Features of accounting policies under the simplified tax system

If an entrepreneur applies a simplified taxation system, then he pays:

- Tax of 6% on income or 15% on income minus expenses.

- Pension contributions.

- Health insurance contributions.

- Contributions related to the provision of social guarantees.

If a company’s expenses make up less than 60% of its income, then of the taxable objects provided for by the simplified tax system, it is more profitable for it to switch to accounting with a simplified tax system of 6% (income) in 2020. It should be noted that this tax regime (USN 6%) has several advantages. When calculating the amount of tax to be paid, only the amount of receipts and payments that can reduce the accrued tax is required. But in this case, special attention must be paid to accounting expenses, since tax authorities check them especially meticulously.

And the transition to accounting under the simplified tax system “income” implies the payment of a single tax on your income, which replaces the profit tax, VAT and property tax, but this does not eliminate the need to pay transport tax, land tax and trade tax. Such taxes depend on the availability of vehicles and the land on which the activity is carried out. If the presence of import operations is implied, then VAT is charged.

Advantages of switching to simplified accounting for a small enterprise

- Reduced tax burden. Companies are freed from the need to remit income tax, VAT, and property tax (with some exceptions). This allows you to reduce the cost of products/services and increase competitiveness.

- The ability to select an object of taxation depending on the economic activity of the enterprise (“income”/“income reduced by the amount of expenses”). From the beginning of the calendar year, based on the results of financial statements, the object can be changed if notification is submitted before December 31.

- Available tax rates (6% for “income” and 15% for “income minus expenses”). At the initiative of regional authorities, rates for different categories of taxpayers may be reduced even further - within 1-6% for “income” and 5-15% for the second scheme.

- Ease of use in practice. Tax accounting is kept in a simple and easy-to-understand accounting book, which, by law, does not need to be certified by the Federal Tax Service. It is enough for representatives of this category to submit a declaration once a year, and enterprises report to the OSN every quarter.

- Additional bonuses. The conditions for including fixed assets and intangible assets purchased during the period of application of the simplified tax system into expenses are much simpler than the procedure for inclusion under the general taxation regime.

First-time registered individual entrepreneurs (subjects of the Russian Federation) who work in the production, social or scientific spheres, in the consumer services industry, have the right to a zero tax rate for two years. This is true for companies in which the average number of employees during the reporting period does not exceed 15 people. According to paragraph 4 of Art. 346.20 of the Tax Code of the Russian Federation, this rule is valid until 2022 - until the end of Law No. 10, which entered into force on March 25, 2015.

By switching to simplified taxation, individual entrepreneurs save time and money

Cash and accrual method

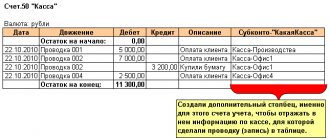

Typically, accounting is done on an accrual basis (double entry). But for organizations that have switched to simplified accounting, the current legislation allows for the possibility of maintaining it on a cash basis (clause 12 of PBU 9/99 and clause 18 of PBU 10/99). This is convenient because, according to the provisions of Article 346.24 of the Tax Code of the Russian Federation, this method takes into account paid income and expenses that are used when calculating tax. In this way, they are reflected in the book of income and expenses, which, when simplified, is a mandatory tax register.

The cash method in accounting distorts the real picture of the taxpayer’s economic life, including his financial statements. Thus, accounting is carried out on an accrual basis, and the cash method is left as a method of maintaining tax accounting. But there are still no recommendations for organizing the cash method.

Accounting for inventories

Let's start with the changes that affected PBU 5/01 “Accounting for inventories”.

Small enterprises have the opportunity to take into account inventories at the supplier’s price.

All other costs directly related to the acquisition of inventories are now allowed to be included in expenses for ordinary activities in full in the period in which they were incurred. EXAMPLE 1. EVALUATING MPZ

Trading purchased goods in the amount of 100,000 rubles.

and spent 7,000 rubles on their delivery. According to generally established rules, goods should be received at actual cost, amounting to 107,000 rubles. (100,000 + 7,000). But based on the new simplified rules, the Parus accountant made the following entries: DEBIT 41 CREDIT 60

- 100,000 rubles.

