About legal entities

Reporting for 2022 At the beginning of 2022, the deadlines for paying individual entrepreneur taxes for

Why is a card for individual accounting of accrued payments required? In accordance with Law 125-FZ

KS-6a or Journal of completed work - a specialized formalized journal related to primary documents,

Who is required to submit calculations for insurance premiums Persons paying employee benefits are required to report quarterly

Is optimization always necessary? Exemption from VAT affects whether it is convenient for you

Why is such a division of the year necessary? Typically, the “quarter” period is used in those institutions where

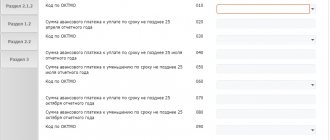

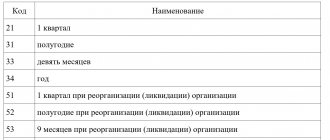

Each declaration or calculation submitted to the Federal Tax Service contains on the title page a three-digit field for

The concept of a strict reporting form or SSR refers to unified primary documents issued as

Which DAM form to use? In 2022, there is a form for calculating insurance premiums, which

Russian legislation provides for various tax regimes. Some of them can be used simultaneously, others