When can you transfer taxes for another person?

Paragraph 1 of Article of the Tax Code of the Russian Federation states: payment of tax can be made for the taxpayer by another person.

The same applies to insurance premiums (clause 9 of Art. Tax Code of the Russian Federation). What are these “other persons”? And in what cases do they have the right to pay off someone else’s debt to the budget?

The answer is found in the letter of the Federal Tax Service dated January 25, 2018 No. ZN-3-22 / [email protected] Its authors noted that there are no restrictions here. And they gave examples: a legal entity can transfer taxes from its account to other organizations, and the manager can pay off tax debts from his own funds).

Generate a tax payment in one click using the data from the report

Important

There is one type of contribution that you can pay only for yourself. These are contributions to the Social Insurance Fund “for injuries”. They are regulated not by the Tax Code, but by Federal Law No. 125-FZ dated July 24, 1998. And this law does not contain a provision allowing the repayment of debts on “injury” contributions for another person. It is also impossible to transfer personal income tax debt from the employer’s money (except for the case when the arrears are accrued based on the results of an audit; clause 9 of Article 226 of the Tax Code of the Russian Federation).

Who pays for what?

It turned out that not all payments and contributions to third parties can be paid for the main payer. In fact, this may be retained for all those taxes that are in the department of the Federal Tax Service. These include: VAT, personal income tax, income tax, water tax, mining tax, state duties, unified agricultural tax, unified tax on the simplified tax system, tax on personal personal income tax, UTII, insurance premiums, corporate property tax, gambling business tax, transport tax , Land tax, Personal property tax, Trade tax. It seems we haven't missed anyone.

Please note that “injury” contributions are excluded from this list. Their payment by third parties is not yet possible due to the fact that they are under the jurisdiction of the FSS. As for other insurance premiums, payments for them are already accepted by the Federal Tax Service, therefore, you can pay your friend for them if you follow all the rules that we indicated above.

In fact, payments from third parties are a fairly variable method of settlement with the Federal Tax Service. For our part, we can offer several possible situations for clarity in order to understand how these rules can work in practice:

- For example, an organization can pay taxes and fees for another organization, individual entrepreneur or individual;

- Or an individual entrepreneur can transfer taxes and fees for another individual entrepreneur, organization or individual;

- An individual also has the right to pay taxes and fees for another individual, organization or individual entrepreneur.

In other words, the Federal Tax Service gives us more freedom in this matter and this, admittedly, should be convenient. Because, firstly, no one exempts us from tax payments anyway, and, secondly, it gives us the opportunity to help “our neighbor” or for him to help you when there is a direct need for it. However, with all this, a completely logical question arises: “Can a person who made a payment for another organization demand compensation from it?” It turned out that she does not have such a right, because... it is assumed that such “charity” was a completely free service. There is another one: “Is it possible to clarify the payment for compulsory pension insurance if the Pension Fund has managed to record the amounts paid in the personal accounts of the insured?” Again, you can't. If the amounts have been taken into account, then consider that your train left a long time ago and no one will give you any information.

How to make a payment for someone else's taxes

The payment form with details numbers is given in Appendix 3 to Bank of Russia Regulation No. 762-P dated June 29, 2021 (see “The Central Bank has updated the rules for filling out payment orders”).

The general rules for filling out payment orders when transferring money to the budget were approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Certain nuances regarding the transfer of taxes and contributions for another person are discussed in the letter of the Federal Tax Service dated January 25, 2018 No. ZN-3-22/ [email protected]

We have collected information on what to indicate on the payment slip when transferring taxes and contributions for another person in the table.

Rules for writing a letter of request for debt repayment

The request letter must include the following information:

- Name of the legal entity entrusted with covering the debt. This is so important because even if the legal entity does not put the required mark in the payment order, using the details it will be possible to prove the purpose of the payment.

- An obligation that is transferred to a third party. In particular, you need to disclose its details: details of the agreement on the basis of which the debt arose, its amount.

- If the third party is a debtor of the enterprise (as is the case in most cases) and the funds paid by him go towards his debt, it is recommended to also indicate this in the letter. This is beneficial to both the first and second parties. The company has a greater chance that the counterparty will agree to such a transaction. The debtor can be sure that the payment will actually go towards the obligations and the creditor will not oblige him to repay the debt.

- The debtor to whom the letter is sent may not know all the intricacies of drawing up a payment order. It is also advisable to mention them. In particular, specify the need to indicate the purpose of the payment - repayment of the debt of another company.

ATTENTION! The letter of request must be signed by the head of the enterprise or a person with appropriate authority. The presence of a signature is of interest to the debtor, since it proves that the order actually took place.

IMPORTANT! The payment is made by a third party, and therefore the company does not have direct access to documents confirming the payments made. However, their presence is necessary to prove repayment of the entire amount of debt. Therefore, it makes sense to request a copy of the payment order from the debtor. The paper must be marked with execution from the financial institution.

Example of a letter of repayment of obligations

General Director of Prodvizhenie LLC I.P. Ufimtsev Chelyabinsk, st. Kirova 1, no. 1 From the General Director of Oliva LLC V.V. Ripak Chelyabinsk, st. Vorovskogo, 6

Ref. dated June 20, 2016 No. 363

LETTER about transferring money towards debt

We have a debt to Oliva LLC in the amount of 200,000 rubles. We ask you to pay off the debt of Oliva LLC in the amount of 200,000 rubles. Details for payments: TIN 11133355443 KPP 7657488956 OGRN 10754754785 r/s 407657776544878558654 in the Chelyabinsk branch of the Sberbank of Russia K/s 6655999996665555700088 BIK 066468888886

Transfer of payment using these details will mean the termination of the debt of Prodvizhenie LLC to Oliva LLC in the amount of 200,000 rubles.

