The state needs to fulfill social guarantees to the population; for this there are appropriate funds: Pension, Social Insurance and Compulsory Medical Insurance. The budgets of these organizations are formed, among other things, from insurance premiums (IC), which are paid by employers and self-employed people. Out of habit, many people call these payments a single social tax. Next, everything you need to know about the unified social tax for individual entrepreneurs: about the features of calculations under various tax regimes, about the table of rates, about the deadlines for payment and responsibility for debt.

What is UST and why is it needed?

The concept of a single social tax existed earlier, when the tax service collected this fee until 2010. After this, the concept of an insurance premium appeared, and the funds themselves performed the functions of monitoring their payment. However, this seven-year practice did not lead to anything good: there was a significant increase in debt. Therefore, from 2022, the SV is again under the jurisdiction of the Federal Tax Service. According to the current tax legislation (Article 8, Chapter 34 and Section XI of the Tax Code), insurance premiums are mandatory payments for entrepreneurs and employers for their employees in order to ensure the implementation of their social rights as insured persons. Any person will sooner or later face old age and illness, therefore his inalienable social rights are:

- in receiving an old-age pension;

- in payment of sick leave;

- taking paid maternity leave;

- free medical care at the clinic.

The collection of insurance premiums is aimed at these purposes; only for employed citizens their employers pay, and self-employed persons, such as individual entrepreneurs, lawyers, notaries, peasant farms, must pay for themselves. The law has not changed only in relation to contributions for injuries and unemployment. Social Insurance continues to provide compulsory insurance against accidents at work and occupational diseases, and the payment of benefits to unemployed citizens.

Changes related to postponements and audits

Supervisory enterprises can now, if there are serious reasons, increase the duration of inspections from the previous four months to six. Such grounds are:

- serious violations that require urgent investigation and immediate action; they must be recorded and documented;

- violations in branches located in different constituent entities of the Russian Federation that require verification;

- inaccuracy in documents or lack of requested data;

- failure to timely make insurance payments, including due to force majeure.

The employer (IP) has the right and even must, in the event of such emergency circumstances, ask for a deferment or installment plan for payments for the unified social tax. These may be reasons such as an unreasonable delay in financing, and for enterprises conducting seasonal work, also force majeure: man-made and natural disasters, military operations, etc.

The subject of taxation will need to submit an application in the established form to the relevant organization. Based on it, a certain decision will be made.

>Tables of UST rates in 2022

Insurance premium rates in 2022

Reduced insurance premium rates in 2022

Who pays

Insurance fees are withheld from the income of any citizen, and in some cases a migrant, carrying out labor, economic or professional activities in Russia. The question is who pays? In this regard, all payers are divided into two halves:

1. Pay for themselves:

- entrepreneurs;

- heads of peasant farms;

- private practitioners, notaries, lawyers;

- arbitration, bankruptcy managers;

- patent attorneys, appraisers.

2.Pay for people who are officially hired:

- enterprises, organizations, institutions;

- Individual entrepreneur with employees;

- Peasant farms for members of the farm.

The businessman belongs to both of these groups. This means that he must pay SV for his staff, as an employer, and also for himself. By engaging in entrepreneurship, he creates a job, first of all, for himself, therefore he is obliged to provide himself with compulsory pension and health insurance (OPS and compulsory medical insurance). Whether or not to pay the social part of the contributions for his person is a voluntary decision for him. Therefore, it is not necessary to pay to the Social Insurance Fund, but it is advisable, especially for women who are planning a pregnancy.

Important! Lack of income from business activities or suspension of work without deregistration as an individual entrepreneur does not exempt from payment of social tax. For the entire period of activity from the date of registration to the date of withdrawal, the businessman must pay contributions for himself and his employees.

In Art. 430 of the Tax Code identifies several compelling reasons that open up a grace period for an entrepreneur for exemption from insurance premiums:

- for a conscript while he is in the army;

- if he is caring for a child under one and a half years old, a severely disabled person or an elderly person who has reached 80;

- when the other half of the individual entrepreneur is a diplomatic service employee or a military serviceman, and the family has to live in a military garrison or abroad (grace period no more than 5 years);

- if the lawyer has suspended his activities and notified his tax authority about this.

