The economic activities of organizations are based on the use of property owned by it, which is reflected in accounting. From January 1, 2019, the movable property of an organization, according to amendments to the Tax Code of the Russian Federation (Article 374-1), is not subject to property tax, and since accounting data is the basis for calculating NU indicators, the criteria defining movable and immovable property acquire special significance. Postings for property accounting, forming the main balance sheet indicators, are also one of the most important in accounting.

How can an organization distinguish movable property from immovable property ?

Movable and immovable property

Back in 2013, the Ministry of Finance, in letter No. 03-05-05-01/5322 dated February 25, 2013, proposed to be guided by the Civil Code of the Russian Federation when classifying property as movable (immovable).

Is a fence a piece of real estate, or is it considered movable property ?

Art. 130 defines the following property as immovable:

- land plots and subsoil;

- buildings (structures), including unfinished construction;

- residential and non-residential premises;

- garages, parking lots, parking spaces, the boundaries of which are determined in cadastral registration.

Question: Can legal entities enter into an agreement between themselves for the free use of movable or immovable property? View answer

Property is recognized as immovable because its movement without damage to subsequent use is impossible. The objects mentioned above most often become the subject of accounting for organizations and firms.

By the way! Immovable objects include vessels: sea and air vessels and space objects.

Federal Law No. 218 of 07/13/15 prescribes state registration of such objects in the Unified State Register (USRN).

Question: How does an object (equipment) qualify as movable or immovable property for the purposes of corporate property tax? View answer

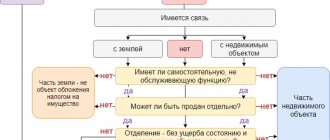

The Federal Tax Service defines property as immovable if it is registered in the Unified State Register of Real Estate, or according to documents for the object, from which it is clear that it is firmly connected to the land and cannot be moved without destruction. The rest of the property of the Civil Code is defined as movable. Such property does not need to be registered in the register.

Obviously, in accounting, many objects of movable and immovable property, due to the difference in the criteria of civil and accounting legislation, will end up on the same accounts. The management of the company will have to think about how to separate property that is subject to taxation from others in accounting, and how to build an accounting policy in this area.

3.2. Property rights

In civil legislation, property rights are understood as the rights of participants in civil legal relations related to their exercise of powers to own, use and dispose of property, as well as property claims that arise between participants in civil transactions regarding the determination of the fate of property and related rights. Property rights include:

real rights . The object of real rights is an individually defined thing, i.e. a thing that has special properties inherent only to it. In accordance with paragraph 1 of Art. 216 of the Civil Code of the Russian Federation, real rights along with the right of ownership, in particular, are: the right of lifelong inheritable ownership of a land plot (Article 265 of the Civil Code); the right to permanent (indefinite) use of a land plot (Article 268 of the Civil Code); easements (Articles 274, 277 of the Civil Code); the right of economic management of property (Article 294 of the Civil Code) and the right of operational management of property (Article 296 of the Civil Code);

rights of obligation (rights of claim). Rights of obligation allow the creditor to demand that the debtor perform a certain action or refrain from performing it. Such rights are also called claim rights. As a rule, rights of obligations arise from contracts and other transactions, but they can also arise between persons not related to each other by any contracts or agreements (clause 2 of Article 307 of the Civil Code of the Russian Federation). Thus, a person bears tort liability for causing harm (Article 1064 of the Civil Code of the Russian Federation), and unjust enrichment is subject to return according to the rules of Art. Art. 1102 – 1109 Civil Code of the Russian Federation;

exclusive rights . Exclusive are the rights to intellectual property, that is, to the results of intellectual activity or equivalent means of individualization of legal entities (their goods, works, services, etc.). Exclusive rights are similar to real rights, however, unlike the latter, they arise on intangible objects (works, inventions, trademarks, etc.). Clause 4 art. 129 of the Civil Code of the Russian Federation provides that it is not the results of intellectual activity and means of individualization themselves that can be alienated and otherwise transferred from one person to another, but 1) the rights to such results and means (intellectual property) and, 2) material media in which the corresponding results and means;

corporate rights are subjective rights of a special nature, different from real and obligatory rights, representing a set of non-property (organizational-managerial) and property rights of a participant arising from participation in a corporate organization. The list of corporate rights is contained in Art. 65.2 of the Civil Code of the Russian Federation in relation to all types of corporations and is specified in relation to business partnerships and companies in Art. 67 Civil Code of the Russian Federation. Property corporate rights are the following rights (clause 1 of Article 67 of the Civil Code of the Russian Federation): 1) rights to participate in the distribution of company profits; 2) rights associated with receiving part of the company’s property in the event of its liquidation.

