Who is eligible for tax relief?

Institutions and organizations providing educational services can take advantage of the right to tax benefits based on the provisions of Art. 149 NK. Current legislation provides for educational institutions a complete exemption from VAT. At the same time, it is important to fulfill the basic condition: only an organization conducting non-profit activities in the field of educational services can receive tax benefits.

This category includes institutions that operate not to make a profit, but to achieve social goals in the field of education.

Services that raise questions regarding VAT calculation

- legal services. As stated above, lawyers and bar associations do not pay VAT on their services when carrying out their professional activities. But this benefit only applies to this activity! After all, there are also private legal consultations that also make money by providing consulting services. Such activities will be subject to VAT at the full rate, that is, 18%.

- software sales. At first glance, this is also the provision of a service, however, Art. 149 of the Tax Code of the Russian Federation allows preferential taxation by transferring exclusive rights under an agreement for the alienation of such rights or a license agreement. In this case, software services are not subject to VAT.

- taxation of MFC services open throughout the country. On the one hand, the organization that provides services must pay VAT. And since the MFC is an organization, it is subject to registration with the tax authority in accordance with Art. 83.84 of the Tax Code of the Russian Federation as a tax agent. But at the same time, according to Art. 145 of the Tax Code of the Russian Federation, a budgetary organization has the right to be exempt from paying VAT, provided that for the three previous calendar months (not quarters!) the amount of revenue from the sale of its services did not exceed one million rubles. Then she has the right to provide the tax authorities with the relevant documents confirming this fact and receive an exemption from VAT for a period of 12 calendar months.

- Electronic services are another innovation in the field of VAT; it appeared in legislation on January 1, 2022. According to ch. 21 of the Tax Code of the Russian Federation, in the case of the provision of electronic services by a foreign organization or entrepreneur, the place of their implementation is recognized as the location of the buyer, that is, the Russian Federation. Accordingly, all users of such services are required to pay VAT, regardless of the form of taxation. The provision of services in electronic form includes all services provided via the Internet (clause 1 of Article 174.2 of the Tax Code of the Russian Federation). But services are not considered electronic if, when ordering via the Internet, the delivery of goods or the provision of the service itself occurs without using this network, that is, “offline”. Electronic services also do not include:

- realization of rights to computer programs, computer games, databases on tangible media;

- email consulting services;

- services for providing access to the Internet.

What transactions are exempt from VAT?

An educational institution has the right to take advantage of tax benefits in the following areas of activity:

- general educational services. This category includes services provided by schools and preschool institutions within the framework of approved government programs. If a specialized educational institution (gymnasium, sports school, etc.) implements additional educational programs developed independently, then such activities are also exempt from VAT;

- services of universities, technical schools, vocational schools, etc. Vocational training services provided by higher education institutions, as well as institutions of secondary specialized education, are not subject to VAT. Similar to the situation with preschool and secondary education, services of both basic and additional (special) programs are provided with benefits;

- educational activities in specialized clubs and sections. If a sports (art, music) school operates on a paid basis, but does not distribute profits among participants, but uses it to meet the needs of the organization, the services provided by this institution are not subject to VAT;

- vocational training services for various fields of activity. If, on a non-commercial basis, an institution provides services for conducting seminars, trainings, and advanced training courses in various areas, then such activities are exempt from VAT.

Are services for writing an educational program subject to VAT?

And reasoning on this topic leads to the idea that the purpose of any seminars (conferences, symposiums) is to study problematic issues, that is, the participants of the seminar (representatives of educational institutions, employees of various organizations, etc.) receive new knowledge and information caused by the need for their use in practical activities (production process, enterprise management process, etc.). And even if the seminar participants are given some kind of document stating that they listened to lectures on certain topics, most likely, tax authorities will still look for evidence that the seminar participants actually received a consulting service. One can, of course, argue: since an educational institution has a license for educational activities, then the seminar is educational, not consulting.

In practice, seminars most often take place in one or two days or even a few hours. In this case, in order to meet the hour requirements, you can try this option - breaking the seminar into several parts, held at different times. For example, a seminar for accountants could be divided into 6 monthly meetings of 12 hours each, resulting in a total seminar duration of 72 hours.

Sales of goods in an educational institution

Quite often, retail outlets selling food, stationery, etc. are located on the premises of universities, technical schools and other educational institutions. The question arises: is such activity subject to VAT? The answer to this question depends on several factors:

- If the owner of a retail outlet is a commercial organization, then the sale of goods is subject to VAT in the general manner. For example, Lilia LLC, which operates in the catering industry, opened a buffet in PTU-14. VAT should be charged on the cost of goods sold by the buffet.

- If goods are sold directly by an educational organization, then their cost is exempt from VAT if two conditions are met simultaneously:

- educational institutions sell food products;

- The organization independently produced the products it sold.

As we can see, educational institutions may not pay VAT only on products of their own production that are sold directly on the premises of the organization. If purchased goods are sold in the university canteen, they are subject to VAT in accordance with the general procedure.

