already submitted to the inspectorate for a desk or field tax audit or for tax monitoring.

Everything is clear here with desk and field tax audits. What about a counter tax audit? For example, when re-requesting for the camera chamber the documents that you once submitted for verification by the counter. Or vice versa, if for the counter they ask for documents submitted as part of previous desk and field tax audits.

In one of these cases, the requirement may not be fulfilled. Read about it here .

In another you will have to submit documents - see this publication .

And there are a lot of such nuances when claiming.

Another batch of controversial questions about requesting documents for tax audits awaits you in this article .

Follow the materials in this section and you will always be aware of all the news and clarifications.

Where is an on-site tax audit carried out according to the Tax Code of the Russian Federation?

The place for conducting an on-site tax audit is the premises or office of the taxpayer (Clause 1, Article 89 of the Tax Code of the Russian Federation). But sometimes it happens that the size of the premises does not allow the entire inspection team to be located there, and then the audit can be carried out at the tax office.

He must inform himself that the taxpayer does not have the ability to accommodate inspectors, otherwise this decision is made by the head of the inspection team upon visiting and inspecting the taxpayer’s premises.

It should be noted that in practice it happens that the tax authority, without receiving the relevant application and due inspection, decides to conduct an on-site tax audit at the inspectorate. But this indicates that the regulatory authorities are violating the current procedure for conducting on-site tax audits.

This opinion is also supported by the courts. Thus, the FAS Moscow District, in resolution dated August 20, 2010 No. KA-A40/8830-10, canceled the decision made based on the results of an on-site tax audit conducted in a simplified version due to a violation of the procedure.

But at the same time, if the decision of the tax authority does not contain significant errors, then the courts are unlikely to side with the taxpayer just because an on-site tax audit was carried out at the tax office without appropriate notification of the person being inspected (resolution of the Federal Antimonopoly Service of the West Siberian District dated April 26. 2013 No. A75-3810/2012).

An important circumstance is that even when conducting an on-site tax audit on the territory of the regulatory authority, the taxpayer must comply with all the requirements of the inspectors, be it a request to submit documents or a requirement to inspect work premises.

Desk tax audit - everyone is on the list

Almost all tax reporting (declarations and calculations) that reaches the inspectors is subject to a desk tax audit. The procedure for conducting an inspection is set out in Art. 88 Tax Code of the Russian Federation.

Find answers to the most pressing questions regarding desk tax audits here .

Such a tax audit takes place at the inspectorate and begins without any decision. At the initial stage the following is checked:

- compliance with the deadline for filing the declaration;

- correctness of reflection of indicators (occurs in an automated mode, including using control ratios, in this case errors, inconsistencies, contradictions, etc. are identified);

The positive result of the desk tax audit is evidenced by the silence of the tax authorities. If 3 months (the established inspection period) have expired, and you have not been disturbed from the inspection, it means that the declaration has passed desk control.

A desk tax audit may be completed before the expiration of 3 months. See more about this here .

If something goes wrong, for example, you made a mistake in the declaration or your information does not fit with what the tax authorities have, the Federal Tax Service will ask you for clarification or demand that you correct the report. Did the explanations clear up all the questions? The check ends without consequences. And if not?

Find out about the State Duma's plans for desk audits from the message.

Read about the negative development of a desk tax audit here .

In some cases, tax officials may request documents from you as part of a chamber meeting. For example, when filing a VAT return with a tax refund, using benefits, inconsistencies between the data from your VAT return and the declarations of your counterparties, etc. Claiming is a complex process, and disputes here are not uncommon. That's why it's so important to know the order.

You can find everything about how documents are required for tax audits in the section “Documents for tax audits” .

Desk tax audits for different taxes have their own peculiarities. In this section of the site you can find out:

- how to prepare for a profit chamber;

We write about it in this article .

- how declarations of simplifiers are checked;

About this here .

- how they handle VAT.

A separate large section “Tax audit of VAT” .

How long does an on-site tax audit take?

The term of an on-site tax audit is 2 months, but at the same time, the Tax Code of the Russian Federation gives the tax authorities the opportunity to both extend it and suspend it. Inspectors very often use these opportunities when they need to find out whether a certain business transaction is a violation, or to study additional materials relating to the activities of the person being inspected.

