On what form and in what form is the declaration for 2022 - 2022 submitted?

For organizations in the general regime, the question is always relevant: how to fill out an income tax return for the year.

After all, it will need to be submitted at the end of March next year, and the filling out process is quite lengthy. First, let’s find out what the reporting form is and whether it has changed since last year.

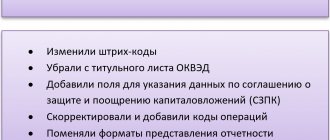

The Federal Tax Service has once again modified the form (as amended by order No. ED-7-3/ [email protected] ). Therefore, at the end of 2022, the income tax return is prepared using a new form. Download the new form for free from the link below:

In order to correctly fill out the income tax return for 2022, please refer to the sample from ConsultantPlus experts. This can be done for free by getting trial online access to the system.

The type of presentation of profit reporting depends on the number of personnel and the scale of activity. If the average number of employees for the previous year in an organization exceeds 100 people (for newly created ones, the total number of employees is taken) or the organization belongs to the category of the largest taxpayers, then the obligation arises to submit an electronic report on the TKS. All others have the right to draw up and submit a declaration on paper.

What are indirect costs

According to tax legislation, all expenses of an enterprise are divided into indirect and direct. If the direct costs of an enterprise are, first of all, production costs, and they arise on the basis of manufactured products or the performance of any work, then indirect costs are a set of costs that are directly related to production.

Indirect ones include:

- General production expenses. These are the costs of organization, maintenance and production management. For example, a certain amount was allocated for the repair of a machine, which was reflected in indirect costs.

- General running costs. These costs directly affect the production process.

Indirect expenses are written off exactly in the period in which they were accrued. Direct payments are distributed over all reporting periods.

What order of distribution of expenses will be carried out at the enterprise directly depends on the type of activity of the organization.

What are indirect costs? The Tax Code in Article 318 says:

“All expenses of an enterprise that are not classified as direct and non-operating expenses are classified as indirect.” The enterprise independently determines what it classifies as indirect or direct expenses.

Direct costs:

- Wage.

- Rent.

- Production costs.

That is, direct expenses are those that are constant, while indirect expenses can change depending on unplanned expenses.

Let's look at an example of what applies to indirect costs.

The organization is engaged in baking cakes. Having produced a certain amount of products, she sent them to a retail outlet for sale. Based on the contract, products must be returned after the expiration date. Some of the products were returned to the confectionery and went for processing.

The Tax Code classifies these expenses as direct. But there are exceptions when expenses for processing products can be written off in a certain reporting period. Certain types of expenses are also prescribed by law:

- Company insurance (Article 272, paragraph 2).

- Advertising and all related expenses (Article 264, paragraph 4).

- Entertainment expenses (Article 264, paragraph 2).

Any action of the enterprise must be recorded in the income tax return.

What is the general procedure for filling out an income tax return?

To correctly fill out the income tax return, you should refer to the Procedure from Appendix 2 to Order No. ММВ-7-3 / [email protected] (hereinafter referred to as the Procedure for filling out). It spells out all the basic rules that should be followed:

- To prepare a paper report, blue, violet or black ink is used.

- You cannot correct errors with a barcode corrector.

- The declaration is printed on only one side of the sheet; it is prohibited to staple the pages.

- Data in the report is entered on an accrual basis from the beginning of the year.

- The pages are numbered in order.

- Cost indicators in the report are rounded according to mathematical rules to full rubles.

- A certain indicator has its own field, consisting of a specific number of familiar places.

- The fields are filled in from left to right. Empty fields are crossed out.

You are allowed to fill out the declaration manually, but few people choose this method anymore. You can also fill out the form on your computer using software. Or you can use specialized accounting programs, where report lines are filled out automatically based on the data entered during the reporting period.

If you have access to ConsultantPlus, check whether you have filled out your income tax return correctly. If you don't have access, get a free trial of online legal access.

Blog

Payers of income tax are organizations subject to the general taxation system. The deadlines for payment and reporting are set forth in Articles 285 and 286 of the Tax Code of the Russian Federation. There are three ways to pay tax and submit reports :

- Monthly based on actual profit

- Quarterly with monthly advance payments (primary)

- Quarterly based on actual profit (preferential: can be used by commercial organizations with revenue for the previous 4 quarters on average not exceeding 15 million rubles).

