When to check

An order is usually drawn up by order of the manager in a planned or unscheduled manner. The chief accountant or another accounting employee is responsible for this, and if he is ill or absent, the person authorized to maintain accounting records.

Inventory is required in several cases (clause 27 of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n):

- before preparing annual reports (you will need to inventory all assets and liabilities);

- when changing financially responsible persons, including those related to the transfer of property to third parties (an order is drawn up to conduct an inventory in connection with the change of financially responsible person in the organization);

- after emergency situations - fires, floods, other disasters;

- upon detection of theft or damage to property.

ConsultantPlus experts discussed how to properly conduct an inventory. Use these instructions for free.

We fill out an order to conduct an inventory (form INV-22)

Most administrative documents have a similar form of completion. This also applies to order INV-22.

At the top of the form you must provide the following information:

- Actual name of the legal entity;

- Indicate the division of the company (enterprise), if inventory of goods and materials is not carried out throughout the entire enterprise, but only in a department or division;

- Indicate the order number, the date of its execution;

- Next, fill in the line “to conduct an inventory.” It indicates property and material assets that require verification or recalculation.

- Below is a list of members of the commission, which includes members of the management team of the enterprise, representatives of the company’s accounting department and the financially responsible person.

It is imperative to fill in the form with the details of all members of the commission, indicate the full name and position of the commission member. Members of the commission sign opposite these records.

Below you need to indicate the property (raw materials, liabilities, assets, etc.) that are subject to inventory. The start and end date of the scan is indicated. You must also indicate the purpose of the inspection. This could be a change of financially responsible persons at the enterprise (company), a revaluation of inventory items or a control check.

During the inspection of inventory items, data is entered into the inventory columns.

- To account for OS, enterprises use .

- To carry out an inventory of all available intangible assets, enterprises perform.

- To record inventory items, inventory INV-3 is filled out.

After filling out the inventory, it is submitted to the accounting department. Next, the accountant enters the actual data into the statement and finds discrepancies, if any.

To account for fixed assets and intangible assets, it is mandatory to fill out a matching statement in the form.

For inventory items, fill out the form.

The inventory result in quantitative and price terms is indicated in the INV-26 statement ().

After the inventory is completed, all forms are first prepared and filled out, and then submitted on the same day. All forms are signed, approved by the head of the enterprise, and stamped.

How to draw up an order for inspection using form No. INV-22

Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 approved form No. INV-22. Form INV-22 is used regardless of what the proceedings involve, whether it is full or partial, whether it was planned in advance or carried out unexpectedly. Commercial organizations and non-profit organizations have the right to use not only a unified form, but also forms of their own design.

The order contains:

- the specific purpose of the conduct is an inventory of goods, fixed assets, assets, receivables, and all property;

- listing the divisions of the organization where the inspection will be carried out, for example, only in a warehouse or in another department, throughout the company;

- period and duration of the event - from what date to what date, when to provide the results of verification actions;

- composition of the commission, including full name its chairman - it is allowed to include not only company employees capable of assessing the state of property and liabilities, but also third-party auditors;

- information about the order: its date, number, information about the manager who signed the order.

Once the establishing document has been prepared, it must be recorded in a journal to record control over the implementation of such decisions. Take the corresponding register form from Goskomstat Resolution No. 88 - form No. INV-23. This is not necessary; companies are allowed to develop their own version of the magazine, but for convenience, use the template proposed by officials.

It is important that all employees listed in it are familiar with the order. They place their signatures directly on the sheet containing data on the upcoming inspection, or on a separate sheet for familiarization with the document, which is filed with the order.

The intention to compare goods, inventories, and valuables on paper and in reality must be notified and signed by the financially responsible persons of the department where the reconciliation is being carried out.

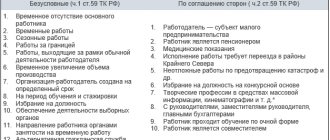

When is inventory required?

Order of the Ministry of Finance No. 49 dated June 13, 1995 states what an inventory is - checking the condition of an organization’s property and comparing actual indicators with accounting information.

This is a mandatory annual procedure: it is carried out before the preparation of annual financial statements. But these are not all cases when such reconciliation is required. Federal and industry standards stipulate who must carry out an inventory in an organization without fail - an inventory commission (permanent or working) when certain situations occur (Part 3 of Article 11 402-FZ dated 12/06/2011, clause 1.5 of the Guidelines from the order Ministry of Finance No. 49). These include:

- annual reporting;

- change of MOL (financially responsible person) who is responsible for inventory items;

- detection of theft, damage, abuse of goods and materials;

- reorganization and liquidation of the enterprise;

- natural disasters, fires or other emergencies.

