New personal income tax rate in personal income tax payment orders

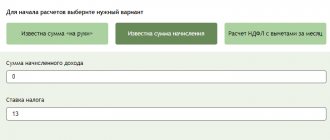

From 2022, a new personal income tax rate of 15% is used for income over 5 million rubles and only for an amount exceeding the specified threshold. This rate applies to income from abroad, dividends, wages, business activities and other income. An exception is the sale of property, which is subject to a 13% tax, regardless of the amount. Insurance and pension payments are deducted from the tax rate.

If income comes from several sources, and the amount for each does not exceed 5 million rubles, tax agents withhold 13%. At the end of the year, the Federal Tax Service summarizes receipts and, if they exceed the threshold, recalculates the tax. The payer will receive a notification that he owes to the budget. The missing amount will have to be paid additionally.

Personal income tax on interest on bank deposits

Amounts exceeding a certain threshold are subject to tax at a rate of 13%. The limit is calculated on the first day of the tax period using the formula:

1 million rubles x key rate of the Central Bank of the Russian Federation

The key rate of the Central Bank of the Russian Federation as of January 1, 2022 was 6.5%. This means that if the amount of interest on the deposit (not the deposit itself) does not exceed 65,000 rubles, then you will not have to pay tax.

There is an exception. Escrow accounts are not subject to taxation - conditional accounts executed upon the occurrence of stated conditions, and ruble deposits with a rate not exceeding 1% per annum.

The new rules came into force in 2022. The tax on them will be paid for the first time in 2022.

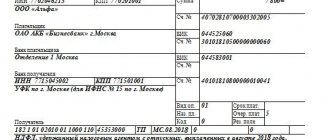

Sample payment order for transfer

It is clear that dividends are the profit that a shareholder or founder expects to receive at the end of the year. And this is a completely legitimate desire, since he invested certain funds by purchasing shares and now wants to make a profit.

He will not receive it if at the end of the year the enterprise is declared bankrupt or simply does not generate any income, but simply pays for itself, with the obligatory payment of all necessary taxes and salaries, as well as other obligations.

If the profit is received, the decision on payments is made, then it needs to be made. And in this case, there is no special document that should be provided in this case. Therefore you can use the following:

- form for payment of money from the cash register or when transferring to an account;

- accounts to shareholders, payments to whom are made in non-cash form.

Here is a sample payment slip for the payment of dividends to individuals: download

For an organization, such a payment document looks somewhat different, although, in essence, it is not very different.

Sample payment order for payment of dividends to a legal entity: download

Correct execution of a payment order for the transfer of profit received is a guarantee of its timely receipt, and therefore evidence that the company founded by shareholders is thriving.

New details of personal income tax payment orders in 2022

In the 2022 personal income tax payment order, a new budget classification code (KBK) has appeared for a tax rate of 15%. If some employees have income exceeding 5 million rubles, fill out two payments.

KBK codes for personal income tax in 2022

| Purpose of payment | Principal amount | Penalty | Fine |

| Personal income tax 13% | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax 15% | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax paid by individual entrepreneurs and individuals engaged in private practice | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Self-pay tax, including on the sale of personal property | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits from foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on profits from foreign companies in rubles issued after 01/01/2017 | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax for foreigners working on a patent | 182 1 0100 110 |

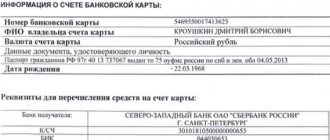

Changes in the payment order for the payment of personal income tax affected the section “Information about the recipient’s bank”:

- new BIC of the recipient's bank;

- name of the recipient's bank;

- bank account number;

- recipient's account number (treasury account);

- bank account number of the territorial body of the Treasury in the divisions of the Central Bank of the Russian Federation on balance sheet account No. 40101.

From May 1, 2022, the old-style personal income tax payment order will not be accepted.

Directing funds to the budget

In 2022, filling out and submitting personal income tax reports on time is not enough if you need funds to pay income taxes to be taken into account in the budget in accordance with their purpose.

To do this, you must fill out a payment order to the Federal Tax Service in accordance with all official requirements. Otherwise, the organization and the federal treasury itself may simply not see the transferred funds. Then you will have to:

- clarify all payment details;

- check details;

- look for the mistake made.

Nobody says that the amounts paid will be lost. However, sometimes legal entities and individual entrepreneurs with staff, as a safety net, have to re-transmit the required amount in order to avoid troubles with relations with the Federal Tax Service.

Thus, paying personal income tax in 2022 with a payment order that is generated according to a specific model requires close attention to avoid making a mistake. Here is a payment order form that in 2022 legal entities can use for the purpose of transferring personal income tax.

