The classification of documents in accounting will be briefly discussed in this article. A document is proof in writing of the implementation of any business transaction and the right to implement it. The quality of accounting is determined primarily by the correct and timely preparation of documents. The role of the latter is extremely important, since it is the documents that serve to control the safety of property, the legality and necessity of various business transactions. So, what is the classification of documents in accounting for?

Documentation control

Managerial employees of the institution carry out preliminary control by signing the document underlying the performance of any operation (for example, payment of money, acceptance of materials, etc.) When an employee signs a document, he automatically becomes personally responsible for the feasibility of this operation, gives responsibility for it your permission.

Further control is carried out mainly through documentary audits, when the accounting department checks all incoming documents, as well as through an audit.

Component of accounting

Documentation as a means of documenting transactions and the basis of accounting records is one of the components of the accounting method. Elements such as inventory and accounts are also closely related to it. Documents justify the records of transactions performed in the system of accounts, are widely used in analyzing the economic functioning of an organization, for the timely management and management of the activities of the institution, since they justify the actions of employees. Only documents drawn up in accordance with the requirements can reflect completed transactions in the accounting system. They allow you to see the movement of material assets, goods, and financial resources every day.

Classification of documents in accounting is important.

Documentation is an element of the accounting method

The financial and economic activities of an organization are accompanied by numerous operations. In accordance with the Law “On Accounting”, each fact of economic life (business transaction) is subject to registration as a primary accounting document. For this purpose, one of the elements of the accounting method is used - documentation, i.e. the main method of accounting monitoring of the economic activities of an organization, reflecting accounting objects, and primary control. Each operation, regardless of volume and content, is formalized in a document at the time of its completion and is the first stage of accounting.

A document (from the Latin documentum - instructive example, evidence, evidence) is written evidence confirming the fact of a business transaction and the right to carry it out.

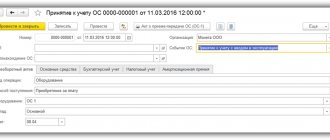

The primary accounting document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion. The primary accounting document is drawn up on paper and (or) in the form of an electronic document signed with an electronic signature.

Electronic document - documented information presented in electronic form, i.e. in a form suitable for human perception using electronic computers, as well as for transmission over information and telecommunication networks or processing in information systems.

Federal Law “On Electronic Signature” dated April 6, 2011 No. 63-FZ defines an electronic signature as information in electronic form that is attached to other information in electronic form (signed information) and that is used for a specific person signing the information.

If, in accordance with the legislation of the Russian Federation, primary accounting documents, including in the form of an electronic document, are seized, copies of the seized documents, made in the manner established by the legislation of the Russian Federation, are included in the accounting documents.

If the legislation of the Russian Federation or an agreement provides for the submission of a primary accounting document to another person or to a state body on paper, an economic entity (organization) is obliged, at the request of another person or government body, at its own expense, to make copies on paper of the primary accounting document drawn up in in the form of an electronic document.

The forms of primary accounting documents are approved by the head of the economic entity on the recommendation of the official responsible for maintaining accounting records. The new law “On Accounting” has abolished the concept of “unified forms”; now organizations can develop all forms of primary documents independently. In order for the forms of primary documents on the basis of which the fact of a business transaction is recorded to become legitimate, they must be approved by order of the manager (possibly as part of the accounting policy) and have mandatory details.

Documentation serves as the basis for subsequent accounting entries and ensures the accuracy, reliability and indisputability of accounting indicators, as well as the possibility of their control.

Differences among documents

Since the operations performed in the process of the financial and economic functioning of an institution are diverse, there are differences among the documents through which they are executed. The variety of documentation can also be explained by their distinctive features in accounting work.

To select the most appropriate form for completing any operation, documents are grouped depending on:

- appointments;

- the method of covering the operations carried out;

- the procedure for recording transactions;

- number of accounts;

- places of formation.

Organizations in their daily work create documents covering various tasks of economic, social, financial, production activities: decisions, orders, contracts, letters, protocols, telegrams, acts, certificates, statements, etc.

Principles of classification of documents in accounting

Accounting documents are classified depending on the following types of accounting:

- agricultural products;

- labor and its payment;

- materials;

- leading assets and intangible assets;

- operation of construction mechanisms and machines;

- work in capital construction;

- work in motor vehicles;

- inventory results;

- trading operations;

- cash transactions.

