Terms and Definitions

The taxation system is a set of tax payments, the obligation to pay which arises from the taxpayer when carrying out business activities.

Moreover, each tax has certain differences; it has an independent object of taxation, which means the sale of goods (work, services), property, profit, income or other circumstance that has a cost, quantitative or physical characteristic.

OSNO is a general (traditional) taxation system in which organizations or businessmen fully calculate and pay taxes.

These include:

- for organizations - profit tax, VAT, property tax;

- for entrepreneurs - personal income tax, VAT.

STS - Simplified Taxation System (STS) - a special tax regime applied to organizations and entrepreneurs; differs from OSNO by replacing the payment of taxes with the payment of a single tax, and at a reduced rate, calculated based on the results of economic activity for the tax period.

Elements of tax - objects of taxation, tax rate, tax base, tax period, calculation procedure and deadlines for tax payment.

What should a manufacturer choose: a general taxation system or a “simplified” one?

Many production organizations, before starting their activities or already in the process of their implementation, think about which taxation system is easier and more profitable to use: general or simplified. On the one hand, the simplified one is attractive due to the simplicity of tax calculation and the ability, under certain conditions, not to keep accounting. On the other hand, it does not allow you to reduce the amount of tax on expenses incurred.

In order to more or less accurately answer this question, you need to study in detail the proposed activities of the organization, the volume of production and sales, the number of employees and other factors. In this article we will try to provide some general recommendations.

Manufacturers who have the right to use the “simplified”

Before looking for the advantages and disadvantages of both systems, you need to understand which manufacturers can count on using “simplified” and which cannot.

First of all, we will focus on industrial organizations that are prohibited from using the simplified tax system . This is, for example, <1>:

— residents of the FEZ;

— members of the holding;

— organizations producing excisable products (alcohol, tobacco products, motor gasoline, etc.);

— manufacturers operating within a simple partnership;

— residents of the Great Stone Industrial Park;

— UE, the founder of which is a legal entity; business companies, more than 25% of shares (shares in the authorized capital) of which belong to one or in total several other organizations;

— RUP, KUP, their subsidiaries; business companies, more than 25% of shares (shares in the authorized capital) of which belong (including in aggregate) to the Republic of Belarus and (or) its administrative-territorial unit (administrative-territorial units).

As we can see, the ban is established by the type of activity of the organization, and by its organizational and legal form, and by the composition of the founders (participants), and by resident status. Moreover, this is far from an exhaustive list. For example, a manufacturer who simultaneously sells its products at retail through an online store, or who has sold a trademark or company name, or who has leased out a “foreign” building (received for free use), also cannot apply the simplified tax system <2>.

If the manufacturer does not find himself on the list of organizations for which there is a direct ban on the use of the simplified tax system , he proceeds to the next step: studying the criteria under which such a taxation system can be applied.

Thus, an existing organization can switch to the simplified tax system only from the 1st day of the next year, provided that for nine months of the current year the average number of its employees is no more than 100 people, and the volume of gross revenue does not exceed 1,159,800 rubles. If only an organization created this year plans to work under the simplified tax system, it is enough that the payroll number of employees does not exceed 100 people. But in both the first and second cases, you need to notify the tax office of your desire <3>.

There are several types of simplified tax system: with payment of VAT, without payment, with accounting in the book of income and expenses, or with regular accounting <4>:

| A type of "simplified" | Average number of employees since the beginning of the year, people. | Volume of gross revenue, rub. <*> |

| USN without VAT or with VAT with accounting in the book | No more than 15 | No more than 410,000 |

| USN without VAT with accounting | No more than 50 | No more than 1,058,400 |

| simplified tax system with VAT with accounting | No more than 100 | No more than 1,542,600 |

Note On innovations in the simplified tax system from 2022, see the commentary “What changes are expected in the simplified tax system in 2022”

Having analyzed these criteria, a production organization that meets them can proceed to choosing the most optimal taxation system for itself: simplified or general.

Advantages and disadvantages of the simplified tax system

Like any other tax system, the simplified tax system has both advantages and disadvantages.