The regulatory procedure for conducting and recording the results of inventory of inventory items is prescribed in the Guidelines approved by Order of the Ministry of Finance No. 49. Inventory items include goods, tangible assets and finished products. During the annual reconciliation, all inventory items are checked. But when the MOL is changed or theft is carried out, a random check is carried out - for a specific area.

IMPORTANT!

The commission inventories its own inventory and materials on the balance sheet and materials on off-balance sheet accounts, the ownership rights to which belong to other organizations (goods in storage, materials in processing, leased property).

How to draw up an order for inventory of fixed assets

Step 1. In the appropriate fields, enter the name of the organization (IP), indicate OKPO, specify the order number and the date of its preparation.

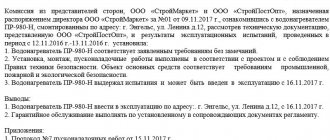

Step 2. We clarify what event is being held and which employee is participating in it: the order contains full full names. employees, but when listing it is allowed to abbreviate their names and patronymics.

Step 3. We indicate what needs to be checked and in which department, we explain the reasons why it is necessary to compare real stocks, valuables, goods and those indicated in the documents. In our case, an example of the reason for inventory in the order contains the wording:

“Identification of the fact of theft of valuables from a warehouse by a security guard.”

At the same time, we enter the start and end dates of the property condition analysis procedure.

Step 4. The last thing is to determine the last date for submitting the report based on the results of the reconciliation, and sign it with the manager who appointed the inspection.

Ready-made sample order for inventory of fixed assets 2021:

Step-by-step instructions for drawing up an order

Step 1. Specify the name of the document.

Step 2. In the appropriate fields, enter the name of the organization (IP), indicate OKPO, and write the date of compilation.

Step 3. Fill out the main part of the order. Here you should clarify the type of inspection and its goals, list the members of the inventory commission participating in the event and its chairman. Their names and patronymics may be abbreviated.

Step 4. We indicate which material assets and in which departments and separate divisions of the company should be checked.

Step 5. We indicate the exact timing of the inspection with its start and end dates.

Step 6. We inform you about the reasons for the need to inventory valuables.

Step 7. We indicate the deadline for submitting the audit results to the accounting department.

Step 8. We certify the document from the manager.

Step 9. Assign a number and register it in a special journal.

Step 10. We introduce it to all interested parties, including employees of departments and divisions where the inspection will take place.

Taking into account all the rules, we offer another sample order for inventory of goods and materials - in connection with the identification of facts of theft of property.

After publication, the local act is registered in a special journal to record control over the implementation of such decisions. Its recommended form is presented in Goskomstat Resolution No. 88 (Form No. INV-23), but it is not prohibited to develop your own.

All employees listed in it must be familiarized with the order. They sign the acquaintance directly on the form or on a separate sheet of acquaintance with the document, which is filed with the order.

ConsultantPlus experts have sorted out when it is necessary to carry out an inventory. Use these instructions for free.

Drawing up an order in any form

The order can also be drawn up in any form. But there is a list of information and details that must be indicated in an official document:

- company name;

- date of preparation and document number;

- objects and purpose of the inspection;

- list of departments involved;

- period;

- deadlines for providing results;

- composition of the commission indicating the last names, first names, patronymics and positions of each of its members;

- last name, first name, patronymic and signature of the manager.

Registration of inventory results

The verification consists of comparing and contrasting the actual volumes of values with those recorded in the primary documents. First, members of the commission get acquainted with the inventories of existing valuables, goods, and supplies. They then compare the property on hand to what is on paper.

At the end of the counting and comparison procedure, the commission members draw up documents containing the results of the inspection. Most often this is not one document, but several. Thus, the identified discrepancies are recorded in the results sheet. As a template for such a document, use form No. INV-26 from State Statistics Committee Resolution No. 26 of March 27, 2000.

Documents for recording the results of the inventory are drawn up after it is completed. For example, if your organization conducted an inventory before drawing up annual reports in December 2021, then you are allowed to draw up documents based on its results as early as January 2022. If a discrepancy is identified between actual data and accounting data, then they must be recorded in the reconciliation statement. A separate comparison sheet is drawn up for objects in custody or leased objects.

The accountant draws up a matching statement in two copies. One of them will remain in the accounting department, the second will be transferred to the financially responsible person.

