Significant errors in the invoice

Errors in invoices are considered significant if they can cause a refusal to deduct VAT. These include errors that do not allow the tax authorities to identify (clause 2 of Article 169 of the Tax Code of the Russian Federation):

1) seller or buyer.

These are errors in the name of the seller or buyer, their address and TIN, due to which the inspection cannot identify the seller or buyer.

For example, in line 6 of the invoice they indicated not the name of the buyer from the constituent documents, but their full name. his employee (Letter of the Federal Tax Service of Russia dated 01/09/2017 No. SD-4-3 / [email protected] ).

You can check the details of the seller (buyer) on the website of the Federal Tax Service of Russia

2) the name of the goods shipped (work, services, property rights).

For example, instead of “rye flour” it is indicated “wheat flour” (Letter of the Ministry of Finance of Russia dated 08/14/2015 N 03-03-06/1/47252).

If this column contains incomplete information, but sufficient to determine the product (work, service, property right), then this does not affect the deduction (Letter of the Ministry of Finance of Russia dated November 17, 2016 N 03-07-09/67406);

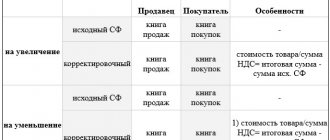

3) the cost of goods (work, services, property rights) and the amount of VAT.

For example, these could be:

— arithmetic errors in the cost or amount of tax (Letter of the Ministry of Finance of Russia dated 04/19/2017 N 03-07-09/23491);

— lack of data on the cost or amount of tax (Letter of the Ministry of Finance of Russia dated May 30, 2013 N 03-07-09/19826);

— absence or incorrect indication of the name and code of the currency (Letter of the Ministry of Finance of Russia dated March 11, 2012 N 03-07-08/68);

— absence or incorrect indication of the unit of measurement, quantity (volume) and price (tariff) per unit of measurement (Letter of the Ministry of Finance of Russia dated October 15, 2013 N 03-07-09/43003);

4) the correct tax rate.

For example, instead of a 10% rate, a 20% rate is indicated.

If errors do not interfere with identifying the seller and buyer, the name and cost of goods (work, services), property rights, the rate and amount of tax, then such errors are insignificant and because of them should not be denied VAT deduction (clause 2 of Article 169 of the Tax Code RF).

Registration by the Northern Fleet branch for the shipment of goods

If goods are sold by organizations through separate divisions, then the SF is issued by a separate division, but only on behalf of the organization (page 2 Seller ). PDF

SF is issued by a separate unit in the usual manner: within five days from the date of sale and must be executed as follows (Letters of the Ministry of Finance of the Russian Federation dated 05.15.2012 N 03-07-09/55, dated 05.18.2017 N 03-07-09/30038, Letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 N SD-4-3/21730, Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137):

A cap

- Number and Date (page 1) - indicated in chronological order, the number - with a dividing line, after which the unit number is indicated. The organization itself numbers its branches and assigns their numbers to its accounting policies.

- Seller (page 2), Address (page 2a), INN of the seller (page 2b) - full or abbreviated name of the parent organization, its address in accordance with the Unified State Register of Legal Entities, as well as INN.

- The seller's checkpoint (page 2b) is a checkpoint of a separate division that ships goods.

- Shipper and his address (page 3) - the name and postal address of the separate unit.

- Consignee and his address (page 4) - the name and postal address of the consignee are indicated; the entry “he” is not allowed (Letter of the Ministry of Finance of the Russian Federation dated July 21, 2008 N 03-07-09/21).

- For payment and settlement document No. dated (page 5) - details (number and date) of the payment order or cash receipt if advance payments were previously received.

- Buyer (page 6), Address (page 6a), INN/KPP of the buyer (page 6b) - full or abbreviated name of the buyer, its location in accordance with the Unified State Register of Legal Entities, as well as INN and KPP.

- Currency: name, code (page 7) - name and code of the settlement currency.

- Identifier of the state contract, agreement (agreement) (if any) (page 8) - details of the state. contract, if any.

Tabular part

- name of the goods supplied and unit of measurement (if it is possible to indicate it);

- code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity for shipments to the EAEU;

- the quantity of goods supplied (shipped) according to the invoice based on the units of measurement accepted for it;

- price per unit of measurement under the contract excluding tax;

- cost of goods for all goods supplied according to the invoice without tax;

- the amount of excise duty on excisable goods;

- tax rate;

- the amount of tax charged to the buyer, calculated based on the applicable tax rates;

- the cost of all goods supplied (shipped) according to the invoice, taking into account the amount of tax;

- country of origin of the goods - code and short name for imported goods;

- registration number of the customs declaration for imported goods.

Signatures

As a general rule, an invoice for the sale of goods is signed (clause 6 of Article 169 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 14, 2015 N 03-07-09/58937):

- head and chief accountant of the organization;

or

- by other persons by power of attorney (order) on behalf of the organization.

If the SF is issued by a separate division, then the signatures are:

- head of a branch who acts by proxy

or

- another authorized person (manager, storekeeper, etc.) based on an order or power of attorney.

