Certificate of completion of verification

On the last day of the on-site tax audit, the head of the inspection team draws up a certificate in the form approved by Order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/338 (clause 15 of Article 89 of the Tax Code of the Russian Federation).

The certificate must indicate:

- place and date of compilation;

- details of the decision to schedule an on-site inspection;

- full and abbreviated name of the organization in which the inspection was carried out, its tax identification number and checkpoint;

- subject of the audit (types of taxes being audited, the period covered by the audit);

- period of inspection.

If the inspection was carried out at a member of the consolidated group, then the certificate also indicates:

- TIN, KPP of a consolidated group of taxpayers with the date and registration number of the agreement on its creation;

- full and abbreviated name of the responsible participant in the consolidated group of taxpayers, his INN, KPP;

- full and abbreviated names of other participants in the consolidated group of taxpayers, their Taxpayer Identification Number (TIN) and KPP.

This follows from paragraph 11 of Article 89 of the Tax Code of the Russian Federation and Appendix 2 to the order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/338.

The preparation of a certificate indicates the completion of the inspection (clause 8 of Article 89 of the Tax Code of the Russian Federation). From the date of preparation of the certificate, the deadlines for further processing of the results of the tax audit begin. After drawing up the certificate, representatives of the tax inspectorate do not have the right to be on the territory of the organization, request documents or carry out any tax control activities. Such clarifications are contained in paragraph 3 of the letter of the Federal Tax Service of Russia dated December 29, 2012 No. AS-4-2/22690.

Presentation of certificate

Inspectors must hand over the certificate of the inspection to the legal or authorized representative of the organization on the day of preparation (i.e., on the last day of the inspection) (paragraph 1, clause 15, article 89 of the Tax Code of the Russian Federation). In this case, the authorized representative must have a power of attorney to represent the interests of the organization in the tax inspectorates.

The certificate form provides a field in which the representative of the organization must mark the receipt of the certificate. If a representative of an organization avoids receiving a certificate, the inspection will send it to the organization by registered mail (paragraph 2, clause 15, article 89 of the Tax Code of the Russian Federation). In this case, the date of receipt of the certificate will be considered the date indicated on the calendar stamp imprint of the postal notification of delivery of the letter (clause 3 of the letter of the Federal Tax Service of Russia dated December 29, 2012 No. AS-4-2/22690).

In addition, the certificate can be transmitted to the organization via telecommunication channels. The procedure for electronic document flow between tax inspectorates and taxpayers was approved by Order of the Federal Tax Service of Russia dated April 15, 2015 No. ММВ-7-2/149. An electronic certificate will be considered received when the inspection receives an electronic receipt for the receipt of this document. If the inspection does not receive such a receipt, it will send a certificate on paper in accordance with the generally established procedure. This conclusion follows from the provisions of paragraphs 12, 16 and 19 of the Procedure, approved by order of the Federal Tax Service of Russia dated April 15, 2015 No. ММВ-7-2/149.

Situation: can the inspection, instead of the original, give the organization a copy of the certificate of the on-site inspection?

Answer: yes, it can.

On the last day of the on-site tax audit, the head of the inspection team draws up a certificate and hands it to the organization’s representative. This procedure is provided for in paragraph 15 of Article 89 of the Tax Code of the Russian Federation. The provisions of this norm do not determine in what form (original or copy) the certificate must be transferred to the organization. Therefore, the inspection has the right to give the organization a copy of the certificate and keep the original. In arbitration practice there are examples of court decisions that confirm the legitimacy of this conclusion (see, for example, the decision of the Seventh Arbitration Court of Appeal dated November 10, 2008 No. 07AP-6276/08).

Situation: is it possible to cancel a decision based on the results of an on-site inspection if the inspection did not provide the organization with a certificate of inspection?

Answer: no, you can't.

The decision based on the results of a tax audit is subject to cancellation if the inspection violates the essential conditions of the procedure for considering audit materials. In particular, such a decision is canceled if the inspection does not provide the organization with the opportunity to participate in the consideration of the inspection materials and provide explanations on them. This is stated in paragraph 2 of paragraph 14 of Article 101 of the Tax Code of the Russian Federation. In addition, other violations related to the procedure for reviewing materials that could lead to the adoption of an incorrect decision (paragraph 3, paragraph 14, article 101 of the Tax Code of the Russian Federation) may become grounds for canceling the inspection decision.