The form of payment order for personal income tax of the 2022 sample has not changed.

The form of the payment order is given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. The payment order for the payment of tax should be filled out according to the Rules established in Appendices No. 1, No. 2, No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

Payment orders for personal income tax: what needs to be taken into account

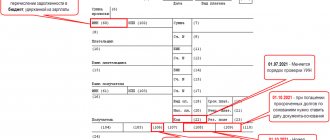

- Line 101 - payer status, filled in in all cases. Each tax payer has its own code. For example, 01 is a legal entity, 02 is a tax agent, and from 09 to 12 are self-employed.

- The OKTMO code is entered in line 105. Please note that they have changed as of 01/01/2021. Before filling out, check the relevance on the website of the Federal Tax Service of your region.

- If you pay tax in the current period, then the code “TP” is entered in line 106. The field is filled in when transferring payment of taxes and fees, payments related to foreign economic activity.

- Line 107 is intended to indicate the tax period. The date is indicated in the following format: MS:01.2021 - income tax for January 2022.

Also, when filling out a personal income tax payment order, pay attention to the order of transfer. For those calculated and paid independently, code “15” is entered, for those listed at the request of the tax office, code “3”. Line 22 is set to “0” for current payments. A unique number is assigned when listing fines, arrears, and penalties.

Deadlines for transferring personal income tax

A payment order for the transfer of personal income tax must be generated and the tax paid on the day the income is paid or the next day (clause 6 of Article 226 of the Tax Code of the Russian Federation). An exception is provided only for vacation and sick pay. The tax is paid during the month in which the employee was paid. For example, sick leave money was issued on the 20th, and the tax was calculated at the same time. You can pay it from the 20th to the 31st of the current month. If the payment is made on the last day of the month, the tax amount is transferred on the same day.

If personal income tax is transferred by an individual payer or an entrepreneur pays for himself, then the last day for payment is July 15 next year. Entrepreneurs on the general taxation system also transfer advance payments:

- for 1 quarter until April 25;

- half a year before July 25;

- 9 months before October 25th.

How to indicate the payment deadline in 6-NDFL

If you write down the transfer deadline incorrectly, the Federal Tax Service will consider the information unreliable, which will lead to a fine. 6-NDFL consists of 2 sections:

- 1 contains information for the last quarter of the reporting period with specific tax amounts.

- 2 is filled in with a cumulative total from the beginning of the year, but is divided by tax form (calculated, withheld, returned) and by interest rates.

Often the days of income payment and tax transfer fall on different tax periods - quarters. In letter No. BS-4-11/ [email protected], the tax office provides explanations on how to correctly indicate the deadlines in the report. The deadline for payment in section 1 is reflected in the quarter in which it falls normatively. That is, it does not matter when the payment actually went through.

Answers to frequently asked questions on the topic “KBK for transferring personal income tax from dividends in 2022”

Question:

What to do if an organization paying dividends to an individual is unable to withhold personal income tax on this income?

Answer:

It is necessary to notify the Federal Tax Service of the impossibility of withholding income tax. See Letter of the Ministry of Finance of the Russian Federation dated October 28, 2016 No. 03-04-06/63138, paragraph 5 of Art. 226 Tax Code of the Russian Federation, clause 14 art. 226.1 Tax Code of the Russian Federation.

Question:

On what date must income tax be withheld when paying dividends? Does the choice of personal income tax withholding day depend on the tax rate?

Answer:

It doesn’t matter whether personal income tax is withheld from dividends at a rate of 13% or 15%, the tax must still be withheld immediately at the time of payment of dividends.

Payment orders for personal income tax when paying penalties

The procedure for issuing a personal income tax payment order when paying a penalty at the request of the Federal Tax Service is different:

- It is necessary to indicate BCC 182 1 0100 110 (at a rate of 13%) or 182 1 0100 110 (at a rate of 15%).

- Line 107 indicates the period for which the debt was formed.

- In line 22 enter the UIN value specified in the Federal Tax Service requirement. If it is not there, put "0".

- On line 106, enter “TP” to indicate that the payment was paid on demand.

- In paragraph 24, it should be clarified that payment of penalties is the fulfillment of tax requirements.

By Order of the Ministry of Finance dated October 12, 2020 No. 236n, new budget classification codes were introduced from January 1, 2021. They apply to personal income tax, calculated at an increased rate of 15%, on income exceeding 5 million rubles per year. This tax must be paid separately.