For information on cases when tax authorities can extend the period of an on-site audit, read the material “How and when an on-site tax audit can be extended .

The period for which the inspector has the right to extend the inspection is 4 (6) months (clause 6 of Article 89 of the Tax Code of the Russian Federation), and to suspend it is 6 (9) months (clause 9 of Article 89 of the Tax Code of the Russian Federation). Thus, if during a control event tax authorities resort to the methods described above, then the maximum audit period can be 1 year and 3 months.

An exception is an on-site tax audit of a specific branch or representative office - it must be carried out within 1 month. In this case, the legislator granted controllers only the right to suspend.

The term of an on-site tax audit begins to be calculated from the day the decision to conduct this control event is made, and ends on the day a certificate is drawn up based on the results of the audit (the specified document must be delivered on the same day).

Therefore, we can highlight the main stages of the verification:

- commencement of an on-site tax audit (delivery of a decision to conduct it);

- verification process (maximum - 1 year 3 months);

- completion of the audit (drawing up a certificate of on-site tax audit).

Thus, within the deadlines indicated above, inspectors are required to carry out all planned activities, as well as those that arose during the inspection process. If inspectors received any evidence after the expiration of the deadline, then they do not have the right to attach it to the materials of the on-site tax audit (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated May 26, 2009 No. F03-2248/2009).

It is also worth noting that such a violation does not imply the cancellation of the decision and the results of the on-site tax audit completely, since there is only one formal circumstance that can influence the court’s decision - this is a violation of the procedure for the participation of the taxpayer in considering the audit materials (paragraph 2, paragraph 14, art. 101 of the Tax Code of the Russian Federation).

The frequency with which tax authorities have the right to conduct on-site tax audits is described in the ConsultantPlus Ready Solution. Get trial access to the system and study the material for free.

More details about the timing of an on-site tax audit are described in the material “What is the deadline for an on-site tax audit?” .

Types of tax audits

The purpose of tax control is to check whether all taxes have been accrued and paid. Inspections are the main tools with which to study the activities of a company or entrepreneur. Inspectors pay special attention to the selection of counterparties, accounting and reporting, economic characteristics of business transactions, timeliness and completeness of the transfer of taxes and fees.

Tax legislation divides all audits into on-site and desk audits.

Desk tax audit

All calculations and declarations that taxpayers submit to the Federal Tax Service are subject to desk (documentary) verification. The purpose of control is to check the figures in the reporting for arithmetic and logical errors, to determine whether tax rates were applied correctly and legally. The inspection is carried out at the inspectorate at the place where the reports are submitted. Each submitted declaration or calculation is checked. The participation of the taxpayer is not necessary; only the documents provided by him are considered.

During the desk audit, reporting data is entered into the information system. The system analyzes indicators and checks control ratios. This is how arithmetic and logical errors made by the taxpayer are identified.

Next, the figures in the declaration are compared with the data of other taxpayers in this industry to determine how far they deviate from the industry average. If there are no errors or discrepancies, the desk audit of the tax return or calculation is successfully completed.

If inaccuracies, errors or violations are discovered, the inspector will send a request to provide additional documents and explanations.

When may documents be required during a desk audit?

During desk inspections, inspectors may require explanations and primary documents only in the following cases (Article 88 of the Tax Code of the Russian Federation):

- Errors and contradictions in the declaration. If counting (arithmetic) errors are detected, you will need to submit adjustment reports. In case of natural discrepancies in data, for example in the profit declaration and the VAT declaration, it is sufficient to provide an explanation in writing. For example, you can say that part of a company's operations requires income recognition for income tax purposes, but is not subject to VAT.

- Submission of an updated declaration. If in the updated declaration the tax was reduced or the amount of the loss was increased, tax authorities have the right to request tax registers and primary documentation for a more detailed study of the reasons due to which contributions to the budget decreased.

- Loss in the income statement. Business must make a profit. The lack of profit is a reason to take a closer look at the company’s activities and study its transactions during the unprofitable period.

- VAT refund claimed. In this case, the Federal Tax Service always requests invoices and source documents for all transactions for the period for which the taxpayer wants to reimburse the VAT paid from the budget.

- Use of tax incentives. Companies using preferential taxation or deferred payment must, at the request of tax authorities, document the legality of their application.