The fact that the inspection did not transfer the certificate to the organization does not affect the procedure for considering tax audit materials. Consequently, such a violation in itself cannot become a basis for canceling the decision based on the results of the on-site inspection. In arbitration practice there are examples of court decisions that confirm the legitimacy of such a conclusion (see, for example, the resolution of the Ninth Arbitration Court of Appeal dated October 16, 2008 No. 09AP-11298/2008-AK).

How to compose correctly

The scheme of the tax audit report has a template established by law. The document consists of three sections. The first, introductory part, contains general information about the audit and the Federal Tax Service employee who conducted it. This paragraph also contains information about the branch and representative office of the Federal Tax Service.

If an on-site verification was carried out, you will need to enter:

- form number;

- the name of the city in which the paper was drawn up;

- date of approval of the finished sample by tax authorities;

- number of the order of the head of the Federal Tax Service on conducting an audit;

- name of the company under study;

- TIN of the legal entity;

- checkpoint;

- start and end days of verification;

- a reference to the fact that the audit was carried out in accordance with the procedure established by law;

- address of the territory where the verification took place;

- the beginning and end of the audit;

- initials of the head of the audited organization, chief accountant or other authorized employees;

- information about licenses to perform certain types of work, if any;

- data on the types of work prohibited by law or performed without a license;

- data on the features of the audit, methods of its implementation;

- information about tax control measures used during verification.

If a desk audit was carried out, then the first section of the act includes:

- reference number;

- name of the locality in which the form was issued;

- position, name of the Federal Tax Service department, full name. inspector;

- information about the reporting documents on the basis of which the audit was carried out;

- Taxpayer INN;

- checkpoint;

- a proposal stipulating that the verification was carried out in accordance with the Tax legislation of the Russian Federation;

- day of beginning and completion of verification;

- a list of official documents confirming the legality of the business activity of the person being inspected;

- information about the audit measures taken.

The second, descriptive section contains information about violations of the law, if any, and circumstances influencing the decision based on the results of the audit.

The information in the main part can be presented in the form of continuous text or a table. It is allowed to use generally accepted abbreviations and abbreviations in the text. It is worth noting that the first mention of the term is indicated in full. If information about foreign currency is entered into the form, you will need to write down the ruble equivalent of the amount next to it. The rate at which expenses are translated must correspond to the indicators established by the Bank of Russia. Information should be presented consistently and concisely. The information provided about violations must be supported by facts. The circumstances of the violations are described in full.

The last section contains data on the amounts of fees not paid in full or not at all, proposals for eliminating inaccuracies, and auditors’ conclusions about violations with references to the Tax Code. This part also indicates the number of pages of the application and the right of the taxpayer to submit objections to the submitted paper. The form is drawn up in 2 copies, one remains with the Federal Tax Service, the second - with the person being inspected.

Checking act

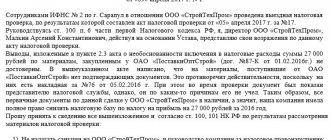

No later than two months from the date of registration of the certificate, the inspectors draw up an on-site tax audit report (paragraph 1, clause 1, article 100 of the Tax Code of the Russian Federation). Its form was approved by order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892. Inspectors must draw up an act, even if the results of the inspection did not reveal any violations (paragraph 1, paragraph 1, article 100 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated April 16, 2009 No. ШТ-22-2/299). In this case, the inspectors indicate in the report that there are no violations of tax legislation (subclause 12, clause 3, article 100 of the Tax Code of the Russian Federation).

Tax legislation establishes clear requirements for the execution of an on-site inspection report (clauses 3, 3.1, 4 of Article 100 of the Tax Code of the Russian Federation, Requirements approved by order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892). For more information about what information inspectors must include in the inspection report, see the table.

If, when preparing an inspection report, the inspectorate has doubts about the interpretation of the legislation, the draft act can be sent for preliminary approval to the regional tax department. For example, this is possible if there are no official explanations from the Federal Tax Service of Russia on some issues or if these explanations do not coincide with the position of the Ministry of Finance of Russia. The deadlines for approval of draft inspection reports are set by the regional Federal Tax Service. However, these deadlines should not increase the total duration of preparation of the act (two months) established by paragraph 1 of paragraph 1 of Article 100 of the Tax Code of the Russian Federation. This follows from the provisions of Section II of the Procedure, approved by Order of the Federal Tax Service of Russia dated October 17, 2013 No. ММВ-7-3/449.