Do commercial educational organizations pay VAT?

Regardless of what educational services a commercial company provides, the activities of such a company are subject to VAT in accordance with the general procedure. This is provided for in Article 149 of the Tax Code. Even if a commercial organization implements state educational programs, the company’s services should be subject to VAT on a general basis.

A similar rule applies to the calculation of VAT on goods (both purchased and self-produced) that an educational institution sells on its territory. As for food products, when taxing their value, there is the following nuance: if a commercial organization operating in the catering industry produces and sells food products to an educational institution, then such a company has the right to take advantage of the VAT tax benefit.

The necessary documents for applying the benefit are a contract for the supply of food products, constituent documents of an educational institution confirming the status of an NPO (non-profit organization), a license to provide educational services.

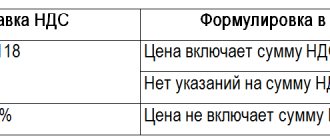

VAT rate for services

The default VAT rate for services, as for all other goods, is 18%. However, there are a number of services that are not subject to VAT at all.

Their list is given in Art. 146 Tax Code of the Russian Federation:

- medical services provided by specialized institutions and private practice doctors, except for cosmetology, veterinary medicine and sanitary-epidemiological services;

- care services for the disabled, elderly, and sick (the need for care must be confirmed by the conclusions of the relevant authorities);

- services for the maintenance of children in municipal preschool educational institutions, as well as for conducting classes in clubs, sections, studios with minor children;

- services provided by archival institutions;

- services for the transportation of passengers by any urban and suburban public transport (except for taxis and minibuses), if transportation is carried out at uniform tariffs and with the provision of benefits;

- funeral services;

- services for the provision of residential premises of any form of ownership for use;

- services related to depository services, which are provided by the depositary of funds of the IMF, the International Bank for Reconstruction and Development, the International Development Association within the framework of the articles of the Agreements of these organizations;

- repair and maintenance services for goods and household appliances during the warranty period;

- services of non-profit organizations licensed in the field of education and educational process;

- social services for minors, the elderly and people in difficult life situations; services to identify such citizens; services for the selection and training of guardians of such citizens;

- services to the population for physical education and recreation activities:

- vocational training and retraining services provided in the direction of the employment service;

- services provided by authorized bodies for which state duty is charged;

- services of non-profit cultural and art organizations, including cinematography organizations;

- services of pharmacy organizations for the manufacture of medicines, production or repair of optics, hearing aids, prosthetic and orthopedic products, provision of prosthetic and orthopedic care;

- insurance and pension services;

- services of a bar association, bureau, or college to its members in connection with their professional activities;

- services of sanatorium-resort and health-improving organizations;

- forest fire extinguishing services;

- services for the provision of air time or print space provided free of charge in accordance with the legislation of the Russian Federation on elections and referendums;

- services related to housing and communal services;

- services for the production and distribution of social advertising provided free of charge.

At the same time Art. 164 of the Tax Code of the Russian Federation indicates that the VAT rate of 10% applies to such services as domestic air transportation of passengers and baggage.

Special cases in questions and answers

Question No. 1. Accrual of VAT on the cost of services of non-state educational institutions Factor Academy is a non-profit organization that, as part of its activities, implements basic and additional educational programs. "Factor" does not have a state license and provides educational services as a private educational institution. Is VAT subject to charge?

Despite the fact that Factor is a non-state educational institution, the academy has the right to use the VAT tax benefit. The main criterion in this case is the following: “Factor” is a non-profit organization that implements educational programs.

Question No. 2. VAT on testing and knowledge testing services. The State Linguistic Institute (GLI) annually conducts tests to test knowledge of the French language for everyone. Based on the test results, GLI issues a certificate. Knowledge testing is carried out on a paid basis. Does GLI have the right to take advantage of the VAT tax benefit for this type of service?

Only services for the implementation of educational and training programs are exempt from VAT. Since testing for knowledge of the French language is a test of knowledge (GLI does not pre-train test takers), VAT should be charged on these services in the general manner.

Question No. 3. VAT on sales of food products to other educational institutions. There are two educational institutions in the building at 15 Lenina Ave.:

- on the ground floor there is an art school for schoolchildren;

- on the second floor there is a music school.

In the hall of the building there is a canteen of the music school, where food products of its own production are sold. Some of the food prepared in the kitchen is sold to the art school's cafeteria. Are goods sold by a music school subject to VAT?

Sales of food products produced in the canteen of a music school are exempt from VAT. This applies to both dishes sold in the canteen and dishes sold to the art school. The music school has the right to take advantage of the benefit based on the provisions of Art. 149 NK.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » VAT » On maintaining the benefit for the abolition of VAT and income tax for an organization engaged in educational activities, including remotely, on the basis of a license

Our organization is engaged in educational activities on the basis of a license, income from it is not subject to VAT and income tax.

