Accounting for non-productive assets not only has its own specifics, but is also associated with tax risks. In this article we will look at the features of reflecting the acquisition and use of non-production materials in 1C using the example of household equipment.

You will learn:

- what document in 1C reflects the posting of non-production inventory;

- how to put it into operation and what cost item to choose;

- Is it possible to take into account the cost of non-production equipment in expenses and deduct VAT?

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

On June 05, the Organization purchased a composition of artificial flowers (1 piece) from the supplier Flower Symphony LLC in the amount of RUB 7,080. (including VAT 18%).

On June 06, a flower display was used for the aesthetic decoration of the office.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Purchase of household equipment | |||||||

| June 05 | 10.09 | 60.01 | 6 000 | 6 000 | 6 000 | Acceptance of materials for accounting | Receipt (act, invoice) - Goods (invoice) |

| 19.03 | 60.01 | 1 080 | 1 080 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| June 05 | — | — | 7 080 | Registration of SF supplier | Invoice received for receipt | ||

| Write-off (transfer into operation) of inventory for general business needs | |||||||

| June 06 | 26 | 10.09 | 6 000 | 6 000 | Write-off of materials | Transfer of materials into operation | |

| MC.04 | — | 6 000 | Reflection of the cost of inventory in operation on an off-balance sheet account | ||||

| HE.01.9 | — | 6 000 | Reflection of expenses not taken into account in tax accounting | ||||

| VAT write-off | |||||||

| 30 June | 91.02 | 19.03 | 1 080 | VAT write-off | VAT write-off | ||

| HE.01.9 | — | 1 080 | Reflection of expenses not taken into account in tax accounting | ||||

Attribution of costs for the acquisition of material assets to the expenses of the institution

The institution's expenses for the acquisition of fixed assets (their cost) are taken into account in the institution's expenses in different ways.

Thus, the cost of fixed assets can be transferred to the institution’s expenses either at a time or gradually, by calculating depreciation.

In other words, depreciation can be accrued: immediately in the amount of 100% of the cost of the fixed asset (at a time) when the facility is put into operation;

— gradually in accordance with calculated depreciation rates over the useful life. Let us recall that in this case, the depreciation amount must be calculated in a straight-line manner based on the book value of the fixed asset and the depreciation rate calculated based on its useful life, and this must be done from the first day of the month following the month the object was accepted for accounting, and until the cost of this object is fully repaid or its disposal.

The depreciation rate for each item of depreciable property is determined by the formula:

K = 1 / nx 100, where:

K is the depreciation rate as a percentage of the original (replacement) cost of the depreciable property;

N is the useful life of this depreciable property item, expressed in months.

The useful life of a fixed asset is the period during which it is intended to be used in the course of the institution’s activities for the purposes for which it was acquired (clause 44 of Instruction No. 157n).

According to clause 92 of Instruction No. 157n for fixed assets - movable property, depreciation is calculated in the following order:

— for fixed assets worth over 40,000 rubles. depreciation is accrued in accordance with depreciation rates calculated in accordance with the established procedure;

— for other fixed assets worth from 3,000 to 40,000 rubles. inclusive, depreciation is accrued in the amount of 100% of the book value when the facility is put into operation.

So, the costs of acquiring fixed assets necessary for the economic needs of the institution are taken into account in the institution’s expenses by calculating depreciation and are reflected in the accounting records in the following correspondence of accounts (clause 26 of Instruction No. 183n):

Debit of accounts 0 401 20 271 “Depreciation costs of fixed assets and intangible assets”, 0 109 00 000 “Costs of manufacturing finished products, performing work, services”

Credit to the corresponding analytical accounting accounts of account 0 104 00 000 “Depreciation”.

Since for fixed assets worth up to 3,000 rubles. inclusive, depreciation is not accrued, the costs of their acquisition are taken into account as expenses at a time when they are put into operation on the basis of the statement of issue of material assets for the needs of the institution (f. 0504210). This operation is reflected differently in accounting; we cited it above. However, let us recall this wiring once again:

Debit of account 0 401 20 271 “Depreciation costs of fixed assets and intangible assets”, corresponding analytical accounts of account 0 109 00 000 “Costs of manufacturing finished products, performing work, services”

Credit to the corresponding analytical accounting accounts of account 0 101 00 000 “Fixed assets”.

The cost of spent material reserves, soft equipment, and utensils that have become unusable, on the basis of primary documents for the corresponding operation and accounting object, is written off as expenses of the institution using the following correspondence accounts:

Debit of accounts 0 401 20 272 “Consumption of inventories”, 0 109 00 000 “Costs for the manufacture of finished products, performance of work, services”

Credit to the corresponding analytical accounting accounts of account 0 105 00 000 “Inventory”.

