Each declaration or calculation submitted to the Federal Tax Service contains on the title page a three-digit field to fill out - “At location (accounting).” This is a required detail. The codes for each form are different: some of them are common to all declarations, some are different. Taxpayers are also divided into accounting categories. The code should be filled out carefully and in strict accordance with the instructions: for example, the same taxpayer can have the same code at the place of registration in all reports. At the same time, there is an exception form that does not obey this rule, and it uses a different code meaning (as is the case with IP).

What location (accounting) code should I indicate in declarations and other reporting ?

What code to put and why

Code at the place of registration, which serves as a taxpayer identifier in the Federal Tax Service database by category, and answers the following questions:

- whether the taxpayer is a legal entity or has the status of an individual entrepreneur;

- the organization is “ordinary” or it is the largest taxpayer;

- reporting is submitted on behalf of the main office of the company or its separate division;

- Russian or foreign organization;

- reports are submitted by a notary, lawyer, entrepreneur or individual, etc.

Question: An individual entrepreneur carries out retail trade in several retail outlets located in different areas of Moscow with different OKTMO codes, and is registered as a UTII payer with the tax office at the location of one of them. Is an entrepreneur required to indicate the OKTMO code for each outlet in 6-NDFL calculations and in 2-NDFL certificates? Is it necessary to pay personal income tax for each outlet using a separate payment order? View answer

Any taxpayer submitting reporting information to the Federal Tax Service in the form of a declaration or calculation (legal entity, individual, entrepreneur) is required to use this code.

Attention! The location (accounting) code is given for use in ready-made form for each legally approved form. Independent compilation and use of codes is prohibited.

The main code that most legal entities use will be 214 “At the location of the Russian organization” (provided that it is not the largest taxpayer). The main code for entrepreneurs will be 120, at their place of residence.

How to fill out the field “At location (accounting) (code)” in the 6-NDFL calculation?

Note that the analogue of the latter in the VAT return will be code 116. The coding for this tax is the most complex and extensive, it consists of 17 codes and takes into account many nuances accompanying personal income tax calculations.

The smallest number of codes contains transport tax - 3. Fiscal authorities are interested in the location of the vehicle, the location of the largest taxpayer or his legal successor and the coding corresponding to these economic facts.

The “simplified” reporting area contains the same number of codes. The largest taxpayers do not appear here due to the specific application of the specified tax regime; only the standard code for individual entrepreneurs at the place of residence, the code for the location of a Russian legal entity, is used. persons here will be 210. In addition, the code 215 is used, indicating the legal successor of the organization. This code, with rare exceptions, is mentioned in all regulations on the topic we are considering, since identifying the successor of the organization when it comes to paying taxes is important for the fiscal authorities.

The codes are recorded in detail in the regulatory documents of the tax service, a list of which is given below.

Attention! The largest tax payers this year include organizations that paid taxes to the federal treasury in the amount of 1 billion rubles. or more. For communications organizations and transport workers, this figure is lower – 0.3 billion rubles. Income and assets according to reports – from 20 billion rubles. In this sense, enterprises of the defense complex have their own characteristics.

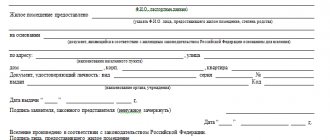

Tax return according to the simplified tax system for individual entrepreneurs

Title page (Fig. 1)

- In the “Adjustment number” field in the primary declaration, “0” is automatically entered; in the updated declaration, you need to indicate the adjustment number “1”, “2”, etc.

- In the “Tax period (code)” , enter code “34” - calendar year (specified by default)

- In the “Reporting year” , enter 2020

- In the line “Submitted to:” indicate the code of the tax authority to which the declaration is submitted

- In the field “At location (registration)”, enter the code “120 - At the place of residence of the individual entrepreneur”

- In the “Full Name” , indicate the last name, first name and patronymic of the individual entrepreneur.

- In the field “Code of the type of economic activity according to the OKVED classifier”, indicate the OKVED code. You can clarify your OKVED code by downloading an extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website.

- the field “Form of reorganization, liquidation (code)” blank if the organization is not liquidated during the tax period.

- “Contact phone number” field is optional and can be filled in as desired.

The field “with supporting documents or their copies on ___ sheets” reflects the number of sheets of supporting documents and (or) their copies (if any). Such documents may be: the original (or a certified copy) of a power of attorney confirming the authority of the taxpayer’s representative (if the declaration is submitted by the taxpayer’s representative), etc.

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

- “Taxpayer” - if the document is submitted by the taxpayer

- “Taxpayer's representative” - if the document is presented by a representative of the taxpayer. In this case, you must indicate the full name of the representative and the name of the document confirming his authority.

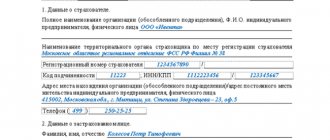

Section 1.1. For SNO “income”

The amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation is income), subject to payment (reduction), according to the taxpayer (Fig. 2)

The values in section 1.1, with the exception of OKTMO codes, are filled in automatically based on the data specified in sections 2.1.1 and 2.1.2.

