Maintaining a book of income and expenses under the simplified tax system: rules and responsibilities

In accordance with Art.

346.24 of the Tax Code of the Russian Federation, all taxpayers who have chosen the simplified tax system must keep records of income received and expenses incurred in order to determine the object of taxation. For this purpose, a tax register is opened annually: a book of income and expenses. The form of this register and the rules (procedure) for its completion were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n (hereinafter referred to as the Procedure, Order No. 135n).

The book can be maintained in any way (filled out manually or on a computer), but in any case, its final copy must exist in paper form, have numbered sheets and be certified by the signature of the head of the legal entity or individual entrepreneur and a seal (if there is one).

The book does not need to be submitted to the Federal Tax Service along with the tax return, but during an audit it must be presented to the inspector within 10 days (clause 3 of Article 93 of the Tax Code of the Russian Federation).

If the book is not kept or there are significant violations when filling it out that lead to an underestimation of the taxable item, the violating taxpayer faces a fine. The maximum fine is 20% of the amount of the unified simplified tax system that has not been received into the treasury, the minimum is 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).

If a violation of the tax accounting procedure does not lead to an understatement of tax, the fine for the taxpayer will be from 10,000 to 30,000 rubles (clauses 2 and 3 of Article 120 of the Tax Code of the Russian Federation). Failure to provide the book at the request of the inspectors will result in a fine of 200 rubles. (Article 126 of the Tax Code of the Russian Federation) plus 300–500 rubles. (Article 15.6 of the Administrative Code) in the form of an administrative penalty against the head of a legal entity.

Read more about liability for tax offenses committed in the article “Responsibility for tax offenses: grounds and amount of sanctions .

How to keep a book of income and expenses of an individual entrepreneur

The procedure for maintaining a book of income and expenses for individual entrepreneurs is no different from the general rules.

Entrepreneurs do not indicate in column 4 of Section I of the book income that is subject to personal income tax. This is directly stated in clause 2.4 of the Procedure approved by Order No. 135n.

In section IV of individual entrepreneurs on the simplified tax system, 6% without employees reflect the insurance premiums they transferred for themselves. Those who make payments to other individuals, in this column reflect both contributions transferred for themselves in a fixed amount, and similar payments paid for employees.

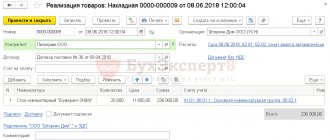

Filling out KUDiR in 1C: Accounting 3.0

In addition to the correct settings, before generating KUDiR, it is necessary to complete all operations for closing the month and check the correctness of the sequence of documents. All expenses are included in this report after they are paid.

The D&R accounting book is generated automatically and quarterly. To do this, you need to click on the “Generate” button in the form where we just made the settings.

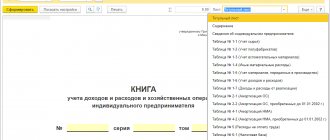

The book of income and expenses contains 4 sections:

- Section I. This section reflects all income and expenses for the reporting period quarterly, taking into account the chronological sequence.

- Section II. This section is filled out only if the simplified tax system is “Income minus expenses”. This contains all costs for fixed assets and intangible assets.

- Section III. This contains losses that reduce the tax base.

- Section IV. This section displays amounts that reduce tax, for example, insurance premiums for employees, etc.

If you have configured everything correctly, then KUDiR will be formed correctly.

How to keep a book of income and expenses in electronic format

Most official portals with regulatory documents offer to download a file in MS Excel format for maintaining the register in electronic form. When you download it, an electronic document opens in the form of a formatted appendix to order No. 135n.

Due to the fact that the procedure for maintaining a book in electronic and paper formats is the same, there should not be any particular difficulties with its design on a computer. If an error made when registering a transaction was discovered before the book was printed on paper, it can be easily corrected. If an error was discovered when the register was printed, the correction is made on the basis of clause 1.6 of the Procedure (certified by the manager’s signature and seal (if any) with the date of the correction).

The register, which was kept in electronic format during the year, must be printed at the end of the tax period. Its sheets are numbered, stitched and sealed with the signature of the head - a legal entity or individual entrepreneur - and a seal (if any).

Sending the book to the Federal Tax Service in electronic format with a digital signature is not provided for by the specified Procedure.

Is it possible to change the method of maintaining KUDiR (from electronic to paper or vice versa) during the year? The Ministry of Finance of the Russian Federation answered this question. Get trial online access to K+ for free and proceed to the explanations of the officials.

Ana-sm.com

Despite the fact that since 2014, individual entrepreneurs using the simplified tax system do not have to submit the KUDiR to the Tax Inspectorate when submitting annual reports, we are required to have this same KUDiR for the past year.