On-site tax audit

An on-site tax audit takes place on the territory of the taxpayer. However, if they are checking an individual entrepreneur without an office or a small company, the inspectors will request documents and will study them at their place.

Unlike a desk audit, when only one declaration is analyzed and only for the reporting period, an on-site audit is usually carried out for several types of taxes. The maximum possible audit period is 3 years.

Inspectors analyze and identify distortions in information in primary documents, check the accuracy and completeness of accounting, inspect premises, and interview employees.

There are several types of on-site tax audits depending on the reasons for which they are caused.

- Comprehensive checks. They check all taxes and fees paid by the taxpayer. Typically within the last three calendar years.

- Thematic checks. Most often they are carried out in companies under special tax regimes (STS, UTII, Unified Agricultural Tax). In general mode, such checks are carried out less frequently and in special cases. For example, a company may be subject to an on-site thematic audit of VAT for the last three years after it has reimbursed the tax from the budget in one of the quarters.

- Inspections in connection with the reorganization or liquidation of an organization. Conducted for a period not exceeding the last three years, but regardless of when the last inspection was. Even if the company has already been inspected during this period, the inspection due to reorganization is not considered repeated.

- Unscheduled inspection upon request. Such verification requires grounds. Usually this is a request from law enforcement agencies or a higher tax office. As well as a violation of the evaluation criteria described at the beginning of the article.

The duration of the on-site inspection should not exceed two months (Clause 6, Article 89 of the Tax Code of the Russian Federation). The beginning of the period is the date of the decision to conduct the inspection. End - the date of drawing up the certificate of inspection (clause 8 of Article 89 of the Tax Code of the Russian Federation).

Passing an on-site inspection

The plan for on-site inspections for the current year is published on the tax inspectorate website. Unscheduled inspections are not included in the published plan and occur suddenly. They are almost always preceded by tax demands and requests for information. Evaluate yourself according to the selection criteria. The more inconsistencies you find, the higher the risk of ordering an inspection.

If you have received a decision to conduct an on-site tax audit, this means that your company began to be audited at least several months ago. You just didn’t know that the preparatory stage was already underway.

Preparatory stage. Tax officials have begun an audit. Before joining the company, they study all the constituent documents and tax reporting, identify your main counterparties and chains of interdependent persons, and analyze the dynamics of changes in the main financial indicators for the audited period.

First stage. The inspector arrives with a decision to schedule an on-site inspection. Make sure that the actions of the tax authorities are legal. The notice must indicate: the full and abbreviated name of the company being inspected, the composition of the inspection team that has the right to access the territory, a list of taxes and the period being inspected.

It is prohibited to check the same period twice. Inspectors must prove their identity with identification. The wording “all taxes and fees paid” is illegal; the decision must indicate a complete list of taxes being audited.

Keep a special calendar and mark all the deadlines related to the inspection in it. Violation of deadlines is an independent reason to challenge the final inspection report.

Second phase. Preparation and transmission of documents. The inspection is strictly regulated by law. A complete list of required documents must be specified in the tax request. If the list is too vague, specify in writing what exactly the inspector wants to see. Tax authorities have the right to demand and study only primary accounting documents and registers. The taxpayer is not required to provide analytical reports or summary reports on its activities.

Keep tax officials out of your accounting software. Article 93 of the Tax Code of the Russian Federation obliges taxpayers to provide documents related to the calculation of taxes. The inspector's demand to provide access to the electronic database is illegal. The safest way to submit is to have copies of documents bound and certified. Check each document provided. It must not only correspond to the form, but also be filled out correctly, contain no corrections, and, if necessary, be signed and stamped.

Try to comply with the deadlines set for submitting documents. Violating them is a reason for the inspector to seize documents and take away the accountant’s computer during the inspection (Clause 3, Part 1, Article 31 of the Tax Code of the Russian Federation, Article 94 of the Tax Code of the Russian Federation). Make an inventory of all documents being transferred. If you cannot meet the deadline, be sure to ask in writing to extend the deadline for submission.

Third stage. Passing the test. An on-site audit is not only about studying accounting documents. During on-site inspections, inspectors most often use three tools: interrogation of employees, inspection of the territory and seizure of material objects (databases, hard drives, computer equipment).

