About legal entities

Problems when changing the tax office When changing the legal address with a change in tax problems and

Who is eligible for tax benefits? Institutions and organizations providing educational services can take advantage of

Significant errors in the invoice Errors in the invoices are considered significant if they can cause

As part of the implementation of the main directions of the budget, tax and customs tariff policies of Russia, the Federal

Grounds and reasons Article 76 of the Labor Code of the Russian Federation lists situations in which an employee must be suspended

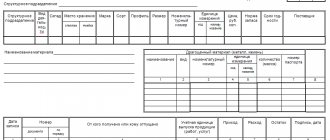

The essence of the warehouse accounting book For accounting purposes at the enterprise where storage takes place

The state needs to fulfill social guarantees to the population, for this there are appropriate funds: Pension, Social Insurance

Personalized accounting since 2017 From January 1, 2022, calculation and payment of insurance

What is the OKTMO code OKTMO is a digital designation that is assigned to each municipal entity

Object of taxation upon import Import of goods in Russian legislation is recognized as the import of such goods into its