Later, the results are discussed at a special meeting of the permanent inventory commission, which is the basis for drawing up a protocol. There is no approved form for the protocol, so the main requirements are to correctly indicate the data from the order on the initiation of control measures, about the members of the commission, and the discrepancies identified. If there are no discrepancies, this must be documented. At the same time, the commission puts forward proposals to capitalize, write off the identified surpluses (deficiencies), and reflect them on the balance sheet. In addition, it is permissible to record other initiatives in the protocol, for example, to strengthen security in order to avoid theft in the future. So, the list of final documents contains the following papers:

- results record sheet;

- comparison sheet of inventory results;

- a comparative statement of the results of the inventory of valuables owned by the organization;

- a comparative statement of the results of the inventory of rented objects;

- inventory list;

- explanatory letter.

Download the inventory order. Form and form INV-22

Download sample forms for inventory at the enterprise: INV-1 Inventory list INV-1a Inventory list of intangible assets INV-4 Inventory of shipped ]INV-5 Inventory of goods and materials accepted for storage[/anchor] INV-6 Inventory of goods and materials in transit INV-15 Inventory of availability fundsINV-17 Inventory of settlements with buyers and suppliersINV-18 Comparison sheet of inventory resultsINV-19 Comparison sheet of inventory items INV-26 Accounting for inventory resultsHow is an inventory of materials carried out?

Summarizing

After the commission has completed the inventory, a meeting is held. During it, the main results and identified discrepancies are determined. At the same time, the cause of the discrepancies and ways to correct the situation are determined. Based on the results, minutes of the meeting are drawn up. Typically this document has the following structure:

- name of the company indicating the organizational and legal form;

- the name of the unit where the inventory was carried out;

- name of the document - protocol of the inventory commission;

- list of commission members indicating surnames, initials and positions;

- description of the test results;

- list of speakers at the meeting;

- decision;

- conclusion of the commission;

- identified violations (if any);

- those responsible for the violation, indicating their surnames, initials and positions;

- information about measures to eliminate violations;

- signatures of the chairman and all members of the commission;

- applications.

The following documents are attached as appendices to the minutes of the meeting:

- acts and inventories of the inventory carried out according to INV forms for each materially responsible employee, facility, warehouse or division;

- list of products unsuitable for further use;

- a list of missing or excess products with an indication of price;

- explanatory notes from financially responsible employees or other officials.

We would like to add that at the meeting the commission must make the following proposals:

- on the timing and methods of eliminating shortages, on conducting internal investigations (if a shortage is detected);

- on the continued use of obsolete and unsuitable products for subsequent use;

- other proposals regarding working with tested values.

If no violations were found during the inspection, then there is no need to draw up a protocol.

Based on such a protocol, the manager issues a final order.

The procedure for conducting a cash register inventory

Immediately before the start of the inventory, all cash transactions are stopped, and the commission is provided with the latest incoming and outgoing cash documents. Financially responsible persons confirm that all expenditure and receipt documents have been submitted to the accounting department or transferred to the commission, all valuables received under their responsibility have been capitalized, and all withdrawn funds are written off as expenses.

Next, the cash register inventory itself is carried out, which includes a full count of the available cash in the cash register. The money is recounted under the strict supervision of all members of the commission. The identified amount of funds is compared with the balances according to primary documents and the accounting program, and cash register indicators are also checked.

If the organization carries out cash payments using cash registers, the cash register inventory begins with checking the actual availability of cash register equipment in the operating cash registers, and documents related to the acquisition, registration and commissioning of each cash register must be available.

In practice, three options for the result of a cash register inventory are possible: compliance of accounting data with the actual availability of funds, a shortage is identified, and a surplus of funds in the cash register is detected.

Order based on inventory results

This document necessarily reflects the “reaction” of management to the proposals of the commission members and specific instructions on what needs to be done: conduct an additional inspection, punish the perpetrators, introduce additional security measures. The manager sometimes reserves control over the execution of orders. Let's take a closer look at the structure of the order. It, like a similar administrative document, is drawn up according to certain rules. Its structure must contain the following points:

- name of the organization and its legal form;

- details (it is convenient to use a letterhead);

- date and order number;

- preamble, which lists all the documents regulating the inventory audit (inventory acts, matching and accounting statements, audit protocol);

- order part.

The last part of the order reflects the following points:

- the results of the inspection are subject to approval;

- it is necessary to indicate the requirement to resolve discrepancies identified during the inventory and recorded in the relevant documents;

- an employee is appointed, usually from the accounting department, who is responsible for fulfilling the requirements of this order related to the elimination of discrepancies previously identified during the audit;

- an employee is appointed responsible for monitoring the implementation of the orders recorded in the provisions of the order on summing up the results.

After the order is signed by the first person of the company, the form is handed over to the responsible employee who is authorized to familiarize the designated employees with the provisions of the order against signature.