Its advantages :

1) this system is applied on a voluntary basis (subject to the fulfillment of established criteria) and can be abandoned <5>;

2) There are no difficulties when calculating tax. Under the simplified tax system, the gross revenue of the organization is taxed, expenses are not taken into account <6>. This simplifies the calculation and minimizes the likelihood of error;

3) An organization using the simplified tax system is generally exempt from paying income tax, and in some cases from paying real estate tax and environmental tax <7>. Also, an organization may not pay VAT if it fits into the established criteria <8>;

4) if the average number of employees does not exceed 15, and the amount of gross revenue from the beginning of the year is 410,000 rubles, then the organization has the right not to conduct accounting on a general basis (with some exceptions). In this case, she will fill out a book of income and expenses and reflect income for tax purposes using the “on payment” method, and not on the “on shipment” method, as with standard accounting <9>. And this is a big plus, especially for a start-up organization. In addition, with “book” accounting there is no need to prepare financial statements and you can abandon the cash book. And thereby reduce “accounting” costs. True, all primary accounting documents will have to be prepared in the usual manner <10>;

5) up to a certain amount of gross revenue and number of employees, you can choose the simplified tax system with or without VAT. The size of the tax rate under the simplified tax system depends on this choice. For those paying VAT it is lower (3%, not 5%) <11>. Moreover, for example, a manufacturer-exporter who has opted for the simplified tax system with VAT has a chance to save: the tax rate under the simplified tax system will be lower, and at the same time he may not have to pay VAT, since when exporting it is calculated at a rate of 0%. In addition, deductions in this case can be returned from the budget <12>. The simplified tax system without VAT will allow the manufacturer to avoid the difficulties of calculating VAT, will reduce the volume of tax reporting and, as a result, labor costs.

The main disadvantages of this tax regime:

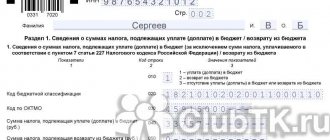

1) The manufacturer applies the general taxation system by default. And in order to apply the simplified tax system, you need to notify the tax authorities about this using a special form and within a limited time frame:

- for a newly created organization - within 20 working days from the date of state registration;

- for an existing organization - in the period from October 1 to December 31 of the year preceding the year in which it applies for the application of the simplified tax system.

And if the manufacturer is late or forgets to send a notification, he will not be able to apply the simplified tax system <13>.

It is necessary to notify the tax authorities about the voluntary refusal of the simplified tax system. They do this by putting the appropriate mark in the tax return according to the simplified tax system <14>;

2) A manufacturer using the simplified tax system must constantly monitor the number of employees and the amount of revenue received throughout the year. If the limit on these indicators is exceeded, the organization will have to either change the conditions for applying the “simplified tax” (for example, start calculating VAT), or switch to a general taxation system <15>.

In addition, it is necessary to monitor transactions in which the use of the simplified tax system is prohibited. For example, simple partnership agreements, participation in a holding company, sale of a trademark, etc. In such cases, the organization loses the right to use the simplified tax system <16>;

3) An organization pays tax under the simplified tax system even if there is a general loss in its activities. This is due to the fact that the tax base from which the tax amount is calculated is the organization’s gross revenue. And it is not reduced by expenses incurred. And the amount of expenses may exceed the income received <17>;

4) Although the simplified tax system replaces the payment of income tax, in relation to certain income (dividends received from a non-resident, income from the sale of securities, etc.), the general procedure for its payment is still preserved <18>;

5) The tax under the simplified system does not completely replace the payment of other taxes and payments. So, the manufacturer will still have to calculate and pay:

- taxes, fees, duties - when importing assets into the territory of Belarus or exporting them <19>;

- real estate tax - in certain cases (for example, if an organization rents out real estate or the total area of all real estate exceeds 1000 sq. m) <20>;

- land tax and land rent (except in certain cases) <21>;

— tax for the extraction (withdrawal) of natural resources <22>;

— payment for consumer waste <23>;

— payments to the Social Security Fund and deductions to Belgosstrakh <24>;

— a number of other payments <25>;

6) Even if the manufacturer applies the simplified tax system without VAT, in some cases it will have to be paid. For example, when importing imported raw materials or other assets <26>;

7) a manufacturer who initially works on the simplified tax system and keeps records in the book of income and expenses, and then, due to exceeding the relevant indicators, loses the right to use the “simplified system” or independently decides to switch to the general system, will have to restore accounting <27>. In addition, the principle of revenue recognition will also change (from the “on payment” method to the “accrual” method). All this increases the risk of making mistakes during the transition period <28>.

conclusions

There is no clear answer to the question about the optimality of a particular taxation system. When choosing it, each specific manufacturing organization must take into account many variables. In particular, one should take into account production, organizational and structural features, and the volume of production, which can differ significantly in different organizations.

Since under the simplified tax system expenses do not reduce the tax base, you should carefully calculate possible options for the structure of income and expenses of the organization and predict its activities for the future. In other words, make a preliminary calculation of the tax burden under different taxation systems.

So, in the case when revenue increases with approximately constant expenses, it makes sense to consider the use of the simplified tax system. But if, as revenue increases, costs also increase significantly, it is better to think about the overall system.