Example 3

Let's continue with the example. A 100% depreciation amount was accrued for the vacuum cleaner put into operation. This amount is included in the general operating expenses of the institution. The cost of consumed stationery was written off to overhead expenses.

These transactions should be reflected in accounting by the following correspondence of accounts:

| Contents of operation | Debit | Credit | Amount, rub. |

| The depreciation charge for the vacuum cleaner is reflected | 2 109 80 271 | 2 104 36 000 | 10 000 |

| The cost of consumed stationery has been written off | 4 109 70 272 | 4 105 36 000 | 2 500 |

Purchase of household equipment

In accounting, household equipment worth no more than 40,000 rubles. and a service life of more than 12 months may be reflected in the inventory (clause 5 of PBU 6/01). The cost limit for accounting for such assets as materials must be fixed in the accounting policy.

If household inventory is taken into account as part of the inventory, then it must be reflected in account 10.09 “Inventory and household supplies” (1C chart of accounts) at the actual cost of its acquisition (procurement) or accounting prices.

In accounting, the actual cost of materials is equal to the amount of actual costs for their acquisition. The amount of VAT is not included in the actual cost of materials (clause 5, clause 6 of PBU 5/01).

In NU, the actual cost of inventories is determined in a similar way - based on their acquisition prices (excluding input VAT and excise taxes) and other costs associated with the acquisition (clause 2 of Article 254 of the Tax Code of the Russian Federation). If inventories are used in activities that are not subject to VAT, then the input tax is included in their actual cost (clause 1, clause 2, article 170 of the Tax Code of the Russian Federation).

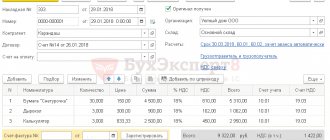

The purchase of non-production materials (including household equipment) is documented with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

The scheme for purchasing non-production materials does not differ from the standard purchase of materials

If no agreement has been concluded with the supplier, and materials are purchased without issuing an invoice, then when filling out the agreement, select the value Without agreement . an Agreement is automatically created with the name Without Agreement . PDF

The tabular section indicates:

- Nomenclature - non-production materials from the Nomenclature directory. In our example, household inventory is purchased, so the Item Type must be set to Inventory and household supplies . PDF

- The accounting account and the VAT account are filled in the document automatically depending on the settings in the information register Item accounting accounts , but they can be changed manually.

For the item type Inventory and household supplies, the default setting is: PDF

- Accounting account - 10.09 “Inventory and household supplies”;

- VAT account - 19.03 “VAT on purchased inventories”.

Find out more about setting up item accounting accounts

Postings according to the document

The document generates transactions:

- Dt 10.09 Kt 60.01 - household equipment accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Documenting

The organization must approve the forms of primary documents, including the document on the receipt of materials. In 1C, a Receipt Order in form M-4 is used. The form can be printed by clicking the Print button - Receipt order (M-4) of the document Receipt (act, invoice) . PDF

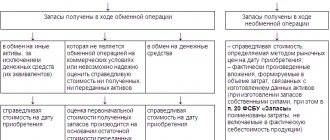

Acceptance of material assets for accounting

Before accepting material assets for accounting, it is necessary to determine what type they belong to: fixed assets or inventories. For these purposes, you should use the provisions of Instruction No. 157n.

According to paragraph 38 of this instruction, fixed assets must include material assets, regardless of their cost, with a useful life of more than 12 months, intended for repeated or permanent use with the right of operational management during the activities of the institution when it performs work, provides services, state powers (functions) or for management needs of institutions that are in operation, in reserve, on conservation, leased, leased (subleasing).

Material reserves should include items used in the activities of the institution for a period not exceeding 12 months, regardless of their cost (clause 99 of Instruction No. 157n).

For example, when purchasing pens, pencils, paper, markers, staplers, cleaning and detergents, light bulbs, buckets, mops, etc., they must be taken into account as inventory (clause 118 of Instruction No. 157n).

If a cooler, electricity meters, vacuum cleaners, etc. are purchased, then they should be taken into account as fixed assets, since in accordance with the All-Russian Classifier of Fixed Assets OK 013-94, approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 N 359, all of them are listed in the subsection “Industrial and household inventory”.

At the same time, in controversial situations, the decision to classify material assets as fixed assets or inventories can be made by the institution’s permanent commission for the receipt and disposal of assets, based on the manufacturer’s documentation and based on certain characteristics of the acquired material assets.

For example, this commission may decide to take into account seals and stamps as part of either fixed assets or inventories, taking into account the period of their use.

So, material assets entering an institution and acquired for the economic needs of the institution should be taken into account according to the rules for accepting them as fixed assets or inventories.

As follows from paragraph 23 of Instruction No. 157n, objects of non-financial assets (including fixed assets and inventories) must be accepted for accounting at their original (actual) cost.

