How have the storage periods for salary documents changed?

Innovations are defined in clause 4.2 of Order No. 236, among them:

- if there are personal accounts, pay slips, payslips and other documents on the issuance of wages and other payments are stored for 6 years (instead of 5 years);

- in the absence of personal accounts, documents on payments for which: the paperwork was completed before December 31, 2002 - are stored for 75 years;

- records were completed as of 01/01/2003 - stored for 50 years;

Read the article about the shelf life of the vacation schedule.

Payslips

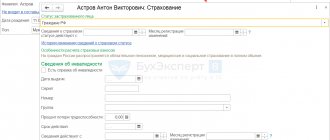

The document is a salary notice, which, according to the Labor Code, must contain the following information:

- the sum of the components of wages for a specific period;

- the amount of other accruals due to the employee, for example, due to delays in wages, vacation pay or dismissal payments;

- the amount and reasons for the deductions made;

- the total amount of money to be paid.

Despite the fact that the legislation clearly regulates the content of the salary notice, according to Article 136 of the Labor Code of the Russian Federation, the form of this document is developed and approved by each employer independently. There is a form of “calculation” developed by experts in practice.

Evasion of issuing “settlements” promises the imposition of a fine on the employer and accountant. Such measures are provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. For example, if the “settlement” was not handed to the employee or all the necessary information was not indicated in it, the organization faces a fine of 30,000 to 50,000 rubles. The manager and accountant face a warning or a fine of 1,000 to 5,000 rubles. The same fine is provided for entrepreneurs. If such a violation is repeated, the amount of the penalty varies from 10,000 to 70,000 rubles, up to the disqualification of the manager for a period of one to three years.

ConsultantPlus experts discussed how to draw up and issue a payslip. Use these instructions for free.

Storage periods for salary documents: table

For convenience, Order No. 236 provides an Index of types of documents, with the help of which the necessary lines of the list can be easily found.

Here are all the salary documents with their storage periods and comments from Rosarkhiv:

| Type of documents | Shelf life | Paragraph of Order No. 236 |

| Approved payrolls: | 293 | |

| a) at the place of approval; | Constantly | |

| b) in other organizations | As needed, but not less than 1 year | |

| Regulations on remuneration and bonuses for employees: | 294 | |

| a) at the place of approval; | Constantly | |

| b) in other organizations | 5 years from the date of replacement with new ones | |

| Documents (consolidated settlement (settlement and payment) payslips and documents for them, payslips for the issuance of wages, benefits, fees, financial assistance and other payments) on receipt of wages and other payments | 6 years, and in the absence of personal accounts - 50/75 years | 295 |

| Personal accounts of employees, salary certificate cards | 50/75 years EPC* | 296 |

| Correspondence regarding payment of wages | 5 years | 297 |

| Documents (copies of reports, applications, lists of employees, certificates, extracts from protocols, conclusions, correspondence) on the payment of benefits, payment of sick leave, financial assistance | 5 years | 298 |

| Writs of execution (executive documents) for deductions from wages | 5 years from the end of execution | 299 |

| Documents (applications, decisions, certificates, correspondence) on payment of additional leaves provided to employees combining work with education | 5 years | 300 |

| Civil contracts on the performance of work, provision of services by individuals, acceptance certificates of work performed, services provided | 50/75 years | 301 |

| Journals, databases for accounting of deposited wages | 5 years | 302 |

* EPC - the expert verification commission makes a decision on the storage of documents at the end of the established period: some may be selected for permanent storage.

Read the articles about new storage periods for other documents:

- “How long to store accounting documents from 2022”;

- “How long to keep tax documents from 2022.”

The procedure for issuing pay slips to employees

Labor legislation does not establish the procedure for issuing pay slips to employees (including when wages are transferred to a bank card). The employer has the right to define and prescribe it:

• in the document that approves the form of the payslip, or

• in a separate document (order or local regulatory act[1] (hereinafter referred to as LNA), for example, Regulations on the issuance of pay slips to employees (example 1)).

The Labor Code of the Russian Federation does not directly indicate whether employees must sign for receipt of pay slips or not. However, if an inspection is carried out by the labor inspectorate in the absence of written evidence, it will be difficult for the employer to prove that the obligation assigned to him by labor legislation is being fulfilled.

The Ministry of Labor of Russia, in its clarifications, recommends that employers issue pay slips to employees against signature, which will help document the fact of issue and protect them from administrative liability for violation of labor laws.