Property rights, as follows from Art. 128 of the Civil Code of the Russian Federation, include non-cash funds, uncertificated securities, digital rights.

non-cash funds - funds available in bank accounts. Cash is traditionally defined as the property rights of the account owner in relation to the bank, which arise from the bank account agreement. That is, non-cash funds are by their nature rights of claim. Accordingly, they cannot be an object of property rights like money in materialized form (banknotes and coins);

uncertificated securities . In accordance with paragraph 1 of Art. 142 of the Civil Code of the Russian Federation, book-entry securities are recognized as obligatory and other rights that are enshrined in the decision on the issue or other act of the person who issued the securities in accordance with the requirements of the law, and the exercise and transfer of which are possible only in compliance with the rules for accounting for these rights in accordance with Art. 149 of the Civil Code of the Russian Federation. Book-entry securities do not have a material form, therefore, even conditionally, they cannot be considered as things and, therefore, cannot be the object of ownership and other property rights. Book-entry securities are, as a rule, issue-grade securities. Accordingly, they are subject to the Securities Market Law;

Digital rights are obligations and other rights, the content and conditions for the implementation of which are determined according to the rules of the information system that meets the criteria established by law. Exercise, disposal, including transfer, pledge, encumbrance of digital rights in other ways or restriction of disposal of digital rights are possible only in the information system without recourse to a third party (Article 141.1 of the Civil Code of the Russian Federation).

For more information about each type of property rights, see the article “Property rights in civil law. Concept and types"

Accounting for movable property

IMPORTANT! The lease agreement for movable and immovable property from ConsultantPlus is available here

From the above, it is clear that movable property, as civil law understands it, will be reflected in different accounts in accounting.

Account 01 and those corresponding to it may reflect the following movable property related to fixed assets:

- machines, equipment;

- office fixtures;

- transport;

- inventory;

- working and productive livestock;

- other types of OS.

The criteria for accounting for such movable property are defined by PBU-6:

- period of use over 12 months;

- subsequent resale is not initially planned;

- in the future the object will bring income to the company;

- its cost is from 40 thousand rubles.

BU wiring:

- Dt 08 Kt 60 (76, 10, 70) – an object of movable property (for example, a car) was acquired and the acquisition costs are reflected.

- Dt 01 Kt 08 – the initial cost (PV) of the asset is fixed.

The specified movable property is depreciated in accounting (in the following ways: reducing balance, linear, proportional to the volume of production, by the sum of the numbers of years of useful life).

There are only two methods of depreciation in NU: linear and nonlinear. As a rule, in order to bring accounting as close as possible and not make unnecessary entries, the linear method is used in both cases.

Formula for monthly depreciation: Depreciation = PS / useful life. use. Accrual posting: Dt 20 (20, 23, 26, 29, 44 and other “cost” accounts) Kt 02.

Analytical accounting for account 01 should take into account the division of property located on this account into movable and immovable. On account 10, in the context of subaccounts, another type of assets is taken into account, classified by the Civil Code of the Russian Federation as movable property: inventories, materials (raw materials, purchased semi-finished products, components, containers, spare parts, etc.) - all goods and materials that cannot be classified as main in accounting means.

Note that in NU the cost of fixed assets “starts” from 100 thousand rubles, and therefore temporary differences are formed in accounting. To account for the diversity of this group of movable property, subaccounts are widely used. For example, containers are taken into account on account 4, fuel – 3.

BU postings: Dt 10 Kt 60, 76, 20, 23, etc. - receipt of materials, depending on the source of receipt. Sometimes an interim account 15 “Procurement and receipt of inventory items” is used: Dt 10 Kt 15. Dt 08 Kt 10 – used inventory items in construction. Dt 20, 26, 28, 91, 44, 94 Kt 10 - transferred to production, for maintenance, used to correct defects, sold, written off as a shortage of goods and materials.

In addition, the civil code defines movable property as funds accounted for in active accounts 50 and 51 using standard transactions. Receipt: Dt 50, 51 Kt 60, 62, 66, 67, etc. – receipt (receipt) to the cash desk (to the current account) from various sources. 50, 51 are credited for expenses, the debit indicates where the funds went. Money can also be transferred to the current account from the cash register and back, for example: Dt 50 Kt 51.