Situation: is it possible to cancel the inspection decision made based on the results of an on-site inspection? The inspection drew up an on-site inspection report containing violations (errors).

It is possible if violations committed during the preparation of the report led to the adoption of an incorrect decision based on the results of the on-site inspection.

The decision on a tax audit is subject to cancellation if the inspection violates the essential conditions of the procedure for considering audit materials. Thus, the inspection decision is canceled if the inspection does not provide the organization with the opportunity to participate in the consideration of the inspection materials and provide explanations on them. This is stated in paragraph 2 of paragraph 14 of Article 101 of the Tax Code of the Russian Federation. In addition, other violations related to the procedure for reviewing materials that could lead to the adoption of an incorrect decision (paragraph 3, paragraph 14, article 101 of the Tax Code of the Russian Federation) may become grounds for canceling the inspection decision.

The on-site audit report is one of the main materials of the tax audit, after consideration of which the inspectorate makes a final decision based on the results of the audit (clause 1 of Article 101 of the Tax Code of the Russian Federation). Consequently, violations committed by the inspectorate when drawing up the report may become the basis for making an incorrect decision based on the results of the on-site inspection. In this case, the inspection decision is subject to cancellation in full or in part related to the violation. In arbitration practice, there are court decisions that confirm the legitimacy of this conclusion. Thus, the inspection decision made based on the results of an on-site inspection can be canceled (in whole or in part) if the inspection made the following violations (errors) when drawing up the report:

- incorrectly applied the legislation and made incorrect conclusions, which were reflected in the final decision (see, for example, the decision of the Supreme Arbitration Court of the Russian Federation dated October 6, 2009 No. VAS-12395/09, resolution of the Federal Antimonopoly Service of the West Siberian District dated June 3, 2009 No. F04-3218/2009(7668-A46-26), F04-3218/2009(8926-A46-26), Moscow District dated September 29, 2009 No. KA-A40/6946-09);

- distorted the facts established during the audit (see, for example, resolution of the Federal Antimonopoly Service of the Ural District dated November 25, 2009 No. F09-9205/09-S2);

- assessed additional taxes, penalties and fines for periods that could not be covered by the on-site inspection (see, for example, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated February 20, 2008 No. F03-A73/08-2/126);

- did not substantiate the fact of a tax offense and held the organization accountable for committing it (see, for example, the determination of the Supreme Arbitration Court of the Russian Federation dated June 4, 2009 No. VAS-6861/09, resolution of the Federal Antimonopoly Service of the East Siberian District dated February 10, 2009 No. A33- 6906/07-F02-15/09, Central District dated January 21, 2010 No. A35-1157/08-C15, dated November 30, 2009 No. A64-3933/07-16, Volga-Vyatka District dated December 21, 2009 No. A82-9362/2008, Volga District dated November 24, 2009 No. A72-2919/2009, West Siberian District dated September 9, 2009 No. F04-5332/2009(18985-A03-34), Moscow District dated April 6, 2009 No. KA-A40/2403-09, dated January 20, 2009 No. KA-A40/11945-08, Northwestern District dated May 4, 2009 No. A56-13415/2006, Ural District dated August 28, 2008 No. Ф09-6143/08-С3).

As a general rule, the on-site tax audit report is drawn up in two copies: one for the inspection, the second for the organization. When conducting a joint tax audit, the act is drawn up in three copies: the third copy is transferred by the inspectorate to the internal affairs bodies. When conducting a repeated on-site inspection in order to monitor the activities of a lower inspection, the report is also drawn up in triplicate. In this case, the higher tax authority that conducted the audit will send the third copy of the report to the inspectorate. This is stated in paragraph 9 of the Requirements approved by order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892.

Delivery of the act

The inspection must give the organization its copy of the act within five working days from the date of signing the act (clause 5 of article 100, clause 6 of article 6.1 of the Tax Code of the Russian Federation).