Management activities are recorded in prescribed forms by various means of relevant information, and thus a document is created.

How are accounting documents created?

Accounting documents can be created both on paper and on computer media. They are necessary because for some time on their basis it is possible to apply the necessary management information for a variety of purposes. An important place is occupied by the classification of primary documents in accounting.

Since accounting is faced with the task of fully providing data from external and internal users and enterprise performance indicators for an objective conclusion about their property and financial status, it is solved by drawing up the necessary documents, which has caused a serious increase in the volume of information and increased requirements for its content and quality. In this regard, it is necessary to assign effective monitoring of the truth of accounting information as one of the main sources for justifying various management decisions. That is why the problem of improving the quality of documents and their circulation is currently acquiring both scientific and practical significance. How is primary accounting documents classified in accounting? More on this later.

Accounting registers for primary

Each primary document received by the accounting department must be registered. Therefore, there are special accounting registers. These are special counting tables made in a specific form. They are necessary to collect information about business transactions on accounts and not get confused in a bunch of certificates, invoices, and so on.

Accounting registers are different. As a rule, they are divided into the following categories:

- By appointment. This includes chronological (documents are recorded as they appear), systematic (the primary document is recorded taking into account its grouping characteristics). The combination of these two types is called synchronistic registers - ideally this is what accounting should do.

- By summarizing the data. Integrated (from particular to general) and differentiated (from general to particular) registers fall into this category.

- By appearance. Everything is very simple - they are divided according to the physical form of the register. It can be in the form of a card, book, electronic media, and so on.

Proper maintenance of accounting registers will significantly simplify the task and protect against many problems.

Requisites

Documents include separate elements, or indicators, called details.

The total number of document details affects the choice of its form. Each document must meet certain requirements and objectives, so it is important to compose it in such a way as is customary in the category to which it belongs. Their legal and evidentiary power is directly related to the quality and completeness of the documentation, since they act as evidence certifying specific facts. Any details are divided into mandatory and additional.

Below are the requirements for the classification of primary documents in accounting.

Mandatory details on primary documents

The primary documents must include the following mandatory details:

- nomination of positions of employees who are responsible for conducting a business transaction and its correct execution;

- personal signatures with transcripts, including those cases when documents are created using technical computing means.

If necessary, additional details are added to the document: the emblem of the enterprise, the State Emblem of the Russian Federation, the nomination of a higher authority, a link to the date and index of the incoming document, an index of the communication organization, a telegraph address, a number, a stamp restricting access, visas, a resolution, etc. All this is included in the document at the discretion of the enterprise.

Correcting erroneous entries in documents

Corrections are allowed in the primary accounting document, unless otherwise established by federal laws or regulatory legal acts of state accounting regulatory bodies. The correction must contain the date of the correction, as well as the signatures of the persons who compiled the document, indicating their last names and initials or other details necessary to identify these persons.

Corrections can be made to primary accounting documents (except for bank and cash documents). In the text and digital data of primary documents, erasures and unspecified corrections are not allowed. Errors in primary documents created manually are corrected as follows: the incorrect text or amount is crossed out, the corrected text and (or) amount is written. It is crossed out with one line so that the correction can be read. Correction of an error in the primary document must be indicated by the inscription “Corrected”, the date of correction must be indicated, and confirmed by the signature of the persons signing the document. (For example, if a document mistakenly writes the number 429 instead of 439, you cannot cross out only the number 2 and write the number 3 above it. The number 429 is completely crossed out, 439 is written, “Corrected” is written, the date is put on May 29, 20, and the signatures: Sviridov, Zaitsev .)

The Law of the Russian Federation “On Accounting” and the Regulations on the Introduction of Accounting and Accounting Reports in the Russian Federation stipulate that making corrections to cash and banking documents is not allowed. In this case, a new document must be drawn up.

Form

Document details arranged in a certain sequence are collectively called a form. If it is used for a specific type of document, it is standard (for example, for protocols or orders). Such a form contains a fixed set of details, which are arranged in a strict order; their content and placement are determined by GOST. The most common classification of accounting documents by purpose is found.

Any primary document must be drawn up at the moment when a business transaction is carried out; if this condition cannot be met, registration is carried out immediately after its completion.

Assets, business transactions and various liabilities are documented in the currency of the Russian Federation (that is, rubles) and in Russian. If a document is prepared in another language, it must contain a line-by-line translation into Russian.

