Individual entrepreneurs who have chosen the general taxation system as a tax regime must pay three mandatory taxes to the budget:

- Value added tax (VAT). In this case, three options for the tax rate are possible: 18% - the most common and widely used, 10% - is used when an individual entrepreneur works with a certain list of goods prescribed by law, for example, medical, children's and grocery products, and 0% - this rate is applied extremely rarely, mainly in cases where goods are exported.

- Personal income tax (NDFL) – 13%, but only if the individual entrepreneur is a resident of the Russian Federation; if not, then this tax will be equal to 30%.

- Property tax for an individual is 2%, in cases where the property is used for business purposes.

In addition to the above taxes, sometimes individual entrepreneurs are required to pay local and regional taxes, such as:

- transport tax;

- land tax;

- mineral extraction tax;

- tax for the use of water bodies;

- tax for the use of biological resources;

- excise taxes;

- customs duties.

Deadlines for paying taxes for individual entrepreneurs on the general tax system

Individual entrepreneurs on OSNO must remember the deadlines for tax payments.

- For VAT - quarterly, but no later than the 25th day of the month following the reporting quarter. VAT payments can also be divided into a monthly regime - then VAT must be paid in equal shares, also before the 25th day of the month following the reporting month, inclusive;

- Personal income tax – based on the results of the quarter, half a year and 9 months, but no later than the 15th day of the month following the reporting period. The final payment must be made no later than July 15 of the following year;

- property tax – until December 1 of the year following the reporting year.

The deadlines for paying local taxes are determined by law at the regional level - the payment deadlines for them need to be clarified at the territorial Federal Tax Service.

Salary reports for individual entrepreneurs: when they are submitted and what is included in them

An individual entrepreneur can start a business and manage all the affairs independently. However, it often happens that a person ceases to cope with the work alone and he has to hire people under employment contracts or civil contracts. In this case, the individual entrepreneur begins to act as an employer, which is associated with the payment of wages, the calculation and withholding of personal income tax, and the calculation of insurance premiums on all payments made in favor of employees. In such situations, the scope of the individual entrepreneur’s reporting on the OSN is significantly expanded. We will tell you what it includes further.

Reports to the tax office

The reporting intended for submission by the individual entrepreneur to the tax authorities will consist of:

- based on the 6-NDFL calculation, introduced into circulation by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] It contains general information about income accrued to employees and the amounts of personal income tax calculated and withheld from such income. The reporting periods are: 1st quarter, half year, 9 months and year. Payments for the first three listed periods must be completed and submitted by the last day of the month following the reporting period. The annual must be submitted before March 1 of the next year, quarterly - no later than the last day of the month following the corresponding period;

Until the end of 2022, together with 6-NDFL, individual entrepreneurs had to submit 2-NDFL certificates. But from 2022 they have been cancelled. Information from certificates from the 1st quarter is included in 6-NDFL.

- A unified calculation of insurance premiums, approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] as amended by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] The report contains information on payments in benefits of employees and calculated contributions to compulsory health insurance, compulsory health insurance, VNiM. It is very voluminous and consists of a title page, three sections, ten appendices to section 1 and one appendix to section 2. But only those parts in which data are entered must be submitted. The calculation is submitted based on the results of the 1st quarter, half a year, 9 months and a year. The deadline for submission is the 30th day of the month following the reporting period.

Reporting to the Pension Fund

The main reports that the Pension Fund expects from employers, including individual entrepreneurs, are:

- monthly SZV-M—sent to the Pension Fund at the end of each month until the 15th day of the next. The form of this report was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. It contains information about persons with whom the employer entered into contracts (labor and civil law). Here are the full name, SNILS, and INN for each employee;

- annual SZV-STAZH together with the EDV-1 form - submitted at the end of the year until March 1 of the following year. For 2022, you must report in the form approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p. The report is intended to provide information about the length of service of insured persons. It must also be handed over by the entrepreneur when his employees retire;

- from 2022 - form SZV-TD (approved by Resolution of the Pension Fund Board of December 25, 2019 No. 730p).

In addition to those listed, there are also reports such as SZV-KORR, SZV-ISKH, DSV-3 and SZV-K, which are submitted when errors are detected or when additional information is provided.

Report to the Social Insurance Fund

All reporting that must be submitted to the Social Insurance Fund for entrepreneurs who use hired labor consists of one single form 4-FSS for insurance premiums for industrial accidents and occupational diseases. The form of the specified report was fixed by order of the FSS of the Russian Federation dated September 26, 2016 No. 381 and edited by order dated June 7, 2017 No. 275.