Error in address on invoice

Address errors on the invoice do not have tax consequences for the seller. But they can lead to the refusal of the buyer to deduct VAT. This is due to the fact that this detail is mandatory and helps the tax authority identify the seller or buyer (clause 2, clause 2, clause 5, clause 2, clause 5.1, clause 3, clause 5.2, Article 169 of the Tax Code of the Russian Federation).

However, the invoice contains other data by which the inspection identifies the seller and buyer. These include, in particular, their names and TIN. Therefore, an error in the address does not always lead to a denial of deduction. This was confirmed by the Ministry of Finance of Russia in Letter dated 04/02/2015 N 03-07-09/18318.

If the invoice contains an incomplete address compared to the address in the Unified State Register of Legal Entities (USRIP), this will also not lead to a refusal to deduct if it is possible to identify the buyer based on other invoice details (Letter of the Ministry of Finance of Russia dated August 30, 2018 N 03- 07-14/61854).

If the address matches the address from the Unified State Register of Legal Entities (USRIP), but there are technical errors in its spelling, the buyer can deduct VAT. For example, acceptable (Letters of the Ministry of Finance of Russia dated 04/02/2019 N 03-07-09/22679, dated 04/25/2018 N 03-07-14/27843, dated 04/02/2018 N 03-07-14/21045, dated 17.01. 2018 N 03-07-09/1846, dated 11/20/2017 N 03-07-14/76455):

• abbreviations of words;

• replacing capital letters with lowercase ones or vice versa;

• changing the places of words in the street name;

• additional indication of the country, if this is not in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities, etc.

We recommend checking the address with data from the Unified State Register of Legal Entities (USRIP). Data from the Unified State Register of Legal Entities is available on the website of the Federal Tax Service of Russia

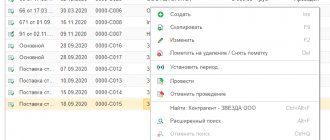

If significant errors are found in the address on the invoice, we recommend that the buyer contact the seller with a request to correct the invoice and cancel the registered invoice in the purchase book.

What data is indicated - legal or factual?

The address indicated in the Unified State Register of Legal Entities (for legal entities) and in the Unified State Register of Individual Entrepreneurs (for individual entrepreneurs) must be indicated in full, including the number of the house, office, room.

The main requirement of modern tax legislation regarding addresses entered in lines 2a and 6a of the invoice is that they must coincide with the address recorded in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. The extract from the Unified State Register of Legal Entities contains information about the location of the organization according to the registration documents (clause 2 of Article 54 No. 51-FZ of November 30, 1994, as amended on December 29, 2017).

For individual entrepreneurs, the address in the Unified State Register of Individual Entrepreneurs is the location of the individual, otherwise the place of registration. To verify the correctness of the information reflected in lines 2a and 6a, the organization can, without additional requests to the partner, check the information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs with the data in the invoice.

Today, anyone, both an individual and a legal association, can get access to extracts from the Unified State Register of Legal Entities of registered taxpayers. Invoices issued after October 1, 217 must indicate the address of the location of the permanent executive body, i.e. legal address.

Incorrect TIN on the invoice

Incorrect TIN indication on the invoice does not entail tax consequences for the seller. But the buyer may be denied a deduction, since this is a mandatory indicator and the tax authority uses it to identify the seller and the buyer (clause 2, clause 2, clause 5, clause 2, clause 5.1, clause 3, clause 5.2, Article 169 of the Tax Code of the Russian Federation ).

However, in a specific situation, the court may side with the buyer.

For example, the AS of the West Siberian District considered that an error in the TIN does not prevent the determination of the VAT amount and the identification of the counterparty to the transaction (see Resolution of the AS of the West Siberian District dated July 18, 2017 N F04-2386/2017).

However, we recommend that you carefully check the completion of such information on the invoice, and if errors are found, ask the seller to make corrections. After all, such a mistake can lead to a dispute with the tax authority.

Invoice deadline

The changes did not affect the order of issuing the document. An invoice is issued within 5 days from the moment of: a) shipment of goods, performance of work, provision of services, transfer of rights, or b) receipt of advance payment. Calendar days are counted.

The period is counted from the day following the day of shipment or receipt of advance payment. If the last day of the term falls on a non-working day, the expiration date of the term is considered to be the nearest next working day.

According to the law, there is no penalty for missing the deadline for submitting an invoice. An organization can be fined only for the absence of a document. However, a violated procedure for issuing invoices at the junction of tax periods can still lead to a fine. Thus, late provision of a document may be considered as its absence. For example, when an organization issues an invoice at the beginning of the current tax period that should have been issued at the end of the previous one.

Minor errors in the invoice

Minor errors are those that cannot be classified as significant errors. That is, these are errors that do not interfere with identifying the seller, buyer, name, cost of goods (work, services, property rights), tax rate and amount.

An insignificant error cannot be the reason for refusal to deduct VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation).