Both primary and consolidated accounting documents can be typed on computer and paper media. Below we will present the classification of documents in accounting with examples.

Documents on transactions related to loans, finance, and funds must be signed by the chief accountant and the head of the enterprise or by persons performing their duties and having special powers. Persons who have the right of first and second signature are registered in the order for the organization.

Classification of accounting documents

A variety of business transactions are carried out at enterprises and organizations. Organizational management is provided by a huge amount of documented information. All documents submitted to organizations are divided into document formations (systems, documentation subsystems), types and varieties of documents. Documentary entities ensure the implementation of certain management functions or activities of the organization. Documentation systems and subsystems include dozens of types of documents characteristic of a given document education, which in turn can consist of many types of documents.

In order to better understand their purpose and filling procedure, as well as to ensure their correct use, it is necessary to classify documents according to homogeneous characteristics.

Accounting documents are classified according to the following criteria:

· appointment;

· the procedure for recording transactions;

· degree of coverage of business transactions;

· number of accounts;

· place of drawing up the document;

· content of business transactions.

According to their purpose, documents are divided into organizational and administrative, exculpatory (executive), accounting and combined.

Organizational and administrative documents are a set of documents that establish the functions, tasks, goals, as well as the rights and responsibilities of employees and managers to perform specific actions, the need for which arises in the operational activities of the organization. Administrative documents serve as the basis for the acceptance and issuance of money and material assets. Thus, you can receive money from a bank account only with a written order from the director of the enterprise and the chief accountant. Administrative documents include a power of attorney to receive inventory items, a check to receive cash from a current account, a payment order to transfer funds to the bank by bank transfer, a work order for piecework, etc.

Supporting (executive) documents are drawn up for operations already performed, i.e. they confirm the fact of business transactions and serve as a basis for accounting in accounting. For financially responsible persons, these documents provide justification for receiving or spending inventory and cash.

Such documents include : acceptance acts, receipts, invoices, payment requests, statements, etc.

Accounting documents are drawn up by accounting employees in order to prepare further accounting records based on data from administrative and supporting documents, to facilitate and speed them up.

These include: cumulative statements of distribution of general production and general business expenses, statements of depreciation, calculation of realized trade discounts, other certificates and calculations prepared by the accounting department.

Combined documents combine the characteristics of organizational, administrative, voucher and accounting documents. Such documents are also an order to carry out a specific business transaction and document an already completed transaction. Sometimes they also contain instructions on the procedure for recording the transaction in the accounting accounts. For example, an expenditure cash order, being an order to the cashier to issue money from the cash register, serves as an administrative document.

After the money is issued with the signature of the person who received it, this document will already be an acquittal document confirming the fact that the money was issued from the cash register. After the accountant indicates the corresponding accounts on this cash receipt order, it already becomes an accounting document. Combined documents include an advance report, a request for the release of materials from a warehouse, a cash receipt order, etc. The use of combined documents is widespread in accounting practice, as it reduces the number of records, facilitates the accounting processing of documents, makes them more visible, and reduces costs labor and paper costs.

According to the order in which the transaction is reflected, documents are primary and summary.

Primary documents are those that document the facts of economic life at the time of their occurrence. These documents are located at the very beginning of the technological chain of the accounting process. They form the basis of primary accounting, because the fact of economic life is recorded in the primary document through preliminary observation and measurement. The primary ones include most of the accounting documents that formalize business transactions (for example, incoming and outgoing cash orders, receiving acts, invoices, payment requests, etc.).

Consolidated documents record data on the facts of economic life from several primary documents. The use of consolidated documents is associated with the need to summarize data from primary documents and obtain aggregated indicators, or obtain additional information about the business transactions being recorded and reflect them in accounting in the appropriate sections. An example of a summary document could be cashier's reports, which summarize information about incoming and outgoing cash orders and documents attached to them; commodity reports compiled on the basis of primary documents on the receipt and expenditure of material assets, etc.

According to the degree of coverage of business transactions, documents are divided into one-time and cumulative. One-time documents document one or more business transactions recorded in the document simultaneously. After compilation, accounting entries are made based on them. One-time documents include claims, invoices, payment requests, checks, cash orders, acts, etc.