You can do it this way. At the beginning of the “life activity” of the organization, while production and sales volumes are small, use the simplified tax system. And then, as production and, accordingly, costs increase, move to a general taxation system. In this case, it is advisable for the manufacturer to keep accounting on a general basis from the very beginning, so that when switching to a common system, it does not have to be restored.

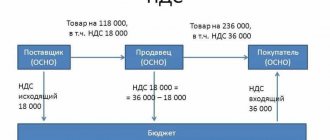

In addition, when deciding on the taxation system or the option of using the simplified tax system, you should take into account who is the main buyer of the products produced. If organizations are VAT payers, then a VAT payment regime may be productive. In this case, customers purchasing products will be able to reduce their VAT payable. This means there is a chance that they will become regular customers.

For those who still doubt which system to choose after calculating the tax burden, you can start with the “simplified” system and work on it for, say, a quarter. And after that, decide whether to stay on the simplified tax system or switch to the general taxation system.

Reporting and taxes

Organizations using the simplified tax system are exempt from paying income tax, property tax (if it is not valued at cadastral value) and VAT (if import operations are not carried out and the duties of a tax agent do not arise) in accordance with paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation.

Individual entrepreneurs using the simplified tax system do not pay personal income tax, are exempt from property tax (if it is not valued at cadastral value) and VAT (if import operations are not carried out and tax agent responsibilities do not arise).

Consequently, LLCs and individual entrepreneurs who have a simplified tax regime submit reports in a simplified format.

The object of taxation for the simplified tax system and the special tax system is also different. The object of the general regime is profit, which is obtained as a result of the difference between income from activities and all expenses. The procedure for determining the tax base under OSNO is defined in Chapter 25 of the Tax Code of the Russian Federation.

There are two options on the simplified tax system:

- “Income minus expenses” (expenses must be economically justified and documented).

- "Income".

It should also be noted here that simplifiers can recognize income and expenses only on the cash basis. This is stated in Article 346.17 of the Tax Code of the Russian Federation. As for income tax, work on the cash basis does not apply to everyone in accordance with Article 273 of the Tax Code of the Russian Federation.

Anyone who chooses the “Income minus expenses” option should be aware that for this regime there are strict restrictions on expenses that can be recognized as part of determining the tax base.

Differences between OSNO and simplified tax system

The main differences between the simplified tax system and the OSNO can be considered:

- Under the simplified tax system, organizations do not have the obligation to pay income tax (except for certain transactions), VAT (except for certain transactions), property tax (except for tax on “cadastral” real estate); Individual entrepreneurs using the simplified tax system do not have to pay personal income tax (in relation to income from activities for which the simplified tax system is applied), property tax for individuals (in relation to objects used in business activities), VAT with the exception of certain transactions).

Read about when a “simplified” person will have to pay VAT in this article .

- Using the simplified tax system, you can choose the object of taxation: “income” or “income minus expenses.”

- There is no need to prepare invoices (except in certain cases).

- There is no need to maintain income tax registers (only a book of income and expenses).

For information about the features of different tax systems, see the material “How can an organization choose a tax regime: OSN, simplified tax system?” .

To make the right decision on choosing the optimal tax system, we recommend studying several opinions. Get free trial access to ConsultantPlus and see the expert opinion of K+ specialists.

Simplified taxation system

Payers of the simplified tax system

Those who have switched to a simplified tax system can pay a single tax instead of several. Not everyone has the right to make such a choice. This possibility depends on:

- the nature of the activity declared during registration. Some organizations and entrepreneurs cannot apply simplification. For example, when their activities are related to the activities of pawnshops, insurance or the production of excisable goods;

- on cost and quantitative indicators.

- a complete list of cases in which a company or merchant cannot apply the simplified tax system is established by paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation.

What taxes does the simplified tax system exempt from?

Simplified organizations are exempt from paying:

- property tax. An exception is real estate for which the tax base is the cadastral value;

- income tax;

- VAT. With the exception of transactions under joint activity agreements, trust management of property, as well as under concession agreements and when importing goods, when the duties of a tax agent arise;

- All other taxes, fees and insurance contributions are calculated and paid by the organization on the simplified tax system on a general basis.

Entrepreneurs on the simplified tax system differ from OSNO in that they are exempt from paying:

- Personal income tax on income from business activities (except for dividends and income subject to personal income tax at rates of 35 and 9 percent);

- tax on property of individuals used in business activities. An exception is real estate for which the tax base is the cadastral value;

- VAT. With the exception of transactions under joint activity agreements, trust management of property, as well as under concession agreements and when importing goods and when the duties of a tax agent arise.