Question:

Will we continue to have tax benefits if we teach distance learning to students from Uzbekistan who pay for their tuition into our bank account?

Expert's answer

When implementing educational programs using e-learning, distance learning technologies, the place of implementation of educational activities is the location of the organization carrying out educational activities or its branch, regardless of the location of the students (Part 4 of Article 16 of the Federal Law of December 29, 2012 N 273-FZ “On Education in the Russian Federation” (hereinafter referred to as Federal Law N 273-FZ)).

{Question: ...How to determine the place of provision of a service for VAT purposes when conducting a webinar? (Expert Consultation, 2014) {ConsultantPlus}}

Services in the field of education (except for consulting services, services for leasing premises) are not subject to VAT if the following conditions are met (clause 14, clause 2, article 149 of the Tax Code of the Russian Federation):

— they are provided by a non-profit organization that conducts educational activities;

— the organization has a license for basic and (or) additional educational programs;

— services relate to the basic (additional) educational programs specified in the license.

{Ready solution: How educational services are subject to VAT (ConsultantPlus, 2018) {ConsultantPlus}}

Article 284.1. Features of the application of the 0 percent tax rate by organizations engaged in educational and (or) medical activities

(introduced by Federal Law dated December 28, 2010 N 395-FZ)

1. Organizations carrying out educational and (or) medical activities in accordance with the legislation of the Russian Federation have the right to apply a tax rate of 0 percent, subject to the conditions established by this article.

3. Organizations specified in paragraph 1 of this article have the right to apply a tax rate of 0 percent if they meet the following conditions:

1) if the organization has a license (licenses) to carry out educational and (or) medical activities, issued (issued) in accordance with the legislation of the Russian Federation;

2) if the organization’s income for the tax period from educational activities, childcare and (or) medical activities, as well as from scientific research and (or) development, taken into account when determining the tax base in accordance with this chapter , constitute at least 90 percent of its income taken into account when determining the tax base in accordance with this chapter, or if the organization for the tax period does not have income taken into account when determining the tax base in accordance with this chapter;

(as amended by Federal Law dated May 2, 2015 N 110-FZ)

3) if in the staff of an organization carrying out medical activities, the number of medical personnel with a specialist certificate in the total number of employees continuously during the tax period is at least 50 percent;

4) if the organization continuously employs at least 15 employees during the tax period;

5) if the organization does not carry out transactions with bills and derivative financial instruments during the tax period.

(as amended by Federal Law dated July 3, 2016 N 242-FZ)

Art. 284.1, “Tax Code of the Russian Federation (Part Two)” dated 05.08.2000 N 117-FZ (as amended on 11.10.2018) {ConsultantPlus}

From the above, we can conclude that the place of implementation of distance learning will be the Russian Federation, which means that VAT will not be subject to

Art. 149, “Tax Code of the Russian Federation (Part Two)” dated 05.08.2000 N 117-FZ (as amended on 11.10.2018) {ConsultantPlus}

And if all the conditions for income tax are met, then such services will be taxed at a zero rate.

The explanation was given by the accountant-consultant of LLC NTVP "Kedr-Consultant" Natalya Borisovna Petrova in November 2018.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

This consultation has passed quality control:

Reviewer – Alexander Pavlovich Chuvygin, Ph.D., Director of Expert-Center LLC.

Showing 0 - 0 of 0 News | Page 0 of 0

No entries found.

Showing 0 - 0 of 0 News | Page 0 of 0

Accounting entries for accounting

Let us examine the accounting procedure for the sale of food products in the cafeteria of an educational institution.

Example No. 2. On 07/23/16, the buffet of the Economic Lyceum No. 1 received a batch of 120 “Start” chocolate bars. The cost of the batch is 2,760 rubles, VAT 421 rubles. The receipt of goods is reflected in the accounting of Economic Lyceum No. 1 with the following entries:

| Debit | Credit | Description | Sum |

| 41 | 60 | A batch of “Start” bars has arrived at the warehouse of Economic Lyceum No. 1 (RUB 2,760 – RUB 421) | RUB 2,339 |

| 19 | 60 | The amount of VAT on the cost of the bars has been allocated | 421 rub. |

| 60 | 51 | The cost of purchased Start bars was paid to the supplier | RUB 2,760 |

| 68 VAT | 19 | VAT is accepted for deduction | 421 rub. |

In April 2022, a batch of bars was sold in the buffet of the Economic Lyceum No. 1 at a price of 38 rubles. a piece. Upon the fact of sale, the accountant of Economic Lyceum No. 1 made the following notes:

| Debit | Credit | Description | Sum |

| 50 | 90 Buffet revenue | Revenue from sales of Start bars is reflected (RUB 38 * 120 pcs.) | RUB 4,560 |

| 90 VAT | 68 VAT | VAT on sales allocated | 696 rub. |

| 90 Cost of goods sold in the buffet | 41 | The cost of bars sold is reflected | RUB 2,339 |