The listed reasons must be supported by documents, however, if during these periods the businessman receives income, for example, through remote sales through an online store, then payment of the CB is inevitable.

Object of taxation

The Tax Code of the Russian Federation specifies several objects of taxation under the Unified Social Tax, which every taxpayer needs to know in order to pay them. More precisely, these payments are provided for in a legally certified employment agreement concluded between the applicant and the employer and an agreement on additional remuneration that is attributed to individuals. persons.

In paragraph number 3 of Article 236 of the Tax Code of the Russian Federation, it is clearly stated that the objects of payment will not be recognized or related to actual payments that in no way reduce the size of the tax base. Precisely, in this regard, there is no refund on them, and there is no need to pay them.

How is the rate calculated?

Premium amounts for different payer groups may vary, so there is a lot of confusion about how the rate is calculated. Since the number of employed citizens is many times greater than the number of self-employed and private practitioners who pay only for themselves, the first group can be considered the main payers. Or rather, their employers. For each employee, a general unified social tax rate is established on his salary: 30%. Moreover, this percentage is divided into 3 percentage components:

- 22 for PF;

- 5.1 for compulsory medical insurance;

- 2.9 for Social Insurance.

Previously, it was expected that the pension insurance tariff would increase to 26%. However, the idea was abandoned. Rates in 2022 have not changed. Moreover, they were made permanent.

Attention! An entrepreneur, when paying UST for employees, cannot refuse part of the interest in Social Security, as in the case of paying for his own SV. At the same time, he can pay contributions at reduced rates. The conditions are enshrined in Art. 427 Tax Code of the Russian Federation. The amount of contributions to the Social Insurance Fund of the Russian Federation is also influenced by a special assessment of jobs, timely confirmation of the type of activity and timely payment of fees.

There is a concept of a maximum base value for calculating insurance contributions for the pension and social part. This is the maximum level of earnings from the beginning of the year (accruing amount) at which the specified tariffs are applied. For excess amounts, contributions are charged at reduced rates:

- in the Pension Fund 10%;

- is not credited to the Social Insurance Fund at all;

- There is no maximum base established for the Compulsory Medical Insurance Fund.

The marginal base is the average annual earnings of a citizen, it is determined by multiplying the average salary in the country by the number of months 12. This value is indexed every year. For 2019 it is: 1,150,000 rubles. in terms of pension insurance, and 865 thousand rubles. regarding payments to Social Security (government resolution No. 1426 of November 28, 2018).

Example: The total salary of an employee by June 2022 was 1 million 140 thousand (228 thousand per month). Starting from the second half of the year, the employer will pay SV for him only to the Pension Fund (10%) and the Compulsory Medical Insurance Fund (5.1%):

(228000x0.1)+(228000x0.051)=34428 rubles per month.

There is no need to pay to the Social Insurance Fund.

Categories of individual entrepreneurs for which the preferential tariff was canceled in 2022

| Organizations and individual entrepreneurs on the simplified tax system, conducting a preferential type of activity, the income from which was at least 70% of the total income of the simplified tax system. At the same time, the annual income of the simplifier did not exceed 79 million rubles. | 13, 14, 15, 16, etc. | 22 | 5,1 | 2,9 |

| Pharmacy organizations, as well as individual entrepreneurs with a license to conduct pharmaceutical activities, on UTII. | 46.18.1, 46.46.1, 47.73 | 22 | 5,1 | 2,9 |

| Individual entrepreneurs applying the patent taxation system - in relation to payments and remuneration of employees who are engaged in a patent type of activity. For some types of activities, this “benefit” was not applied (clause 9, clause 1, clause 3, clause 2, article 427 of the Tax Code of the Russian Federation, as amended, valid from 01/01/2017) | 31.0, 74.20, 75.0, 96.01, 96.02, etc. | 22 | 5,1 | 2,9 |

Features of calculations for individual entrepreneurs

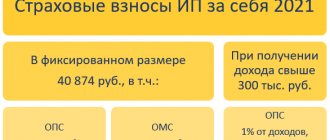

Fixed contributions have their own calculation features. Let's consider what total amount of social tax an ordinary businessman must pay for 2022.