– goods are capitalized; DEBIT 44 CREDIT 76

- 7000 rub. – expenses for delivery of goods are included in expenses.

The adopted simplified procedure for assessing industrial property applies to all types.

It is unlawful to apply a simplified procedure for some types (for example, materials), and a generally established procedure for others (for example, goods). The next innovation, truly revolutionary, is that micro-enterprises are allowed to write off inventories accepted for accounting as financial results, without waiting for their actual use in activities. EXAMPLE 2. WRITTEN OFF INVESTMENTS AT A MICRO ENTERPRISE

The production facility is a micro-enterprise.

When purchasing a batch of raw materials from a supplier in the amount of 50,000 rubles. RUB 2,000 spent on consulting services. According to simplified rules, the accounting records for these operations look like this: a) on the date of expenses - DEBIT 20 CREDIT 60

- 50,000 rubles.

– raw materials are capitalized; DEBIT 20 CREDIT 76

- 2000 rub.

– costs for consultant services are written off as expenses; b) at the end of the calendar month (irrespective of the consumption of materials in production) - DEBIT 90 subaccount “Cost of sales” CREDIT 20

- 52,000 rubles. (50,000 + 2000) – the costs of raw materials are written off to the cost of sales.

This method will lead to the fact that in the accounting and financial statements of a micro-enterprise there will be no residual inventories - raw materials, supplies, purchased goods and work in progress. And this type of materials production as finished products will not arise at all. There is simply “nothing” to form it from.

This method of cost accounting is known as the “boiler” method; it does not involve maintaining analytical accounting.

How to keep track of sales?

EXAMPLE 3. REFLECTING SALES

Let's use the conditions of example 2. Let's assume that raw materials were purchased in March 2022.

Vympel had no sales this month. In April, finished products were sold in the amount of 20,000 rubles. The accountant will make entries: in March - DEBIT 99 DEBIT 90 subaccount “Cost of sales”

- 52,000 rubles.

– expenses of the month are included in the financial result; in April - DEBIT 62 CREDIT 90 subaccount “Revenue”

- 20,000 rubles. – revenue is recognized.

Read also “Reducing the cost of inventories. What should I pay attention to?

As a result of such accounting policies, operational control over inventories will be lost. Management accounting will have to be kept separately. Meanwhile, simplified accounting has an important advantage.

Let us remember that microenterprises have the right to recognize revenue as funds are received (clause 12 of PBU 9/99 “Income of the organization”), and expenses - after repayment of debt (clause 18 of PBU 10/99 “Expenses of the organization”). Now imagine that there was no cash flow in March - April 2022: the raw materials were not paid for, no money was received from the buyer. Examples 2 and 3 relate to the accounting policy using the accrual method (paragraph 5, clause 5 of PBU 1/2008 “Accounting policy of the organization”). If Vympel decides to conduct accounting on a cash basis, then in the conditions of examples 2 and 3 no facts of economic life will arise at all (Clause 8 of Article 3 of the Federal Law “On Accounting”).

At first glance, this is exotic. However, under the conditions of applying the simplified taxation system, Vympel will not have entries in tax accounting (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation). After all, the simplified tax system is based on the cash method (paragraph 1, clause 1, article 346.17 of the Tax Code of the Russian Federation). As a result, there will be no discrepancies between Vympel’s tax and accounting records.

Thus, the simplified procedure for writing off raw materials and supplies is attractive for manufacturing micro-enterprises using the simplified tax system. For trade operations, there is no point in introducing a simplified procedure, since in tax accounting the cost of goods is expensed as the said goods are sold (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Remember: you have the right to establish the use of a simplified write-off procedure for inventories of only one type - say, for raw materials or supplies.

In this case, you will write off goods according to generally established rules - as they are sold. Another simplification has been introduced, which is very convenient for accounting departments. The Ministry of Finance of Russia allowed to write off as expenses the costs of purchasing industrial equipment intended for management needs in full amount as they were acquired. In practice, this means that accountants will no longer have to maintain burdensome control over the use of office supplies. EXAMPLE 4. WE CONSIDER “MANAGEMENT” MPZ

The small enterprise “Paritet” purchased paper for office purposes in the amount of annual needs in the amount of 30,000 rubles.