Extraction

from the letter of the Ministry of Labor of Russia dated July 16, 2019 No. 14-2/OOG-5284

[…]

The Code[2] does not directly say about the need to issue pay slips to employees against signature. At the same time, in order to avoid a controversial situation and possible administrative liability, the employer will need to confirm the issuance of a pay slip to the employee, and therefore we believe that the employer can issue pay slips to employees against signature.

If on the day of termination (termination) of the employment contract the employee did not work, the employer may notify the employee in advance about the components of the salary or when issuing a work book.

Thus, the employer must have confirmation that employees received pay slips. To do this, you can use one of the following options:

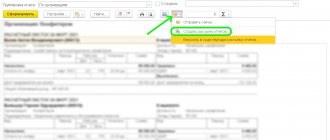

Issue payslips to employees against signature in a special journal (for example, a journal for recording the issuance of payslips to employees), which the employer can draw up in free form (example 2).

In practice, such a log indicates:

• last name, first name and patronymic of the employee;

• information about the position (profession) and the structural unit in which the employee works,

and columns are also provided where employees will put their signature and the date of receipt of the pay slip.

Provide a special column in the payroll or pay slip in which employees will sign for receipt of the pay slip.

To do this, it is necessary to enter a separate column in the unified form No. T-51 or form No. T-49[3], for example, “Pay slip received, date, employee signature.”

Let us remind you that changes can be made to the unified forms [4] (for example, they can be supplemented with columns, lines), which must be formalized by order or instruction of the head of the organization or a person authorized by him.

This method can only be used when wages are paid in cash through the cash register, since these forms of statements are used for cash payments to employees. If wages are paid by bank transfer to employees' bank cards, these payslips are not processed.

[1] Letter of the Ministry of Labor of Russia dated May 31, 2018 No. 14-1/OOG-4574; letter of Rostrud dated July 23, 2018 No. PG/23734-6-1.

[2] Labor Code of the Russian Federation.

[3] Approved by Resolution of the State Statistics Committee of the Russian Federation dated January 05, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment.”

[4] The procedure for applying unified forms of primary accounting documentation, approved. Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20.

Legislative framework

As stated in the basic accounting law 402-FZ, the storage period for accounting documents should not be:

- less than 5 years after the reporting year (Clause 1, Article 29 of Law 402-FZ) - for primary and cash accounting registers;

- less than 5 years, starting from the year in which they were last used. This applies to accounting policies and other local acts that establish the procedure, methods and methods of accounting at a particular enterprise.

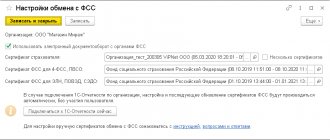

However, it should be taken into account that the procedure and terms for storing accounting documentation in LLCs and organizations of other forms of ownership are established by each organization independently, taking into account the norms and requirements:

- Tax Code of the Russian Federation;

- Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation”;

- Order of Rosarkhiv dated December 20, 2019 No. 236;

- Order of the Ministry of Culture of Russia dated July 31, 2007 No. 1182;

- list approved by the USSR Main Archive dated August 15, 1988;

- provisions approved by Resolution of the Federal Commission for the Securities Market of the Russian Federation dated July 16, 2003 No. 03-33/ps for JSC.

IMPORTANT!

Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 became invalid on February 18, 2020. New storage periods for accounting documents were introduced by order of the Federal Archive of December 20, 2019 No. 236.

Material on the topic The storage period for accounting and tax documents has changed

From February 18, 2022, the retention periods for some accounting and tax documents have changed.

The new List, approved by Order of the Federal Archive Agency dated December 20, 2019 No. 236, comes into force.

The most important changes:

- Tax returns submitted to the Federal Tax Service for all categories of taxes, fees, contributions - 5 years;

- Invoices - 5 years;

- Register of information on the income of individuals submitted by tax agents - 5 years;

- Documents confirming receipt of wages and other payments (if there are personal accounts) - 6 years;

- Calculations for insurance premiums (annual and quarterly) - 75/50 years (until 01/01/2003 - keep for 75 years, after 01/01/2003 - keep for 50 years);

- Correspondence with tax authorities on tax issues - 5 years;

- Employment contracts, service contracts, agreements on their amendment, termination – 75/50 years;

- Vacation schedule - 3 years;

- Primary accounting documents and supporting documents associated with them - 5 years;

- Accounting statements: annual - constantly, interim - 5 years.