The initial cost of non-financial assets is recognized as the amount of actual investments in their acquisition, taking into account the VAT amounts presented to the institution by suppliers and (or) contractors (except for their acquisition within the framework of activities subject to VAT, unless otherwise provided by the tax legislation of the Russian Federation).

In particular, it may consist of amounts paid in accordance with the contract to the supplier (seller), amounts paid to organizations for information and consulting services related to the acquisition of material assets, costs of delivering them to the place of use and other costs directly related to the acquisition material assets.

To form the initial (actual) cost of material assets, account 0 106 00 000 “Investments in non-financial assets” is used. This account is intended to account for investments in the amount of the institution's actual costs in material assets upon their acquisition.

For the purpose of maintaining accounting records of investments in material assets, analytical accounting accounts are used in accordance with the object of accounting:

- 0 106 21 000 “Investments in fixed assets - especially valuable movable property of an institution”;

- 0 106 24 000 “Investments in inventories - especially valuable movable property of an institution”;

- 0 106 31 000 “Investments in fixed assets - other movable property of the institution”;

- 0 106 34 000 “Investments in inventories - other movable property of the institution.”

Example 1

The autonomous institution incurred the following expenses using funds received from income-generating activities:

— a vacuum cleaner worth 10,000 rubles was purchased for household needs;

— paid for the services of a transport organization to deliver a vacuum cleaner to the institution in the amount of 1,500 rubles;

— a new seal was made by a specialized organization (due to the wear and tear of the old one) at a cost of 2,800 rubles.

The permanent commission on the receipt and disposal of assets classifies a vacuum cleaner and a seal as fixed assets (other movable property).

In accounting, these transactions must be reflected in the following entry:

| Contents of operation | Debit | Credit | Amount, rub. |

| The initial cost of the vacuum cleaner was formed: | |||

| Cost of a vacuum cleaner; | 2 106 31 000 | 2 302 31 000 | 10 000 |

| Amount of transport services | 2 106 31 000 | 2 302 22 000 | 1 500 |

| Investments in printing are reflected | 2 106 31 000 | 2 302 31 000 | 2 800 |

Acceptance for accounting of material assets as fixed assets. According to clause 9 of Instruction No. 183n, the acceptance for accounting of fixed assets at the original cost formed upon their acquisition is carried out on the basis of primary accounting documents: an act of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001), act on the acceptance and transfer of groups of fixed assets (except for buildings and structures) (f. 0306031). The specified documents in relation to fixed assets worth up to 3,000 rubles. inclusive are not compiled.

To account for the fixed assets considered in the article, the following accounts can be used:

- 0 101 26 000 “Industrial and business equipment - especially valuable movable property of the institution”;

— 0 101 24 000 “Machinery and equipment are particularly valuable movable property of the institution”;

- 0 101 28 000 “Other fixed assets - especially valuable movable property of the institution”;

- 0 101 34 000 “Machinery and equipment - other movable property of the institution”;

- 0 101 36 000 “Industrial and business equipment - other movable property of the institution”;

- 0 101 38 000 “Other fixed assets - other movable property of the institution.”

Example 1

Let's continue our example. The received seal and vacuum cleaner were accepted for accounting.

This operation must be reflected by the following posting:

| Contents of operation | Debit | Credit | Amount, rub. |

| The vacuum cleaner was accepted for accounting at the generated initial cost (10,000 + 1,500) rubles. | 2 101 36 000 | 2 106 31 000 | 11 500 |

| Print accepted for registration | 2 101 38 000 | 2 106 31 000 | 2 800 |

Acceptance of material assets for accounting as inventories. According to clause 32 of Instruction No. 183n, the receipt of inventories is reflected in the accounting registers on the basis of primary shipping documents of suppliers (sellers), other documents confirming the receipt by the institution of material assets, formalized within the framework of customary business practices, containing the details of the primary accounting document.

If discrepancies with the data in the supplier’s documents are identified during the acceptance of material assets, a materials acceptance certificate is drawn up (f. 0315004).

To maintain accounting records of material inventories, analytical accounting accounts are used in accordance with the object of accounting and the content of the business transaction. These accounts are listed in clause 31 of Instruction No. 183n.

As mentioned above, the actual cost of inventories is formed on accounts 0 106 24 000 and 0 106 34 000, provided that they are purchased under several contracts. However, if they are acquired within the framework of one contract, then Instruction No. 183n allows for the acceptance of inventories for accounting bypassing the specified accounts. That is, inventories are immediately recorded in account 0 105 00 000.

Example 2

The autonomous institution made an advance payment for office supplies (other inventories - other movable property) in the amount of 2,500 rubles. through subsidies for the implementation of government tasks. A personal account is opened in OFK. Stationery supplies have been received and accepted for accounting.

