About legal entities

Why is Form 3-inform needed? The report is submitted to summarize information on the use of information and computer technologies in

Form P-4 (NZ) is part of the statistical reporting forms that reflect information about the organization’s employees.

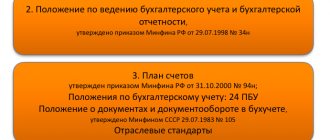

What is PBU “Accounting Policy” First, let us remember that the legal regulation of accounting (hereinafter referred to as

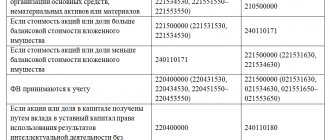

Reflection of financial and other current assets in the balance sheet Some organizations are given the right to draw up a simplified

Pay taxes in a few clicks! Pay taxes, fees and submit reports without leaving your

Taking time off according to the vacation schedule The employer establishes in the regulatory act of the enterprise the obligation of employees

How will Article 219 of the Tax Code of the Russian Federation help reduce personal income tax? Due to social tax deductions, individual taxpayers

Value added tax is not an absolute charge. A number of entrepreneurial actions are subject to it, others

Who is the General Director The head of the company is an elected position and appointed by the general meeting of employees

The website of the Federal Tax Service contains a taxpayer’s personal account for individuals. With him