The essence of the inventory book

For accounting purposes, at an enterprise where goods and materials are stored, it is necessary to maintain warehouse records, which is a registration of actual transactions of receipt and expenditure of inventory items. For its implementation, form N M-17 is often used. It can be in the form of a card or a book, which is generally equivalent.

The warehouse accounting book in form M-17 is a large number of sheets numbered and sewn together, having a certain structure, which we will discuss later.

Sample document 2022

It is possible to develop a template of your own type, in accordance with the peculiarities of inventory accounting in a particular company. Accounting is always carried out according to the distinctive features of values:

- unique name;

- unique code or article - a combination of numbers and/or letters in accordance with the nomenclature system of the enterprise;

- brand;

- dimensions;

- variety and others.

The template developed within the company must contain all the sections that are given in the unified template.

In order to optimize warehouse accounting, you can use not cards according to the current M-17 form, but a book of a similar purpose. As a form for maintaining such a book, it is permissible to use the now canceled form with the same number as the card. The financially responsible employee will have to keep the book, and it will be certified and verified by the company’s accountant.

Application of the warehouse accounting book according to the M-17 form

The obligation to use the M-17 warehouse accounting book in all organizations was introduced in 1999. However, today the use of this form of document is not mandatory and for the purpose of maintaining warehouse accounting, any other developed form can be used, this is due to the fact that in 2004, Order N87n of the Ministry of Finance was issued, allowing the use of any form as a warehouse accounting document.

Important ! As an alternative to the M-16 form, some organizations may use the M-40 accounting book. Other companies have the opportunity to create their own form of warehouse accounting, including certain mandatory details, and consolidate it in the accounting policy of the enterprise.

No. M-17 of the warehouse accounting book, you can follow this link - form of the M-17 accounting book.

Structure of the warehouse accounting book

The document for recording inventory in warehouses according to form M-17 has the following structure:

- A title page, which includes the following details: period of validity of the document, owner organization, name of the structural unit that includes the warehouse.

- Accounting cards for each individual item of inventory. They consist of several sections:

- A block of information about the location of the goods in the warehouse, the financially responsible person and the stored goods.

- The tabular part where information about the departure or arrival of inventory items is filled out: date of transaction, recipient or supplier, quantity of goods, its balance, as well as some other information. Each table entry is signed by the financially responsible person;

- Block for checking the accounting book, including the date of the check, the details of the checker and his signature. The test results are also indicated here.

- The last page of the book. Registration data is indicated here: number of pages, start and end dates of maintaining the book, signature of the registrar - chief accountant.

About the TORG-18 form

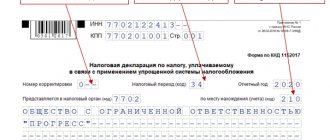

This form for registering the movement of goods in a warehouse was approved by Decree of the State Statistics Committee of December 25, 1998 No. 132. It was mandatory until the end of 2012. Since the beginning of 2013, the form has been advisory in nature. Now organizations can decide for themselves which forms of primary accounting documents to use: unified or independently developed. You can change existing unified forms.

When choosing to use its own forms, the company must take into account that the primary accounting document must contain a number of mandatory details. Their list can be found in paragraph 2 of Art. 9 Federal Law of December 6, 2011 No. 402-FZ (“Accounting Law”). Also, do not forget about approving documents in the company’s accounting policies.

In principle, the TORG-18 form currently continues to be used by organizations. It is easy to fill out and familiar to inspection authorities.

Rules for registering a book using the M-17 form

As a rule, the accounting book of inventory items in form N M-17 is drawn up at the beginning of the calendar year (for new goods, a new sheet of the book is created before it arrives at the warehouse) by an employee of the purchasing department. Each sheet of the accounting book is a card for recording inventory items of one item. It records data such as the name of the item, the characteristic features of the product, the number of the item, the unit of measurement, as well as the accounting value of the product.