We will reflect these transactions in accounting as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Prepayment for stationery has been made | 4 206 34 000 | 4 201 11 000 | 2 500 |

| Stationery accepted for accounting | 4 105 36 000 | 4 302 34 000 | 2 500 |

| The advance has been offset | 4 302 34 000 | 4 206 34 000 | 2 500 |

Registration of SF supplier

VAT is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- materials purchased for activities subject to VAT;

- in stock - correctly issued SF (UPD);

- materials were accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

Accepting VAT as a deduction on materials for non-production purposes is risky . According to tax authorities, if an asset is not acquired for production purposes, this automatically means that there is no right to deduct VAT on such transactions (Letters of the Ministry of Finance of the Russian Federation dated October 18, 2011 N 03-07-11/278, dated March 29, 2012 N 03- 03-06/1/163).

However, there is arbitration practice that takes the side of the taxpayer. Thus, the Supreme Arbitration Court of the Russian Federation, in Ruling No. 1238/07 dated July 26, 2007 in case No. A55-19265/2004-31, indicated that tax legislation does not determine the dependence of the right to deduct VAT on whether expenses can be taken into account for profit tax purposes. At the same time, there are opposing court decisions (Determination of the Supreme Arbitration Court of the Russian Federation dated 06/05/2008 N6440/08).

Considering the lack of a unified position among judges and repeated explanations from officials about the impossibility of deducting VAT in this situation, we believe that the tax risk continues to remain relevant.

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

In our example, the organization refuses the right to accept VAT as a deduction, because it considers this operation to be risky. The Reflect VAT deduction in the purchase ledger checkbox is not set by the date of receipt.

Input VAT, which is decided not to be deducted, must be written off using the VAT write-off document.

Cleaning equipment: labeling, storage, rules of use

Each area has its own requirements for storing various types of cleaning equipment. It is especially strictly necessary to monitor this in healthcare organizations, in public catering establishments, in preschool and school education institutions, as well as in enterprises that produce or trade food products.

Storage of cleaning equipment should be organized as follows. Thus, items must be labeled according to the direction of use. For example, buckets used for cleaning kitchen floors must be labeled a certain way, but buckets used for cleaning office areas must be labeled differently. Equipment must be used strictly for its intended purpose, and markings will help identify it.

Equipment and household supplies (cleaning items) must be stored in special rooms designated for these purposes. Detergents and disinfectants must be contained in the manufacturer's packaging, with a label containing the name and purpose of the item.

Requirements for cleaning equipment may vary from organization to organization.

Please note that cleaning equipment must also be processed and disinfected in a certain way by immersion in special disinfectants, and in some cases using quartz treatment, irradiation, etc. It must be remembered that all sanitary and hygienic standards must be observed, since not only the cleanliness of the room, but also the health of the people in it depends on this. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Write-off (transfer into operation) of inventory for general business needs

Regulatory regulation

The write-off (transfer into operation) of household equipment for general business needs is taken into account according to Dt “General business expenses” Kt 10.09 “Inventory and household supplies” (chart of accounts 1C).

In order to ensure the safety of inventory in operation, it is necessary to organize its accounting on the off-balance sheet account MTs.04 “Inventory and household supplies in operation” (clause 5 of PBU 6/01).

In tax accounting, expenses reduce the taxable base for income tax if they (Clause 1, Article 252, Article 270 of the Tax Code of the Russian Federation):

- justified: they are economically justified costs, the assessment of which is expressed in monetary form;

- documented;

- not named in Art. 270 Tax Code of the Russian Federation.

Consequently, in NU, expenses for the purchase of non-production materials (including household equipment) cannot be taken into account, since they are not aimed at generating income and are not economically justified expenses (clause 1 of article 252, article 270 of the Tax Code of the Russian Federation ).

If you properly prepare administrative documentation confirming the validity of expenses for the purchase of interior items, then they can be taken into account when calculating the tax base. Production goals in this case may be:

- creation of a rest room for employees;

- creating a favorable image of the organization for visiting clients.

Thus, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated November 25, 2009 N KA-A40/12251-09, the court rejected the tax authorities’ claims against the organization and indicated that flowers and other interior items have a positive effect on its image and provide living conditions for employees. However, an attempt to take into account the costs of indoor plants purchased for the decoration of office premises is likely to cause claims from regulatory authorities.

However, the risk of non-acceptance of these expenses for deduction cannot be completely excluded (Letter of the Ministry of Finance of the Russian Federation dated May 25, 2007 N 03-03-06/1/311), and disputes with tax authorities may have to be resolved in court.