- Interrogation. According to Art. 90 of the Tax Code of the Russian Federation, during the inspection the inspector can interrogate any employee of your company or counterparty companies. Keep control over calling employees to the Federal Tax Service. All demands to appear must be issued by summons or notice indicating the date and time (letter of the Federal Tax Service dated July 17, 2013 No. AS-4-2/12837). If an inspector comes to the company’s territory and calls employees to “talk”, politely but firmly refuse and offer to send the summons officially - by Russian Post.

Tell your subordinates to immediately inform the responsible employee (lawyer, accountant or manager) that they have received a subpoena. All letters sent by the Federal Tax Service by mail are considered received within 6 calendar days after sending (Part 4 of Article 31 of the Tax Code of the Russian Federation).

Before going to the Federal Tax Service, explain to the employee how to act, and the visit to the tax office itself should be accompanied by a lawyer or lawyer with a notarized power of attorney from the company. The called storekeeper or driver often does not understand the specifics of legal or accounting issues and gives answers that can be interpreted not in favor of the company.

It is good if you train the employees who are about to be interrogated in advance how to answer the most likely questions. A lawyer can act as an inspector and simulate the situation.

Most often questions concern:

- selection of counterparties and contact with them;

registration and signing of certain primary documents;

- stages of shipment of goods or provision of services;

- employee's work responsibilities, etc.

- Inspection of territories, premises and objects. Carried out only after notification of the taxpayer. Only objects and territories that belong to the person being inspected and not to third parties are inspected.

If you have any comments about the inspection, write them down in the protocol.

Make sure that the facts and information in the protocol are not distorted.

- Removal of documents and objects. Occurs only upon a reasoned decision of an official. Only that which relates to the subject of the inspection can be confiscated.

The resolution must indicate the individual characteristics of the items or documents subject to seizure, as well as the reasons for which this decision was made.

If it takes time to prepare for the interview, call the inspector and ask to reschedule the visit. You can refer to illness, business trip or other reasons. Usually tax officials do not refuse and schedule another time for the meeting.

After the interrogation, read the protocol and make sure that the inspector understood and recorded everything correctly. If there are inaccuracies or errors, the protocol can be corrected before the witness signs it. Refusal to make adjustments is a violation of citizen rights, and this should be recorded in writing.

Fourth stage. Familiarization with the certificate and inspection report. On the last day of the inspection, the inspector is obliged to familiarize the company representative with the certificate. Make sure that it fully and correctly indicates the subject and timing of control activities, as well as the violations identified.

Within two months after drawing up the certificate, inspectors must provide you with a final report with the results of the inspection.

In some cases, Federal Tax Service employees take advantage of taxpayers’ ignorance and violate their rights. For example, they transfer the inspection materials to an unauthorized person or one who does not have the appropriate power of attorney, do not hand over the act for review and signing, and do not notify about the date and time of consideration of the inspection materials.

Record every violation in writing. In the future, this may become a basis for canceling the inspection decision (clause 14 of Article 101 of the Tax Code of the Russian Federation).

After reviewing and signing the act, the inspection ends. But only if you agree with the conclusions of the tax inspectorate. If the violations and conclusions indicated in the report are unfounded, you can submit written objections within one month from the moment you received the inspection report.

How will the on-site inspection end?

On the last day of the audit, tax officials draw up a certificate of the audit and hand it over to the taxpayer. Over the next two months, they issue an on-site inspection report. To prepare an act for a consolidated group of taxpayers, 3 months are allotted for drawing up an act. The report and the documents attached to it are also handed over to the taxpayer.

If the person being inspected has objections, he has the right to send them to the Federal Tax Service for consideration within a month. See the objection form here. If no objections are received, tax officials begin to review the case materials and make a final decision.

Read more about the procedure for processing tax audit results in the section of the same name.

Results

The purpose of a tax audit is to monitor the correctness of calculation and payment of taxes. The procedure for conducting an on-site tax audit is regulated by Art. 89 Tax Code of the Russian Federation. The results of an audit can be canceled only in cases of significant violations on the part of the tax authority, for example, if the taxpayer is not given the opportunity to participate in the consideration of the audit materials and provide explanations.

Sources:

- Tax Code of the Russian Federation

- order of the Government of the Russian Federation dated March 18, 2020

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.