After you have generated an income tax return in the program, you need to check it with SALT, so to speak, manually calculate the amount of tax, check the program.

We will consider the option of operating a regular organization without applying PBU 18/02.

First, we check Appendix 1 and 2 of sheet 02 of the declaration .

Appendix 1 – Income of the organization.

As a rule, line 010 - this is the organization’s revenue from its main activities without VAT. In SALT we take the turnover on Credit 90.01 and subtract the turnover on debit 90.03

Line 011 is the proceeds from the sale of purchased goods without VAT; here you need to track the amounts passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt 90.02 Kt 41). You can generate an analysis of account 41 and look at the correspondence from 90.02.

Line 012 is the proceeds from the sale of finished products without VAT, here it is necessary to track the amounts passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt90.02 Kt 43). You can generate an analysis of account 43 and look at the correspondence from 90.02.

Line 040 = sum of lines 020.......030

Non-operating income, line 100 – we check the turnover on the credit of account 91.01 (excluding VAT)

I remind you that when calculating income tax, use in your calculations only the income and expenses accepted in tax accounting (Chapter 25 of the Tax Code of the Russian Federation).

Appendix 2 – Organizational expenses

Related course

Advanced accountant

Find out more

Line 010 – debit turnover 90.02 in correspondence with account 20

Line 020 – turnover on debit 90.02 in correspondence with 41.43 accounts

Line 040 – debit turnover 90.07 + 90.08

Line 130 is the sum of the above lines. (these are expenses for account 90 without VAT and turnover for account 90.09)

Line 200 – non-operating expenses accepted as expenses for tax accounting purposes

See SALT for account 91.02

Sheet 02

We take income according to Kt 90.01 (without VAT) - turnover according to Dt 90.02 - turnover according to Dt 90.07 - turnover according to Dt 90.08 + Turnover according to Dt 91.01 (without VAT) - turnover according to Dt 91.02 (accepted expenses) = line 060 of sheet 02

Then calculate the tax amount in accordance with the established rate in your region. When calculating the amount of tax payable, take into account previously paid advance payments (turnover according to Dt 68.04)

If you have any questions about filling out your income tax return, call us, we will help you with a consultation (we’ll come in remotely). Tel. +7(391) 287-7-287 / “Accounting encyclopedia “Profirosta” 07/25/2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

How to design each section and applications

The voluminous income tax reporting consists of 9 sheets, various appendices to these sheets and two appendices directly to the declaration itself. However, you do not have to fill out all the forms and submit them. If a legal entity does not have data to include in any part, then it is not included in the annual report.

The following must be filled in:

- Section 1.

- Sheet 02, even if all the organization’s indicators are zero. This is possible if there is no activity during the year.

- Title page.

We will consider below what data is entered on each sheet of the declaration.

Title page

The title page provides basic information about the organization itself: INN and KPP, which are then repeated on each page of the report; name of the organization or separate division; telephone number where you can contact the taxpayer's representative. If reorganization occurred during the reporting period, information about it is also provided.

The title page also contains information on the declaration:

- correction number (submission of the original form is indicated by the symbol “0”);

- tax or reporting period code;

- year;

- code of the tax authority accepting the report;

- code for submitting the declaration at the place of registration;

- the number of pages of the report itself and copies of documents attached to it if necessary.

In addition, the date of completion or submission of the declaration and the seal of the business entity (if any) are indicated on the title page, and the full name is indicated. manager or other authorized person, after which all information provided is certified by his signature.

Section 1

The section contains three subsections:

- 1 - all taxpayers must take it;

- 2 - rented only if the business entity pays monthly advances on profit;

- 3 - included in the annual report if the taxpayer acted as a tax agent for the specified tax.

All these subsections are completed last, based on the data presented in the declaration.

Subsections are characterized, with some variations, by the presence of fields for reflection:

- OKTMO;

- BCC for each payment;

- amounts of tax liabilities.

Each of the transferred subsections must be certified by the signature of the person who signed the title. They must also be marked with the date of completion/submission of the report.

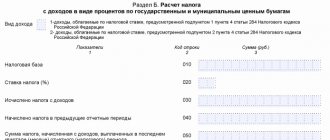

Sheet 02

This section is for tax calculation. It begins with the identification of the taxpayer; codes with explanations are presented here.

