Who is objecting to what?

Among the rights of tax authorities (under Article 31 of the Tax Code of the Russian Federation) is the conduct of tax audits (TA) - a set of procedures that monitor the accuracy of calculations, as well as the completeness and timeliness of payment of mandatory payments. Control can be desk-based or on-site. In the first case, employees of the Federal Tax Service analyze the information provided by the person being checked, plus the data they have, in their office offices. In the second case, the specified analysis is carried out where the person being tested is located. They can check:

- taxpayers;

- payers of fees and insurance premiums;

- tax agents.

The results of the inspection (the presence of violations or their absence) are reflected in the act, its form is determined by Appendix No. 23 to the order of the Federal Tax Service of Russia dated 05/08/2015 N ММВ-7-2 / [email protected] Violations identified by the inspection most often become the reason for documented objections . Moreover, they can be submitted both regarding the entire list of identified violations, and part of it.

How to calculate the expiration date for filing written objections to an act?

According to the rules of Article 6.1 of the Tax Code of the Russian Federation, deadlines calculated in months expire on the corresponding month and day of the last month of the period. The article contains two clauses regarding the expiration date:

1) If there is no corresponding date in the month of expiration (for example, the 31st day, or “the end of February”), in such a month the period calculated in months ends on the last day of the month.

2) If the last day of the period falls on a weekend, non-working day, or holiday, the end of the period is considered to be the first working day following them.

Taking into account the rules of Part 6 of Article 100 of the Tax Code of the Russian Federation, it is possible to file objections to a tax audit report within one month, therefore, the period for objections to a tax audit report expires next month on the calendar date following the date of the month of delivery of the act.

For example:

The desk tax audit report was handed over to the taxpayer on December 28, 2022, taking into account the above rules of Articles 6.1 and 100 of the Tax Code of the Russian Federation, the deadline for objections to the report expires on January 29, 2022.

If the desk tax audit report was delivered to the taxpayer on January 29, 2022, taking into account the above rules of Articles 6.1 and 100 of the Tax Code of the Russian Federation, the deadline for objections to the report expires on March 01, 2022. (The period must expire on February 29, 2022, but this date is missing in 2022, therefore, the month period expires on the first following business day).

Deadlines for preparing a controversial document

The time frame for preparing the report depends on the type of inspection and varies as follows:

- ten days after completion (we are always talking about working days, unless otherwise indicated) - in case of office;

- within two months from the date of drawing up the certificate of conduct - in the case of an on-site event;

- within three months from the date of drawing up the certificate of conduct - for an on-site, relatively consolidated group of taxpayers (Chapter 3.1 of the Tax Code).

The NP act is handed over to the person who was inspected (or his representative against signature) within five days from its date. This document can be transmitted in another way, which indicates the date of its receipt.

Evasion from receiving the document is recorded in it, after which it is sent by registered mail to the location of the organization (separate unit) or the place of residence of the individual. In this case, the date of delivery is considered to be the sixth day after sending the registered letter.

If a consolidated group of taxpayers was audited, the report (within ten days from its date) is handed over to the responsible member of the specified group.

For a foreign organization that does not have a separate branch on the territory of the Russian Federation (minus an international organization, a diplomatic mission, a foreign organization that is registered for taxation under clause 4.6 of Article 83 of the Tax Code), the NP act is sent by mail (registered mail) to the address from the single state register of taxpayers. In this case, the 20th day after sending the registered letter will be the date of delivery of the document.

How to file an objection?

You can submit objections to the inspectorate that drew up the report in the following way:

- personally or through a representative. To do this, we prepare two copies so that on one of them the inspection officer puts a mark on accepting objections;

- send by mail to the inspection address. This option does not always work, since by the time the act is considered, objections may not yet have been received, and then the inspection will not take them into account. But if you send them by mail, then you need to send them with a reserve (6-10 working days before the date of consideration of the act). It is best to send objections by a valuable letter with a list of attachments. This way you can track its delivery and get proof that it was the objections that were sent, and not some other document.

The tax authority is obliged to investigate objections and, if there are grounds, take them into account when considering tax audit materials (clause 4 of Article 101 of the Tax Code of the Russian Federation).