From 2022 – new rules for filling out payment slips for taxes and other payments

| AndreyPopov / Depositphotos.com |

Changes have been made to the Rules for indicating information identifying the payer and recipient of funds in orders for the transfer of funds for payment of payments to the budget (Order of the Ministry of Finance of Russia dated September 14, 2022 No. 199n (registered with the Ministry of Justice of Russia on October 15, 2022)). The innovations will begin to apply from different dates next year, and will affect the procedure for filling out several fields of the payment order:

- 60 "TIN",

- 106 “Basis of payment”,

- 108 “Document number”,

- 109 “Date of the payment basis document.”

All important documents and news about the COVID-19 coronavirus are in the daily newsletter Subscribe

Bond yields in 2022

Personal income tax benefits for federal and municipal loan bonds and bonds of Russian companies have been excluded. In 2022, income is subject to personal income tax on a general basis. When receiving income from Russian companies and government agencies, you do not need to pay tax. The owner of the bond receives payment minus personal income tax.

Foreign companies only withhold taxes imposed by the foreign country. Therefore, when receiving income from such bonds, an individual himself calculates and pays personal income tax.

If the investor calculates the tax independently, he fills out the 3-NDFL declaration. It must be submitted by April 30 of the year following the reporting year. Tax must be paid by July 15th. Deductions under IIS allow you to reduce the tax amount down to zero. To do this, you will need an application for a deduction and payment orders confirming the replenishment of the IIS. Dividends are not exempt from taxation.

Recipients of dividends

When making after-tax profits at the end of the year, the organization's participants can count on receiving additional payments from this profit. Recipients are the owners of shares in the management company, among whom there may be both legal entities and individuals.

ATTENTION! The tax base of a non-resident dividend recipient is equal to the amount of dividends paid, and the tax rate established by clause 3 of Art. 224 of the Tax Code of the Russian Federation and equal to 15%.

Profit is divided between participants in accordance with the procedure reflected in the charter of the legal entity. Most often this distribution is made in proportion to the share of participation. Newly admitted participants can also count on payment of dividends according to their available share.

The organization paying dividends acts as a tax agent, withholding personal income tax from payments to an individual, and income tax from payments to a legal entity.

For information on what is considered the date of receipt of income in the form of dividends, read the material “Is personal income tax levied on dividends?” .

For information on calculating tax on dividends paid to legal entities – residents of the Russian Federation, read the articles

- “How to correctly calculate income tax on dividends?”;

- “Features of calculating dividends for determining income tax.”

Filling out a payment order for personal income tax when receiving dividends

Tax on dividends is withheld and paid to the budget no later than the next day after their payment. The payment order for personal income tax in 2021 for dividends is filled out in the same way as for other income. Difficulties usually arise with the indication of the tax period, which is written in line 107.

According to the letter of the Ministry of Finance No. 21-08-09/83856, the payment form is filled out in accordance with the frequency of payments. The board of directors can choose a dividend policy with any payment frequency. If the company’s profit is distributed once a year, then in line 107 of the payment order there is a date in the format: “GD.00.2021”. The same date is indicated if dividends are paid for a period exceeding one year, for example, for 1.5 or 2 previous years. If income is distributed quarterly, you should write: “Q.01.2021” - the first quarter of the year, “GD.02.2021” - the second quarter and beyond.

A number of changes have been introduced since July 1. Among them are new grounds on which the Federal Tax Service will consider reporting not provided, and new forms of reporting to the Pension Fund. Also, the product traceability system ceases to be an experiment and becomes mandatory. You can avoid mistakes and subsequent penalties by monitoring all changes in legislation. It is worth subscribing to accounting forums and mailing lists, and regularly visiting the website of the Federal Tax Service and other services. But you can take a simpler route - outsource accounting.

will provide accounting and tax accounting services. Our experts will reduce the tax burden and take on interaction with government agencies.

Dividends: concept, general information

If an organization has several participants, the profit received during the period (year) must be distributed among them in appropriate shares. What each participant receives is called dividends. According to the instructions of the Letter of the Ministry of Finance of Russia dated May 14, 2015 No. 03-03-10/27550, the following are recognized as dividends for tax purposes:

- income received by a company participant from the distribution of remaining profits;

- other similar payments to members of the organization;

- cash receipts from abroad, which are recognized as dividends in accordance with the laws of the source state of the funds (see paragraph 1 of Article 43 of the Tax Code of the Russian Federation).

On the topic of paying dividends to participants of organizations, the following main points can be outlined:

- Recipients of dividends can be both individuals and organizations.

- The procedure for distributing profits meets the requirements of the charter of a legal entity (as a rule, amounts are divided in accordance with the participant’s share - in proportion to it).

- Even if the participants are recently admitted, they are also entitled to claim dividends according to their shares.

- A legal entity that pays dividends is recognized as a tax agent in relation to participants:

- Personal income tax is withheld from dividends of individuals,

- from dividends of legal entities – income tax.