More detailed changes in the storage periods for accounting, tax and personnel documents are given in the table:

| Type of documentation | Until February 18, 2022 | After February 18, 2022 | Note |

| Salary documents | |||

| Registers of information on the income of individuals submitted by tax agents | 75 years old | 5 years | |

| Documents confirming receipt of wages and other payments – if you have personal accounts | 5 years | 6 years | |

| Personal accounts of employees, salary certificate cards | 75 years old | 75/50 years | Their storage period now depends on the date of completion of paperwork for the following documents: – before 01/01/2003 – keep for 75 years, – after 01/01/2003 – keep for 50 years |

| Tax documents | |||

| Invoices | 4 years | 5 years | |

| Tax returns for all types of taxes and fees | 5 years | 5 years | |

| Calculations for insurance premiums (annual and quarterly) | — | 75/50 years | Previously, there was no direct rule for calculating insurance premiums. List No. 558 provided for storage periods only for payroll statements for contributions to the Social Insurance Fund: – quarterly – 5 years; – annual – constantly |

| Correspondence with tax authorities on tax issues | 5 years | 5 years | |

| Books of accounting of income and expenses when applying the simplified tax system | constantly | 5 years | |

| Certificate of fulfillment of the obligation to pay taxes, fees, insurance premiums, penalties and tax sanctions, certificate of the status of settlements with the budget | — | 5 years | |

| Employment contracts | |||

| Employment contracts, service contracts, agreements on their amendment, termination | 75 years old | 75/50 years | Their storage period will now also depend on the date of completion of paperwork for the following documents: – before 01/01/2003 – keep for 75 years, – after 01/01/2003 – keep for 50 years |

| Vacation documents | |||

| Vacation schedule | 1 year | 3 years | |

| Books, magazines, accounting cards, vacation databases | 3 years | 5 years | |

| Source documents | |||

| Primary accounting documents and related supporting documents: – cash documents and books, – bank documents, – counterfoils of cash check books, – orders, – time sheets, – bank notices and transfer requests, – acts of acceptance, delivery, write-off of property and materials , – receipts, invoices and advance reports, – correspondence | 5 years | 5 years | The general storage period has not changed, but in case of disputes or disagreements, documents will need to be stored until a decision is made on the case |

| Documents on accounts receivable and payable (certificates, acts, obligations, correspondence) | 5 years | 5 years | The general retention period has not changed, but it only applies if the debt is repaid. If the debt is not repaid even 5 years after formation, the documents must continue to be stored |

| Financial statements | |||

| Accounting statements - annual | Constantly | Constantly | Previously, the storage period for quarterly reports was 5 years, and for monthly reports – 1 year. Now these types of reporting are combined into intermediate |

| – intermediate | 5 years / 1 year | 5 years |

Is the employer required to keep payslips?

Many personnel service workers are perplexed that the form of the pay slip and the rules for working with it have not yet changed due to the development of modern technologies. It would be logical to switch long ago to an electronic version of this document, sent to the email specified by the employee. This would help to significantly save the employer’s resources, including time and financial ones.

It would be strange if all these actions related to notifying the employee regarding accrued and paid financial resources as part of wages were destroyed or thrown out after the end of the month or year.

However, in reality this is true: information that pay slips have been issued should be retained (for example, the employee signs in a special journal or returns a tear-off coupon attached to the pay slip). The requirement to make copies of payslips and store them at the enterprise is not legally established.

The situation may change if this storage is provided for by the accounting policy of the enterprise. For what needs this may be required is unknown; usually such a document flow system is practiced by large companies that can afford to allocate an individual person for these purposes. However, there is no legal requirement for such duplication and storage.

What are pay slips?

The current legislation of the Russian Federation regarding the labor of hired workers contains a number of requirements for the employer, which he must comply with when paying wages. One of the main norms is fixed in Article 136 of the Labor Code of the Russian Federation and is that each employee must be informed about what salary has been accrued to him, what deductions have been made, what the total amount is due for payment, what has already been paid and what is due for payment this time. All this information must be presented in an approved form on a piece of paper called a payslip.

It is clear that the information contained in this document must be truthful, correspond to previously reached agreements with the employee, comply with the conditions specified in the collective agreement (if there is one at the enterprise) and be provided upon payment of wages for review.

There are only a few cases when, when receiving money from an employer as remuneration for work, an employee may not receive a pay slip:

- when paying an advance, since the total amount of accrued wages is not yet known;

- when paying vacation pay, because vacation pay, by definition, is not wages;

But when an employee is dismissed, they are required to issue him a pay slip on the day of dismissal.

At the same time, the state does not force the employer to use any specific form; moreover, it does not even give recommendations on how this very sheet should look. However, the form must be developed without fail within the enterprise and enshrined in one of the local acts - for example, an order of the director. And yes, regardless of whether the salary is issued in cash at the company’s cash desk or on a bank card, the pay slip must still exist.