If the organization does not belong to a specific category from those proposed, then you need to enter code 01.

Lines 010–020, 030–040 and 050 reflect income, expenses and losses that fall into the specified lines from the corresponding appendices to sheet 02.

Line 060 displays the financial result - profit or loss, which is then adjusted to the indicators from lines 070 “Income excluded from profit” and 080 “Profit of the Bank of Russia...” and falls into line 100 as the tax base.

If the taxpayer suffered losses in previous periods, he fills out line 110. His tax base from line 100 will be reduced by the figure on line 110, and the final base value will fall on line 120.

Lines 140–170 reflect tax rates, while line 171 clarifies the regional legislative act allowing the use of a reduced rate (if any).

Lines 180–200 display the calculated tax amounts by budget level.

Lines 210–230 show accrued advances also broken down by budget.

Lines 240–260 include the portion of income tax paid abroad.

Lines 265, 266, 267 were introduced to reflect the trade fee, the amount of which can be reduced tax.

New lines 268, 269 also appeared to indicate investment deductions.

The amount of tax to be paid additionally or reduced is entered by budget level in lines 270–271 and 280–281, respectively.

Lines 290 to 340 in the final declaration must be left blank. They are intended to reflect advances:

- for the next quarter (290–310);

- for the first quarter of next year (320-340).

Lines 350 and 351 are filled in by participants in regional investment projects that calculate taxes at tax rates that differ from standard ones.

Appendix 1 to sheet 02

The appendix presents indicators characterizing the amount of income received by the taxpayer:

- from implementation;

- non-sales.

Both indicators are given in total and broken down by type of income.

The first indicator is deciphered as follows:

The second indicator is divided into the following types:

Line 040 is the total for income from sales, which is then transferred to field 010 of sheet 02.

For non-operating income, the summary line is line 100, the figure from which will go to line 020 of sheet 02.

Lines 200 (with a breakdown of lines 201, 202, 203), 210, 220 are filled in only by participants of investment partnerships.

Appendix 2 to sheet 02

Here is a detailed breakdown of the expenses incurred during the period:

- related to production and sales;

- non-sales.

The first category is broken down into direct and indirect costs.

To indicate direct expenses, lines 010–030 are intended, which are never filled in by business entities using the cash method:

To reflect indirect expenses, lines 040 (summarizing) and 041–055 (detailing) are needed.

Following them are lines in which data is entered when performing transactions related to the sale of property. Moreover, one that does not apply either to manufactured products or to goods purchased specifically for resale:

Income from the sale of such property should be reflected in line 014 of Appendix 1 to Sheet 02.

The next two pairs of lines will be needed exclusively by securities market participants:

Line 080 is filled in if the taxpayer fills out Appendix 3 to Sheet 02, otherwise it will remain empty. The value from line 350 of Appendix 3 to sheet 02 is transferred to this line.

The values in lines 090, 100, 110 determine the organization’s losses:

Line 120 shows the amount of the premium paid by the buyer of the enterprise as a property complex.

Depreciation data is entered in lines 131–135:

The full amount of all non-operating expenses falls into line 200, which is then deciphered along lines 201 to 206.

The indicator from line 300 is losses equated to non-operating expenses, including those identified in the current period for previous (line 301) and bad debts (302).

When correcting errors from previous periods that did not result in an understatement of the tax base, lines 400–403 are filled in.

Appendix 3 to sheet 02

The application is a calculation of financial results taken into account in a special manner in accordance with the provisions of Art. 264.1, 268, 275.1, 276, 279, 323 Tax Code of the Russian Federation.

These are indicators for the following types of economic activities:

- sale of assets for which depreciation was charged - lines 010–060;

- exercise of the right to claim a debt before the due date of payment - lines 100–150;

- activities carried out by service departments - lines 180–201;

- trust management - lines 210–230;

- realization of the right to plots of land - lines 240–260.

The summary lines are:

- 340 — total revenue,

- 350 — total expenses,

- 360 - losses for the operations specified in the application.

Appendix 4 to sheet 02

The annual declaration and the report for the first quarter must be supplemented with this appendix if the enterprise has the right to carry forward old losses to the current year. The transfer is carried out over the next 10 years after the year of receipt (clauses 1, 2 of Article 283 of the Tax Code of the Russian Federation).

