What an accountant needs to remember when issuing money for reporting

The issuance of money on account is regulated by the instruction of the Bank of the Russian Federation dated March 11, 2014 No. 3210-U, which establishes the procedure for conducting cash transactions (hereinafter referred to as procedure No. 3210-U). Based on its provisions, there are 3 main points that every accountant needs to remember when issuing money for reporting:

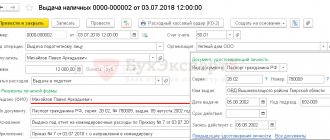

- Accountable funds are issued on the basis of a written application from the person receiving the funds or an order from the manager. The required details of such an application include (except for the full name, position and signature of the applicant): the amount of accountable funds, the period for which the money is issued, the date and signature of the manager who authorized the release of funds into account (clause 6.3 of order No. 3210- U). A sample application can be viewed on our website.

ATTENTION! From November 30, 2020, an administrative document can be drawn up for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

2. The deadlines for issuing money for reporting may be established by accounting policies or a separate order. This will make it easier for accountable persons to write statements, and for an accountant to check the timing of refunds. Legislatively, there are no established boundaries for the periods for which money is issued for reporting purposes. Each enterprise resolves this issue independently.

IMPORTANT! The enterprise must have an order stating who has the right to receive money on account. We have a sample of such an order on our website.

- The accountable person is obliged to report the accountable amount or return unused funds to the enterprise's cash desk within the number of days established by the employer after the end of the period for which he was given the money. If the money was issued for a business trip, the accountable person is obliged to report within the period established by the employer after returning.

Another important nuance is the maximum possible amount that can be reported. This has its limitations.

We recommend that you look at the material “What amount can be issued for reporting in 2022 - 2022?”

Is the employee’s consent required to withhold an accountable amount?

An employee can return unspent funds in cash and deposit them into the company’s cash desk. But if he does not have the opportunity to repay the debt on time, then several options are allowed for deducting it from his salary.

Labor Code in Art. 137 provides for the employer’s right to return unspent accountable amounts. Refunds are available in several options:

- At the request of the employee . In this case, the employee writes a free-form application addressed to the employer, where he asks to withhold accountable amounts from his income.

- By decision of the employer through the issuance of an order to withhold accountable amounts from the employee.

Regardless of the method of returning the accountable amount, consent to the withholding must be obtained from the employee. Otherwise, according to the provisions of Art. 137 of the Labor Code and according to the explanations of Rostrud of 2007 No. 3044-6-0, the only way to collect debt is to go to court.

It is impossible to obtain accountable amounts by order without the prior consent of the employee. The employee’s consent to withholding must be obtained in writing so that regulatory authorities do not have a reason to hold the employer liable.

Consent may take the form of a statement from the employee, or he may sign the order to withhold the accountable amount and indicate there that he does not dispute the grounds for the withholding and the amount of the debt.

The employer can also provide the employee with a preliminary written notice of the amount of the upcoming deduction, where he must sign.

Also in practice, the following scenarios are possible:

- If there is a disagreement between the employer and the employee regarding the amount of debt, or the employee refuses to return the money voluntarily, then the employer must go to court . In this case, the limitation period for debt collection is three years.

- Company management may decide to write off debt by recognizing it as employee income . It is important to consider that this amount will become taxable income and personal income tax must be transferred from it from unused accountable amounts. Forgiveness of debt to an employee is formalized through the issuance of an appropriate order.

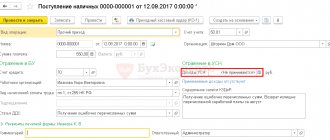

How an accountable person must report

To write off money received from an employee, there is a prescribed form called an “Advance report”. The advance report form (AO) in the columns on the expenditure of amounts is filled out by the accountable person independently. The JSC is accompanied by primary documents confirming the fact of expenditure.

For a sample of filling out an advance report, see here.

In the corresponding columns of the table on the reverse side of the JSC form, the accountable person indicates:

- serial number of the record;

- date of expenditure of funds (issue of the primary document);

- number of the primary document;

- name of the primary document;

- amount of expense.

If daily expenses that do not have primary documents are written off, the date of the expense is indicated and the daily allowance approved by the enterprise is entered. You should also indicate the number of the order on the basis of which the daily allowance was issued to the business traveler.

In the final line of the form, the accountable person enters the amount of funds spent. The accountant checks the correspondence of the amount in the report with the amount of funds received by the accountable person.

If the amount on the advance report is greater than what was issued to the accountable person, then an additional payment is made to the accountable person from the cash desk of the enterprise or (at his request) to a bank card.

How to do this correctly, see here “Transferring a sub-report to an employee’s card from a current account.”

If the amount of funds written off according to the advance report is less than what was issued to the accountant, he is obliged to return the remaining money to the enterprise. If the accountable person does not return the balance of unspent (not written off according to the advance report) funds or does not report within the specified time frame, he or she becomes indebted to the enterprise for the amounts received in the account.

Methods of deduction of funds from wages and standard entries for repayment of accounts

There are 3 possible scenarios:

- The accountable person acknowledges the debt and writes an application to withhold funds received on account for which he owes money from his salary.

- The employer retains the debt of the accountable on his own initiative. This situation, in turn, suggests 2 possible scenarios:

- when the reporting person does not dispute the debt, the enterprise, within a month from the end of the deadline by which the employee was supposed to report, may decide to withhold the money;

- when the accountable person does not agree with the fact of the debt, only the court can make a decision to withhold money.

