Procedures possible during an on-site inspection

Inventory (clause 13 of article 89 of the Tax Code of the Russian Federation)

This procedure is necessary to verify the accuracy of the information that the taxpayer indicated in his documents. Here you can also find out other circumstances that may be important during a tax audit.

Inspection (Articles 91, 92 of the Tax Code of the Russian Federation)

The tax authority may examine premises and territories that:

- The taxpayer uses it to generate income.

- Needed to contain the taxable object.

Regardless of their location.

Request for documents (information) (Article 93, 93.1 of the Tax Code of the Russian Federation)

The tax authority appoints a competent employee to audit the taxpayer. The inspector may require documents necessary for the audit.

Seizure (Article 94 of the Tax Code of the Russian Federation)

The seizure is needed to prove that the taxpayer has violated tax laws. Then documents and items are confiscated.

Expertise (Article 95 of the Tax Code of the Russian Federation)

If during an on-site tax audit the need for an examination arises, an agreement is concluded with the expert.

Interrogation (Article 90 of the Tax Code of the Russian Federation)

The witness may be questioned during an on-site tax audit if such a need arises as part of tax control.

Calling as a witness (Article 90 of the Tax Code of the Russian Federation)

Tax authorities can take testimony from every individual who knows a circumstance that is important for tax control.

Obtaining an expert opinion (Article 95 of the Tax Code of the Russian Federation)

If an expert, in the course of his work, learned information that is important for the case, but about which questions were not asked, he can indicate this in his conclusion.

Engaging a translator (Article 97 of the Tax Code of the Russian Federation)

If necessary, you can enter into an agreement with a translator.

Methods for conducting an on-site tax audit

An analysis of the rights and obligations of tax authorities allows us to define the tax audit method as a method or a set of techniques by which tax authorities determine whether the taxpayer complied with the legislation on taxes and fees during the audited period.

There are 2 methods of on-site tax audit:

- Solid

- Selective

As a rule, tax authorities use a comprehensive audit method, since decisions based on the results of random audits may be invalidated.

During the application of the continuous method, the tax authority checks, establishes, requests, and examines all documentation (primary documents, order journals, general ledger, cash book, purchase ledger and sales ledger, invoice journal, income and expense journal, payment orders , tax returns, business agreements, etc.) of the taxpayer for all tax periods covered by the audit.

In particular, tax officials:

1. Checked:

- does the taxpayer keep records;

- availability of documents from the taxpayer required by law;

- the fact of submitting reports to the tax authorities.

2. Installed:

- whether the taxpayer has chosen the correct taxation regime for the type of activity;

- facts with which the Tax Code of the Russian Federation connects the emergence of an obligation to pay taxes;

- compliance by the taxpayer with the requirements of legislation on taxes and fees.

3. Required:

- taxpayer additional documents and necessary explanations;

- documents about the taxpayer from third parties, organizations, contractors of the taxpayer;

4. Researched:

- the correctness of the documents and the presence of the necessary details in them;

- accuracy and completeness of document recording;

- the correctness of the taxpayer’s determination of the taxable object, tax base, etc.;

- completeness and correctness of tax calculation, as well as timeliness, completeness and correctness of its payment to the appropriate budget;

- timeliness and accuracy of reporting to the tax authority.

Documents are analyzed and compared, among other things, with documents received from third-party organizations and contractors of the taxpayer.

Records from primary documents are compared with records from accounting and tax accounting and reporting.

A conclusion is made about the presence or absence of a tax offense.

If facts of a tax offense are revealed, the event and elements of the offense are established, an evidence base is formed, and additional taxes and penalties are assessed.

When conducting an on-site tax audit, only part of the documents for certain tax (reporting) periods are checked using a selective method. Violations of a systematic nature are identified, which are extended by the tax authority to the remaining tax periods.

The choice of method depends on the period being audited, the taxes being audited, the volume of activity of the taxpayer and the number of inspectors.

Renewal terms

The on-site inspection can be extended for up to 4 months, and in exceptional cases - up to 6 (letter of the Ministry of Finance dated November 20, 2009 No. 03-02-07/1-516). An example of such a case is if an organization has 10 or more separate divisions. As for other grounds for extending the inspection for 6 months, the law does not precisely define them. That is, in each specific situation, Federal Tax Service specialists make decisions independently.

But this does not mean that the verification can be extended without reason. If the taxpayer doubts the appropriateness of such a decision by the Federal Tax Service, he can go to court. In practice, there are examples when arbitrators confirmed that there were no grounds for extending the inspection (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated April 1, 2013, No. A43-17631/2012).

Contents of the on-site tax audit report

The on-site tax audit report, like any official document, must be drawn up in the prescribed form.

There are three main requirements for the content of the act:

1) the act is drawn up on paper, in Russian and has continuous page numbering.

Blots, erasures and other corrections are not allowed in the act, with the exception of corrections agreed upon and certified by the signatures of the inspector and the person being inspected (his representative).