And it must be properly formatted: filled out correctly, the pages numbered and filed, on the last page there is the inscription “Sewn and numbered (for example) 7 (seven) sheets”, signature and seal of the individual entrepreneur. I would also like to note that since 2013, a new KUDiR form has been used for individual entrepreneurs and organizations using the simplified tax system. Since 2013, the mandatory certification of the book of income and expenses by the tax authority has been abolished. However, the stitched and numbered KUDiR must be there in any case. The fine for the absence of a book for individual entrepreneurs is 200 rubles, for organizations 10,000 rubles.

If you have not yet filled out the KUDiR, then you should familiarize yourself with the instructions for filling out the KUDiR on the simplified tax system, and in this note we will talk about filing documents, and specifically how to sew the KUDiR.

How, in principle, to staple documents correctly?

Are there any general rules?

None of the authorities that require documents to be stapled in order to ensure maximum difficulty for forgery provide instructions, rules or samples on how to do this. Although, it would seem, well, take a photo of how to staple documents and everyone will be better off. After all, this must be done “correctly”, and not otherwise.

You cannot staple sheets of one document together with a stapler, nor can you glue them together. You just have to stitch it together. This can be done using a needle and thread, stitching through sheets of paper. If there are a lot of sheets, then you will need an awl, but it is more convenient to use a hole punch and a thin strip of braid instead of thread. Some sew “on the left side”, others - “at the upper left corner”.

But then everything is the same for everyone: take a small piece of paper, paste it on top of the threads / tape, then on this piece of paper, ending up on the document itself, it is written “Sewn and numbered so many

pages. Last name I.O. Signature." A stamp is placed (if any).

So, what is needed to stitch KUDiR:

- filled out KUDiR, with numbering of sheets - hole punch or needle - thin strip of braid or thread (documents are stitched with thread twice, for strength) - office glue - paper for stickers measuring approximately 4*6 cm (not thick) - pen - stamp (if available )

We make holes through all the sheets of the document, thread the ribbon, tie it on the back side of the bound document, paste a piece of paper on top, sign (the edges of the signature and seal should extend beyond the borders of the sticker paper). That's all.

For clarity, I will give two versions of the video with stitching of documents: - from the left side

- from the upper left corner

I would like to say that the ribbon sometimes makes the inspector/receiving person from the Pension Fund smile (it was noted when I had to submit the KUDiR to the tax office), but it was very convenient when returning the book “back” (in the first year they immediately returned the book to me, putting a mark, and the next year they said: come for it in 5 days) - my KUDiR stood out very clearly from the general pile and I simply pointed to it, so I didn’t have to go through the whole pile.

Order of the Ministry of Finance of the Russian Federation dated December 30, 2005 N 167n “On approval of the form of the Book of Income and Expenses of Organizations and Individual Entrepreneurs applying the simplified taxation system, and the Procedure for filling it out”:

…

1.5. The book of income and expenses must be laced and numbered. On the last page of the Income and Expense Accounting Book, numbered and laced by the taxpayer, the number of pages it contains is indicated, which is confirmed by the signature of the head of the organization (individual entrepreneur) and sealed with the seal of the organization (individual entrepreneur - if any), and also certified by the signature of an official of the tax authority and sealed with the seal of the tax authority before the start of its maintenance. On the last page of the Taxpayer’s numbered and laced Income and Expense Book, which was kept electronically and printed on paper at the end of the tax period, the number of pages it contains is indicated, which is confirmed by the signature of the head of the organization (individual entrepreneur) and sealed with the seal of the organization ( individual entrepreneur - if available), and is also certified by the signature of an official of the tax authority and sealed with the seal of the tax authority.

—

How to fill out sections of the income and expense ledger

Each business transaction performed by a taxpayer using the simplified tax system during the tax period, which has an impact on the formation of the tax base, must be registered in the book. Entries are made in chronological order. Based on the results of each quarter and at the end of the year, results are compiled.

ConsultantPlus experts provided a detailed commentary on filling out the book of income and expenses, including samples of completion. Get trial online access to K+ for free and proceed to recommendations.

Column 4 of Section I reflects income, the list of which is contained in Art. 249–250 Tax Code of the Russian Federation. Accordingly, the operations listed in Art. 251 of the Tax Code of the Russian Federation, as well as those that are subject to income tax for legal entities or personal income tax for individual entrepreneurs. Income received in kind is reflected at the market price of the received property.

Taxpayers who have chosen the accounting object “income minus expenses” enter their expenses in column 5 of the same section (their list is specified in Article 346.16 of the Tax Code of the Russian Federation). “Simplified people” who pay tax on the object “income” indicate in this column their expenses incurred as part of the implementation of budget unemployment programs, as well as expenses that were made from funds subsidized for the development of entrepreneurship.

Section II, concerning fixed assets, is filled out by simplifiers who have chosen “income minus expenses” as the object of taxation. Section III is also completed by taxpayers working with the “income minus expenses” object, if they have losses based on the results of previous years that can be taken into account when calculating the tax for the current year.