Instead of receiving paper and then gradually writing it off, Paritet’s accountant has the right to make a single entry: DEBIT 26 CREDIT 60

- 30,000 rubles. – printer paper has been written off.

And the last simplification of the work on accounting for inventories at small enterprises is that the obligation to annually revaluate inventories at current market value in the event of its decline has been abolished. In other words, it is no longer necessary to create reserves to reduce the value of material assets (clause 25 of PBU 5/01). However, until recently such reserves were formed by rare enthusiasts.

Peculiarities of accounting for individual entrepreneurs in a simplified manner

Individual entrepreneurs are luckier than legal entities: they do not have to do accounting. For them, there is a choice among free programs for maintaining accounting for individual entrepreneurs using the simplified tax system. Federal Law No. 402-FZ exempts individual entrepreneurs from accounting reporting. However, if you want to take into account the facts of economic activity, you can use any convenient rules; no one checks their compliance with the law.

For individual entrepreneurs, only tax accounting is required. It includes primary accounting documents, such as cash registers, an income book (or income and expenses), and tax returns. In addition, you must report to the Federal Tax Service on insurance premiums (if you have hired employees).

Which companies are classified as small businesses

Small enterprises include (Article 4 of the Federal Law of July 24, 2007 N 209-FZ):

- business societies and partnerships, production and consumer cooperatives, peasant farms and individual entrepreneurs with indicators for last year: average headcount - up to 100 people.

- business income (revenue + non-operating income) - no more than 800 million rubles. (Clause 1 of the Decree of the Government of the Russian Federation dated 04/04/2016 N 265).

- the total share of participation in the LLC of other organizations (not small or medium-sized), foreign organizations - no more than 49%.

- the total share of participation in the LLC of the Russian Federation and constituent entities of the Russian Federation, municipalities, public, religious organizations and foundations is no more than 25%.

Simplified accounting forms and forms, relevant in 2020

Bookkeeping on the simplified tax system from scratch usually begins with the questions: what accounting documents should an LLC have under the simplified tax system, what forms and forms of documents to use. Federal Law No. 402-FZ has granted broad powers to economic entities in this area, which the Ministry of Finance regularly confirms. For example, instead of a consignment note, it is convenient to use a universal transfer document (Letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ). This is what the UPD form, a universal transfer document, looks like:

Basic rules for primary and accounting and tax accounting registers:

- Only events that took place are recorded; the law specifically stipulates liability for records of imaginary transactions.

- All forms are approved in the accounting policy of the organization.

- The documents for which the Federal Tax Service has developed an electronic format have an established structure, but differences in appearance are allowed and have an expanded set of indicators.

- Some primary documents are unified (cash, bank). In addition, accounting, for example, in a travel agency or concert box office in a simplified manner, encounters ticket forms, in laboratories or research centers - with centralized forms of reports and protocols, etc. There are no unified registers.

Which companies are microenterprises?

Micro-enterprises include (Article 4 of the Federal Law of July 24, 2007 N 209-FZ):

- business societies and partnerships, production and consumer cooperatives, peasant farms and individual entrepreneurs with indicators for last year: average number of employees - less than 15 people.

- business income (revenue + non-operating income) - no more than 120 million rubles. (Clause 1 of the Decree of the Government of the Russian Federation dated 04/04/2016 N 265)

- the total share of participation in the LLC of other organizations (not small or medium-sized), foreign organizations - no more than 49%.

- the total share of participation in the LLC of the Russian Federation and constituent entities of the Russian Federation, municipalities, public, religious organizations and foundations is no more than 25%.

Accounting statements of an organization on the simplified tax system in 2022: document forms

The LLC accountant's calendar on the simplified tax system for 2022 includes only annual reporting. This is not required from the individual entrepreneur either. Interim reports (monthly, quarterly) are relevant only if they are specified in the accounting policy.

The deadline for submitting annual reports is March 31. Composition - only the balance sheet and financial statements with attachments. In case of significant deviations from industry averages or losses over several years, tax authorities have the right to demand explanations for the balance sheet. The form is paper or electronic, not unified. The recommended format for submitting financial statements in electronic form is approved by Order of the Federal Tax Service of Russia dated March 20, 2017 No. ММВ-7-6/ [email protected] Place of submission - Federal Tax Service and Rosstat.

