Examples of selecting OKVED codes depending on the chosen field of activity

The applicant’s idea of the proposed activity codes does not always coincide with the logic of the structure of the OKVED classifier. For example, it is understandable when it comes to activities related to the rental of apartments and offices. The following OKVED codes are suitable:

- 68.20 Rent and management of own or leased real estate

- 68.20.1 Rent and management of own or leased residential real estate

- 68.20.2 Rent and management of own or leased non-residential real estate

Also, quite logically, activities related to trade or the provision of taxi services are structured. But, for example, a designer associated with Internet advertising can work under the following OKVED codes:

- 18.12 Other types of printing activities

- 74.20 Activities in the field of photography

- 62.09 Activities related to the use of computer technology and information technology, other

- 73.11 Activities of advertising agencies

- 73.12 Representation in the media

- 90.03 Activities in the field of artistic creativity

- 90.01 Performing arts activities

- 62.01 Computer software development

As you can see, when selecting suitable OKVED codes, it is not always possible to limit yourself to one class or classifier group.

We recommend that you use a special selection of OKVED codes by type of business: Ready-made sets of OKVED codes by type of business

How to choose an OKVED code in the classifier

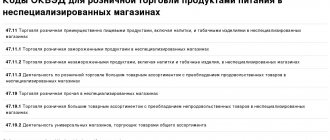

Many businessmen have difficulty choosing the right type of activity. All types of economic activities are combined into groups. For example, “Transportation and storage” or “Contamination activities”. To find your type of activity, navigate by groups.

The OKVED classifier for 2022 includes 21 sections and 99 subsections. They contain the names of activities and their codes. Let's look at the example of an online car dealership:

- Section G - Wholesale and retail trade, repair of motor vehicles and motorcycles;

- Class 45 - Wholesale and retail trade in motor vehicles and motorcycles and their repair;

- Subclass 45.1 - Trade in motor vehicles;

- Group 45.11 - Trade in passenger cars and light trucks;

- Subgroup 45.11.3 - Retail trade in passenger cars and other light vehicles;

- Type of activity 11/45/31 — Retail trade of cars and light vehicles via the Internet.

How many OKVED codes can be indicated in the application?

As much as you like, it is not forbidden to include at least the entire Classifier in the application (the only question is how much you need it). In the sheet where OKVED codes are indicated, you can enter 57 codes, but there can be several such sheets, in this case the main type of activity is entered only once, on the first sheet.

Please note that if the OKVED code you have chosen relates to the field of education, upbringing and development of children, medical care, social protection and social services, youth sports, as well as culture and art with the participation of minors, then to register an individual entrepreneur you will need a certificate of no criminal record (clause 1(k) of article 22.1 of law No. 129-FZ). The document is submitted upon an interdepartmental request, but in order not to delay the registration process, you can, after checking with the registration inspection about this possibility, request a certificate in advance.

The law stipulates this requirement only for individuals, that is, individual entrepreneurs, and when registering an LLC such a certificate is not required.

Application of the classifier

In total, the structure of the classifier includes 21 sections. These sections represent enlarged types of activities and are designated by consecutive letters of the Latin alphabet. Each of them is divided into classes with a total of 88 positions: they are already numbered with regular Arabic numerals. However, this is not all: the classification principle according to OKVED-2 also provides for a more detailed division. So:

- the first two characters indicate the class of the area of work;

- the third character is a subclass. If a subclass or a more detailed division is used in the designation of a type of activity, the first two characters indicating the class are separated from the rest by a dot;

- fourth sign - group;

- the fifth character is a subgroup. If a subgroup or a more detailed division is used in the designation of the type of activity, the second two characters indicating the subclass and group are also separated from the rest by a dot;

- the sixth character is type.

Thus, the dots in the coded designation are placed after the second and fourth characters.

When registering companies or individual entrepreneurs, the type of future activity must be recorded with an accuracy of at least 4 characters of the OKVED-2 code.

Companies submitting documents for registration should take into account that some codes relate entirely to licensed activities. Therefore, to work in this direction, an organization needs to obtain a license according to the established rules.

Responsibility for conducting activities not in accordance with OKVED

As such, there is no liability for activities not in accordance with OKVED. Both judicial practice and letters from the Ministry of Finance confirm that an entrepreneur is not subject to liability for carrying out activities not specified in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

At the same time, if you operate under an OKVED code that is not registered or was not entered later, you may be brought to administrative liability in the amount of up to 5,000 rubles under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation for “...failure to submit, or untimely submission, or submission of false information about a legal entity or an individual entrepreneur.” OKVED codes are included in the list of such mandatory information in Art. 5 (5) of Law No. 129-FZ of 08/08/01, so you will need to hurry to make changes within three days after the start of activities under the new code.

Main activity according to OKVED

But here you need to be careful. The fact is that the calculation of contributions for workers for insurance against industrial accidents and occupational diseases occurs according to the tariffs for the main type of activity. The more risky (traumatic or provoking occupational diseases) the activity is, the higher the insurance premium rate.