Minor errors, for example, include:

1) typos in the name and address of the buyer or seller

, For example:

- indication of full name buyer-entrepreneur without the words “IP” (Letter of the Ministry of Finance of Russia dated 05/07/2018 N 03-07-14/30461);

— replacing capital letters with lowercase ones in the names of the seller and buyer (Letter of the Ministry of Finance of Russia dated January 18, 2018 N 03-07-09/2238);

— extra characters, such as dashes or commas (Letter of the Ministry of Finance of Russia dated May 2, 2012 N 03-07-11/130);

- abbreviations in the address, replacing capital letters with lowercase ones or vice versa, reversing words, additional indication of the country if this is not in the Unified State Register of Entrepreneurs or the Unified State Register of Legal Entities (Letters of the Ministry of Finance of Russia dated 04/02/2019 N 03-07-09/22679, dated 04/25/2018 N 03-07-14/27843, dated 04/02/2018 N 03-07-14/21045, dated 01/17/2018 N 03-07-09/1846, dated 11/20/2017 N 03-07-14/76455);

2) violation of invoice numbering;

3) indicating the graphic symbol of the ruble instead of the name of the currency

(Letter of the Ministry of Finance of Russia dated April 13, 2016 N 03-07-11/21095);

4) indication of the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU when selling goods in Russia

(Letter of the Ministry of Finance of Russia dated 01/09/2018 N 03-07-08/16);

5) a dash instead of the phrase “without excise tax” in column 6

(Letter of the Ministry of Finance of Russia dated April 18, 2012 N 03-07-09/37);

6) absence of the symbol “%” in column 7 “Tax rate” of the invoice

(Letter of the Ministry of Finance of Russia dated March 3, 2016 N 03-07-09/12236).

Registration by the branch of the Northern Fleet for the implementation of works and services

If work and services are sold by organizations through separate divisions, then the SF is issued by a separate division, but only on behalf of the organization (page 2 Seller ). PDF

The SF is issued by a separate unit in the usual manner: within five days from the date of implementation of work, services and must be executed as follows (Letters of the Ministry of Finance of the Russian Federation dated 05.15.2012 N 03-07-09/55, dated 05.18.2017 N 03-07-09 /30038, Letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 N SD-4-3/21730, Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137).

A cap

- Number and Date (page 1) - indicated in chronological order, the number - with a dividing line, after which the unit number is given. The organization itself numbers its branches and assigns their numbers to its accounting policies.

- Seller (page 2), Address (page 2a), INN of the seller (page 2b) - full or abbreviated name of the parent organization, its address in accordance with the Unified State Register of Legal Entities, as well as INN.

- Seller's checkpoint (p. 2b) - checkpoint of a separate division performing work (services).

- The shipper and his address (page 3) are a dash.

- Consignee and his address (page 4) - dash.

- For payment and settlement document No. from (page 5) - details (number and date of preparation) of the payment order or cash receipt in case of receiving advance payments.

- Buyer (page 6), Address (page 6a), INN/KPP of the buyer (page 6b) - full or abbreviated name of the buyer, its location in accordance with the Unified State Register of Legal Entities, as well as INN and KPP of the buyer.

- Currency: name, code (page 7) - name and code of the settlement currency.

- Identifier of the government contract, agreement (agreement) (if any) (page - details of the government contract, if any.

Tabular part

- description of the work performed, services provided and the unit of measurement (if it is possible to indicate it);

- quantity according to the invoice based on the units of measurement accepted for it (if applicable);

- price per unit of measurement under the contract excluding tax;

- the cost of work, services for all work and services sold according to the invoice without tax;

- tax rate;

- the amount of tax presented to the buyer of works, services, calculated based on the applicable tax rates;

- the cost of all implemented works and services according to the invoice, taking into account the amount of tax.

Signatures

As a general rule, an invoice for the implementation of work and services is signed (clause 6 of Article 169 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 14, 2015 N 03-07-09/58937):

- director and chief accountant of the organization

or

- by other persons by power of attorney (order) on behalf of the organization.

If the SF is issued by a separate division, then the signatures are:

- head of a branch who acts by proxy

or

- another authorized person (manager, storekeeper, etc.) based on an order or power of attorney.

Incorrect checkpoint on the invoice

Incorrect indication of the checkpoint on the invoice does not entail tax consequences for either the seller or the buyer. The checkpoint is not a mandatory detail in the invoice according to the Tax Code of the Russian Federation. In addition, an incorrect checkpoint does not interfere with identifying the seller and buyer if other mandatory invoice details (name, tax identification number, address) are indicated correctly (clause 2, clause 5, 5.1, 5.2 of Article 169 of the Tax Code of the Russian Federation).

If the checkpoint is not indicated in the invoice, then the buyer also cannot be denied a VAT deduction if the remaining details of the invoice (name, tax identification number, address) are indicated correctly and allow identification of the seller and the buyer (clause 2, clause 2 p 5, paragraph 2, paragraph 5.1, article 169 of the Tax Code of the Russian Federation).