The inspection can hand over the act:

- personally to the legal or authorized representative of the organization against signature. In this case, the authorized representative must have a power of attorney to represent the interests of the organization in the tax inspectorates;

- in another way indicating the date of receipt of the act by the organization (for example, through a courier service).

This follows from paragraph 5 of Article 100 of the Tax Code of the Russian Federation.

Upon receipt of the act, the representative of the organization must put two signatures on it:

- on receipt of the act (clause 5 of article 100 of the Tax Code of the Russian Federation);

- about familiarization with the contents of the act. If a representative of the organization refuses to sign the act (for example, due to his incompetence), then the corresponding note about the refusal to sign will be made in the act (clause 2 of Article 100 of the Tax Code of the Russian Federation).

Situation: to whom is the tax audit report handed over: the head office of the organization or its branches? The on-site tax audit was carried out simultaneously in relation to the head office of the organization and its branches.

When simultaneously inspecting the head office of an organization and its branches, the head office of the organization receives an on-site tax audit report.

Within five working days from the date of drawing up, the tax audit report must be sent to the organization in respect of which the audit was carried out, or handed over to its representative (clause 5 of Article 100 of the Tax Code of the Russian Federation). The document is drawn up in accordance with the order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892.

The results of the branch inspection are documented by filling out the relevant sections of the single inspection report. After reading them, the relevant section of the act is signed by the head of the branch. This is stated in the Requirements approved by order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892. At the same time, the order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892 does not provide for the delivery of individual parts of the act (sections) to the branch of the organization. Therefore, a single inspection report is handed over to a representative of the organization’s head office (sent to the organization).

At the same time, the head office of the organization has the right to send to its branches extracts from the inspection report (copies of sections of the report) relating to its branches.

Similar explanations are contained in letters of the Ministry of Finance of Russia dated September 10, 2007 No. 03-02-07/1-406, Federal Tax Service of Russia dated March 19, 2007 No. CHD-6-23/216.

Form of on-site tax audit report

The tax audit report form was approved by the Federal Tax Service of the Russian Federation in Appendix No. 23 of Order No. ММВ-7-2 / [email protected] dated 05/08/15. Appendix No. 24 of the same regulatory act contains requirements for the execution of the document. The tax audit report is signed on the one hand by the responsible persons who actually exercised control over the data of the inspected business entity. On the other hand, the signature of the representative of the taxpayer or the person directly being inspected/participant of the Group of Taxpayers is affixed.

Note! If the taxpayer or his representative refuses to certify the inspection report, a corresponding entry is made in the document.

Sending the act by mail

If an organization (its representative) avoids receiving an on-site inspection report, the inspection reflects this fact in the report and sends it by registered mail to the location of the organization (separate unit). In this case, the date of receipt of the act is considered to be the sixth working day from the date of sending the registered letter. This follows from the provisions of paragraph 2 of paragraph 5 of Article 100 and paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Moreover, the countdown of the six-day period begins from the day following the day of sending the act (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

Situation: does the inspection have the right to transfer a tax audit report (desk, field) by registered mail (by mail), if the organization does not evade receiving it?

The inspectorate may send a tax audit report by registered mail. But the date of its receipt will be considered the sixth working day from the date of sending the registered letter only if the organization evaded receiving the act. If the organization did not evade receiving the act, then the day of its delivery should be considered the day the organization actually received the registered letter.

This conclusion follows based on the totality of the following norms.

Tax legislation indicates that the inspectorate has the right to transfer a tax audit report in person against a signature or in other ways indicating the date of receipt of the report by the organization. This is stated in paragraph 1 of paragraph 5 of Article 100 of the Tax Code of the Russian Federation. Consequently, sending the act by registered mail is not a violation of the law on the part of the inspectorate, since this method of transmission allows one to reliably determine the date of actual receipt of the act by the organization.

At the same time, the legislation specifies that the inspectorate has the right to send a tax audit report by registered mail only if the organization avoids receiving it. In this case, the date of receipt of the act by the organization is considered to be the sixth working day from the date of sending the registered letter. This follows from the provisions of paragraph 2 of paragraph 5 of Article 100 and paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation. Moreover, the countdown of the six-day period begins from the day following the day of sending the act (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

The regulatory agencies did not express an official point of view on this matter. But in arbitration practice there are court decisions that confirm the legitimacy of this conclusion (see, for example, Resolution of the FAS of the Volga District dated December 17, 2009 No. A55-5813/2009).