From reporting for the quarter of 2022, amendments to Form 4-FSS are expected in connection with the transition of all regions to direct payments. The draft form and instructions for filling it out can be viewed on the Federal portal of draft legal acts.

The form includes a title page and 6 tables, but you must submit only the title page and tables 1, 2, 5. They contain information:

- on payments that form the basis for calculating NS and PP contributions;

- payments for which contributions are not calculated;

- tariffs of contributions assigned by the Social Insurance Fund based on the types of activities included in the extract from the Unified State Register of Individual Entrepreneurs;

- the amount of calculated contributions;

- employees of the entrepreneur undergoing medical examinations and conducting a special assessment of working conditions at the individual entrepreneur.

Tables 1.1, 3 and 4 are prepared and submitted only if data is available.

A report is presented based on the results of the reporting periods: 1st quarter, half year, 9 months, year. The deadline for submitting the report depends on the form of submission. If the report is submitted on paper, then the report must be submitted by the 20th day of the month following the reporting period; if the report is transmitted electronically, then until the 25th.

Mandatory payments to OSNO

In addition to the above taxes, all individual entrepreneurs under the general tax regime must pay insurance contributions to extra-budgetary funds. This:

- payments to the Pension Fund of the Russian Federation in the amount of 22% (for the formation of a future pension);

- payments to the Social Insurance Fund - 2.9% (to pay for sick leave), 0.2% (in case of industrial injuries and accidents, as well as the development of occupational diseases);

- payments to the Federal Compulsory Medical Insurance Fund – 5.1% (for various medical purposes).

The individual entrepreneur must make all these contributions both for himself personally and, when hiring personnel, for each of the hired employees. At the same time, contributions to the Pension Fund can be paid either as a lump sum at any time in the calendar year, or quarterly. The last option is the most convenient because it allows you to control the timeliness and completeness of payments to all extra-budgetary funds. Contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund must be made every month, no later than the 15th.

What reporting should an individual entrepreneur submit for taxes on OSNO?

When applying the general tax regime, entrepreneurs must submit the following declarations to the tax office:

- for value added tax (VAT) - at the end of each quarter, but no later than the 20th day of the month following the reporting period;

- for personal income tax - form 3 personal income tax once a year, but no later than April 30 of the following year. At the same time, the tax must be paid no later than mid-July next year.

In addition to these two documents, before April 1 of the next year, you must submit to tax specialists a certificate in Form 2 of personal income tax on the income of employees and information on the average number of employees - before January 20 of the following reporting year. An individual entrepreneur who has hired staff is required to provide a certificate in Form 4-FSS on a monthly basis to the social insurance fund.

Attention! If for some objective reasons an individual entrepreneur has suspended his activities for some period of time, due to which he has no movement of financial funds either in his accounts or in the cash register, he can replace the VAT and income tax declarations with one - Single simplified declaration. However, personal income tax cannot be included in the Unified Declaration.

For your information. Experts have calculated that individual entrepreneurs using the general taxation system must submit at least 21 reporting documents to regulatory authorities per year.

How to report to an entrepreneur without employees

For entrepreneurs who do not use hired labor, the main reports for OSNO in 2022:

- declaration 3-NDFL at the end of the year;

- VAT return quarterly.

Additionally, other forms for taxes and fees are submitted; individual entrepreneurs’ accounting reporting on OSNO is not provided for by law.

Declaration 3-NDFL

OSNO for individual entrepreneurs means taxation of his income received from business activities with personal income tax at a rate of 13%. Individual entrepreneurs are required to calculate and pay taxes independently at the end of the year. Since net income is subject to taxation, it is reduced by analogy with the income tax provided for legal entities for expenses. But for individual entrepreneurs this is determined by the norms of Article 221 of the Tax Code of the Russian Federation, and this is a professional deduction that reflects the individual entrepreneur’s reporting on OSNO for the year (form 3-NDFL).

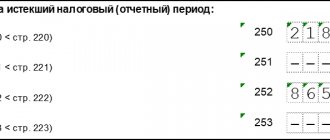

The amount of professional deduction consists of all expenses of an individual entrepreneur for the reporting period:

- costs of purchasing goods;

- salaries;

- depreciation of fixed assets;

- other material costs;

- insurance premiums paid for yourself and employees;

- other costs specified in Chapter 25 of the Tax Code of the Russian Federation.