- In line 010, 030, 060 and 090 you need to indicate codes in accordance with the OKTMO directory. You can find out your OKTMO code on the Federal Tax Service website “Find out OK.

- The field “OKTMO code” is required to be filled out only on line 010, and on lines 030,060 and 090 it is filled in only if the individual entrepreneur has changed his place of residence. If the Individual Entrepreneur has not changed the place of registration with the tax authority, then lines 030, 060, 090 are not required to be filled out.

- Lines 020, 040, 070, 100 are calculated automatically. Lines 050, 080, 110 will also be filled in automatically if the values in lines 040, 070 and 100 are negative.

Section 1.2. For SNO “income minus expenses”

The amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (the object of taxation is income reduced by the amount of expenses), and the minimum tax subject to payment (reduction), according to the taxpayer (Fig. 3)

The values in section 1.2, with the exception of OKTMO codes, are filled in automatically based on the data specified in sections 2.2.

- In fields 010, 030, 060 and 090 you need to indicate codes in accordance with the OKTMO directory. You can find out your OKTMO code on the Federal Tax Service website “Find out OK.

- In the “OKTMO Code” field, only line 010 is required to be filled in, and lines 030,060 and 090 are filled in only if the individual entrepreneur has changed his place of residence. If there has been no change in the place of registration with the tax authority, then these lines are not filled in.

Section 2.1.1. For “income” other than those paying a trade tax in addition to tax

Calculation of tax paid in connection with the application of the simplified taxation system (Fig. 4)

- In the “Taxpayer Identification” field, indicate:

— code “1” — if you make payments and other rewards to individuals,

— code “2” — if you do not make payments to individuals

- In lines 110 -113, indicate the amounts of income received by the taxpayer for the first quarter, 6 months, 9 months and the year. Amounts must be indicated on an accrual basis.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 110, 111, 112, is repeated on line 113.

- For lines 120-123, the default rate is 6%. if the rate is not 6%, select the current rate in line 123.

- In lines 120-123, indicate the rates in effect in the reporting periods, if the rate changed during the year.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 120, 121, 122, is repeated on line 123.

- Lines 130-133 are calculated automatically.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 130, 131, 132, is repeated on line 133.

- Lines 140 - 143 indicate, on an accrual basis, the amount of insurance premiums paid to employees for temporary disability benefits and payments (contributions) under voluntary personal insurance contracts, which reduces the amount of tax (advance tax payments) calculated for the tax (reporting period). Individual entrepreneurs in lines 140–143 reflect contributions for themselves.

Important! A taxpayer (organization, individual entrepreneur) who has indicated taxpayer attribute “1” on line 102 can reduce the amount of tax (advance tax payments) by the amount of insurance premiums, payments and benefits by no more than 50%

Important! An individual entrepreneur who has indicated taxpayer attribute “2” on line 102 can reduce the amount of tax (advance tax payments) by the amount of insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund paid in a fixed amount. In this case, the amount of insurance premiums paid in the tax (reporting) period and related to this tax period, reflected on lines 140 - 143, should not exceed the amount of calculated tax (advance tax payments), indicated, respectively, on lines 130 - 133 .

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 140, 141, 142, is repeated on line 143.

Section 2.1.2. for SNO “income” paying a trade fee

Calculation of the amount of trade tax that reduces the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation - income), calculated based on the results of the tax (reporting) period for the object of taxation from the type of business activity in respect of which In accordance with Chapter 33 of the Tax Code of the Russian Federation, a trade fee has been established (Fig. 5)

- In lines 110-143, enter the values that were specified in lines 110-143 of section 2.1.1

- Indicators on lines 110 -143 need to be reflected only by the type of business activity for which a trade fee is established and are included in the values of indicators on lines 110 - 143 of section 2.1.1.

- If you carry out only the type of business activity in respect of which a trade fee is established, the values on lines 110 - 143 are repeated in lines 110 - 143 of section 2.1.1.

- In lines 150 - 153, indicate the amounts of the trade fee that were actually paid based on the results of the first quarter, half a year, nine months and the tax period. The data is indicated on an accrual basis.

- Lines 160 - 163 will be calculated automatically.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 160, 161, 162 is repeated on line 163.

Section 2.2. for SNO “income minus expenses”

Calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax (object of taxation - income reduced by the amount of expenses) (Fig. 6)

- In lines 210 - 213, indicate the amounts of income received on an accrual basis for the first quarter, 6 months, 9 months and the year.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 210, 211, 212, is repeated on line 213.

- In lines 220 - 223, indicate the cumulative amounts of expenses for the first quarter, 6 months, 9 months and the year.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 220, 221, 222, is repeated on line 223.

- In line 230, indicate the amount of loss from the previous tax period(s), it will reduce the tax base for the tax period.