Typical situations in SPS ConsultantPlus will allow an accountant to quickly resolve issues that he encounters on a daily basis.

How and when to submit written objections

Filing objections to tax audit reports (personally or through a representative) occurs in one of the following ways:

- via mail;

- through the office or the window for receiving tax documents.

Let us remind you: if you disagree with the facts noted in the IR act, as well as with the conclusions and proposals of the tax authorities, the person who was inspected (his representative) has the right to submit written objections to the document in whole or in part to the tax authority that conducted the inspection.

A month is given for this from the date of receipt of the document. Moreover, the specified paper can be supplemented with documents (their certified copies) confirming the validity of the protest.

How to prepare objections?

You can submit your objections orally or in writing. It is better to do this in writing, and when considering the inspection materials, you can supplement the objections orally. This is enshrined in paragraph 6 of Art. 100 of the Tax Code of the Russian Federation, as well as in the Information of the Federal Tax Service of Russia “Filing objections to tax audit reports”, posted on the official website.

Here, the Federal Tax Service of Russia provides the recommended form of objections to the tax audit report. But since there are no mandatory requirements for written objections, you can draw them up in a form or use sample documents posted in the ConsultantPlus legal reference system.

Ready-made solutions from SPS ConsultantPlus will tell you how to act in a specific situation: step-by-step instructions, sample documents, links to legal acts.

The structure of objections may have the following parts.

Introductory part, which indicates:

- name and address of the tax office;

- name, address, INN/KPP of the organization;

- number and date of the on-site or desk inspection report.

The descriptive part should contain:

- facts and conclusions from the inspection report that you do not agree with, and the rationale for why you do not agree with them;

- references to legal acts as amended in force during the disputed period;

- links to official explanations of the Ministry of Finance of Russia, the Federal Tax Service of Russia or the regional Office of the Federal Tax Service of Russia. If your inspection provided written explanations on controversial issues, we recommend that you refer to them;

- links to judicial practice that confirms your conclusions. We recommend that you first use the decisions of the highest courts, as well as judicial practice in your judicial district or in other districts;

- if you believe that there are circumstances mitigating liability, as well as circumstances excluding prosecution, indicate them;

(Mitigating circumstances may not be included in the objections, but stated separately. To do this, we draw up and send to the inspectorate a petition to reduce the fine.)

- links to documents that confirm the validity of the objections. Please attach these documents (their certified copies) to your objections.

Results (final) part:

- Let's summarize everything said above. For example, that no arrears have arisen, therefore there are no grounds for charging fines and penalties for late payment of tax;

- We indicate that we are asking for a decision to refuse to prosecute for committing a tax offense;

- We list supporting documents that we attach to support our arguments.

How they are drawn up and what is noted in objections

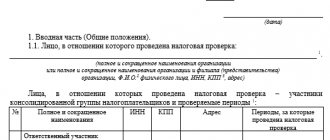

The document is drawn up in writing, in compliance with the following structure (of three parts):

- Introductory - informs about the inspection itself, its grounds, the actual time of the inspection, the composition of the inspectors, the number and date of the document being disputed.

- Descriptive - here the person being checked has the right to present all his arguments and arguments (both indisputable and doubtful) in detail and consistently, with maximum justification.

- Resolution (final) - where both the total additional charge of payments, with which the person being inspected does not agree (broken down by periods and amounts), and the amount of tax that is refused to be reimbursed can be indicated.

Acts of the tax authority

The tax authority accompanies the results of certain actions (tax audits, detection of tax violations) by issuing a report, which is handed to the taxpayer.

Type of tax control

Desk tax audit (CTA)

Presentation of results (note)

Tax audit report (drawed up only if inspectors identify violations - clause 5 of Article 88 of the Tax Code of the Russian Federation)

Deadlines for processing tax control results

10 working days from the date of completion of the inspection (paragraph 2, paragraph 1, article 100 of the Tax Code of the Russian Federation)

Type of tax control

On-site tax audit (VNP)

Presentation of results (note)

Tax audit report (drawn up regardless of the results of the audit)

Deadlines for processing tax control results

Two months from the date of drawing up a certificate of on-site tax audit (paragraph 1, paragraph 1, article 100 of the Tax Code of the Russian Federation).

