What exactly is an objection to a tax audit report used for?

An objection drawn up on behalf of the company allows its management to appeal any actions, results and conclusions of the tax authorities who carried out the tax audit.

There are two main types of violations committed by tax authorities:

- procedural (i.e. errors in the order of the event);

- violations related to substantive law (i.e. incorrect interpretation of any documents, incomplete accounting of provided papers, etc.).

The tax office is obliged to respond to a written objection, regardless of which of these types of violations it is written about.

What you shouldn't complain about

Everything related to the company’s activities in terms of documents, finance, accounting and taxes can and should be appealed in case of disagreement.

But there are some points against which it is not advisable to file an objection with the tax office. This:

- timing of the verification procedure (start and end dates),

- inaccuracies in the preparation of the protocol,

- minor procedural violations.

All these minor details should be ignored at this stage, focusing on the essence of the claim. Here the mark “at this stage” means that they should be reserved for the court, where, if something happens, they can try to discredit the act (i.e., declare it illegal).

In addition, it should be borne in mind that an objection drawn up in accordance with all the rules, with all the necessary papers attached, regarding the audit procedure may well lead to additional control measures on the part of the tax authorities. And their results, in turn, can easily reveal more serious errors and violations in the activities of the enterprise.

How to justify an objection

Before “starting a discussion” with the tax authorities, it is advisable to stock up on one hundred percent arguments and a set of convincing documents certifying the correctness of the organization, which must be added to the objection. To do this, it is necessary to carefully study the tax audit report, and recheck all identified controversial points several times.

If, at the time of writing the tax audit report, the company for some reason lacked some documents, but it managed to restore them as soon as possible or was able to correct minor inaccuracies in the existing papers, this must be reflected in the objection.

This will reduce the amount of additional tax assessed, if any, and also avoid all kinds of fines and penalties.

All your arguments must be carefully and thoroughly explained, indicating the circumstances that led to this or that shortcoming and referring to the legislation of the Russian Federation in the field of taxes, civil law, judicial practice and company regulations.

It will be difficult for tax authorities to argue with well-founded arguments; moreover, if something happens, they will become the evidence base when the company goes to court (if, of course, it comes to that). It should also be noted here that in court it will be possible to raise only those points of the tax audit report that were previously appealed to a higher tax office.

home

Hello! I am pleased to welcome you to the personal website of private lawyer Sergei Pavlovich Mashenkov.

I have been providing legal services for more than 9 years.

My main rule when providing legal services is not just participation in litigation, but also the desire to win every case in which I participate. At the same time, as a lawyer, I do not distinguish between significant and insignificant cases, because for the Principal, every case is important. I provide a full range of legal services: legal advice, representation of the interests of clients in litigation, drafting legal documents of any complexity, examination of contracts, and also provide legal support services for the activities of organizations. By applying for legal assistance, you are guaranteed to receive an individual approach to the study of each case, confidentiality of the information provided, as well as a professional attitude towards the work performed. You can find a specific list of legal services provided in the relevant sections of the site. With respect and hope for mutually beneficial cooperation!

On the site you can find a lot of useful information, in particular:

- the section SAMPLES OF CONTRACTS contains - FORM OF AGREEMENT, EXAMPLE OF AGREEMENT, TEMPLATE OF AGREEMENT, TEXT OF AGREEMENT, FORM OF AGREEMENT, DRAFT AN AGREEMENT;

- the section SAMPLES OF CLAIM contains - CLAIM FORM, EXAMPLE CLAIM, CLAIM TEMPLATE, TEXT OF CLAIM, CLAIM FORM, COMPLETE A CLAIM;

— in the section SAMPLES OF CLAIM STATEMENTS there is a FORM OF CLAIM STATEMENT, EXAMPLE OF A STATEMENT OF CLAIM; TEXT OF THE CLAIM; CLAIM TEMPLATE, CLAIM FORM, COMPLETE A CLAIM STATEMENT;

- in the section SAMPLES OF COMPLAINTS - contains the COMPLAINT FORM, EXAMPLE OF COMPLAINT, COMPLAINT TEMPLATE, TEXT OF THE COMPLAINT, COMPLAINT BANK, COMPLETE A COMPLAINT;

- in the ADDITIONAL AGREEMENTS section - contains an ADDITIONAL AGREEMENT FORM, A SAMPLE ADDITIONAL AGREEMENT, THE TEXT OF AN ADDITIONAL AGREEMENT TO THE AGREEMENT, AN EXAMPLE OF AN ADDITIONAL AGREEMENT, AN ADDITIONAL AGREEMENT TEMPLATE, AN ADDITIONAL AGREEMENT FORM, COMPLETE AN ADDITIONAL AGREEMENT DISCLOSURE;

- in the JOB DESCRIPTIONS section - contains the JOB DESCRIPTION FORM, JOB DESCRIPTION TEMPLATE, JOB DESCRIPTION TEXT, JOB DESCRIPTION EXAMPLE, JOB DESCRIPTION FORM;

— IN THE SECTION SAMPLES OF POWER OF ATTORNEYS — CONTAINS FORM OF POWER OFFER, TEMPLATE OF POWER OF ATTORNEY, EXAMPLE OF POWER OFFER, FORM OF POWER OFFER, TEXT OF POWER OFFER.