Section IV is filled out by taxpayers who calculate the single tax on the “income” object. All insurance premiums paid are recorded here, which have an impact on reducing the amount of accrued tax.

Since 2022, the book of income and expenses has been supplemented with Section V, in which taxpayers who have chosen “income” as the object of taxation reflect the amounts of trade duty paid, which affect the amount of tax payable to the budget.

For more information about the differences in the procedure for filling out the book, depending on the chosen object of taxation, read the material “The procedure for filling out KUDiR under the simplified tax system, income minus expenses .

You can download the current book of expenses and income form for 2021-2022 on our website using the link below:

If you use the tax object “income”, then see the sample KUDiR for 2022 in ConsultantPlus. If you have “income minus expenses,” then a sample for 2022 can be found at this link. It's free.

And if you need the previous version of the register (for 2013-2017), then this is it:

Setting up KUDiR in 1C 8.3

Before you start creating this income and expense accounting book in 1C 8.3, check the program settings. If you have problems with the formation of KUDiR and some expenses do not fall into the book, carefully double-check the settings. Most of the problems lie here.

Where is the income and expense accounting book 1C 8.3? In the “Main” menu, select the “Accounting Policy” item in the “Settings” section.

You will see a list of configured accounting policies by organization. Open the position you need.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the accounting policy setup form, at the very bottom, click on the “Set up taxes and reports” hyperlink.

In our example, the “Simplified (income minus expenses)” tax system was selected.

Now you can go to the “STS” section of this setting and configure the procedure for recognizing income. This is where it is indicated which transactions reduce the tax base. If you have a question why an expense does not fall into the book of expenses and income in 1C, first of all look at these settings.

Some items cannot be unchecked as they are required to be filled out. The remaining flags can be set based on the specifics of your organization.

After setting up the accounting policy, let's move on to setting up the printing of the KUDiR itself. To do this, in the “Reports” menu, select the “STS Book of Income and Expenses” section of the “STS” section.

The ledger report form will open in front of you. Click on the "Show Settings" button.

If you need to detail the records of the received report, check the appropriate box. It is better to clarify the remaining settings with your tax office, having learned the requirements for the appearance of KUDiR. These requirements may vary between inspections.

How to check the book of income and expenses in 1C

There is an opportunity to check the correctness of the book of income and expenses in the 1C: Accounting program. For this purpose, a special function “Book Filling Assistant” is provided. With its help, an accountant can run routine operations and analyze the results.

When you download the special service built into the program, you can view all accepted and non-accepted expenses. The most common mistake is the program’s failure to provide documents confirming payment of expenses incurred. And in the absence of payment, expenses cannot be taken into account (Article 346.17 of the Tax Code of the Russian Federation). You can correct the error by group re-posting all documents for the tax period.

Read about all the nuances of using this accounting program by simplifiers in the article “Using “1C Accounting” under the simplified tax system .

Book of income and expenses: example of filling out in special situations

An example of filling out a book of income and expenses will help you avoid mistakes in its design. This is especially true in situations where some non-standard operation arises.

Example:

The taxpayer transferred the advance payment to the supplier using the simplified tax system, but he did not ship the goods to him, and in the end he returned the advance payment. In this situation, an entry in column 5 cannot be made when transferring the advance, since this type of expense is not specified in Art. 346.16 Tax Code of the Russian Federation. This means that the returned advance is not shown in column 4 “Income”. This is stated in the letter of the Ministry of Finance of Russia dated December 12, 2008 No. 03-11-04/2/195.

If the taxpayer receives an advance payment, this amount is reflected in income, since simplifiers are required to use the cash method. But when returning the advance payment, it is necessary to reverse the entry made earlier for the amount of the advance payment returned to the buyer.

A sample of filling out the book of income and expenses for 2019-2020 can be found on our website.

And this is a sample of filling out a book of income and expenses for periods up to 2018:

Results

Do not neglect filling out the book of income and expenses, because filling out this register is not difficult, and the consequences of its absence can be quite noticeable. and samples from our article and check yourself when filling out.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What income is taken into account at the tax rate of 6%?

Entrepreneurs are interested in how the income of individual entrepreneurs is calculated under the simplified tax system of 6%. It includes cash receipts to the bank account or cash register from customers. The fact of receipt of income is considered to be the receipt of revenue, and not the shipment of goods or the fact of performance of work confirmed by relevant acts.

Interesting materials:

How to get permanent access to a folder? How to get administrator access rights? How to get permission to access a folder? How do I get my parent's access code? How to remotely access your tablet? How can I see which folders are shared? How to provide access to Google Ads? How to provide access via RDP? How to register an access point? How to unlock Apple ID if you don't have access to mail?