To fill out form No. M-17, follow this link - sample accounting book M-17.

Each new sheet must be numbered and registered in the accounting department. After this, the accounting book is handed over to the financially responsible person for accounting. The warehouse manager enters information about storage locations for each product. Moreover, records are made on the basis of certain documents:

- Receipt and expense orders;

- Requirements and invoices;

- Other accompanying documentation: TTN, checks, etc.

A record of a completed transaction is made as follows. The person in charge indicates the date of the operation, then enters the details of the documents that are the basis for the operation, and other information about the operation in a brief form.

Transactions must be recorded on the same day they were performed. In this case, information about each new operation must be entered in the next line. At the end of the working day, the materially responsible person checks the transactions performed and displays the results of the remaining goods in the warehouse. At the end of each month, the warehouse manager must enter summary information on receipts and expenses for the month.

Important ! All entries in the M-17 accounting book must be periodically checked by the accounting department. Information about the verification is recorded in the appropriate cells of the table.

At the end of the year, the book displays the balances as of January 1, which are transferred to the new accounting book M-17. The completed book is checked and deposited in the archives of the enterprise.

What is the MX-2 form

Document MX-2 is one of the unified primary forms approved by the State Statistics Committee in Resolution No. 66 dated 08/09/1999, and is a logbook of inventory items taken for storage.

The journal compiled on the basis of the MX-2 form must be filled out by the materially responsible employee (MOL) personally. Data from other primary documents can be used to fill out.

What are the features of filling out the MX-2 form?

Form MX-2 consists of:

- from the cover;

- even page;

- odd page.

The cover of the document records the name of the employer, its coordinates, and indicates OKPO and OKDP codes.

On the even-numbered page of the document they state:

- the period of time during which inventory records are kept;

- information about the MOL;

- in the table - information from acts confirming the acceptance and return of goods and materials (these most often become forms MX-1 and MX-3, respectively).

On the odd side of the document indicate:

- coordinates of the storage location of accepted inventory items;

- number and date of form MX-1 or a similar source;

- number and date of form MX-3 or a similar primary document;

- information about the MOL that accepted the goods and materials, his personal signature;

- date of acceptance by the MOL of inventory items;

- information about the MOL that issued the goods and materials, his personal signature.

Also, on the odd page, the recipient of the goods and materials signs and thus confirms the absence of his claims to the goods and materials, which are returned to him by the MOL.

In some cases, it may be necessary to print additional pages of the journal in the MX-2 form. In this case, all subsequent even pages must correspond in structure to the first even one, and all odd pages must correspond to the first odd one.

Components

The journal is kept only in paper form, since financially responsible persons must sign it. The document includes:

- cover;

- even side;

- odd side.

The cover details the organization that handles the storage. In particular, it must contain its full name, OKPO form, type of activity according to OKDM, type of operations performed by it, address, fax and contact telephone number, and, if available, the structural unit in which the journal is opened.

A document for each individual division or warehouse is created individually.

The even-numbered side contains the name of the paper itself, a description of the period (from which date the journal was or was kept), position and signature with a transcript of the financially responsible person who keeps the journal.

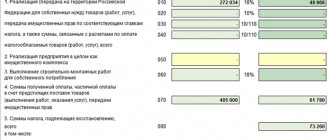

A wide table in which the necessary information is entered is located on the odd side and can continue for a long time if necessary. If the magazine is printed on more than three sheets, then all subsequent even pages repeat the contents of the first even one, and all subsequent odd pages repeat the contents of the first odd one. The columns should contain the following information:

- the first is the serial number of recording;

- the second - when the actual transfer of property occurred, the date;

- third - the full name of the person who gives it for storage (if he does this on behalf of any company, then mention of it in this column is also mandatory);

- fourth - what type of property is being transferred, as well as the type of packaging (for example, Alenka candies in cardboard boxes);

- fifth - unit of measurement of goods (g, kg, tons);

