Every day, funds from ordinary citizens and organizations are received into the accounts of Russian budgetary organizations. Most payments are for relatively small amounts, but there are many such orders. In order not to get confused in the transfers, to be able to track payments for each receipt and reduce lost payments to 0, a system for assigning a UIN was developed.

What is UIN?

UIN is an abbreviation that stands for “Unique Accrual Identifier”. As of 2022, the use of UIN is regulated by Order of the Ministry of Finance No. 107n “On approval of the Rules on the approval of orders for the transfer of funds to the budget system of the Russian Federation.”

Reference! The UIN was used until 2014, when the Order of the Ministry of Finance came into force. The new law only introduced minor adjustments to the use of the identifier and its placement on receipts.

UIN is a payment detail that consists of 20 or 25 characters, although in some payment orders 23 free cells are left, where the first three are for the lettering of the abbreviation (UIN). The value is digital, but in some cases it is possible to generate an alphanumeric code where Russian or Latin letters are used.

UIN is used only for payments to the account of budgetary organizations. This unique number is assigned to each transaction to track the payment of a specific payment.

Example. A citizen needs to pay a transport tax. He receives a corresponding notification from the Federal Tax Service with the specified UIN. A citizen pays tax at the bank. The UIN from the notification is duplicated in the generated payment slip. When the money arrives at the account of the local Federal Tax Service department, the system automatically checks the payment UIN with the data from the mailing and marks the payment.

Thanks to the UIN, the payment system has become fully automated. The human factor and any possible errors are excluded.

What is UIP in a payment order?

If we turn to an explanation of what the specified details are, then correctly it sounds like this - a unique payment identifier (abbreviated as UIP).

What kind of details are these and where to get them when filling out a payment order, we will look into it below. First, it should be noted that it does not always need to be indicated, but only in special cases determined by the Bank of Russia. To do this, you need to refer to Regulation N 383-P. which regulates the rules for transferring funds.

Thus, UIP is indicated in two cases:

- The first is if it was appropriated by the recipient of the funds and brought to the attention of the payer in accordance with the terms of the agreement. Accordingly, when making a payment, the organization will know its number and how to use it. This type of calculation is made for the convenience of organizations. The procedure for its formation and the method of verification by the bank when making a payment are determined by the Bank of Russia;

- The second is when transferring taxes and contributions. Taxpayers are more interested in the procedure for filling out this detail in case of paying taxes, because in this case he should know where to find it when filling out this field in the payment order.

How to find out the UIN for payments to the budget?

The UIN is used only to identify budget payments. These include:

- taxes;

- state fees;

- fines;

- fines;

- fees, etc.

You can find out the code from the notification receipt sent by the relevant organization. If the receipt has not arrived, you can personally visit the regional department of the Federal Tax Service and clarify this information at the reception. A corresponding receipt with all details, including UIN, will be printed for the visitor.

Below we will discuss in detail examples of where to get a UIN for specific situations.

Attention!

UIN is a dynamic value. This means that the receipt for payment of fees for the Pension Fund for January and February will have different values, even if the recipient is the same.

Content

UIN stands for Unique Accrual Identifier - a payment detail introduced in February 2014 by order of the Ministry of Finance of the Russian Federation No. 107-n dated November 12, 2013.

Its introduction is due to the need to simplify tracking of fees received by the budget. Using the UIN, payments are made to both business enterprises and individuals. Having a unique accrual identifier when paying taxes ensures that they are immediately sent to exactly the right place.

Unique Charge Identifier – payment details

A unique accrual identifier is required when taxpayers make payments. The Russian Treasury approved the UIN by Order No. 19n on November 30, 2012.

Since its introduction into the everyday life of taxpayers in 2014, the UIN had to be used every time payments were made. Why was an individual digital payment code entered in a special column of the taxpayer’s declaration?

An identifier is assigned for each individual operation by the budget administrator. According to the original idea of the Treasury, all payments recorded in the GIS should have a UIN, but not all budget recipients have so far been concerned about this.

The tax service indicates the identifier on the request for repayment of debt, fine or penalty. The code consists of 20–25 characters and is the UIN of the corresponding payment. This ID should be transferred to the payment details.

If the payer fills out a document for payment at a Sberbank branch, the identifier is not indicated. Only standard data for an individual is entered: last name, first name, patronymic, identification code, registration address or actual place of residence.