Cumulative documents are compiled gradually over a certain period (day, decade, month) to reflect homogeneous, systematically repeating operations. Accumulation documents are finalized after a specified period, after which they are transferred to the accounting department for records. Such documents include: a statement of distribution of overhead expenses, a certificate from the accounting department for writing off the calculation difference, a limit card. Based on the intake limit card, materials are released from the warehouse into production. It is written out for each item number of materials consumed by the workshop and contains data on the supply limit for these materials. By comparing data on the actual release of materials with the established limit, the release of materials into production is constantly monitored.

The use of cumulative documents significantly reduces the number of documents issued and simplifies accounting techniques. So, instead of making entries in the accounting accounts of each individual release of materials from the warehouse at the end of the month, one entry is made for the amount of the totals of the limit-fence card. Such cumulative entries into accounts once a month based on the overall results of homogeneous documents are becoming increasingly common in accounting practice.

Based on the number of accounts, documents are divided into single-line and multi-line. A one-line document reflects the receipt or consumption of one type of material. Such documents include: power of attorney, material label, materials warehouse card, etc.

A multi-line document contains several positions and types of material assets. Multi-line documents reduce the number of entries when compiling documents and reduce the need for paper for the production of invoice forms. These documents are also more efficient when processed using computer technology. All general details are recorded in the document and then processed once. In this way, the following are filled in: a receipt order, a waybill, a limit card, an invoice for the release of materials to third parties, etc.

Depending on the place of preparation, internal and external documents differ. Internal documents are drawn up at this enterprise. These include the bulk of the enterprise's documents, for example, cash orders, invoices, acts, advance reports, statements, requirements, etc. External documents come from other organizations and reflect economic relations with them, for example, invoices, payment requests, bank statements with current account, payment orders, etc. The differences between these documents determine their verification and accounting processing, the procedure for correcting detected errors.

According to the content of business transactions, documents are divided into:

· material documents that reflect the movement of inventory (act of acceptance and transfer of fixed assets, statement of materials consumption, etc.);

· monetary documents that reflect transactions with cash and non-cash funds (payment order, check for receipt of funds, receipt for cash deposit, etc.);

· settlement documents that reflect settlement relationships with partners regarding obligations incurred (invoices, pay slips, etc.).

In accounting, each document has its own purpose and therefore belongs simultaneously to different classification groups. For example, a supplier's invoice for materials purchased from him is a supporting and at the same time primary, one-time, external document. A cash receipt order is a combined, primary, one-time, one-line, internal document. Thus, from the point of view of various classification criteria, each document belongs to the corresponding group. Classification of documents according to characteristics makes it possible to correctly understand their content and purpose in the economic activities of the enterprise.

A variety of business transactions are carried out at enterprises and organizations. Organizational management is provided by a huge amount of documented information. All documents submitted to organizations are divided into document formations (systems, documentation subsystems), types and varieties of documents. Documentary entities ensure the implementation of certain management functions or activities of the organization. Documentation systems and subsystems include dozens of types of documents characteristic of a given document education, which in turn can consist of many types of documents.

In order to better understand their purpose and filling procedure, as well as to ensure their correct use, it is necessary to classify documents according to homogeneous characteristics.

Accounting documents are classified according to the following criteria:

· appointment;

· the procedure for recording transactions;

· degree of coverage of business transactions;

· number of accounts;

· place of drawing up the document;

· content of business transactions.

According to their purpose, documents are divided into organizational and administrative, exculpatory (executive), accounting and combined.

Organizational and administrative documents are a set of documents that establish the functions, tasks, goals, as well as the rights and responsibilities of employees and managers to perform specific actions, the need for which arises in the operational activities of the organization. Administrative documents serve as the basis for the acceptance and issuance of money and material assets. Thus, you can receive money from a bank account only with a written order from the director of the enterprise and the chief accountant. Administrative documents include a power of attorney to receive inventory items, a check to receive cash from a current account, a payment order to transfer funds to the bank by bank transfer, a work order for piecework, etc.

Supporting (executive) documents are drawn up for operations already performed, i.e. they confirm the fact of business transactions and serve as a basis for accounting in accounting. For financially responsible persons, these documents provide justification for receiving or spending inventory and cash.

Such documents include : acceptance acts, receipts, invoices, payment requests, statements, etc.

Accounting documents are drawn up by accounting employees in order to prepare further accounting records based on data from administrative and supporting documents, to facilitate and speed them up.