- sixth - its quantity and mass (or only weight);

- seventh - cost;

- eighth - price;

- ninth – description of the storage premises, including address details and contact telephone number;

- tenth and eleventh - number and date of admission papers;

- then three columns make up a description of the acceptance for storage: what date this occurred, a signature with a transcript of the financially responsible person for this operation;

- columns fifteen to eighteen are responsible for the description of the return (the field for checking goods by quantity and quality is filled in), including the full name of the returner, his signature with a transcript, as well as the number and date of the return document;

- columns nineteen to twenty-one are created to indicate the full name, date and signature of the bailor after receipt, indicating that the goods and materials were received in full and he has no complaints about the storage process.

Some columns can be left blank if there is no data. You can also put dashes.

Nuances of filling

The signature (with transcript) in the depositor's accounting journal when returning inventory items is, among other things, also a waiver of claims.

Before signing the document, the depositor is obliged to check what he takes away for compliance with quantity, quality, etc.

If there are any claims regarding these components (for example, he believes that some of the goods were damaged in some way during storage), then he has the right not to sign the last column of the journal. To resolve such issues, an act of acceptance of goods in terms of quantity and quality is drawn up. This is the only way to insure yourself during a possible trial.

What laws does it refer to?

The journal has a form code according to OKUD 0335002. At the very beginning it states that this form was approved by Resolution of the State Statistics Committee of the Russian Federation dated 08/09/1999 No. 66. However, since 2013, this particular form, like many other primary documents, has become not mandatory, but only a recommendation form to fill out. To issue your own forms, you will need compelling reasons and numerous references in the constituent documents.

Deadlines

If the depositor has exceeded the storage time previously agreed upon, then a note about this fact must be present in the journal. It is acceptable to note this in one of the return columns.

Typically, the document is submitted monthly to the company’s accounting department for reconciliation and control over the movement of inventory. Each organization has the right to independently determine the frequency of such transmission.

Shelf life of the warehouse accounting book M-17

As mentioned earlier, the warehouse inventory ledger is started once a year at the very beginning. The book should be finished at the end of this year. During this period of time, it must be filled out by warehouse service employees and, accordingly, stored with them. After the specified period, the book is submitted to the accounting department for verification and then deposited. Archival storage of inventory books is carried out within the period of time allotted by regulatory documents. In this case, the storage period cannot be less than five years from the date of closure of the document.

Answers to frequently asked questions

Question N1: Good afternoon! I'm interested in this question. When using the inventory book according to the canceled form N M-17, is it necessary to keep similar materials accounting cards?

Answer: Hello! This is not necessary, since by reflecting the movement of inventory items in special books, you fully ensure that the organization maintains warehouse records necessary for accounting purposes. If you also use cards, you will end up with double accounting, which can lead to confusion or omission of important information. Also, maintaining cards together with books will double the time spent on certain operations of the movement of materials.

Question N2: Good afternoon! Everyone knows that inventory books are subject to inspection by the accounting department, in particular the chief accountant. What should be the optimal frequency of these checks?

Answer: The accountant authorized to maintain accounting records related to the storage of inventory items can check the M-17 warehouse books on a monthly basis, which would be optimal. However, often in practice such frequency is not observed. As for checking books by the chief accountant, it is enough for him to check book M-17 once a year at the time of its completion.

Possibilities for monitoring and managing the electronic warehouse ledger system

The following is a short list of the capabilities of the warehouse Universal Accounting System program. Depending on the configuration of the developed software, the list of capabilities may vary.

- Using analytics, you can keep track of payments to suppliers.

- Product accounting can be made easier by the “Universal Accounting System”.

- To conduct business productively, you need proper warehouse accounting, which the “Universal Accounting System” can handle.

- Storage accounting is one of the main tasks of any warehouse.

- The storage program is compatible with most standard equipment used in accounting.