If it is necessary to use abbreviated names and generally accepted abbreviations in the text of the act, upon first use, the corresponding phrase is given in full, while its abbreviated name or abbreviation used further in the text is indicated in brackets;

2) on-site tax audit report:

- must contain a systematic presentation of documented facts of violations of the legislation on taxes and fees and other significant circumstances identified during the inspection process, or an indication of the absence thereof, as well as conclusions and proposals of inspectors to eliminate the identified violations and links to articles of the Tax Code of the Russian Federation providing for responsibility for identified tax violations;

- should not contain subjective assumptions of inspectors that are not based on sufficient evidence;

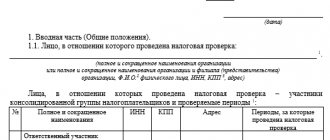

3) the act must consist of three parts: introductory, descriptive and final.

Suspense

In addition to extending the audit, the tax authority may decide to suspend it. This right is given by paragraph 9 of Article 89 of the Tax Code of the Russian Federation. This applies to both inspections of the main organization and inspections of divisions. Suspension means that the GNP is interrupted for a certain period of time, and then resumes again. For example, the audit was carried out over a period of one month. Further, a decision was made to suspend it for 15 days. After 15 days, the inspection continues, while the Federal Tax Service specialists have one more month before its completion.

The total period of suspension of an on-site tax audit (maximum possible) is six months. So it turns out: 6 months of verification + 6 months of suspension = 1 year . An on-site inspection can last exactly that long, and not a day more. The period is calculated from the date of the decision on the inspection until the date of drawing up the certificate of completion of the inspection.

What can and cannot inspectors do during a suspension? The answer is contained in paragraph 9 of Article 89 of the Tax Code of the Russian Federation and is explained in letters of the Federal Tax Service dated November 21, 2013 No. ED-3-2/ [email protected] and dated July 25, 2013 No. AS-4-2/13622. The inspectors must vacate the taxpayer's territory, return to him all original documents, except those seized during seizure, and also stop requiring the submission of new documents. The Federal Tax Service clarifies that during the period of suspension, inspectors are prohibited from seizing documents and items, inspecting, taking inventory, and studying documents on the taxpayer’s territory.

At the same time, inspectors have the right to carry out actions during the suspension that are not related to being on the territory of the inspected entity. The Ministry of Finance believes that this does not contradict the Tax Code (letter dated 05/05/2011 No. 03-02-07/1-156). For example, inspectors may send requests to third parties to provide information on the taxpayer being inspected.

Often during a suspension, inspectors interrogate witnesses. However, whether this is legal or not is a moot point. Such actions become the object of complaints from audited taxpayers.

Completion of on-site tax audit

On the last day of an on-site tax audit, the inspector is obliged to draw up a certificate of the audit, which records the subject of the audit and the timing of its conduct, and hand it over to the taxpayer or his representative.

Thus, the fact of completion of the on-site tax audit is recorded by a certificate. The end date of the inspection must coincide with the date the certificate was prepared. At the same time, the day the certificate is delivered to the taxpayer may differ from the day it was drawn up, which does not change the end date of the audit.

The certificate is signed by all authorized persons.

The tax authority, after drawing up a certificate of the audit, must stop activities for this on-site tax audit.

Why are checks taking so long?

Although the law sets a very specific period for the GNP - 2 months, in practice this event sometimes drags on for more than six months, and this is not the limit. Moreover, this happens on completely legal grounds. After all, suspension and extension of inspection can be used together.

For example, one and a half months after the start of the inspection, the inspectorate decides to suspend the process for a period of two months. At this time, information will be requested from the counterparties of the inspected entity. After the end of this period, it was decided to resume the check for the remaining 2 weeks, plus extend it to another 3 months. As a result, with one suspension and one extension, instead of two months, the inspection takes a 7-month period.

Registration of the results of an on-site tax audit

The Tax Code of the Russian Federation establishes rules for preparing an on-site tax audit, which the tax authority must comply with.

It is not enough for tax officials to establish the facts of a tax offense; it is necessary to correctly document the identified violations.

Thus, based on the results of an on-site tax audit, within two months from the date of drawing up a certificate of an on-site tax audit, authorized officials of the tax authorities must draw up a tax audit report in the prescribed form.

Based on the results of an on-site tax audit of a consolidated group of taxpayers, a tax audit report is drawn up within three months from the date of drawing up a certificate of the on-site tax audit.

Thus, the results of the on-site tax audit are consolidated in the corresponding act, which is drawn up both in the event of detection of violations of the legislation on taxes and fees, and in the absence of such.

Delivery of the on-site tax audit report

The completed and signed on-site tax audit report is handed over to the person in respect of whom the tax audit was carried out.

The tax audit report, within five days from the date of this act, must be delivered to the person in respect of whom the audit was carried out, or his representative against signature, or transferred in another way indicating the date of its receipt by the specified person (his representative).

When conducting a tax audit of a consolidated group of taxpayers, the tax audit report is handed over to the responsible participant of the consolidated group of taxpayers within 10 days from the date of this act.

As a rule, tax authorities do not take measures to deliver the inspection report to the person in respect of whom the inspection was carried out, but are limited to sending it by mail.