I provide legal services in the following areas of law: - Divorce, including determining the place of residence of children and the procedure for communication with them by a parent living separately. Collection of alimony for children until they reach the age of majority and for a spouse until the child reaches the age of three. Drawing up a marriage contract. — Legal advice on labor law. Resolution of labor disputes.

— Development of documents in the field of labor law: employment contract, internal labor regulations, regulations on remuneration, etc. — Consultations on the protection of consumer rights. Settlement of disputes in pre-trial order, preparation of claims, claims for the protection of consumer rights. Representation in court. — Copyrights for works of science, literature and art. Legal support when using copyrights. Copyright protection. Read more. — Legal services in land, housing and other areas of law. Representation of interests in cases of deprivation of a driver's license. Drawing up a contract and its examination, as well as other legal assistance from a lawyer.

Lawyer

Mashenkov Sergey Pavlovich

Share on social networks:

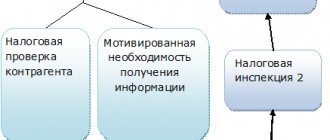

Where and how to file an objection

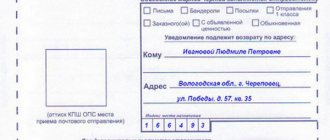

The objection should be submitted to the address of the territorial tax service, whose specialists carried out the audit. The document can be transferred:

- personally “hand to hand”,

- by sending it by registered mail with return receipt requested.

Both of these methods ensure that tax authorities receive the objection in a timely manner.

Today, another proven option for document delivery has become widespread: through electronic services , but only on condition that the organization has an officially registered digital signature.

Deadlines for preparing a controversial document

The time frame for preparing the report depends on the type of inspection and varies as follows:

- ten days after completion (we are always talking about working days, unless otherwise indicated) - in case of office;

- within two months from the date of drawing up the certificate of conduct - in the case of an on-site event;

- within three months from the date of drawing up the certificate of conduct - for an on-site, relatively consolidated group of taxpayers (Chapter 3.1 of the Tax Code).

The NP act is handed over to the person who was inspected (or his representative against signature) within five days from its date. This document can be transmitted in another way, which indicates the date of its receipt.

Evasion from receiving the document is recorded in it, after which it is sent by registered mail to the location of the organization (separate unit) or the place of residence of the individual. In this case, the date of delivery is considered to be the sixth day after sending the registered letter.

If a consolidated group of taxpayers was audited, the report (within ten days from its date) is handed over to the responsible member of the specified group.

For a foreign organization that does not have a separate branch on the territory of the Russian Federation (minus an international organization, a diplomatic mission, a foreign organization that is registered for taxation under clause 4.6 of Article 83 of the Tax Code), the NP act is sent by mail (registered mail) to the address from the single state register of taxpayers. In this case, the 20th day after sending the registered letter will be the date of delivery of the document.

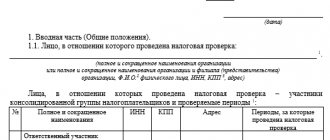

Main nuances in drawing up an objection

To date, there is no strictly established sample of an objection to a tax audit report. Employees of enterprises and organizations can draw up a document in any form, based on their understanding of it.

In this case, it is advisable to take into account some office work norms and rules for writing business documentation. In particular, the objection must indicate:

- addressee, i.e. the name, number and address of the exact tax office to which the objection is sent,

- sender information (company name and address),

- number of the objection and the date of its preparation.

In the main part it should be indicated

- the act in respect of which an objection is being drawn up,

- describe in detail the essence of the claim, including all available reasons and arguments.

The document must refer to the laws that confirm the correctness of the author of the objection and indicate all additional papers attached to it (marking them as a separate attachment).

When should you file an objection?

Tax Code of the Russian Federation, in particular paragraph 6 of Art. 100, gives the opportunity to the person in respect of whom the audit was carried out to submit written objections to the tax authority regarding the control measures act as a whole or regarding their individual provisions. Objections can be filed, for example, in case of disagreement with the facts, conclusions or proposals of the inspectors stated in the inspection report. In this way, you can convey your vision of the violations that the inspectors discovered. For example, some documents supporting a position were mistakenly not taken into account during the review. The issue with the testimony of the necessary witnesses who were not indicated in the inspection report is especially acute. It happens that the inspector made a mistake in the calculations or incorrectly interpreted the norm of the Tax Code. In this regard, there is the right to appeal both the entire act and its individual provisions.

SPS ConsultantPlus will help you correctly fill out tax calculations, determine deadlines and avoid penalties.

What to pay attention to when preparing a document

Neither the Federal Tax Service in its acts nor the law regulates the filing of an objection in any way. That is, it can be written by hand or printed on a computer on an ordinary A4 sheet or on company letterhead.

It is strictly important to comply with only one condition: the objection must be signed by the head of the enterprise or an employee authorized to create such documents. If the form is endorsed by a proxy, it must also indicate the number and date of the power of attorney.

Today it is not necessary to certify an objection with a stamp, since since 2016, enterprises and organizations have every right not to use stamped products in their work (unless this norm is prescribed in the local regulations of the company).

The document should be drawn up in two copies , one of which should be submitted to the tax office, the second, after the tax specialist has marked the acceptance of the document, should be kept.