Situation: to what address of the organization - legal or actual - should the inspection send a registered letter with a tax audit report (office, on-site)?

The inspectorate must send a registered letter with a tax audit report to the location of the organization, that is, to its legal address, which is indicated in the Unified State Register of Legal Entities (clause 5 of Article 31, clause 5 of Article 100 of the Tax Code of the Russian Federation). Similar explanations are contained in paragraph 1 of the letter of the Federal Tax Service of Russia dated September 20, 2013 No. AS-4-2/16981.

Situation: is the inspection obliged to attach to the report handed over to the organization evidence of violations that were identified during a tax audit (on-site, office)?

If documents received from the organization being inspected serve as evidence of a violation, then the inspectorate is not obliged to attach such evidence to the inspection report.

In this case, the following features must be taken into account.

If evidence of a violation is provided by documents received from other sources (for example, documents from counterparties, protocols for interviewing witnesses), then the inspectorate must attach such evidence to the tax audit report. This obligation remains even if information received from third parties:

- constitute a banking, tax or other secret protected by law (for example, commercial);

- contain personal data of citizens.

In these cases, not complete copies of documents, but extracts from them certified by the inspectorate should be attached to the tax audit report.

This procedure is established by paragraph 3.1 of Article 100 of the Tax Code of the Russian Federation, paragraph 1.13 of Appendix 6 to the order of the Federal Tax Service of Russia dated December 25, 2006 No. SAE-3-06/892.

General points ↑

The report on the results of an on-site tax audit must be drawn up in a certain way.

In case of violation of the rules established by law and the deadlines for its submission, the person being inspected has the right to sue.

However, judicial practice on this matter is extremely ambiguous. The final court decision depends on many different conditions and factors.

To avoid various shortcomings, it is worth considering in detail the following issues in advance:

- what it is?

- basics of the procedure;

- legal regulation.

What it is

On-site tax audit is one of the types of functions of the Federal Tax Service. When implementing this procedure, tax office employees travel to the location of the enterprise itself.

Such checks are ordered in case of suspicion of truly serious violations of the law. For example, when a company records a loss for several reporting periods in a row, it submits zero reports.

The result of an inspection of this type is always a special act. It lists:

- all errors found while maintaining tax and accounting records;

- requirements for their elimination.

The act has legal force and can be used during legal proceedings as evidence and argumentation. Mandatory.

Failure to comply with instructions in some cases may result in not only administrative, but also criminal liability.

Therefore, it is worth taking the inspection report responsibly, observing the deadlines for drawing up an objection and fulfilling the instructions - if necessary.

The document of this type includes the following main sections:

- name, serial number;

- date of compilation;

- list of persons carrying out inspections;

- place of inspection, start and end date;

- responsible officials on the date of the inspection;

- place of business activity;

- listing of all detected violations;

- proposals, as well as various conclusions of those conducting the inspection.

The bottom part of the report must contain complete information about all persons conducting the inspection. A signature with transcript is required.

Management who has received the inspection report must ensure that it is drawn up correctly.

The presence of gross violations of the format, as well as legal norms, may cause the verification results to be invalidated. It is possible to implement this procedure through the court.

Basics of the procedure

Typically, an on-site tax audit is carried out in relation to a whole group of consolidated taxpayers. The subject of close study is the profit of organizations and taxation.

How to appeal an on-site tax audit report can be found in the article: sample objection to an on-site tax audit report. Read the reasons for conducting a repeat on-site tax audit here.

The utmost attention is paid to compliance with recent amendments to tax legislation. Since most often it is in this segment of reporting that most of all possible errors are made.

In some cases, the verification procedure may be suspended. The list of such situations can include:

| If there is a need to obtain information about foreign counterparties | From foreign government regulatory authorities |

| If you need to carry out an examination | Translation of documentation for verification into Russian |

The format of the act drawn up upon completion of an inspection of this type is drawn up on the basis of the order of the Federal Tax Service of Russia No. SAE-3-06 / [email protected] dated December 25, 2006.

This document is fundamental. If for some reason the person being audited refuses to receive a report with the results, this fact is recorded by the Federal Tax Service.

Subsequently, the documentation is sent to the address of the organization or individual entrepreneur by registered mail - with a list of attachments.