Contributions for yourself

So, the merchant pays only the mandatory pension and medical part of the contributions. The calculation of these amounts is not tied to tariffs and rates. Earlier in 2022, an attempt was made to calculate the Unified Social Tax for individual entrepreneurs based on the minimum wage. That is, the formula was taken into account: minimum wage x rate x 12, where the rate was equal to 5.1% (compulsory medical insurance) or 26% (OPS), and the resulting amount was payable for the whole year.

But in 2022 it was decided to abandon such a system. The real average income of an entrepreneur usually significantly exceeds the minimum wage, so the amounts of the pension and medical part were fixed for 2019:

- Compulsory medical insurance 6884 rubles;

- OPS 29,354 rubles.

These tariffs are the same for all entrepreneurs in the country. This means that in total for himself, not taking into account his hired personnel, for 2019 the individual entrepreneur must contribute 36,238 rubles to the fund budgets for those periods when he was in the status of an existing business entity, regardless of the presence or absence of profitability. The income limit when calculating insurance premiums for individual entrepreneurs also applies to contributions for compulsory pension insurance. Here the concept of an additional insurance premium is highlighted if the income level exceeds 300 thousand rubles. The additional amount will be equal to one hundredth of the difference (1%) of the difference in total income minus 300 thousand. Example: For the first half of 2022, a merchant using the simplified tax system “Income” received 540 thousand rubles. Let’s calculate what amount of insurance premiums for himself he can already contribute to the fund’s budgets if he plans to continue working for the whole year:

- 6884 rubles for compulsory medical insurance, regardless of income;

- 29,354 rubles for OPS within 300 thousand;

- (540000-300000)x0.01=2400 rubles additional contribution to the compulsory pension insurance.

Only the heads of peasant farms do not pay the additional 1% of contributions to mandatory pension insurance. Regardless of their income, even if it exceeds 300 thousand, they pay only a fixed part of 29,354 rubles. For entrepreneurs, a maximum UST contribution has also been established in terms of payment for compulsory pension insurance. Since the calculation of this part is divided into the main (29,354 rubles) and additional parts (1% of income over 300 thousand), the total insurance premium should not be more than eight times the size of the fixed part: 26,545x8 = 234,832 rubles.

Employee contributions

A merchant and an employee, in addition to their contributions, contribute to and for the funds. He, as an employer, together with other enterprises and organizations that employ hired labor, belongs to the main group of payers of the single social tax. The calculation of contributions for employees is carried out according to the previously described tariffs. The question is, from what are these amounts calculated? The base of insurance contributions for employers is regulated by Art. 420 Tax Code: payments and rewards to individuals. In this case, relations between the parties must exist within the framework of such agreements as:

- labor;

- provision of services, performance of work;

- author's order;

- license agreement or alienation of copyright.

The following is not recognized as a basis for the unified social tax:

- benefits;

- compensation;

- tax refunds;

- material assistance and support from social programs;

- payments and remuneration to lawyers, notaries, other individual entrepreneurs, within the framework of supply contracts, provision of services, etc.

The employer must keep separate records of the insurance premium base for each of its employees on a monthly basis so as not to miss the maximum base value. The reduced rate for OPS applies only during the reduced tariff of 22% (until 2019). From 2022, when the regular rate of 26% will be in effect, reaching the maximum base for calculating contributions will mean their complete abolition for compulsory health insurance and compulsory health insurance. Preferential categories of payers are separately identified (Article 427 of the Tax Code). When calculating contributions for employees, they have the right to apply reduced rates:

- OPS: 20%, 14%, 13%, 8%, 6%, 0;

- OSS: 1.8%, 1.5%, 0%;

- Compulsory medical insurance: 4%, 0.1%.