How to find out the document index for tax payment

When the question arises about where to get a UIN, the most logical answer that comes to mind first is the tax service. Indeed, it is the Federal Tax Service that is responsible for creating a unique accrual identifier. True, simply coming to a branch and asking for the required code will still not work, since the need to have it does not exist for every payment transfer and not for all organizations.

As was briefly mentioned earlier, today a unique accrual identifier for individual entrepreneurs and legal entities is indicated only when paying penalties and interest. So, if you are wondering: where to get a UIN, just look at the requirement for the need to pay off fines.

Individuals also receive a unique accrual identifier along with a notification to make a payment.

When filling out a payment order, enter the code (that you received in the payment request) in the designated field No. 22. Since the code is quite long, you should try to enter it as compactly as possible, reducing the size of the characters you enter. Not everyone is able to do this, so if your unique accrual identifier does not fit into one cell, the Bank of the Russian Federation has allowed you to use the adjacent one so that all characters are entered legibly.

Don’t waste your time trying to find an identifier in reference books or on the Internet, the code is unique for each individual payment document and you can only get a UIN if the tax service has generated it and given it to you in the form of 20–25 digits on a payment order.

We remind you which UIN must be indicated when filling out tax payments.

Currently, it is considered mandatory to indicate the UIN in payment orders of the Federal Tax Service (FTS), the Pension Fund of Russia (PFR), the Social Insurance Fund of the Russian Federation (FSS), and the State Road Safety Inspectorate ( traffic police).

However, the use of the identifier is not limited to the above organizations. Increasingly, you can find UIN in payments from kindergartens, schools, higher educational institutions and medical institutions. If the code is not indicated in the payment order from the organization, you can ask the company’s accounting department about the possibility of obtaining it.

The situation is somewhat different with individual entrepreneurs and legal entities. Since they generate and calculate most of their payments independently, they are not assigned a UIN. Identification of such payments is made using other details.

UIN for individuals

In their case, the UIN is used only when paying fines, debts, state duties, etc.

Entering the UIN into a payment order should be taken very seriously and carefully. Otherwise, this may result in:

- the payment will not go to the right place and the taxpayer will have a new debt to the state budget;

- Failure to receive a payment at the required time using the required details will result in new penalties;

- in order to return the paid funds, you will have to spend time and nerves to find where they went;

- the legal deadlines for receipt of payment will be violated.

The requirements of the law, especially when it comes to paying taxes, should be fulfilled on time and very carefully. After all, the consequences of the most minimal violation can be very unpleasant.

Entering the UIN into a payment order should be taken very seriously and carefully.

Finally, a few nuances that are worth considering when working with UIN:

Relatively recently, since 2014, a new code called UIN has appeared in payments issued by business entities to transfer payments to the budget. This code is used only for payments to government agencies. Its main role is to identify the payment in the budget system and will not allow it to get stuck on unidentified receipts. Therefore, everyone should know what the UIN is in a payment order and where to get it from 2019.

UIN code in a payment order: what is it?

A unique accrual identifier is generated automatically for each payment that is created by the budget authority. But this set of numbers is not completely random. It consists of blocks where certain information is encrypted. Here is an analysis of the UIN of the State Inspectorate for Real Estate:

- The first character is M, the same for all payment orders of the State Inspectorate for Real Estate;

- Characters 2-7 - recipient code, i.e. State inspectorates;

- Symbols from 8 to 20 are a unique payer code that is generated automatically for each transaction.

In the case of payment of traffic fines, information about the protocol of the offense and the date is “embedded” in the block with the payer code. However, this does not mean that the UIN can be calculated independently.

Reference! Different budget organizations draw up their own protocols for creating UIN, so the section by blocks may not correspond to what is stated.

Decoding UIN

This code is a combination of 20 characters. Each of them is very important.

The code is divided into four blocks:

- The first three mean the government agency that acts as the payment administrator - that is, it indicates who the recipient of the money is. For example, code 183 is used to designate the tax office, social insurance - 393, etc.

- The fourth character is most often designated 0. Since currently the fourth digit is not used for specific identification.

- The fifth to nineteenth digits are used to indicate the unique index of the document, which is assigned to it at the time of accrual.

- The twentieth digit is formed by the relevant authorities using a special algorithm. This is a control value that is used to check the correctness of the UIN.

Where can I get a UIN for payment orders to organizations?

The use of UIN for a payment order by a legal entity is regulated by Order of the Ministry of Finance No. 107n. And the Rules cover several situations:

- payment of current taxes;

- payment of non-tax contributions.

