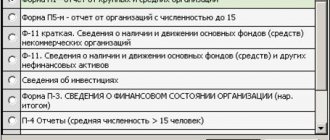

About legal entities

What is income? The term “income” denotes not only cash, but also material assets,

An employer can help employees by reimbursing their expenses for paying interest on loans and credits

It would seem that soap and various disinfectants are a trifle in comparison with others

Checking the 1C database for errors with a 50% discount. We will provide a written report on errors. Analyzing

An employee does not always have to notify the employer of his intention to leave work 2 weeks in advance.

What is the essence of the document? The new Regulatory Directive establishes additional requirements for the procedures for providing

Tax deduction for children Parents have the right to take advantage of deductions for children. At the same time, NK

Documents to confirm the zero VAT rate To confirm the zero VAT rate when exporting goods

Who is required to report on insurance premiums and how? Calculation of insurance premiums is transmitted

KND form 1110021 is a standard unified form of document that is submitted to the territorial tax service