Accounting in 1C

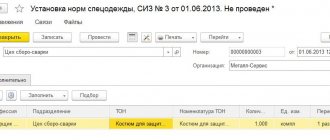

The write-off (transfer into operation) of inventory (including non-production purposes) is documented in the document Transfer of materials into operation in the section Warehouse - Workwear and equipment - Transfer of materials into operation.

On the Inventory and household supplies , the following is indicated:

- Nomenclature - inventory transferred for operation;

- An individual is the financially responsible person for the equipment in use.

In our example, the costs of purchasing inventory will be taken into account as part of general business expenses for accounting, since the flower arrangement is used for the aesthetic decoration of the office. In NU, the organization decided not to recognize such expenses as expenses that reduce the tax base.

- Method of reflecting expenses - the method of accounting for the costs of purchasing inventory, selected from the directory Method of reflecting expenses: Cost account - “General business expenses”;

- Division - AUP ;

- Cost items - the cost item for which expenses will be accumulated is selected from the Cost Items directory, Type of expense - Not taken into account for tax purposes .

Postings according to the document

The document generates transactions:

- Dt Kt 10.09 - the cost of inventory is reflected in general business expenses according to accounting;

- MC.04 - the cost of inventory is reflected off the balance sheet;

- NOT.01.9 - expenses that are not accepted in the NU are reflected.

Documenting

The organization must approve the forms of primary documents, including the document on commissioning of equipment. In 1C, the Requirement-invoice in form M-11 is used for this. The form can be printed by clicking the Print button - Requirement-invoice (M-11) of the document Transfer of materials into operation . PDF

Issuance of material assets for use and their movement within the institution

Transfer of material assets into operation. According to clause 10 of Instruction No. 183n in accounting, the transfer into operation of fixed assets worth:

— up to 3,000 rub. inclusively reflected on the basis of the statement of issue of material assets for the needs of the institution (f. 0504210) with the following posting:

Debit of account 0 401 20 271 “Depreciation costs of fixed assets and intangible assets”, corresponding analytical accounts of account 0 109 00 000 “Costs of manufacturing finished products, performing work, services”

Credit to the corresponding analytical accounting accounts of account 0 101 00 000 “Fixed assets” with simultaneous reflection on the off-balance sheet account 21 “Fixed assets worth up to 3,000 rubles. including in operation."

According to clause 373 of Instruction No. 157n, the acceptance of fixed assets for off-balance sheet accounting is carried out on the basis of a primary document confirming the commissioning of the object in a conditional valuation: one object - one ruble, if approved by the institution as part of the formation of an accounting policy of a different order - according to book value of the commissioned facility;

— over 3,000 rub. reflected on the basis of the invoice request (f. 0315006) with the following entry by changing the financially responsible persons:

Debit of the corresponding analytical accounts of account 0 101 00 000 “Fixed assets”

Credit to the corresponding analytical accounting accounts of account 0 101 00 000 “Fixed assets”.

Reflection in the accounting of transactions for the transfer of material reserves (acquired for business needs) for operation is carried out in the registers of analytical accounting of material reserves on the basis of the statement of issue of material assets for the needs of the institution (f. 0504210).

The release of inventories can be made at the actual cost of each unit or at the average actual cost; the decision made is fixed by the accounting policy of the institution (clause 108 of Instruction No. 157n).

It should be taken into account that the use of one of the specified methods for determining the cost of issue by group (type) of material inventories is carried out continuously throughout the financial year.

Let us recall that the determination of the average actual cost is made for each group (type) of inventories by dividing the total actual cost of the group (type) of inventories by their quantity, which is formed, respectively, from the average actual value (quantity) of the balance at the beginning of the month and the received inventory during of the current month on the date of their departure (vacation).

Let us once again pay attention to the documentation of the release of material assets. Issuance of material assets for use for business needs, as well as transfer for operation of fixed assets worth up to 3,000 rubles. inclusive per unit are carried out on the basis of the statement of issuance of material assets for the needs of the institution (f. 0504210). Entries in it must be made for each financially responsible person, indicating the material assets issued.

Internal movement of material assets. According to clause 9 of Instruction No. 183n, the internal movement of fixed assets between materially responsible persons in an institution is carried out on the basis of an invoice for the internal movement of fixed assets (f. 0306032) and is reflected in accounting by the following account correspondence:

Debit of the corresponding analytical accounts of account 0 101 00 000 “Fixed assets”

Credit to the corresponding analytical accounting accounts of account 0 101 00 000 “Fixed assets”.

An invoice for the internal movement of fixed assets is drawn up when moving fixed assets within an institution from one structural unit to another and is issued by the transferring party (deliver) in triplicate, signed by the responsible persons of the structural divisions of the recipient and the deliverer. The first copy is transferred to the accounting department, the second copy remains with the person responsible for the safety of the asset(s) of the deliverer's fixed assets, the third copy is transferred to the recipient. Data on the movement of fixed assets is entered into the inventory card (book) for recording fixed assets.