The untransferred balance in the total amount at the beginning of the tax period is shown on line 010. In lines 040 to 130, the resulting losses are detailed for each specific year.

The following are written line by line:

- in line 140 - the income tax base from line 100 of sheet 02;

- in line 150 - the value of the loss, which goes towards reducing the current tax base and is then transferred to line 110 of sheet 02;

- in line 160 - the balance of the uncarried loss at the end of the tax period.

Fields 135, 151 and 161 are needed for reference to show losses received from securities transactions that arose before 2015 and have not been taken into account to date.

Appendix 5 to sheet 02

The presence of separate divisions obliges the organization to properly draw up Appendix 5 to Sheet 02. Information about the amount of tax liabilities attributable to each division is disclosed here. The number of attachments included in the declaration will correspond to the number of separate entities or their groups.

At the very beginning of the application, you must enter the taxpayer code.

Below is another code for making calculations.

The following are fields intended for entering information on the division: its name, the value of the checkpoint, whether it has an obligation to pay tax.

Then there are lines reflecting the tax base (030), its share for a specific division (040) and the regional tax rate (060), on the basis of which the tax and advance payments are calculated, taking into account the tax paid abroad (090), trade tax ( 095, 096, 097) and investment deduction (098).

Appendices 6, 6a, 6b to sheet 02

Appendix 6, including 6a and 6b, is intended for registration by a consolidated group of taxpayers (CGT).

The number of applications 6 must coincide with the number of constituent entities of the Russian Federation in whose territory the participants of the group of groups and their units are located.

The procedure for completing Appendix 6 occurs in the following steps:

- First, data is provided for one of the participants at the location of the separate division (responsible separate division), through which the payment of tax to the budget of the constituent entity of the Russian Federation is taken into account (TIN, KPP, OKTMO, name).

- Then, based on the total tax base (030) and the share per participant (040), the total tax amount (070) and the amount accrued to the regional budget (080) are calculated.

- Taking into account the amount of tax paid abroad (090), the amounts of trade tax (095, 096, 097) and the amount of investment deduction (098), it determines the amount of tax to be paid (100) or to be reduced (110) and the amounts of monthly advance payments are displayed (120 and 121).

Appendix 6a provides information on the amount of tax calculated, subject to payment or reduction, advance payments for each participant based on data on his share.

Appendix 6b reflects information on the income and expenses of the group members who have formed the consolidated tax base for the group as a whole.

Appendix 7

The application consists of sections A, B, C, D and represents a layout for calculating the investment tax deduction.

Sheet 03

Companies paying income in the form of dividends or interest on state and municipal securities and acting as tax agents must draw up sheet 03, consisting of three sections:

- section A - for tax calculation, where income is dividends;

- section B - if the income paid is interest on securities;

- section B - register of income recipients indicating the amounts.

The sheet is compiled for those periods when income was paid by the agent. If no payments are made, it is not included in the declaration. That is, there will be no cumulative total here, which is typical for other parts of the declaration.

Sheet 04

If a business entity has an obligation to calculate income tax at rates other than the traditional 20%, it should include this sheet in the declaration. For the most part, these rates relate to taxes on income from securities interest and dividends. Each sheet is filled out for a specific type of income and the interest rate related to it:

From the proposed codes from 1 to 9, the desired one is selected and entered in the “Type of income” field.

Then for each type you should reflect:

- taxable base - line 010;

- income that reduces the tax base - line 020;

- interest rate, which can take the value 15, 13, 9 or 0% - line 030;

- the amount of the calculated tax liability - line 040;

- the amount of tax on foreign dividends paid and included in the payment of tax in accordance with Art. 275, 311 of the Tax Code of the Russian Federation in previous periods and in the current reporting period;

- the amount of tax accrued in previous reporting periods - line 070;

- the amount of tax calculated from income received in the last quarter (month) of the reporting (tax) period - line 080.

Sheet 05

The sheet contains a calculation of the tax base for transactions, the financial results of which are taken into account in a special manner. The types of transactions to be reflected in this sheet are as follows:

Accordingly, in this field you need to enter the code of the required operation.

The sheet shows the amounts:

- for income - line 010 with decoding in lines 011–014;

- for expenses - line 020, also with a breakdown on lines 021–024;

- profit - line 040;

- adjusting the profit received - line 050;

- the result of the adjustment made - line 060;

- loss or part thereof, if it is possible to reduce the tax base for it - line 080;

- the final result, which represents the tax base for the reflected transactions - line 100.