Before April 15 of the year following the reporting year, employers must submit to the Social Insurance Fund documents confirming the main type of activity, in the manner prescribed by Order of the Ministry of Health and Social Development No. 55 of January 31, 2006. Organizations submit such confirmation annually, and individual entrepreneurs - employers only if they have changed their main type of activity. The main type of activity is considered to be the type of activity from which the income received is higher in comparison with the income from other activities for the previous year.

If confirmation is not submitted, then the FSS sets the highest tariffs of all types of activities specified by the policyholder, and this is where excessively specified OKVED codes can turn out to be very inappropriate.

How are tax regimes and OKVED codes related?

All special, or preferential, tax regimes (USN, Unified Agricultural Tax, PSN) have restrictions on the type of activity. If you intend to engage in certain types of activities and at the same time choose a mode in which such activities are not provided, then there is a conflict of interest. It will be necessary to change either the tax regime or the desired OKVED. To avoid getting into such a situation, we recommend that you consult with experts in advance on the issue of choosing an appropriate taxation system.

Free tax consultation

For example, under the simplified tax system 2022 it is impossible to carry out insurance activities, extract minerals, except for common ones, or produce excisable goods, except for grapes and wines made from them. On PSN you can only provide certain types of services and engage in retail trade with restrictions.

Read more: Types of activities covered by patent in 2022 for individual entrepreneurs

Unified agricultural tax is generally intended only for activities related to agriculture and fisheries. The general taxation system (OSNO) has no restrictions related to types of activities, but it has the highest tax burden.

New OKVED codes in 2022

In 2022, companies choose codes to designate their types of activities from the all-Russian classifier of types of economic activities OKVED-2. It contains codes with a detailed breakdown by type of activity. Work on unspecified types of activities and use of outdated codes will result in a fine. A code directory will be needed to register a business; each type of activity is assigned its own code. Are there any changes in 2022 and what does this mean for business, do we need to make changes to documents and what to write in declarations? We'll tell you in our article.

Tax disputes related to activities under an unspecified OKVED code

The entire “reinforced concrete” logic of tax officials is based on their constant desire to not recognize the taxpayer’s right to a tax benefit or to reduce the tax base. Everything comes into play here, including the refusal to accept expenses for transactions with counterparties if they do not indicate the type of activity for which the business transaction took place.

Most often, such refusals are associated with the recognition of expenses when calculating income tax and VAT refund. Judges in such disputes, as a rule, side with the businessman, but if you do not want to bring the matter to court, then it is better to make sure that your partner has the required OKVED code.

Another important point is when tax authorities unreasonably try to prove that activities under an unspecified OKVED code are, in principle, not entrepreneurial. In particular, there are known denials of the right to apply a tax rate of 6% for an entrepreneur on the simplified tax system for income if he received this income under unspecified OKVED codes. The Federal Tax Service is trying to tax such income with personal income tax at a rate of 13%, as received by an individual from activities not related to business.

How to report a new OKVED code or exclude the previous code

Above, we have already noted the need to inform your tax office within three days that you have changed the types of activities you carry out. Individual entrepreneurs report changes (adding or deleting) OKVED codes using form P24001.

Organizations submit a notification of changes to OKVED codes, regardless of whether changes are made to the charter or not, in form R13014. The fact of changes in the charter is taken into account when filling out the form itself.

Change of OKVED for LLC in Moscow on a turnkey basis

A short minimum you need to know about OKVED

- OKVED codes are a digital designation of the types of activities that the applicant indicates in the application for registration of an individual entrepreneur or LLC.

- You must indicate at least one activity code in the application; the maximum number of OKVED codes is theoretically unlimited.

- There is no point in indicating as many codes as possible in the application (just in case), because... When registering an individual entrepreneur, among them there may be those for which, in addition to the usual package of documents, you must present a certificate of no criminal record.

- If you have chosen a special tax regime, then when choosing OKVED codes you must take into account restrictions on the types of activities in this regime.

- If there are employees, the main type of activity must be confirmed with the Social Insurance Fund before April 15: for organizations annually, for individual entrepreneurs only if the main code is changed, because The rates of insurance premiums for employees depend on this.

- There is no liability for activities using unspecified OKVED codes, but an administrative fine of up to 5 thousand rubles may be imposed for late (within three days) notification of a change in codes.

- If you or your counterparty do not have the appropriate OKVED codes, tax disputes are possible, with a refusal to reduce the tax base or apply another tax benefit for the transaction.

Which OKVED should you choose as the main one?

The main thing will be what is expected to generate the most income. Whichever OKVED code you indicate as the main one, you will be able to receive tax benefits and other bonuses in the future.

The state, represented by the Federal Tax Service and banks, wants to know what a business is doing, so the number of OKVED codes during registration is not limited. Lawyers advise indicating up to 20 positions, but keep in mind that too varied occupations may not be liked by regulatory authorities.

For example, sewing knitwear, production of reinforced concrete structures and educational activities can hardly be covered by one company. The tax office or bank will probably want to check.

Therefore, even if you “combine incompatible things,” indicate only “your” codes and be prepared to demonstrate their correct use.