The movement of inventories within an institution between structural divisions or financially responsible persons is reflected in accounting on the basis of a demand invoice (f. 0315006) and is accompanied by the following posting (clause 35 of Instruction No. 183n):

Debit of the corresponding analytical accounts of account 0 105 00 000 “Inventories”

Credit to the corresponding analytical accounting accounts of account 0 105 00 000 “Inventory”.

Example 3

Let's use the conditions of examples 1 and 2. Let's agree that the vacuum cleaner, printing and stationery were put into operation. The cost of printing does not form the cost of finished products, works, or services. According to the accounting policy of the institution, a seal is accepted for off-balance sheet accounting at its book value.

These transactions should be reflected in accounting by the following correspondence of accounts:

| Contents of operation | Debit | Credit | Amount, rub. |

| Transfer into operation reflected: | |||

| Vacuum cleaner; | 2 101 36 000 | 2 101 36 000 | 11 500 |

| Prints; | 2 401 20 271 | 2 101 38 000 | 2 800 |

| Stationery | 4 105 36 000 | 4 105 36 000 | 2 500 |

| Accepted printing on off-balance sheet account | 21 | 2 800 |

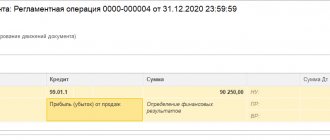

VAT write-off

In accounting , VAT that is not accepted for deduction must be included in other expenses (clause 152 of the Methodological Guidelines for Accounting of Inventory Production, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n).

In tax accounting, VAT, not accepted for deduction and not taken into account in the cost of inventories, is not taken into account as income tax expenses (clause 1 of Article 170 of the Tax Code of the Russian Federation).

VAT write-off is documented using the VAT Write-off document in the Operations - Period Closing - Regular VAT Operations - Create - VAT Write-off document section or based on the document Receipt (act, invoice) .

On the Purchased valuables , the supplier and the basis document on which the input VAT was taken into account, which is not deductible, is indicated.

On the Write-off account , the expense account and its analytics are indicated:

- Write-off account - 91.02 “Other expenses”;

- Other expenses and income - an item of other income and expenses with the Accepted for tax accounting .

Postings according to the document

The document generates transactions:

- Dt 91.02 Kt 19.03 - write-off of VAT on other expenses in accounting;

- DT NOT.01.9 - reflects expenses that are not accepted in the NU.

Test yourself! Take a test on this topic using the link >>

See also:

- Typical scheme for purchasing materials in 1C

- Document Receipt (act, invoice) transaction type Goods (invoice)

- Document Transfer of materials into operation

- Document VAT write-off

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Test No. 38. Acquisition and use of materials (household equipment) for non-production purposes...

- Write-off of non-production inventory for general business needs...

- Write-off (transfer into operation) of business equipment as part of distribution costs Household equipment: office furniture and equipment, stationery, tools, etc....

- Test No. 39. Write-off (transfer into operation) of business equipment as part of distribution costs...

Main types of modern household goods

- Kitchen goods. Perhaps the most numerous type of household goods. This includes measuring jugs, various containers and jars (cans for bulk products are especially popular), napkin holders, trays and other products that make the kitchen more functional and comfortable. This category mainly includes plastic products, but there are also specific items such as dyes for Easter eggs.

- Picnic goods. Another popular type of product, which includes everything related to the barbecue and its operation. In particular, these are the barbecues themselves of various designs, skewers, grills for frying meat, consumables - coal, wood chips, lighter fluid, etc.

- Repair goods. This category sells everything that is not directly materials or tools, but performs an auxiliary function during repairs. Mainly packaging materials made of polymers (air bubble and smooth films). A separate category should include adhesive tapes of different widths and reel windings.

- General purpose products used in the household. These are clothespins, ropes, glue, candles, plungers, seals for doors and windows, and even pots for flowerpots. You can view the full range and order household goods in bulk in this section.

The costs of training and retraining of personnel are determined by a special estimate for each object of the educational and course network.

The estimate includes the following costs: wages of administrative, teaching and instructor personnel and workers with accruals, office and business expenses, purchase of literature, teaching aids and equipment, costs of practical training, and other expenses. [p.214] Production units have a current account with the State Bank, not a current account. As a rule, funds are received into the current account only from the current account of the production association and they are used mainly for paying wages and payments related to it, for expenses from special funds (allocated by the association for production units), for paying electricity bills , utilities and other services and for other current business expenses provided for in the general production cost estimates. Transactions for settlements with buyers and suppliers for goods and services are not carried out on current accounts. [p.248]

General plant expenses include wages of plant management personnel, travel expenses, postal and telegraph costs, expenses for the maintenance and repair of general plant buildings and structures, their depreciation, for the maintenance of general plant laboratories, plant security, taxes, and other business expenses. [p.141]

