About legal entities

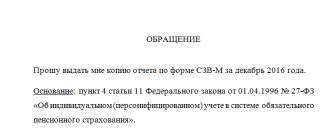

As it was before Until 2022, all insurers were required to issue all their employees

The economic activities of organizations are based on the use of property owned by it, which is reflected in accounting. From 1.01.19

Adjustment of 6-NDFL may be necessary if the tax agent makes errors in the Calculation. Responsibility for defects

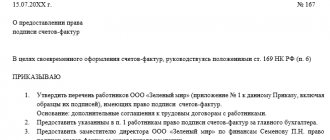

Who signs the invoice The seller must decide who signs the invoices in a timely manner. If

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

An applicant interested in getting a new job must not only be able to write a resume correctly. Better

On what form and in what form is the declaration for 2022 - 2022 submitted?

How are the terms of an on-site inspection calculated? Why might a check be suspended? Is it possible to cancel

In this article we will figure out whether an online cash register is needed for various individual entrepreneurs on a valid patent.

Why does a director need to understand financial statements? The director is responsible for everything that happens in his