From the last line the number falls into the line under the same number on sheet 02.

Sheet 06

The sheet is intended for a narrow circle of taxpayers - non-state pension funds. In it, based on the presented income, expenses, placed pension reserves, deductions from income from the placement of reserves and other indicators, the base for calculating the tax is derived.

Sheet 07

This is a report on the intended use of property (including funds), work, and services. Its indicators are formed based on information about the receipts and expenditures of funds within the framework of charitable activities or targeted financing.

This information includes:

Receipt codes are selected from Appendix 3 to the Filling Out Procedure.

Sheet 08

This part is completed for transactions between related parties in respect of which adjustments were made in accordance with the norms of Section V.1 of the Tax Code of the Russian Federation. Here are indicators that adjust the amount of all types of income and expenses of the taxpayer company.

Sheet 09 and Appendix 1 to Sheet 09

Sheet 09 itself represents the calculation of tax on income in the form of profit of a controlled foreign company. It consists of several sections:

In the appendix to sheet 9, the loss is calculated by which it is possible to reduce the base for the presented type of income.

Appendix No. 1 to the declaration

The appendix provides income that is not taken into account when determining the base, and expenses taken into account for tax purposes by certain categories of taxpayers. In columns 1 and 3, respectively, the codes of income and expenses are entered (the required codes are selected from Appendix 4 to the Filling Out Procedure), and in columns 2 and 4 - their amounts.

All income and expenses are not of a massive nature. However, if an economic entity decides to charge depreciation on fixed assets using special coefficients in accordance with Art. 259.3 of the Tax Code of the Russian Federation, then he will have to fill out and submit this application for similar expenses that correspond to codes 669-680.

Appendix No. 2 to the declaration

The application reflects income and expenses, as well as the calculated tax base and the amount of tax when implementing agreements on the protection and promotion of investment. The application includes two sections:

- section A - income, expenses and tax as a whole under the agreement;

- Section B - tax base and tax amount for separate divisions.

ConsultantPlus experts spoke about the nuances of filling out a profit-making return for a consolidated group of taxpayers. Get trial access to the system and upgrade to the Ready Solution for free.

Features of filling out line 010 of application 2

The second appendix to sheet No. 02 is intended to summarize all types of expenses that were incurred in the course of the business activities of the enterprise. That is, all types of costs (direct and indirect) are accumulated here, by which the total income of the enterprise is then reduced.

Line 010 “Direct expenses” is one of the main cost items of the declaration, since it determines the amount of income tax that will be paid in the future by this enterprise. Line 010 displays direct costs that occur during the production and sale of products.

Direct costs include:

- purchase of materials that are used in the production of finished products and goods;

- salaries of company employees who take part in the production and sale of these products;

- contributions to insurance funds for the salaries of employees of the main production;

- depreciation of production equipment and others.

When filling out line 010, you need to understand that each amount of costs must have documentary evidence and justification for their implementation.

Filling out line 010 of Appendix 2 to sheet 02 of the declaration is possible if three conditions are met:

- Cost accounting is carried out only on the accrual basis;

- No work in progress (monthly account closure 20);

- At the end of the month there are no remaining unsold finished products.

If one of these conditions is not met, it is impossible to carry out separate tax accounting of this indicator.

In order to fill out line 010 of Appendix 2 to sheet 02 of the declaration, it is necessary to generate a report Analysis of account 20. The amount of the debit turnover of this account with the credit of accounts 02, 10, 69.1, 69.2, 69.3 will be an indicator of the direct expenses of the enterprise.

Sheet 02 is one of the most important declaration documents, since it is its indicators that affect the size of the enterprise’s tax base. During a tax audit of a declaration, tax officials often study not only the amount of profit received, but also the amount of costs incurred. It is necessary to approach the filling out of this application with special responsibility, so that in the future you do not have to submit an adjustment calculation or an explanatory note to Appendix No. 2 of sheet 02.

Results

Preparing to submit income tax reports is not an easy task.

Considering that the form for 2022 has been updated, you will have to work hard to accurately enter all the data into it. We talked about filling out all sections of the report: in detail about those that are prepared by almost all business entities, in less detail about those that will be needed by a narrow circle, and also gave an example of filling out an income tax return for 2022. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.