These could be, for example:

- residents of special zones (advanced development, Crimea, Vladivostok, Kaliningrad region);

- Skolkovo project participants;

- charitable foundations on the simplified tax system;

- enterprises in the information technology sector;

- Individual entrepreneur on a patent for his workers as part of PSN activities;

- pharmacies on UTII;

- Individual entrepreneurs and legal entities using the simplified tax system when implementing priority areas.

A preferential rate for the social part of the UST is also provided for foreigners and stateless persons, if they are not among highly qualified specialists. The Social Insurance Fund pays not 2.9% for them, but always 1.8%, so it is more profitable for employers to employ such workers. Features of calculating social tax are also typical for peasant farms. For each member of such a household, the head pays a fixed amount, as for himself. Typically, a peasant farm represents one family, where there are no salaries for its members, so a different system for calculating insurance premiums is used here. Let us note some features of the calculation of UST under various taxation regimes:

Tax base for UST

Based on the objects of taxation established by law, the tax base is formed. For employers it is determined:

- all kinds of remunerations and payments made in accordance with labor legislation;

- payment under civil contracts;

- income from copyright and licensing agreements;

- various payments to provide financial assistance and other gratuitous payments.

When the tax base is determined, all income that is in one way or another accrued to workers by their employers in cash or in kind, as well as under the guise of social, material and other benefits, is taken into account, minus non-taxable income, which we will talk about later. When UST is accrued, taxpayers-employers are required to determine the tax base for each employee separately throughout the entire tax period. The tax base of entrepreneurs is the generalized amount of income that is subject to taxation and was received by them during the tax period, excluding expenses not related to their extraction. Income received by employees in kind (goods, services) must be taken into account as part of taxable income, based on their value/cost, which is determined under Art. 40 of the Tax Code of the Russian Federation, based on market tariffs and prices.

simplified tax system

Merchants using the simplified tax system have the right to deduct the paid unified tax when calculating tax. On both simplified tax systems this happens in different ways:

- with the “income-expense” object, the amounts of the Unified Tax are included in expenses, thereby reducing the tax base;

- with the object “income”, the calculated tax itself is reduced, from the amount of which the paid contributions are deducted.

The presence of hired personnel also plays a role. If an entrepreneur works alone, he can deduct from the tax the entire amount of his contribution (Article 346.21 of the Tax Code). This means that you don’t have to pay tax at all if it is less than 36238 (if the businessman’s income does not exceed 300 thousand). When there are employees, the tax can only be reduced by half. Example: A businessman works alone. His annual income was 290 thousand rubles, which means that the amount of insurance premiums is 36,238 rubles payable. Let’s calculate the simplified tax system “income” 6%: 290,000x0.06=17,400 rubles. We reduce the tax by the amount of SV: 17400-36238=-18838 rubles - no need to pay tax. A businessman has 2 hired workers with a salary of 20 thousand per month. The annual amount of CB for them: (20000x0.2x12)x2=96000 rub. – the SV rate is taken to be 20%, since individual entrepreneurs on the simplified tax system are among the beneficiaries. Amount of SV (individual entrepreneurs + employees) = 96000 + 32385 = 224385 rub. We reduce the tax by the amount of SV: 17400-(50% tax) = 8700 rubles payable.

Unified Social Tax rate in 2013 and 2014

In Russia, there is a gradual increase in the tax burden, which is caused by the “aging of the nation”, and subsequently by a drop in the number of able-bodied and working citizens. Of course, the older generation needs to be treated and pensions regularly paid to these people. Nowadays, individual entrepreneurs and other self-employed citizens pay the lowest insurance premiums. They pay a fixed premium, which is noticeably lower than the “average” employee who works for someone else. As for the actual interest on insurance premiums (UST), in 2013 they amounted to 30% of wages. Plus, since 2012, an additional rate of 10% has been withdrawn for wages over 512 thousand rubles, 568 thousand in 2013 and is expected for wages over 624 thousand in 2014. Unified Social Tax in 2014 is expected to rise to 34% . Due to a sharp increase in rates in 2010, which increased by 8% (from 26% to 34%), most small businesses went into the shadows, as they were unable to bear such a significant burden on their business.