This is what the form of simplified annual financial statements looks like, which small businesses submit to the simplified tax system.

In recent years, the number of reports to other departments has increased significantly: SZV-M reports must be submitted monthly to the Pension Fund of the Russian Federation, and personal income tax declarations must be submitted quarterly. In this regard, although small businesses are allowed to conduct accounting in a simplified form, the total volume of accounting work has not become smaller, and the cost of outsourcing accounting services in an LLC using the simplified tax system does not decrease.

Procedures and algorithms that simplified accounting does without

SMP has the right to waive the following generally accepted accounting standards:

- forget about the accrual method and determine income and expenses using the cash method;

- apply a simplified system of accounting registers;

- refuse to maintain accounts 09 and 77, intended for accounting for deferred tax assets and liabilities (do not keep records of permanent and temporary differences);

- use one synthetic account instead of a group of accounts (for example, account 20 “Main production” instead of accounts 23, 25 and 26);

- do not form reserves;

- do not apply certain PBUs (for example, for construction SMP - PBU 2/2008 “Accounting for construction contracts”, approved by Order of the Ministry of Finance of Russia dated October 24, 2008 No. 116n);

- do not overestimate fixed assets and intangible assets, do not reflect the depreciation of intangible assets and financial investments in accounting;

- recognize commercial and administrative expenses in the cost of products (goods, works, services) in full in the reporting year of their recognition as expenses for ordinary activities;

- recognize all borrowing costs as other expenses (without inclusion in the value of the investment asset).

Organizations using the simplified tax system have the right to use simplified accounting. How to organize accounting under this special regime, read the material “Procedure for maintaining accounting records under the simplified tax system (2020).”

In addition to accounting concessions, SMEs have the right to reduce their costs when preparing reports:

- reduce the volume of reports by filling out only the balance sheet and income statement;

- refuse to detail indicators by article, generalizing them by group;

- disclose information to a lesser extent, without reporting related parties, discontinued activities, etc.;

- correct significant errors at the time they are discovered, without using retrospection.

At the same time, the accounting of a small enterprise must be organized in such a way that its reporting is reliable and useful for its users, truthfully reflecting in all material aspects the financial position of the enterprise and the financial results of its work.

The procedure for filling out a balance sheet in a simplified form

The reporting includes 2 sections for entering information about the assets and liabilities of the organization with a balance sheet for both sections.

Let's imagine an algorithm for entering information in table format.

| Indicator name | Clarification on filling | Accounts included in the indicator |

| ASSETS | ||

| Tangible non-current assets | Includes residual value of intangible assets | 01, 03, 08 |

| Intangible, financial and other non-current assets | Combines the residual value of intangible assets and R&D expenses, deposit balances, long-term investments and debts | 55, 58, 60, 62, 68, 69, 70, 71, 73, 75, 76 |

| Reserves | Information on balances of materials and goods, costs of work in progress | 10, 41, 44, 45, 20, account balance 97 |

| Cash and equivalents | Combines information on the movement of funds from “cash accounts”, excluding subaccount 55 “Deposit accounts” | 50, 51, 52, 55, 57 |

| Financial and other current assets | Data on short-term investments | 58 |

| BALANCE | Total amount 5 lines | |

| PASSIVE | ||

| Capital and reserves | Credit balances are entered. If a negative result is obtained, the number is written in brackets. | 80 (less account balance 81), 82, 83, 84 |

| Long-term borrowed funds | Information about the organization’s outstanding debt on long-term loans. Interest that has been paid for less than 1 year at the date of compilation should not be taken into account. | 67 |

| Other long-term liabilities | Combines data on balances on other accounts for long-term liabilities. | 60, 62, 68, 69, 70, 71, 73, 75, 76 |

| Short-term borrowed funds | The account balance is 66 and accrued interest that was not taken into account in the previous line. | 66 |

| Accounts payable | Summary information on the balance of all short-term liabilities. | 60, 62, 68, 69, 70, 71, 73, 75, 76 |

| Other current liabilities | Filled in if some data on short-term liabilities was not reflected above. | |

| BALANCE | Total amount 6 lines | |

According to the drawing up rule, balances must be identical to each other.