- The program includes reporting analytics and reminders for employees to help control inventory

- The software for warehouse and trade can maintain not only warehouse accounting, but also financial accounting.

- can be found on our website; you can use the trial period to try it out.

- In the system, accounting for the enterprise's products will be carried out automatically through the recalculation of balances and transactions on them.

- In the program, inventory is accounted for using storage lockers.

- A warehouse program can help you keep track of goods and products.

- A warehouse accounting program will help automate work and reduce the influence of the human factor.

- Inventory management will become easier with the automation of storage of various types of invoices.

- The site has the opportunity to test and familiarize yourself with an already completed type of program.

- The program manages the warehouse with support for various access rights.

- The warehouse accounting program uses various types of search, grouping and screening of product data.

- The free warehouse software includes product accounting, movement and storage.

- The warehouse program can manage the storage and movement of various goods.

- The trade and warehouse program has a function for analyzing balances to remind you about the finished product.

- The main functions of the program are: storage management, placement and movement of goods.

- Accounting for finished products can be made easier with the help of auxiliary equipment for calculating raw materials.

- Accounting for goods in an enterprise is one of the important parts for warehouse management.

- Logistics and warehouse management will allow you to control the actions of employees and improve warehouse processes thanks to advanced access settings.

- In the program, each product has a warehouse card, which stores the entire history of operations on it.

- Analytics in the program can evaluate or account for inventory.

- The program allows you to keep inventory records of materials, financial accounting, sales, analyze the company’s activities at different levels, and much more.

- It will be possible to automate the warehouse with the “Universal Accounting System”.

- In the program, materials are accounted for automatically using barcodes.

- In the program, storage control is carried out with the help of responsible persons and audit.

- Working with balances will become easier with a CRM system.

- Goods accounting will become faster with a reduction in warehouse operations time.

- The program keeps records of a warehouse or a group/network of departments for storing goods.

- The program uses product accounting and analysis to manage warehouse and trade.

- Enterprise accounting software helps you manage your warehouse remotely or offline.

- The warehouse system stores basic data of the persons with whom you do business.

- In the program, records of materials in the warehouse can be kept by a responsible person with specially configured access rights.

- Warehouse automation makes it possible to conduct business in any company/organization.

- Residue control can be configured by activating a flag on a program parameter.

- A warehouse management system makes it possible for employees to work productively.

- On our website you can also download for review an informational Power Point presentation, which lists the main characteristics of the program;

- Unlike working with a conventional spreadsheet electronic version of such documents, you can easily import information created earlier by transferring it from existing electronic format files;

- To an entry created for a specific product, you can attach a photo of it, which can first be taken on a web camera and downloaded to the database;

- If, according to the regulations of your company, you still require such documentation in paper form for audits, you can download it at any time and endorse it for storage in the archive;

- You can use any convenient currency in financial transactions, and even assign different types to different cash registers;

- The “Reports” section is able to display not only all movements of warehouse balances for a selected period, but also highlight all completed financial transactions;

- You can download and upload your corporate logo to the workspace, or rather to the main screen and taskbar, which will definitely raise your corporate spirit;

- Unlike paper accounting forms, using our unique software you will be able to control several warehouses and cash desks at once;

- A striking advantage of automating activities is that you can automatically track the shelf life of certain products;

- Automatic use of electronic type of accounting documentation can occur in any convenient language;

- The appearance of the tables in the “Modules” section can be customized by you according to your preferences: cells and columns can be hidden if they do not carry a clear meaning, they can be swapped and deleted;

- Multi-window operation in the system workspace facilitates simultaneous access to several inventory transactions;

- No monthly subscription fee, low installation price and two hours of free technical support? that's why our clients choose us;

- Easy access to overall turnover indicators and their analysis is provided by the “Reports” section;

- To work with the program, you only need a personal computer, a Windows operating system and the Internet. Moreover, you can work remotely from any mobile device if you cannot be at your workplace.