- Lines 240-243 are calculated automatically

Important! If the declaration is submitted in the event of termination of business activity or in the event of loss of the right to the simplified tax system, then the value of the indicator on line 243 will be equal to the value of the indicator for the last reporting period (lines 240, 241, 242), reduced by the amount of the loss received in the previous (previous) tax period (tax) period(s) (line 230).

Important! If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the value in line 243 will be equal to the value for the last reporting period (lines 240, 241, 242), reduced by the amount of the loss received in the previous (previous) tax period ( tax) period(s) (line 230).

- If the amount of loss from previous periods by which the tax base is reduced is equal to the amount of the tax base calculated for the tax period, then the value of the indicator on line 243 is zero.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 250, 251, 252, is repeated on line 253.

- For lines 260 - 263, the default rate is 15%. If the rate is not 15%, then indicate the current rate in line 263. If the rate changed during the year, then the rates in effect in the reporting periods are also marked in the corresponding field in lines 260 - 263.

- If you submit a declaration due to termination of activity or loss of the right to the simplified tax system, then the indicator for the last reporting period, lines 260, 261, 262, is repeated on line 263.

- Lines 270-273 are calculated automatically

Section 3. To be completed by recipients of targeted funds

Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing (Fig. 7)

Important! Do not include in the section funds that were received as grants to autonomous institutions.

Please include the following information in this section:

- Code of the type of receipts, which is selected from the directory of charitable receipts codes (column 1);

- Date of receipt of funds (column 2);

- Period of use (column 3);

- The cost of property, work, services or the amount of money (column 4);

- The amount of funds used for their intended purpose (column 5);

- The amount of funds whose use period has not expired (column 6);

- The amount of funds used for other purposes or not used within the prescribed period (column 7).

This section is filled out separately for each type of income.

First of all, indicate the transition balances from the last tax period for funds that were received but not yet used, with an unexpired use period, and also for which there is no use period:

- The date of receipt of funds into the accounts or cash register of the individual entrepreneur, or the date of receipt by the entrepreneur of property (work, services) that has a useful life - in column 2;

- The amount of funds whose use period has not expired in the previous tax period, as well as unused funds that do not have a use period, reflected in column 6 of the report for the previous tax period, is in column 3.

The report then provides data on funds received in the tax period for which the report is being prepared.

The “Report Total” field will automatically reflect the amount of data in columns 4, 5, 6, 7.

Code by location (accounting) in questions and answers

Despite the simplicity of the code itself and the operations for filling it out, taxpayers often have questions. Let's look at the most common of them.

Where is the code field? On the title page of the form, usually under the “tax period” field, in a line below.

What does the code mean and why is it called that? The code corresponds in meaning to the municipal territorial entity from the OKTMO classifier.

Is it possible to put dashes or zeros instead of the code if there are doubts about the correctness of the encoding? No you can not. Such a calculation or declaration will not be accepted by the Federal Tax Service. The taxpayer will be subject to sanctions. If in doubt, contact the Federal Tax Service and clarify the code. According to tax legislation, the service is obliged to advise the taxpayer on all relevant issues that arise.

What code does a separate division of an organization put in the RSV? The general rule establishes the need to submit DAM at the location of the organization (or place of residence of the entrepreneur), with the corresponding code - 214 or 120. However, if a separate division independently makes payments to employees and charges contributions on these amounts, then the calculation is submitted at the location of this division, with code 222. In the calculation, do not forget to indicate the checkpoint of the separate unit.

Attention! Reporting on contributions at the location of the largest taxpayer to the Federal Tax Service has not been submitted since 2022 (see letter of the tax service No. BS-4-11/993 dated 01/23/17). The corresponding code also does not apply.

What happens if you enter the wrong code in the declaration? You will have to submit an updated declaration, since the Federal Tax Service will record an error. Sometimes the local Federal Tax Service requires an explanatory letter from the taxpayer indicating the correct code at the location (accounting).

The organization on UTII is registered in one of the cities of the Russian Federation, where its head office is located. However, it operates in another Russian city. Which code should be used when drawing up a declaration: 214 or 310? Since the activity is carried out in another city, code 310 should be used, not 214. The organization also submits reports at the place of its activity.

Main

- Code at the location (accounting) is a mandatory requisite for all tax reporting.

- It helps to accurately identify the payer of taxes and fees based on the Federal Tax Service.

- The main codes used when filling out forms are 214 and 120 for firms and entrepreneurs, respectively.

- The codes are approved by orders of the Federal Tax Service, simultaneously with the approval of the corresponding declaration or calculation.

- Incorrect application of the code or ignoring it is fraught with problems when submitting tax reports.

How to find out the code in the information system?

You can find out the FIAS code of the registration address yourself on the website fias.nalog.ru. Information can be found both on the Internet and by installing the database on your PC. You can download the full database in the “Updates” section. Files in DBF and XML formats are available for download.

Tip: To ensure that the data is always up to date, it is necessary to update the system at least once a week.

To search on the site, you need to go to the page and enter the required address in the search bar.