In the first case, the UIN is not generated. The order of the Ministry of Finance does not have clear instructions in this regard, therefore there is an official clarification from the Federal Tax Service, which states that when forming tax payments, legal entities do not receive a UIN and do not indicate it accordingly. The “Code” field is set to 0.

For non-tax transfers to budgetary organizations, the standard rules from Appendix No. 2 to the Order of the Ministry of Finance apply. If a payment order generated by a government agency has a UIN, it is duplicated by the payer in the details. If a field with a UIN is missing (missing) in the payment, 0 is entered in the corresponding block.

Why do you need a UIN when transferring taxes and where to get it?

When issuing a demand for payment of debts on taxes, fines and penalties, the Federal Tax Service indicates on the document a 20-digit index, which is the UIN of this payment. When transferring funds, the taxpayer is required to enter this code into the details, and the organization receiving the payment is required to accompany the budget transfer with the received digital code.

- in field 22 - code “0”;

- KBK;

- TIN;

- FULL NAME;

- home address.

An exception is a transfer through Sberbank using a receipt issued on a special form No. PD-4sb (tax). There is no space for an index on this form. To identify the payer, the full name, address and TIN must be entered.

We recommend reading: Payments from maternity capital in 2020

UIN for individual entrepreneurs: where to get it

The status of an individual entrepreneur is viewed from different angles in different legislative acts. Most often, it is placed in a separate category along with individuals and legal entities. However, in the Order of the Ministry of Finance, individual entrepreneurs are not included in a separate category, therefore they are automatically equated to organizations, this means:

- When paying taxes on behalf of an individual entrepreneur, a UIN is not required;

- when listing other types of fees, the UIN is indicated if it is formed by a budget organization and is indicated in the notice.

Note! An individual entrepreneur pays taxes separately both as an individual entrepreneur (organization) and as an individual.

How to find out traffic police fines, there is only the resolution number (UIN) from the letter

The order number alone is not enough for verification.

You need registration certificate (CTC) and license numbers. To view the fine for these documents, enter their numbers in the form above. Check the fine against other data in the resolution

Checking by UIN is not always convenient - this number must be found on a paper decree. The easiest way is to look for fines based on STS and driving licenses.

UIN: where to get it for individuals

As in the case of legal entities and individual entrepreneurs, a citizen can find all the necessary details for payment to budgetary organizations in the payment receipt, which is generated by the relevant government agency.

But there is also a difference. An individual also uses the UIN when paying taxes. Below are examples of where the UIN is located in payments and other ways to obtain it, including tax fees.

Attention!

The main and practically the only way to obtain a UIN is by payment. It is sent to the place of registration of the citizen along with the rest of the mail. Therefore, it is important to change your registration in a timely manner and enter correct data into the database of budgetary organizations about your place of residence.

UIN on the receipt: what is it?

There is one difficulty when searching for UIN - it may have a different name on different receipts. The abbreviation UIN is not always used; the notice may state:

- document index (at the top of the form above the barcode with the payment number or on the tear-off block above the payer information);

- code (on the right side of the payment card in the block with other details).

The relationship between the document index and the UIN is quite complex. These are not different names for the same identifier. Most receipts with an index are payments for utility services. The index here serves the same purpose as the UIN, but it is a different system that uses its own algorithm.

Where can I get the UIN to pay the state duty?

UIN is a convenient payment identifier, but it is not always used to pay state fees. It was previously said that citizens mainly receive UIN from receipts and notifications. But to pay the state duty, a payment order is not always generated. Typically, this requires a personal visit to a budget organization and a requirement to issue a receipt for payment.

Even in such cases, the citizen can only be provided with general details, without creating a unique identifier. However, if an individual receipt is created, then it will definitely contain a UIN.

Where can I get a UIN to pay a fine?

The number of the decision on the offense and the UIN for paying the traffic police fine usually coincide. If you have a resolution on hand, you can see the number next to the barcode, i.e.:

- top line of the document;

- the bottom block of the receipt with payment details, but the barcode is located above this block.

Although the UIN for the resolution (and its number) are generated automatically, they usually consist of the exact time and date the offense was recorded. Those. If desired, you can compose it yourself. This applies to protocols that are compiled on site, since their numbers do not correspond to the identifier number.

The UIN for fines is formed according to one formula 188 1 1 AA ВВВВВВВВВВВВВ С, where:

- AA - date of offense;

- B...B - number of the protocol or other document about the offense;

- C is a symbol to exclude 2 identical UINs.

Although it is possible to compile a UIN using this formula, it is problematic. Therefore, it is better to look for details in the receipt or decree.