These include: cumulative statements of distribution of general production and general business expenses, statements of depreciation, calculation of realized trade discounts, other certificates and calculations prepared by the accounting department.

Combined documents combine the characteristics of organizational, administrative, voucher and accounting documents. Such documents are also an order to carry out a specific business transaction and document an already completed transaction. Sometimes they also contain instructions on the procedure for recording the transaction in the accounting accounts. For example, an expenditure cash order, being an order to the cashier to issue money from the cash register, serves as an administrative document.

After the money is issued with the signature of the person who received it, this document will already be an acquittal document confirming the fact that the money was issued from the cash register. After the accountant indicates the corresponding accounts on this cash receipt order, it already becomes an accounting document. Combined documents include an advance report, a request for the release of materials from a warehouse, a cash receipt order, etc. The use of combined documents is widespread in accounting practice, as it reduces the number of records, facilitates the accounting processing of documents, makes them more visible, and reduces costs labor and paper costs.

According to the order in which the transaction is reflected, documents are primary and summary.

Primary documents are those that document the facts of economic life at the time of their occurrence. These documents are located at the very beginning of the technological chain of the accounting process. They form the basis of primary accounting, because the fact of economic life is recorded in the primary document through preliminary observation and measurement. The primary ones include most of the accounting documents that formalize business transactions (for example, incoming and outgoing cash orders, receiving acts, invoices, payment requests, etc.).

Consolidated documents record data on the facts of economic life from several primary documents. The use of consolidated documents is associated with the need to summarize data from primary documents and obtain aggregated indicators, or obtain additional information about the business transactions being recorded and reflect them in accounting in the appropriate sections. An example of a summary document could be cashier's reports, which summarize information about incoming and outgoing cash orders and documents attached to them; commodity reports compiled on the basis of primary documents on the receipt and expenditure of material assets, etc.

According to the degree of coverage of business transactions, documents are divided into one-time and cumulative. One-time documents document one or more business transactions recorded in the document simultaneously. After compilation, accounting entries are made based on them. One-time documents include claims, invoices, payment requests, checks, cash orders, acts, etc.

Cumulative documents are compiled gradually over a certain period (day, decade, month) to reflect homogeneous, systematically repeating operations. Accumulation documents are finalized after a specified period, after which they are transferred to the accounting department for records. Such documents include: a statement of distribution of overhead expenses, a certificate from the accounting department for writing off the calculation difference, a limit card. Based on the intake limit card, materials are released from the warehouse into production. It is written out for each item number of materials consumed by the workshop and contains data on the supply limit for these materials. By comparing data on the actual release of materials with the established limit, the release of materials into production is constantly monitored.

The use of cumulative documents significantly reduces the number of documents issued and simplifies accounting techniques. So, instead of making entries in the accounting accounts of each individual release of materials from the warehouse at the end of the month, one entry is made for the amount of the totals of the limit-fence card. Such cumulative entries into accounts once a month based on the overall results of homogeneous documents are becoming increasingly common in accounting practice.

Based on the number of accounts, documents are divided into single-line and multi-line. A one-line document reflects the receipt or consumption of one type of material. Such documents include: power of attorney, material label, materials warehouse card, etc.

A multi-line document contains several positions and types of material assets. Multi-line documents reduce the number of entries when compiling documents and reduce the need for paper for the production of invoice forms. These documents are also more efficient when processed using computer technology. All general details are recorded in the document and then processed once. In this way, the following are filled in: a receipt order, a waybill, a limit card, an invoice for the release of materials to third parties, etc.

Depending on the place of preparation, internal and external documents differ. Internal documents are drawn up at this enterprise. These include the bulk of the enterprise's documents, for example, cash orders, invoices, acts, advance reports, statements, requirements, etc. External documents come from other organizations and reflect economic relations with them, for example, invoices, payment requests, bank statements with current account, payment orders, etc. The differences between these documents determine their verification and accounting processing, the procedure for correcting detected errors.

According to the content of business transactions, documents are divided into:

· material documents that reflect the movement of inventory (act of acceptance and transfer of fixed assets, statement of materials consumption, etc.);

· monetary documents that reflect transactions with cash and non-cash funds (payment order, check for receipt of funds, receipt for cash deposit, etc.);

· settlement documents that reflect settlement relationships with partners regarding obligations incurred (invoices, pay slips, etc.).