Securities (Article 130 of the Civil Code, clause 2) are taken into account in the accounting system depending on their type and transactions. Account 58 is used as standard, and other accounting accounts are used less frequently.

VU wiring (example):

- Dt 58 Kt 51 – purchased by the Central Bank of another company.

- Dt 91 Kt 58 – sold to Central Bank.

- Dt 76 Kt 51 – bond paid.

- Dt 76 Kt 91 - income on it is recorded, etc.

Intangible assets (trademarks, software, inventions) are also classified as movable property of the company, despite the fact that they do not have a physical form. The characteristics of intangible assets are otherwise the same as those specified for operating systems; for example, they must be used for more than a year in the organization.

The postings through them, as in the previous case, are varied. Correspondence depends on the method of receipt of intangible assets, the method of its disposal.

VU wiring (example):

- Dt 08 Kt 60, 76, 66, etc. – paid to suppliers of intangible assets, duties, interest on loans, etc., were paid in connection with the acquisition of intangible assets.

- Dt 08 Kt 70, 69, 71, etc. – NMA was created in the organization.

- Dt 04 Kt 08 – registered with intangible assets.

- Dt 20, 26, etc. Kt 05 – depreciation of intangible assets.

- Dt 91 Kt 04 – asset sold, residual value reflected.

- Dt 05 Kt 04 – depreciation of retired intangible assets is written off.

Property of municipalities

Municipal property is a separate form of property that exists in parallel with state property. Municipal property by law belongs to rural, urban settlements or other municipalities and is intended to satisfy the interests of their residents. It is divided into two types: property that is assigned to municipal institutions and enterprises, and property that is not assigned to enterprises and municipal institutions and constitutes the treasury. The list of municipal property includes municipal natural and land resources, municipal organizations, enterprises, banks, extra-budgetary funds, residential premises and housing stock, etc.

Real estate accounting

Real estate is included in the OS. This:

- buildings, structures;

- perennial plantings (shrubs and trees);

- plots;

- environmental management facilities;

- other objects, according to the Civil Code of the Russian Federation (Article 130), which are real estate and require state registration.

The synthetic accounting transactions are similar to those already given for the operating system. Analytical accounting is organized in such a way as to distinguish between movable and immovable assets. Some categories of real estate are not depreciated: land, natural resources. Real estate must be registered with the state (Article 131 of the Civil Code of the Russian Federation, Federal Law No. 218 of 07/13/15).

The state registration procedure and registration of real estate are not related to each other. Before registration is completed, you can reflect the real estate by posting Dt 01 Kt 08, opening a separate sub-account for account 01, for example, “OS with unregistered title”, and then transfer it to another sub-account using internal posting to 01.

Briefly

- Movable and immovable property, named in accordance with the Civil Code of the Russian Federation, is reflected in various accounts in accounting.

- Both types of property can be recorded on the account. 01 BU, in analytical accounting they need to be separated. Land and natural resources related to real estate are not depreciated.

- Other movable property (inventory, shares, money, intangible assets) is accounted for in accounting in accordance with the Chart of Accounts. Accounting accounting accounts are used by type of value.

- The moment of reflection in the accounting of real estate does not depend on the date of its state registration.

The concept of property and objects of its rights

The Civil Code in its Article 209 designates property as an object of property rights. That is, the definition of “property” has an individual character. But by property the Civil Code understands not only objects, but also (property) rights of the same name. And logically, they should also relate to objects of property. Examples include the right to participate in commercial companies or bank deposits. But many lawyers believe that only a thing can be the object of property rights.

Let's first look at some general concepts.

Property of individuals

Let's now talk about such a category as property of individuals. Quite often this concept is used in connection with the insurance procedure, when it is necessary to determine the value of material assets included in the contract. As you know, the subject of property insurance are structures, buildings, individual premises, and their decoration, as well as household items. The agreement, as a rule, is concluded either with the owner of the apartment or with a member of his family - if it affects their common property.

In this regard, it is necessary to clarify the concept itself. According to the law, household property is recognized as a set of objects, things, material assets and furnishings used in everyday life for personal household and consumer needs. Their purpose is to satisfy the everyday and cultural needs of the owner and his family.