Where can I get the UIN when paying taxes?

To transfer taxes, individuals receive a receipt indicating the amount and purpose of payment with all the necessary details. A citizen can receive such a notice:

- via Russian Post (to the mailbox at the place of registration);

- in your personal account on the Federal Tax Service website.

To receive a notice in the LC on the Federal Tax Service website, you must register. If you have a confirmed account on the State Services portal, you can log in (even without prior registration on the tax service website) using it. The electronic notice can be printed for convenience. The advantage of an electronic receipt is that it always arrives on time.

There is a practice when, after registering on the Federal Tax Service website, the taxpayer stops receiving paper receipts by mail. You can write an application to resume mailing at your place of registration at the regional department of the Federal Tax Service.

The taxpayer does not have to wait for a notification with details. You can pay taxes and create a payment slip directly on the tax service website. When you select payment “By details”, the UIN will be generated automatically and “attached” to the online receipt.

How and where to get a UIN - step-by-step instructions

To pay the required amount and indicate the UIN in the payment document, an enterprise or individual entrepreneur must:

| Steps | Content |

| 1. | Receive an official request from the relevant organization, which indicates the need to pay a penalty, fine or arrears |

| 2. | Find the UIN in the document |

| 3. | Carefully transfer all the numbers to the payment slip: cell 22 “Code”. The corresponding field is located at the bottom of the payment document |

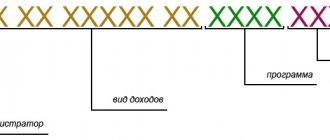

Each field of the payment slip is assigned a conditional numeric number. In the excerpt from the payment slip below, they are highlighted in black. The UIN field is marked in red. The corresponding part of the payment order looks like this:

| PAYMENT ORDER No. | |||||||||||||||

| Type of payment | (18) | Payment due date | (19) | ||||||||||||

| Payment name | (20) | Sequence of payments | (21) | ||||||||||||

| Recipient (16) | Code | 22 | R. field | (23) | |||||||||||

| (104) | (105) | (106) | (107) | (108) | (109) | (110) | |||||||||

Important! The UIN code cannot be found in any table or directory. There are no lists where it is indicated. The name of the code indicates that the UIN is unique. This means that it is not repeated and each specific payment is assigned its own set of numbers.

The UIN is contained in the payment request, which comes from a certain regulatory authority. Thus, to determine the UIN, you must carefully study the receipt or notice; the code must be present in this document.

What is indicated in field number 22

There are only two options:

- If the request received from certain authorities contains a UIN, it must be transferred number by number to the payment slip (field 22).

- When the UIN is missing, the number 0 (without quotes) is entered in field 22.

If there is a UIN on the payment:

- the money will go exactly to the specified address;

- recipients of the payment will be able to correctly identify it and record it in the relevant documentation.

If the payer is an ordinary person, and his payment is not related to business, it is enough to present a notice to the operator at the bank, deposit the specified amount and receive a receipt confirming its payment.

Is it possible to come up with a UIN yourself?

To create a UIN, budgetary organizations have their own protocols and systems. This means that the details can only be created by the payee. The “expected” payment is registered under this number. And if it does not arrive, the system will automatically start counting the delay.

The payer does not have the opportunity to independently come up with a UIN. If you write a random set of numbers in this column in the payment slip, in the best case scenario, the money will be returned to the sender. At worst, the funds will remain in the system. However, they will not be transferred to the budget organization and it will be difficult to return them to the recipient.

There are no services or catalogs on the Internet where you can view your UIN for payment. The only option is to independently draw up a UIN to pay the traffic police fine. The standard scheme applies here, described in the corresponding section of the article.

Is it possible to use one UIN for different payments?

For each payment, the system generates a unique identifier. Even if the payments themselves came from the same budget organization, the UIN will be indicated in them differently. The same applies to the time period, i.e. UIN for paying taxes for 2022 and 2022 are different details. And you cannot pay taxes for the new billing period using the old UIN. This is equivalent to a self-invented UIN - it will lead to an error and money hanging in the system.

If the UIN is not included in the new receipt, you must follow the instructions in the section below. It is prohibited to use old codes.

