Accounting accounts for accounting of finished products

Information about manufactured products is stored in account 43 “Finished products”. This account is used by manufacturing enterprises that independently create products. In this case, the cost or complexity of the product does not play a role.

Finished products for one company may be raw materials for another. For example, for a flour mill, flour is a finished product. But for a gingerbread factory it is raw material.

Important! Trade enterprises do not use account 43. To account for goods for resale, they use account 41 “Goods”.

Types of GP

There are several groups into which it is divided depending on a large number of factors. Read more about classification in this section.

Gross

It is characterized by the fact that it was manufactured by the company for a specific period of time. Expressed in monetary terms. Includes several subspecies: complete, final, and intermediate.

Total turnover

A set of goods from the previous category that were produced by all workshops and departments of the organization. This includes carrying out production work.

Comparable

All products and services produced by the corporation in the current and previous (base) year. In this case, production can be serial or mass. Parties made on an experimental basis are not included in this concept.

Incomparable

The total number of products that were launched for the first time during the current reporting period. Its quantity shows the degree of development and implementation of new technologies, as well as the level of expansion of the product range.

Accounting for finished products

The manufactured products at any enterprise go through several stages: production, movement and sales. Production takes place in the workshop, then the GP moves from the workshop to the warehouse, and then goes to the buyer.

The production stage is the most important, since at this stage the cost of production is formed. It can be actual - calculated based on actual costs incurred, or normative - calculated based on write-off rates.

Accounting for finished products at actual cost

In this case, the cost of the GP is determined by the actual production costs incurred. When releasing, the accountant makes the following entry:

Dt 43 Kt 20 / 23 / 29—reflects the release of finished products

On account 20 “Main production”, all actually incurred costs are collected in the form of:

- spent raw materials - count 10;

- wages of production personnel - account 70;

- insurance premiums from wages of production personnel - account 69;

- depreciation of equipment used in production - account 02;

- services of third parties - count 60.

In addition, auxiliary production costs and defects may be written off on finished products.

In accordance with clause 23 of FSBU 5/2019, the real cost of production includes:

- material costs;

- labor costs;

- insurance contributions from salary;

- depreciation;

- other costs.

At the same time, in accordance with clause 26 of FSBU 5/2019, it is prohibited to include in the actual cost:

- costs resulting from natural disasters, fires, accidents, etc.;

- impairment of assets, even if they were used in production;

- administrative expenses not related to production;

- storage costs if storage is not part of the production cycle;

- advertising and promotion costs;

- and other costs that do not affect production.

Accounting for finished products at planned (standard) cost

Planned cost is the estimated cost of finished products for the planned period. To calculate it, write-off rates for raw materials, supplies, fuel, labor costs, and so on are used. The method is allowed to be used in mass or serial production (clause 27 of FSBU 5/2019).

The cost price according to the standard is recorded on account 40 “Output of products (works, services)”. In this case, when releasing products, the accounting department makes the following entries:

Dt 43 Kt 40 - manufactured products are accounted for at standard cost

And then they build wiring to account for the actual cost:

Dt 40 Kt 20 - manufactured products are accounted for at actual cost

The main difficulty of such accounting is that the actual and planned costs usually do not coincide. Therefore, the balance on account 40 is:

- debit - if the actual cost is higher than the planned cost;

- credit - if the actual cost is lower than planned.

At the end of the month, the balance of account 40 is written off using one of the entries, depending on what balance is formed:

Dt 90.2 Kt 40 - “overspend” is written off as expenses (debit balance)

Dt 90.2 Kt 40 - “savings” are reversed (credit balance)

Important! Account 40 has no balances at the end of the month.

To account for cost according to the standard, it is not necessary to use account 40. It is enough to open a sub-account “Finished products at accounting prices” to account 43. Product output is reflected in the following entries:

Dt 43.GP at accounting prices Kt 20 / 23 - products are accounted for at accounting cost

At the end of the month, the difference between the two types of cost is determined, which is reflected in the subaccount “Deviation of actual cost from accounting cost.” And then they build one of the wiring:

Dt 43. Deviation of actual cost from accounting Kt 20 / 23 - if the actual cost is higher (overspend)

Dt 43. Deviation of the actual cost from the accounting cost Kt 20 / 23 - reversal for the amount of excess of the planned cost over the actual (savings)

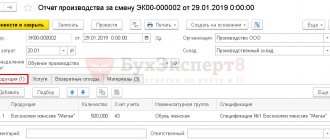

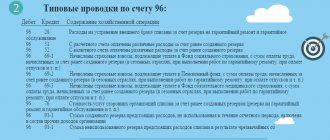

Typical transactions for account 43

Account 43 correspondence

Account 43 corresponds in debit with the accounts of production (20, 23, 29), production output (40), internal expenses (79), authorized capital (80) and other income and expenses (91). Such postings indicate the acceptance of finished products for accounting.

For the loan, account 43 corresponds with the accounts of production (20, 23, 29), materials (10), general production, general and commercial expenses (29, 26, 44), defects in production (28), shipped goods (45), settlements - with debtors and creditors and intra-economic (76, 79), authorized capital (80), sales (90), shortages and losses from damage to valuables (94), deferred expenses (97), profits and losses (99). With similar postings, finished products are written off from account 43.