In the order, we ask you to mention the purpose of the funds: “Payment for the rental of premises for Oliva LLC under agreement No. 10 dated July 10, 2016 in the amount of 200,000 rubles is not subject to VAT.” We also urge you to send us a copy of the payment order. The document must bear a mark from the banking institution regarding execution.

General Director of Oliva LLC Ripak /V.V.Ripak/

How to fill out individual payment details when paying taxes for another person

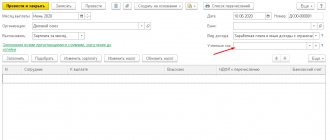

| Field name | Props number | What you need to indicate |

| Payer | 8 | Information about the person who transfers money to the budget |

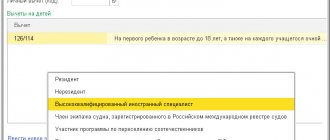

| Payer's TIN | 60 | TIN of the person for whom the tax (contributions) is being transferred |

| Payer checkpoint | 102 | Tax (contributions) are transferred for:

|

| Payment originator status | 101 | Status of the person for whom the tax (contributions) is transferred |

| Purpose of payment | 24 | TIN and KPP of the person transferring money to the budget (for legal entities - only TIN); name (full name) of the person for whom the tax (contributions) is being transferred. To highlight information about the payer, the “//” sign is used. These details are indicated in the first positions in relation to other information in this field |

| Code | 22 | If the person for whom the tax (contributions) is being transferred does not have a TIN, a UIN (document index) is entered. |

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

How to pay tax for another person through State Services

Through the State Services portal, you can debit funds from your card to pay taxes for another person. To do this, you need to have your own account in the system (pre-registration and identification). After logging into the State Services website, follow the following procedure:

- select “Search by document index” or “Search by TIN”;

- you need to select a person or a document (if they do not appear automatically, then you need to enter it yourself);

- Click on the desired tax or select its purpose;

- choose a transfer method (by card or through electronic money systems);

- check the entered details and confirm them.

To carry out online transactions in the State Services system, the payer’s signature is not required. However, the fact that you paid from your account means that if problems arise, it will be against you that the claims will be made. The deadlines for paying taxes through State Services are similar to those in other authorities. Funds are credited instantly, but it’s still better not to risk it and pay in a few days. In this case, if problems arise (for example, payment does not go through for some reason), the client will not have to pay a late fee.

How to account for taxes paid by another person

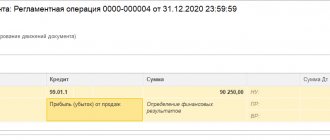

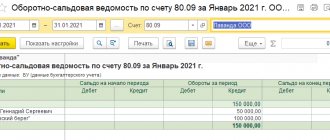

In accounting, taxes and contributions transferred for another person are reflected in account 76 “Settlements with various debtors and creditors”: the one who paid - by debit; for whom they paid - on the loan.

Example

October 20, 2022 Director of Vikhr LLC Sidorov S.S. transferred personal money to pay VAT for the specified company (clause No. 99 dated 10/20/21).

In November 2022, Vikhr LLC returned the funds spent to Sidorov.

The Whirlwind accountant made the following entries:

In October:

DEBIT 68 subaccount “VAT” CREDIT 76 subaccount “Settlements with Director Sidorov” - VAT paid for the third quarter. 2022 through director Sidorov S.S.

In November:

DEBIT 76 subaccount “Settlements with Director Sidorov” CREDIT 51 - Sidorov S.S. The amount spent on paying VAT for the third quarter was returned. 2022 for Vikhr LLC

Get a sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs Get it for free

How to clarify a payment and return an overpayment

What to do if an error is found in the payment slip that did not prevent the flow of money to the budget. Who should apply for clarification of payment - the one who paid, or the one for whom they paid?

Paragraph 7 of Article of the Tax Code of the Russian Federation states: in any case, an application for clarification of payment is submitted by the taxpayer himself. That is, the person for whom the money was transferred to the budget.

The situation is similar with the return of overpaid taxes (contributions). Only the person for whom the tax or contributions were paid can demand a refund (Clause 1 of Article of the Tax Code of the Russian Federation).

Is it possible to pay tax for third parties?

Payment of taxes for third parties is regulated by Federal Law No. 401 “On Amendments to the 1st and 2nd Parts of the Tax Code of the Russian Federation” dated November 30, 2016. The regulation states that a third party can pay both taxes and state duties. This person could be, for example, a parent company paying tax for its subsidiary.

Before the entry into force of Federal Law No. 401, there were no restrictions on the payment of taxes by third parties. However, the operation in question was questionable. The Tax Code of the Russian Federation contains instructions that the taxpayer must independently bear its payment obligations. Tax could be transferred by third parties only if these circumstances were present:

- The company uses the services of tax agents.

- Payment of fines and taxes by the successor of a previously reorganized legal entity.

- Collection of debt of a subsidiary legal entity from the account of the parent company.

- The taxes of the liquidated organization are paid by a third party - the liquidation commission.

- The debt is paid by the founders of the organization that is being liquidated.

The wording that a company must independently bear its obligations can be interpreted in different ways. However, most authorities believe that payments can be made by third parties. At the same time, an important condition is set: the funds allocated for paying taxes must belong to the taxpayer himself. That is, the third party acts as a representative of the taxpayer.

IMPORTANT! On November 30, 2016, with the entry into force of Federal Law No. 401, it became possible to make payments to third parties. From January 1, 2022, the transfer of insurance premiums according to a similar scheme is allowed.