Administrative and economic expenses include the following cost items: basic and additional wages of administrative and management personnel of a drilling enterprise (including wages of shop personnel), social insurance contributions, expenses for business trips and travel, expenses for passenger transport and travel, postal and telegraph, office and office expenses, depreciation of buildings and equipment of a drilling enterprise, deductions for the maintenance of a higher organization. [p.336]

Overhead costs include administrative and business expenses, costs of servicing construction workers, organizing and performing work on construction sites and other overhead costs. They are determined as a percentage of direct costs or basic wages. There are average, marginal and uniform marginal rates of overhead costs. Average standards are not used when determining the estimated cost of construction. They are the basis for calculating limit standards. Maximum norms for expenses for general construction work are developed according to the methodological instructions of the USSR State Construction Committee and are differentiated by ministries, departments and main departments (associations). Unified maximum overhead costs (the same for all performers) are established for installation and special work: installation of metal structures, internal sanitary work, underground mining and capital work, drilling and blasting work, installation of equipment, laying and installation of communication networks, electrical installation work, etc. [ p.217]

Reducing the duration of construction leads to savings in the semi-fixed overhead costs of a construction organization, which include administrative and business expenses, wear and tear of temporary buildings and structures, maintenance of fire and security guards and other expenses of a construction organization, which little depend on the volume of construction and installation work performed for a given organization and relatively constant over time. Savings from reducing the time spent spending these funds can be determined by the formula [p.62]

Overhead costs C consist of administrative and business expenses, costs of servicing workers, and organizing [p.106]

Overhead costs include four groups of costs: administrative and business expenses, costs for servicing workers, costs for organizing and producing work, and other overhead costs. [p.62]

In accordance with the established procedure N. r. in construction, and in particular in the drilling of oil and gas wells, administrative and business expenses, expenses for servicing workers, expenses for organizing and performing work (normalized expenses) and other non-residential expenses are divided into four groups. the list of types of costs included in the composition of the cash flow is strictly regulated, and it is not allowed to expand it. [p.76]

The section Administrative and economic expenses includes the basic and additional wages of management and shop personnel, social insurance accruals for wages, costs of business trips and movements of administrative and economic personnel, expenses for passenger transport and travel on official business, maintenance and depreciation of buildings and inventory, deductions for the maintenance of a higher organization and other expenses. [p.76]

Overhead costs include administrative and business expenses, costs of servicing construction workers, costs of organizing work on construction sites, and other overhead costs. [p.223]

Administrative and economic expenses consist of the basic and additional wages of employees of the department of engineering and technical workers, clerks and junior service personnel and other employees of the social insurance department of these workers, expenses for [p.223]

Reducing construction time has a significant impact on reducing the cost of construction and installation work. The latter leads to a reduction in administrative and economic costs, costs of maintaining household premises, fire and security guards, safety precautions, heating and lighting of temporary buildings and structures, etc. The amount of overhead costs, depending on the construction period, is approximately 50 and 30% general construction and specialized construction organizations, respectively. [p.229]

Construction organizations, in addition to calculating the task to reduce the cost of construction and installation work, prepare estimates of overhead costs and production costs. When preparing estimates for overhead costs, established limits for overhead and administrative expenses are taken into account. In turn, administrative and business expenses are planned in accordance with the current staffing levels, salaries and overhead standards. Determination of other overhead paths is carried out in accordance with established rules and regulations. [p.230]

Administrative expenses 223 [p.374]

Administrative expenses, thousand rubles. [p.184]

Administrative expenses. . 108.0 115.3 12G>.0 143.2 150.0 [p.141]

The estimate of administrative and economic expenses is made for the main production and each auxiliary workshop. Administrative and economic expenses include basic and additional wages of management employees, junior service personnel, social insurance contributions, travel expenses, lifting and other expenses associated with the movement of workers to other areas, postal and telegraphic expenses, office expenses, costs of maintaining passenger vehicles, buildings and etc. [p.224]

Particular attention is paid to typification and industrial methods in the construction of educational institutions. Thanks to this, construction costs are sharply reduced. Large reserves of efficiency exist in the use of funds allocated for the maintenance of an educational institution (costs of major and current repairs, business expenses). [p.300]

Capital construction plans provide for the following indicators: the total volume of capital investments for the industry or enterprise as a whole and for each individual facility, the commissioning of production facilities, the volume of construction and installation work, the cost of purchasing equipment, tools and inventory, the number of employees, the average salary, the fund wages and labor productivity of workers engaged in construction and installation work, the cost of construction and installation work and the task of reducing it, planned savings, the rate of overhead and administrative expenses. [p.307]