Selecting an object of taxation according to the simplified tax system

The object of taxation according to the simplified tax system is “Income” or “Income minus expenses”.

In the first case, the business entity generally applies a rate of 6 percent (unless another reduced rate is established by regional legislation), in the second case - 15 percent. By the way, choosing an object under the simplified tax system is also an element of tax planning. The right to think about the choice is granted to both newly registered organizations and businessmen, and to existing entities. Tax legislation allows you to change the object once a year.

Many experts point out that the determining criterion for choosing an object of taxation is the profitability of the products (works, services) produced. Moreover, this indicator is planned.

So, if the profitability according to the business plan is above 40 percent, then the “Income” object with a rate of 6 percent is more profitable. If profitability is lower, then the “Income minus expenses” object with a rate of 15 percent is more profitable.

In numbers. Example of choosing a taxable object

When registering, the owner of Alpha LLC selects an object under the simplified tax system, using the following information on the proposed activities according to the business plan:

- type of activity - consumer services for the population;

- estimated income - 4,250,000 rubles;

- the estimated amount of expenses taken into account under the simplified tax system is 2,700,00 rubles (including 1,250,000 rubles for payments in favor of individuals and contributions);

- profit from sales (financial indicator) - 1,200,000 rubles.

- profitability indicator - 44%.

Let's assume that in 2022 society will be able to use the aggregate rate for insurance contributions to extra-budgetary funds - 30%. The contribution rate to the Social Insurance Fund in case of injury is 0.3%.

Calculation of indicators for choosing a tax system

First, we will determine the amount of insurance contributions to extra-budgetary funds that the society will have to pay. Let's assume that all payments are subject to contributions. Then the amount of contributions will be 375,000 rubles (1,250,000 rubles × 30%), and for insurance in case of injury - 3,750 rubles (1,250,000 rubles × 0.3%).

Object - “Revenue”

The tax amount is 255,000 rubles (4,250,000 rubles × 6%). In this case, the tax payable can be reduced by the transferred insurance premiums. The total amount of contributions is 378,750 rubles (375,000 rubles + 3,750 rubles). This is more than half the tax. Therefore, the tax can be reduced only by 50%, and the amount payable will be 127,500 rubles (255,000 rubles × 50%).

Object - “Income minus expenses”

The tax base will be 1,550,000 rubles (4,250,000 rubles – 2,700,000 rubles). The tax amount at a rate of 15% is equal to 232,500 rubles (1,550,000 rubles × 15%).

Let's compare the results: 127,500 rubles < 232,500 rubles. For society, the simplified tax system with the object “Income” is preferable, as indicated by the profitability indicator.

Advantages of using the simplified tax system

- Low tax burden.

- Possibility of changing the object of taxation.

- Tax reporting is submitted in a reduced quantity.

- Possibility of applying tax holidays for entrepreneurs.

Disadvantages of using the simplified tax system

- The likelihood of switching to OSNO if the profitability threshold or the number of employees is exceeded.

- A limited list of expenses taken into account under the object of taxation “Income minus expenses”.

Simplified taxation system (STS)

Beneficial for small businesses and suitable for many businesses

The simplified tax system is often chosen by beginning entrepreneurs. It is convenient because you will pay one tax under the simplified tax system instead of three taxes under the general system and report once a year.

Before switching to the simplified tax system, select an object - something from which you will pay tax:

- On income - at a tax rate of 1 to 6% depending on the region, type of activity and amount of income received.

- The difference between income and expenses - at a tax rate of 5 to 15% depending on the region, type of activity and amount of income received.

With income from 150 to 200 million rubles and with a number of employees from 100 to 130, the business rate increases: to 8% for the simplified tax system “Income” and up to 20% for the simplified tax system “Income minus expenses”. The increased rate is applied from the quarter when the business has exceeded the limit of 150 million rubles in income or 100 employees.

Using the simplified tax system “Income” you can reduce the amount of tax on insurance premiums for individual entrepreneurs and employees. Individual entrepreneurs without employees can reduce the tax entirely on contributions for themselves, but LLCs and individual entrepreneurs with employees can only reduce them by half.

Using the simplified tax system, you can deal with reporting even without an accountant. And electronic accounting services, such as Kontur.Elba, make this task easier. Elba generates reports in a few clear steps and sends them to the tax office via the Internet. You can quickly create invoices and statements for clients, automatically track bank receipts and debits, and receive notifications about reporting deadlines - even from your mobile phone. And with complex questions, you can contact an accountant directly in the service.

If your individual entrepreneur is less than 3 months old, use all the features of Elba for free for a whole year.