Postings to account 43

When accepting finished products for accounting, the accountant makes the following posting options:

| Dt | CT | Content | A document base |

| 43 | 20, 23, 29 | Receipt of GP from any production to the warehouse | Purchase Invoice |

| 43 | 79 | Receipt of GP from any division of the enterprise | Transfer and Acceptance Certificate |

| 43 | 98 | Accounting for GP as a discount for the buyer | Packing list |

| 43 | 80 | The entry of a state enterprise as a contribution to the authorized capital | Minutes of the board's decision |

Postings for writing off the cost of finished products from the balance sheet:

| Dt | CT | Content | A document base |

| 45 | 43 | Shipment of GP to third parties | Transfer and Acceptance Certificate |

| 80 | 43 | Transfer of a state enterprise under a simple partnership agreement | Transfer and Acceptance Certificate |

| 94 | 43 | Write-off of GP when a shortage is detected | Commission report, Inventory sheet |

| 44 | 43 | GP consumption for commercial purposes | Expense report |

| 97 | 43 | The cost of the GP used to perform the work is written off as deferred expenses. | Work contract |

The accounting scheme for finished products looks like this:

Accounting for sales of finished products

After the production is released, a balance is formed on account 43. This is the amount of finished products that the company has at its disposal and which can be sold. During implementation, the accounting department makes the following entries:

Dt 62 Kt 90.1 - income received from the sale of products

After this, the accountant writes off the cost of goods sold:

Dt 90.2 Kt 43 - cost of products sold is included in expenses

The cost of identical products may differ from each other. In order to determine at what cost to write off finished products upon sale, use one of three methods.

Write-off of finished products at the cost of each unit

This method is used for products that cannot replace each other. Therefore, upon sale, the cost of a specific unit is written off.

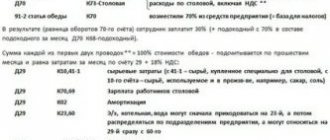

Write-off of product costs at average cost

To calculate the average cost per unit of production, the total cost of the GP is divided by the quantity. The average cost can be recalculated at regular intervals or as each new batch of products is released.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. Let's say we sold 230 buns.

We calculate the average unit cost using the formula:

(100 * 7 + 100 * 6.8 + 100 * 7.1) / (100 + 100+ 100) = 2,090 / 300 = 6.97 rub.

We calculate the cost of 230 rolls using the formula:

230 * 6.97 = 1,603.1 rub. — written-off cost.

Write-off of cost using the FIFO method

FIFO - first in, first out (First In, First Out). First of all, the cost of finished products that were previously produced is written off.

For example, within 3 days 300 loaves of bread were produced with different costs:

- on 1 day - 100 rolls, cost of 1 roll - 7 rubles;

- on day 2 - 100 rolls, cost of 1 roll - 6.8 rubles;

- on day 3 - 100 rolls, cost of 1 roll - 7.1 rubles.

The total cost of production is 2,090 rubles. 230 buns were sold. The cost price for write-off is calculated using the formula:

100 * 7 + 100 * 6.8 + 30 * 7.1 = 700 + 680 + 213 = 1,593 rub. — written-off cost.

Is count 43 active or passive?

This is an active account, which is debited in accounting when finished products arrive at the company’s warehouses. The ending balance can only be in debit; in the balance sheet, the account results are reflected as assets. In the case of selling a certain amount of finished products or transferring them to another department for the needs of the organization, the account. 43 is credited. Products ready for sale, including semi-finished products of own production, should be accounted for at actual cost.

When organizing analytical accounting, a separate sub-account is created for each product category, which reflects data in cost and physical terms. Subaccounts 43 accounts:

- 43.01, in which it is customary to keep records of products using the planned cost method;

- 43.02, which provides for accounting at actual cost.

Accounting for shipped GP

Typically, title to the finished product passes to the buyer at the time of shipment. But the terms of the contract may establish a different procedure. In this case, finished products shipped to the buyer, but for which he does not have ownership rights, are recorded on account 45 “Goods shipped”. When shipping, accounting records the following:

Dt 45 Kt 43 - products shipped to the buyer

After the transfer of ownership, the cost of shipped products is written off:

Dt 90.2 Kt 45 - the cost of shipped products is expensed

Write-off of costs at planned cost without using account 40

This method of accounting implies that the planned cost should be reflected on the 43rd account immediately after the GP is entered into the incoming documents: Dt 43 Kt 20.

When the GP is shipped, the same amount is reflected on the 90th account: Dt 90.2 Kt 43.

As soon as the reporting period ends, the actual cost of the GP and the difference in the actual and planned cost indicators will appear on the 20th account. You will need to make adjustments to account 43 for the amount received:

- upward, if the actual indicator is greater than the planned one, with the following entry: Dt 43 Kt 20.

- downward if the planned indicator turns out to be greater than the actual one: reversal Dt 43 Kt 20.

Finished products in the balance sheet

In the balance sheet, the balance of the state enterprise at the end of the period is recorded on line 1210 “Inventories” at actual or planned cost.

The organization independently determines the level of detail of this line. For example, you can separately highlight the cost of raw materials, finished goods and work in progress if the company recognizes such information as significant.

For accounting of finished products and inventories in general, we recommend the web service Kontur.Accounting. The program will suggest the correct transactions and help you register the GP in accounting. We give all newbies a free trial period of 14 days.