In accounting, each document has its own purpose and therefore belongs simultaneously to different classification groups. For example, a supplier's invoice for materials purchased from him is a supporting and at the same time primary, one-time, external document. A cash receipt order is a combined, primary, one-time, one-line, internal document. Thus, from the point of view of various classification criteria, each document belongs to the corresponding group. Classification of documents according to characteristics makes it possible to correctly understand their content and purpose in the economic activities of the enterprise.

Document requirements

Each management document must meet the following requirements: be drawn up in a strictly defined form and, in some cases, comply with standards; issued by a competent authority or person having official authority, as well as by those persons to whom this right is granted by law or directive; published for the purpose of complying with legal norms and not contradicting them. The classification of documents in accounting and their mandatory details must be controlled by the head of the enterprise.

It is advisable to divide the texts in the document into two main parts. The first notes the reasons for the formation of the document, the second explains proposals, conclusions, decisions, requests, orders. If the document contains one phrase, the first part of it should still indicate the basis for the creation, and the second part should indicate the direct order. In some cases, the document may only have the final part if it is a letter or request without any explanation. The text of the document must be accurate and understandable.

All accounting documents refer to the Unified Classification and Coding System (USCC). The code acts instead of a name and serves as a way to identify the object. It is used to simplify the processing of information in primary documents. For example, code 5002 indicates the issuance of funds from the cash register in an accountable form.

Such classifications are a standard mandatory for all business entities. Also, GOSTs, standard design solutions of an intersectoral nature, data processing using a computer, and application software packages play a large role in the standardization and unification of documents.

The movement of high-quality processed source documentation along certain routes from the place of formation or appearance in the institution to delivery to the archive for storage or sending to individuals and legal entities interested in them is called document flow.

Requirements for filling out documents

Documents must be drawn up in a timely manner, as a rule, at the time of the transaction, or if for some reason this is impossible, immediately after the completion of the transaction.

When selling goods, products, works and services using cash registers, it is allowed to draw up a primary accounting document at least once a day after its completion on the basis of cash receipts.

The documents must contain all details that reflect reliable data. Documents can be filled out with ballpoint pen paste, chemical pencil, using typewriters or in a fully automated way. The document must be drawn up clearly, clearly, without erasures; it is not allowed to make entries in documents with a simple pencil. Final entries related to the transfer of valuables must be written in words. Free lines must be crossed out.

The list of persons authorized to sign primary accounting documents is approved by the head of the organization in agreement with the chief accountant. Documents used to document facts of economic life related to funds are signed by the head of the organization and the chief accountant or their authorized persons.

By purpose

There is a classification of documents in accounting according to their purpose:

- Exculpatory (executive) – confirmation of the transaction (receipts, acts, invoices).

- Directive – includes an indication to perform any operation (instructions, payment orders to the bank, checks, powers of attorney, orders, etc.)

- Accounting registration – such documents that prepare accounting records (distribution and grouping statements, certificates, calculations, etc.)

- Combined - documents with the simultaneous content of an order and confirmation of its execution (settlement and payroll statement, report on accrual of advance payment).

What is included in the primary documentation

A primary document is any document that serves as the basis for an accounting entry, recognition of income or expense in tax accounting. The “primary” includes, for example, an invoice, act, accounting certificate, expense report, and so on.

Each primary accounting document must contain seven mandatory details (clause 2 of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, hereinafter referred to as Law No. 402-FZ):

- Name;

- date of compilation;

- the name of the economic entity that compiled it;

- content of the fact of economic life;

If one primary accounting document documents several related facts of economic life, then it is necessary to provide the contents of all these facts. If the “primary report” is drawn up on the basis of another (supporting) document that contains information about the fact of economic life, it is necessary to make a reference to this supporting document (clause “c” clause 8, clause “a” clause 9 FSBU 27/ 2021).

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the positions of the persons who performed the transaction and the person responsible for its registration, or the person responsible for the registration of the accomplished event;

- signatures of the above persons, listing their last names and initials or other details necessary for their identification.

The expert will tell you even more about primary education at a free webinar on October 6: sign up.

At the place of registration

- Internal – compiled directly in the organization (payroll statements, commodity reports).

- External – received from other organizations (for example, bank statements).

Document flow is a reflection of the organizational structure of the management apparatus that has developed in the institution. It is very important to comply with the deadlines for submitting documents, since violation of them leads to their loss of efficiency and relevance.

We examined the classification of documents in accounting.