Type of tax control

Detection of facts indicating violations of the legislation on taxes and fees, responsibility for which is established by the Tax Code of the Russian Federation

Presentation of results (note)

Act on the discovery of facts indicating tax violations

Deadlines for processing tax control results

10 days from the date of detection of the specified violation (clause 1 of Article 101.4 of the Tax Code of the Russian Federation)

What happens after filing written objections?

The head of the inspection body or his deputy considers written objections to the results of the inspection. This can happen either in the presence of the objector or without him. In any case, the specified person is notified of the time and place of such consideration. If there is inadequate notification of this or in the absence of the person being inspected, when his appearance is required, the consideration will be postponed. When appearing for consideration, you can explain the situation (both verbally and in documents).

The result of the review is a specific decision that appears ten days after the end of the month for appeal. They may consider the relevant materials and make a final decision longer, up to a month.

The final solution could be:

- carrying out such additional control measures as requesting documents, questioning a witness, examination;

- prosecution for tax violation;

- denial of this.

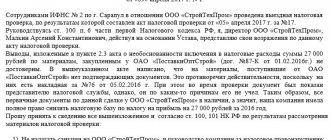

Sample objection to an on-site inspection report

Here is a sample of an objection to an on-site audit report conducted by the tax authorities.

To Interdistrict Inspectorate of the Federal Tax Service No. 46 for Moscow

125373, Moscow, Pokhodny proezd, building 3, building 2

25.08.2020

Objections to the on-site tax audit report

LLC "Electrotech" No. 452-52/3 dated 08/18/2020

Interdistrict Inspectorate of the Federal Tax Service No. 46 for Moscow during the period from 05/10/2020 to 07/09/2020 conducted an on-site tax audit of the limited liability company "Electrotech" (hereinafter referred to as the Company) on compliance with the legislation of the Russian Federation in the field of taxes and fees for 2017–2019 .

Based on the results of this inspection, the Company received Act No. 452-52/3 dated 08/07/2020 on August 20, 2020 (hereinafter referred to as the Act).

The society has familiarized itself with the act and expresses its disagreement with the facts set out in it, as well as with the conclusions and proposals of the tax inspectors.

In accordance with paragraph 6 of Art. 100 of the Tax Code of the Russian Federation, the Company submits its objections to the on-site tax audit report.

The tax authority, in clause 2.2.3 of the act, established the fact of violation of tax legislation through illegal reimbursement from the budget of value added tax in the amount of 350,528.40 rubles. (three hundred fifty thousand five hundred twenty-eight rubles 40 kopecks) in the 4th quarter of 2022.

The company was asked to pay value added tax in the amount of RUB 350,528.40. and penalties in the amount of RUB 15,358.03.

The tax authority concluded that when purchasing production equipment for a total amount of RUB 2,297,908.40. At the limited liability company "Tristan", the Company did not take measures to establish the integrity of the counterparty, which submitted zero value added tax returns for the 4th quarter of 2022.

However, we consider this conclusion to be incorrect because:

- When concluding the agreement, Tristan LLC presented an extract from the Unified State Register of Legal Entities, which indicated that Tristan LLC was registered in 2012 and is engaged in the wholesale trade of electrical equipment (a copy of the extract from the Unified State Register of Legal Entities is attached).

- Tristan LLC provided a certified copy of the certificate of registration as a VAT payer (a copy of the certificate is attached).

- The society did not know and could not know that Tristan LLC was committing any violations when calculating taxes and submitting tax returns.

- The equipment purchased from Tristan LLC was fully paid for during the 3rd and 4th quarters of 2022 and put into operation on December 1, 2019 (payment orders No. 358 dated September 10, 2019, No. 402 dated October 15, 2019 and commissioning certificate dated December 1 .2019 attached).

Considering the above, in accordance with Art. 100, 101 of the Tax Code of the Russian Federation, we ask, based on the results of consideration of the materials of the on-site tax audit of Elektrotekh LLC, to make a decision to refuse to prosecute for committing a tax offense.

Appendix: according to the text.

Director Komissarov Yu. V.

Chief accountant Yusupova I. N.

The procedure for considering taxpayer objections is discussed in detail in the Federal Tax Service Information. Get trial access to ConsultantPlus and read the tax authorities’ arguments for free.