Administrative expenses are the costs of maintaining the management apparatus of the main and auxiliary production. They include the basic and additional wages of senior engineering and technical workers, employees and junior service personnel, social insurance contributions, travel expenses, etc. [p.350]

The largest share in administrative and economic expenses is occupied by the salaries of administrative and economic personnel. The amount of wage costs is determined according to the approved staffing schedules and based on the calculation of amounts for bonuses for administrative and economic personnel in accordance with the current regulations on bonuses. [p.350]

Costs for other items of administrative and economic expenses are determined by calculations based on approved standards or based on an analysis of reporting data for the previous period, taking into account the available opportunities to reduce them. The total amount of these costs, as a rule, does not exceed 30-35% of the total amount of administrative and economic expenses. [p.350]

For administrative and economic expenses, a consolidated estimate is drawn up in Form 28-TP, the results of which are entered into the first section of the consolidated estimate of overhead costs for the relevant production departments. [p.91]

A small part of semi-fixed costs (well maintenance, production and operating expenses, etc.) is due to the activities of the enterprise. [p.6]

Account 26 General business expenses is intended to summarize information on administrative and business expenses not directly related to the production process. Here, information is accumulated on the costs of maintaining general business personnel not associated with the production process, on accumulated depreciation charges for fixed assets for managerial and general business purposes, etc. Expenses recorded in account 26 are written off to the debit of accounts 20 and 23 or 90 (in accordance with the selected accounting policy of the enterprise). Analytical accounting for account 26 is carried out for each item of the corresponding estimates, the center of responsibility and the place of cost occurrence. [p.73]

According to the Chart of Accounts [7], in this account, in addition to management expenses, business expenses not directly related to the production process are also taken into account. In particular, depreciation charges and expenses for the repair of fixed assets for administrative and general purposes, rent for general business premises, etc. are reflected. [p.163]

The acceptable range of turnover is limited, on the one hand, by the number of sets of plumbing fixtures that the vehicle transports (192 pieces), and on the other hand, by the area of rented warehouse space, where no more than 400 sets can be placed at a time. When selling more than 400 sets, it is necessary to increase some expenses that are considered fixed (salaries, warehouse expenses, depreciation of fixed assets, bank services, business expenses). Therefore, the scale base is the turnover in the range from 192 to 400 sets of plumbing fixtures. [p.217]

Fixed costs do not depend on changes in the volume of output. These are administrative and management expenses, time wages, depreciation, business expenses, rent, etc. [p.23]

General business expenses include administrative, managerial and business expenses (depreciation of fixed assets for general business purposes, wages with deductions for administrative and managerial personnel, expenses related to labor protection, safety precautions, etc.). At the end of the reporting period, these expenses are also written off in proportion to the selected base (wages, etc.) to cost accounting and costing objects. [p.127]

Expenses of the general contractor associated with the provision of various types of services to the subcontractor (administrative and economic costs associated with the provision of technical documentation and coordination of work performed by the subcontractor, acceptance from the subcontractor and delivery of completed work to the customer, with resolving issues of logistics, provision of temporary structures, fire guard security at the construction site, general health and safety measures during joint work and other costs of the general contractor associated with the work of the subcontractor) are reimbursed by the subcontractor in the form of deductions to the general contractor as a percentage of the estimated cost of the subcontracted work performed [p.33]

Administrative and business expenses. Basic and additional salaries of administrative, management and production and technical personnel (drilling foremen, engineering and technical personnel of workshops and drilling sites, rolling depots and auxiliary shops); expenses for business trips and travel; reimbursement of travel expenses - payment of travel passes, daily allowances and room allowances; maintenance of passenger vehicles and traveling - depreciation and maintenance of passenger cars, fuel for them, lifting when moving - one-time benefits, the cost of travel and baggage transportation, paid to employees and members of their families when they are transferred to work associated with a change of residence, etc. Other administrative and economic expenses maintenance and depreciation of buildings, household equipment and equipment for administrative, economic and managerial purposes social insurance deductions from the wages of administrative, managerial and production and technical personnel deductions for the maintenance of a higher organization clerical, printing, postal, telegraph, telephone and other expenses. [p.212]

It is most convenient to calculate the cost of transporting single pipes and pipe sections using the most common vehicles (pipe carriers and pipe carriers) on the basis of dividing the costs of operating vehicles into a semi-fixed and variable part of the costs. Fixed expenses (independent of transport work - vehicle mileage) include part of administrative and business expenses, depreciation charges for the restoration and overhaul of workshops, garages, etc., the cost of their maintenance and other expenses. [p.136]

Overheads include administrative and business expenses, costs for occupational health and safety, production of design estimates, wear and tear of tools and clothing, etc. A detailed analysis of these costs is necessary to identify the reasons for changes in the cost of construction work and reserves for its reduction. [p.584]