UTII

A businessman’s income on UTII is not real profit, but imputed income, depending on the established value of the basic profitability, coefficients and various physical indicators. The level of this income determines whether an individual entrepreneur needs to pay an additional 1% contribution if his annual earnings are more than 300 thousand rubles. As for reducing the amount of tax on SV, the system is similar to the simplified tax system:

- no workers, decreases without restrictions;

- there are workers, it decreases by a maximum of 2 times.

Patent

Income for businessmen on a patent, as well as on UTII, is determined by average indicators. The cost of a patent per year depends on the potential annual income, which also depends on the number of employees. However, this regime does not imply a reduction in the value of the patent due to contributions paid for oneself or for workers. Individual entrepreneurs on PSN pay only a preferential 20% on compensatory pension for their employees.

Payment deadlines

Payment of social tax occurs according to different deadlines that must be observed. For example:

- the fixed amount of 36,238 rubles is paid for this year until its end;

- additional contributions of 1% for excess income must be repaid in the first six months of 2022;

- contributions for workers are made monthly until the middle of the next month (15th).

An individual entrepreneur can pay a fixed amount for himself either at one time or in parts. You can make advance payments every quarter, then you can take these amounts into account when calculating your tax (convenient for quarterly UTII). Additional contributions can also be paid ahead of schedule, when it becomes clear that the income limit of 300 thousand rubles has been reached.

Legislation changes in 2019

The transition period of transferring control of insurance premiums from the Pension Fund to the Tax Service was observed in 2022. The following changes were:

- The amounts of contributions for individual entrepreneurs were established for themselves without reference to the minimum wage.

- The maximum values of the bases have increased due to indexation.

- The concept of a maximum contribution for individual entrepreneurs to OPS has been introduced.

Codes according to the new current OKVED 2 have been introduced into the list of types of work at preferential rates.

This year, the legislator finally fixed the rates of insurance premiums for employees. In addition, a tax amnesty was implemented. Entrepreneurs were written off debt on fees accrued for missing reports. Let us remind you that if they evaded submitting a declaration, businessmen had to pay eight times the amount of contributions to the Pension Fund. All hopeless arrears to the fund that arose before 2022 were automatically cancelled.

However, the position is clear: the tax burden under the SV on small businesses is growing, unfortunately. Despite some relaxations, freezing tariffs for three years in advance, the amount of unified social tax will increase annually.

How to correctly calculate the amount of unified social tax

As mentioned above, rates for the beginning of 2022 remain the same. The maximum allowable size of the base with contributions can be:

- In the Pension Fund - 876 thousand rubles, the amount may be less if this indicator has reached its limit.

- Insurance deductions – 755 thousand rubles. Upon reaching the limit, the bet is set to zero.

- If the amount of the fund into which the Pension Fund will be charged exceeds the permissible limit, then the tariff is reduced by 1%.

Liability for non-payment

Payers of insurance premiums, in addition to paying them, have obligations to submit reports (only with employees) and maintain personalized records. Violators face various penalties:

- minimum 1 thousand rubles for missing the deadline for submitting a calculation, maximum 30% of the total amount of the calculated UST;

- for missing the deadline for submitting personalized accounting information to the Pension Fund, for errors in information - 500 rubles for each person;

- reduction in the calculation base for social tax, incomplete payment of insurance premiums: fines from 20 to 40% of the calculated amount;

- Gross violations in calculations, deliberate concealment of income and real payments to employees will lead to an additional recovery of at least 40 thousand rubles or 20% of the unified social tax amount.

Sanctions are quite strict when it comes to social payments to citizens of the country. Therefore, the administration of insurance premiums again passed to the Federal Tax Service, which shows good results in terms of collection of taxes, fees and contributions. Small business representatives can only pay them on time to avoid unnecessary hassle in the future.