- The manager decided to forgive the debt to the accountable person.

In the first case, when the accountable person acknowledges the debt and writes an application with a request to withhold the accountable money from his salary, the entire amount of the debt can be withheld at a time, unless otherwise indicated in the application for withholding (letter of Rostrud dated September 26, 2012 No. PG/7156-6- 1).

In the second case, when the accountant does not dispute the fact of the debt, the accountant has the right to withhold the debt from the employee. To do this, it is necessary to make a decision (issue an order) to withhold the debt within a month from the date set for submitting the advance report to the accounting department or returning the imputed amounts. The order must include the signature of the employee, indicating that he has no objections. This norm is established by Art. 137 Labor Code of the Russian Federation.

Important! ConsultantPlus warns that the maximum amount of deductions from an employee’s salary is 20% of the accrued amount minus personal income tax (Article 138 of the Labor Code of the Russian Federation, Letter of the Ministry of Health and Social Development of Russia dated November 16, 2011 N 22-2-4852). Therefore, if the unreturned accountable amount exceeds 20% of the accrued salary minus personal income tax, then... See K+ for more details. Trial access is available for free.

Here are typical transactions for the operations discussed above:

| Dt | CT | Operation description |

| 71 | 50 | Issuance of cash from the company's cash desk |

| 94 | 71 | Reflects debt on unreturned accountable funds |

| 20–44 | 70 | Employee's salary accrued |

| 70 | 68 | Personal income tax withheld from salary |

| 70 | 94 | Employee debt repaid |

In the case where the accountable person disputes the debt, only the court can resolve the issue. At the same time, after a month from the last reporting date, the accountant is obliged to accrue additional insurance premiums for the amount of unreturned accountable funds (Articles 7, 8 of Law No. 212-FZ dated July 24, 2009). As for personal income tax, it is accrued upon the fact that the debt is written off in connection with a court decision (if the court made a decision in favor of the employee) or on the date the debt is forgiven.

Debt forgiveness is the last possible development of events in the event of non-repayment of accountable amounts. If a decision is made to forgive the debt of an accountable person, it is necessary to issue an appropriate order (you can also limit yourself to receiving the appropriate resolution from the manager on the accountable person’s application to forgive his debt).

The date of the resolution (or order) is considered the date the debt is written off from the debtor (clause 2 of Article 415 of the Civil Code of the Russian Federation).

Whether the written-off debt of an accountant is subject to personal income tax and insurance premiums and what to do with income tax, find out in the Ready-made solution from ConsultantPlus by getting trial access to the system for free.

Postings when forgiving a debt on an unreturned account look like this:

| Dt | CT | Operation description |

| 91 | 71 | Debt written off based on order |

| 70 | 68 | Personal income tax withheld from the amount of the written off debt |

| 91 | 69 | Contributions accrued on written-off debts |

How to write off unreturned amounts in accounting

If the director has forgiven the debt to the employee, then this amount must be recognized as another expense (clause 11 of PBU 10/99). In accounting, unreturned accountable money is recognized as another expense by posting Dt 91.2 Kt 94. The basis will be the order of the manager and the accounting certificate.

And if the company collects the amount in court, then it must be reflected in account 73 (or 76 if the employee has already quit). Moreover, the amount can be indicated in the amount that is considered correct on the basis of accounting records (clause 73 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance No. 34n dated July 29, 1998, hereinafter referred to as the Regulations).

When the debt is doubtful (most likely it will not be repaid), a reserve for doubtful debts is created. You can write off such an amount if the court refuses to collect, the debtor does not have property to pay off the debt, it cannot be found, or the statute of limitations has expired. They do this at the expense of the created reserve, and if it is not there or there are insufficient funds, then they are recognized as another expense (clause 77 of the Regulations).

If a debt is written off due to the impossibility of collection (no property, no person found), then it should be recorded in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” in order to monitor the possibility of its collection when the financial situation of the debtor is stabilized. Writing off a debt at a loss due to insolvency is not a cancellation of the receivable. It must be reflected on the balance sheet within 5 years from the date of write-off (clause 77 of the Regulations).

You will need to make the following entries in your accounting:

- the debt of the employee (dismissed) is reflected according to the report - Dt 73 (76) Kt 94;

- a reserve for doubtful accounts receivable was created - Dt 91.2 Kt 63;

- the debt of the accountable person is written off (if there is a reserve) - Dt 63 Kt 73 (76);

- the debt of the accountable person is written off (if there is no reserve or insufficient funds) - Dt 91.2 Kt 73 (76);

- debt written off due to impossibility of collection - 007.

Confirmation will be orders from the manager, accounting certificates, certificates of calculations, an agreement on debt forgiveness, an act of inventory of settlements.

Results

When issuing imprest amounts, the enterprise accountant is obliged to keep records of the timing of their return. If the accountable does not timely report for the amounts issued (or does not return them), it is possible to deduct them from the salary. The procedure for such retention can be initiated by both the employee and the employer.

More information about how to collect a report from the director of an enterprise can be found in the article “Five effective ways to reset the accumulated report of a director.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other nuances

Giving an employee a certain amount on account is not an expense transaction for the enterprise. That is, the excess of previously issued funds does not relate to the income of the enterprise and does not require adjustments to income tax.

If the employee does not repay the debt, the court does not take the employer’s side, the debt is written off. It is considered hopeless and is reflected in tax accounting as non-operating expenses. To transfer an unrefunded amount to the category of hopeless, you need a court decision in favor of the employee or documentary evidence of the expiration of the statute of limitations.