Searching for a document by unique identifier

try this, I really have never tried it through Run. Identifier = "New UniqueIdentifier("""+UID+""""); //after this action, the Identifier should be something like this: New UniqueIdentifier("dfgdfgd-dfgdfg-dfgdfg-dfg") Execute("DocReceive = Documents." + String(DocumentType) + ".GetLink(" + Identifier + ")" );

You may like => Family Code of the Russian Federation Personal Rights and Responsibilities of Spouses

There aren’t enough quotes in your code, I had 3 quotes surrounding the UID, and you had 2. And I wasn’t mistaken when I put “New” in quotes. because in Execute you are passing a STRING. There is no way you can pass an object there - a unique identifier, you must create it inside Execute.

- go to the official resource and log in;

- then go to the “Transport and Driving” tab, and then to “Traffic Police Fines”;

- then find the transition to “Checking fines by UIN”;

- in the window that appears, display the 20-digit code and check the information on it;

- a new window will display all the necessary information about the completed collection.

If, as a result of checking the specified details, unpaid enforcement proceedings are found, then you will be provided with detailed information on them: date, UIN, description of the debt, amount to be paid, etc. If you wish, you can immediately pay for the found enforcement proceedings.

What to do if the UIN is not known?

Although the UIN assignment system was created specifically for budgetary organizations, it is not used everywhere. For example, in some payments only KBK is indicated (code of a budgetary organization, consists of 20 digits). If the payment with updated details has not arrived or there is a receipt, but the UIN is missing for some reason, the procedure is as follows:

- All known details are filled in (duplicated from the payment slip).

- The code field is entered as 0.

- In case of payment through the terminal, the field can be left blank.

Attention!

If there is no UIN, only one digit is entered in the form - 0. If the system does not allow it, you can leave the field empty, but it is prohibited to indicate all 0 to fill out the column.

When is it necessary to indicate the UIN when paying taxes?

The UIN is indicated when paying tax if this detail is indicated in the payment receipt. Although, according to an explanatory note from the Federal Tax Service, legal entities do not need this detail when paying current tax fees, it can be indicated on the payment slip, which means it is required when entering details for the transfer if a payment notice has been received from the Federal Tax Service:

- arrears;

- fines;

- fine

The use of an identifier in such payments is explained by their urgency. The system will “see” the standard payment document much later, and the transfer using the UIN is automatically counted almost instantly. Timely deposit of money guarantees that penalties and other penalties will stop accruing.

The requirements are different for individuals. UIN indication is required when paying several types of taxes:

- transport;

- land

In case of arrears or a fine, the taxpayer, as well as the legal entity, will receive a notification with the specified UIN.

What can you pay using your UIN?

Payment by UIN is a simple and convenient tool for making payments for any state and municipal services. With the help of this service, paying debts, fines and various duties has become much easier and no longer requires even leaving home. With us you can make payments for services such as:

- fine for violating quarantine and disseminating false information about coronavirus;

- a fine for violations of the self-isolation regime and other violations of legislation in the field of ensuring the sanitary and epidemiological well-being of the population;

- administrative fines, in particular, for ticketless travel and traffic violations;

- fee for obtaining a civil and foreign passport from the State Administration for Migration Issues of the Ministry of Internal Affairs of the Russian Federation (formerly the Federal Migration Service);

- educational services - payment for kindergartens and schools, replenishment of personal accounts in various payment systems for passage and meals;

- state duties for the provision of hunting and fishing licenses, as well as permits for trading and other activities.

When is the UIN not used when paying taxes?

Dealing with payment orders is very simple. The unique accrual identifier is not used in cases where it was not initially specified by the budget organization. The reason may be:

- For legal entities and individual entrepreneurs - the manager’s obligation to pay taxes according to the declaration.

- For individuals - to pay property tax.

In these cases, KBK (budget organization code) is used to track the payment. However, if the Federal Tax Service indicated the UIN in the receipt for payment of property tax, it should also be moved to the payment slip. This will simplify the search for payment in the system; the details will not be superfluous.

In what cases does the UIN not need to be indicated in the details?

The UIN is needed when transferring funds to the fiscal service: fees, taxes, etc. It is also used when making payments to federal and city authorities.

There are situations when you do not need to specify a twenty-digit code:

- Individual entrepreneurs and organizations calculate the tax themselves, based on their own completed fiscal declarations. In this case, a different payment ID is used. It is listed in column 104. In simple terms, if you have not received any notifications requiring you to transfer money, you should not enter the identifier.

- Individuals pay property taxes. But before this, a special notification comes from the fiscal service. Your payment ID is also used here.

On a note! Even if according to the rules the number is not required to be written down, this field should not be empty. Instead of a twenty-digit code, enter the number zero (“O”).

The “Code” line should not be left blank