Legal regulation

The procedure for conducting the on-site inspection itself, as well as drawing up the report, must be carried out in full compliance with current legislative norms.

The fundamental documents are the following:

| Article No. 83 of the Tax Code of the Russian Federation | Procedure for keeping records by legal entities |

| Article No. 85 of the Tax Code of the Russian Federation | Obligations are established to notify tax authorities when certain important data changes |

| Article No. 88 of the Tax Code of the Russian Federation | Establishes the procedure for desk inspection |

| Article No. 89 of the Tax Code of the Russian Federation | How and when is an on-site inspection carried out? |

| Article No. 89.1 of the Tax Code of the Russian Federation | On-site inspections for auditing consolidated groups of taxpayers |

| Article No. 89.2 of the Tax Code of the Russian Federation | Conducting on-site inspections of tax payers participating in various types of investment projects |

| Article No. 91 of the Tax Code of the Russian Federation | Obliges tax inspectors to have access to all documents and premises of the enterprise relevant to conducting an audit of the type in question. |

| Article No. 93.1 of the Tax Code of the Russian Federation | Designates the right of the Federal Tax Service to demand data from counterparties conducting commercial transactions with the taxpayer being inspected. |

| Article No. 94 of the Tax Code of the Russian Federation | It is possible to seize documentation |

| Article No. 95 of the Tax Code of the Russian Federation | Possibility of conducting an examination in case of a tax audit |

| Article No. 96 of the Tax Code of the Russian Federation | It is allowed to involve third-party specialists to carry out the verification (translators, others) |

| Article No. 100 of the Tax Code of the Russian Federation | Drawing up an act based on the results of completing the procedure under consideration |

If possible, it is worth familiarizing yourself with the federal legislation affecting this issue, as well as judicial practice.

The latter allows you to assess the chances of resolving the trial in favor of the person being audited. If you have no experience working with inspection reports, you should familiarize yourself with the sample.

Using the example of the act and objections, it is possible to draw up similar documents and avoid standard mistakes. The report on the completion of the on-site inspection is drawn up within the established period.

Decision on the act

Based on all available tax audit materials (on-site audit report; written objections from the organization, protocols, expert opinions, etc.), the inspectorate makes a final decision based on the results of the on-site audit (Clause 1, Article 101 of the Tax Code of the Russian Federation). The inspection must hand over the decision to a legal or authorized representative of the organization. In this case, the authorized representative must have a power of attorney to represent the interests of the organization in the tax inspectorates. For more information about the timing, procedure and rules for processing such a decision, see How a decision is made based on the results of a tax audit.

In a visual form, the stages of conducting an on-site inspection, the procedure for processing its results, the document flow diagram and options for actions of inspectors in various situations are presented in the letter of the Federal Tax Service of Russia dated December 15, 2011 No. AS-4-2/21396, which was sent to all tax inspectorates.

Registration of additional tax control measures

Additional control measures are carried out on the basis of a separate reasoned decision of the head of the Federal Tax Service inspection. Duration: no more than 1 month.

The decision must indicate the reasons for the impossibility of considering the results of the GNP without obtaining new evidence (clause 6 of Article 101 of the Tax Code of the Russian Federation):

- questioning a witness;

- requesting documents;

- or an expert opinion.

The decision is sent to the person being checked. The Federal Tax Service of the Russian Federation recommends simultaneously sending a notification of a call to familiarize yourself with the inspection materials and a new notice of consideration of the inspection materials (clause 5 of letter No. CA-4-9/ [email protected] ).

IMPORTANT! Additional control measures cannot be aimed at identifying new offenses (see the resolution of the Arbitration Court of the Ural District dated May 26, 2017 in case No. A76-9954/2015).

From September 3, 2018, an addition to the tax audit report is drawn up, which reflects (clause 6.1 of Article 101 of the Tax Code of the Russian Federation):

- the beginning and end of additional control measures;

- information about additional measures taken;

- additional evidence received confirming the fact of violation of tax laws;

- conclusions and proposals of inspectors to eliminate violations;

- links to articles of the Tax Code of the Russian Federation, which provide for liability for identified violations.

The inspector is given 15 days from the date of completion of the activities to draw up the document. Within 5 days from the date of preparation, the addition to the tax audit report is transferred to the person being audited.