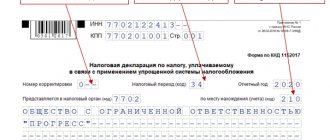

The determination of the tax base and the amount of personal income tax payable is indicated in the 3-NDFL declaration. Its IP is submitted annually, in accordance with the requirement of Article 227 of the Tax Code of the Russian Federation, no later than April 30 of the year following the reporting year. If the date coincides with a weekend or non-working day, annual personal income tax reporting for individual entrepreneurs is submitted on the next business day.

The form and procedure for filling out the 3-NDFL declaration were approved by Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/. An individual entrepreneur reports personal income tax once a year, but throughout the entire period he pays advance payments.

Read more: “How to fill out the new form 3-NDFL”

VAT

Entrepreneurs registered as payers of value added tax submit a tax return to the Federal Tax Service in the form approved by Order of the Federal Tax Service No. ММВ-7-3/ dated 10.29.2014. It must be submitted electronically quarterly no later than the 25th day of the month following the reporting quarter. Along with the declaration, logs of issued and received invoices are submitted; reporting forms and the procedure for submitting VAT reports for individual entrepreneurs do not differ from those provided for legal entities. An entrepreneur who is not a VAT payer, but acts as an agent or intermediary, is not exempt from the obligation to report VAT. Agents submit declarations, and intermediaries only submit logs.

Read more: “New form of VAT declaration”

Additionally, the entrepreneur submits statistical reports (you should check with Rosstat or on its website to find out which reports an individual entrepreneur submits without employees), forms for other taxes and fees for which he is a payer.

ConsultantPlus experts compared OSNO and simplified tax system: which is better and simpler, including in terms of reporting. Use this manual for free.

Keeping records of individual entrepreneurs on OSNO

Although the law does not require individual entrepreneurs to maintain full accounting records, some rules must still be followed. Among other things, the individual entrepreneur must:

- keep a book of income and expenses. All expenses must be documented, in particular, collecting and storing checks, receipts, contracts and other papers proving expenses. Data from KUDiR is used to calculate the tax base of individual entrepreneurs for personal income tax;

- keep a book of purchases and sales. The need to maintain this document is due to the fact that individual entrepreneurs on OSNO are required to calculate and pay VAT;

- keep a log of issued and received invoices;

- If individual entrepreneurs hire staff, they must maintain mandatory payroll and personnel records.

Important! All primary documents of individual entrepreneurs on OSNO must be stored for at least 4 years. Otherwise, sudden tax audits may result in inconvenient questions from tax authorities, as well as fines and administrative sanctions.

Tax deduction for personal income tax for individual entrepreneurs in the general mode

According to the Tax Code of the Russian Federation, individual entrepreneurs can apply a personal income tax deduction for the amount of expenses incurred within the framework of commercial activities. True, all these expenses must be documented. In cases where it is impossible to prove expenses, you can use a professional tax deduction, which will be equal to 20% of the total income of the individual entrepreneur.

For your information! IP expenses include insurance contributions to extra-budgetary funds, state duties paid in connection with professional activities and some types of taxes.

Combining IP OSNO and UTII: accounting rules

If an individual entrepreneur combines two tax regimes, general and imputation, he must keep separate records . Despite the fact that such a requirement is not spelled out in the Tax Code of the Russian Federation, this makes it possible to correctly divide the tax base and correctly calculate and pay due taxes under OSNO to the budget.

Thus, for individual entrepreneurs who are on the general taxation system, the process of keeping records of tax deductions and accounting is a very difficult and time-consuming task, largely due to the large number of taxes paid. Therefore, despite the fact that individual entrepreneurs are not required by law to hire an accountant, they still have to resort to specialized accounting assistance on an ongoing basis. However, the opportunity to develop a business without having to worry about all sorts of restrictions that exist in other tax regimes more than compensates for this minor inconvenience.

Tax system for individual entrepreneurs with VAT

VAT is a tax paid by a business that has chosen the general taxation system. This can be either a legal entity or an individual entrepreneur. All individual entrepreneurs who:

- did not apply for the use of one of the special regimes: simplified tax system, PSN, NPD;

- worked under a special regime, but lost the right to use it;

- combines OSNO with UTII or PSN.

Immediately after registration, an individual entrepreneur finds himself in the general regime and pays VAT. To stop paying tax, he must submit an application for the use of one of the special regimes, under which he will be exempt from paying VAT:

- STS “Income” and “Income minus expenses”;

- PSN;

- Professional income tax (PIT);

Sometimes an entrepreneur in a special regime can also pay VAT. This happens if:

- The individual entrepreneur issued a VAT invoice to the buyer;

- Individual entrepreneur is a tax agent for VAT;

- The individual entrepreneur is engaged in importing.