Joint reconciliation of settlements with the Social Insurance Fund

Sometimes it becomes necessary to reconcile the information available to the payer and the fund. For this purpose, a special application is drawn up in any form. The Fund will issue a special act in response. FSS employees have the right to invite the payer to conduct a joint reconciliation of payments to the budget. The payer himself may also request it.

Most often, this is done to avoid any troubles with FSS employees, or to find out about the presence of debts or overpayments by the company.

As a rule, this reconciliation is carried out every quarter, after the reports are submitted. But the law does not provide for a time frame, so it can be arranged at any time.

These calculations help organizations eliminate possible problems with the Social Insurance Fund. And when liquidating a company, you can easily deal with existing debt and incorrect tax collection information. This reconciliation will help you get your funds back and avoid fines.

Connection

To activate the service, fill out an application for its connection.

You can find detailed information on how to do this in the “Subscriber Service” and “Tax Representative Service” sections.

Within three business days you will receive confirmation that your application has been accepted. If the information in the application is incorrect or your tariff plan does not provide for connection of the service, a notification will be sent to the system mailbox indicating the reason for its rejection.

After processing the application, a connection notification will be sent to your mailbox.

You can view all notifications:

- in “Referent” - on the “News” tab in the “Distribution” section;

- in “Online Sprinter” - on the “Letters from Tax” tab;

- In Taxi-Docliner - on the "Mail" tab in the "Mailout" section.

You can monitor the status of your application in your “Personal Account” on the “Management” tab.

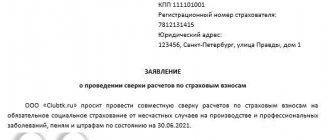

Application for verification with the Social Insurance Fund: how to submit and its sample

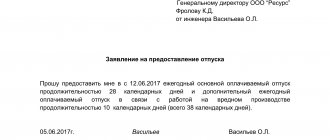

It is important to understand that this kind of document does not have a specific form in law. This means that payers will fill it out on their own. A sample document can be downloaded here ˃˃˃

In order to obtain information from the fund, you need to request the following documents from it:

- A certificate of existing insurance premiums and fines. Here you can see whether the company has an overpayment or debt to the fund;

- The settlement status will tell you about all payments made.

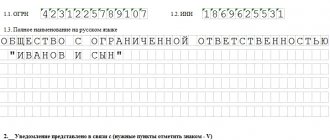

To carry out reconciliations, you must first write an application. Its structure is not provided for by law, but must contain certain columns. In other words, the application for reconciliation with the Social Insurance Fund does not have a specific sample, but it must contain some information:

- Contributions and codes for them must be written down. Otherwise, the verification will be carried out in full on all available contributions;

- the application must also contain information about the payer: full name, tax identification number, checkpoint, registration number, subordination code;

- inside the application the request itself and the requirement for reconciliation are described;

- Such a document must be signed either by the head of the organization or the chief accountant:

Instead of providing information about contributions that need to be verified, you can add an appendix with this information to your application. It is thanks to it that the reconciliation process can be significantly simplified and accelerated.

You need to know that to submit this type of document, the payer must contact the Social Insurance Fund at the location of the organization. You must bring the application in person to the fund’s employees or send it electronically.

How to request information

The tax office for policyholders is the same counterparty as other third-party organizations. Consequently, you will have to reconcile mutual settlements with the Federal Tax Service as often as with business partners. However, sending a reconciliation report to the Federal Tax Service or the Social Insurance Fund (for contributions for injuries) is not enough. To obtain information from state and extra-budgetary bodies, you should act differently:

- Prepare your request in the prescribed form. The current application form for the provision of information about SV is available for download below.

- Submit your request to the Federal Tax Service. It is acceptable to submit the application in person, by mail, or by sending a request through the taxpayer’s personal account.

- Get an answer: a certificate about the status of insurance premium payments (the document form is presented below).

- Conduct an independent data check: compare the indicators of the certificate received and the accounting and reporting data for the reporting period.

- Identified errors in the organization's accounting should be corrected in the prescribed manner. If there are disagreements, you should contact the Federal Tax Service for advice and clarification.

Note that the organization of settlements for the Pension Fund of the Russian Federation is carried out in a similar manner. However, the form of the request to the Pension Fund of the Russian Federation differs from the form sent to the Federal Tax Service.

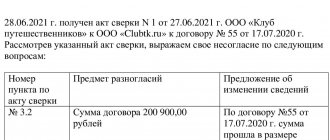

Reconciliation report with the Social Insurance Fund

There is no specific deadline for the transfer of information in the legislation. But if a debt is discovered from a company, the FSS is obliged to notify the payer about it within ten days. The answer is provided in the form of a Reconciliation Report:

This document contains all the information on contributions to the Social Insurance Fund. Fund employees have the right to send the act by mail or hand it over personally to the payer.

Then, when all the information matches the data from the payer and the Social Insurance Fund, the reconciliation is considered completed. If there are differences, the organization faces a lengthy process of rechecking and correcting its data.

When, after receiving a new certificate, can you send reports to the FSS?

It is recommended to send a report to the FSS within 2-3 hours from the moment the certificate is received. This time is necessary to synchronize software settings.

To successfully send a report after registering a certificate:

In "Referent":

Update the Referent settings and make sure that the new certificate is specified in the exchange direction settings.

If the old certificate is specified in the settings:

- Open the menu item “Options” - “Box settings” - “FSS” tab;

- Select the line with the data in the “Exchange Directions” section;

- Click the "Edit" button;

- In the “Personal Certificate” item, click the “…” button and select a new certificate;

- Click “Select” - “Ok”.

In Taxi-Docliner:

Update the Taxcom-Docliner program settings and make sure that the new certificate is specified in the exchange direction settings.

In Online Sprinter:

Settings are updated automatically. To submit a report, log into Online Sprinter using a new certificate, which will be displayed on the main page of the service.

In the 1C-Sprinter program:

Update the settings of the 1C-Sprinter program.

Reasons for drawing up a Reconciliation Report with the Social Insurance Fund

Reconciliation is an important document, because no one is immune from errors. This document will allow you to avoid incorrect information. There are several reasons why fund reconciliation may be necessary. This:

- reorganization or liquidation of the enterprise;

- to identify debt to the fund or overpayment for the return of funds;

- to systematize information;

- Reconciliation is also carried out by organizations that are going to participate in competitions and tenders for licensing.

If a debt is identified, the payer is given the opportunity and a certain period to make payment.

If there is an overpayment, the payer is given a choice. He can apply for payment of this amount. Or you can simply leave the money in the account for further payments of contributions to the fund. It is also possible to request a certain part of the amount of money, then the exact amount must be indicated in the refund application.

If the company’s management does not want to have any problems and troubles with FSS employees, it is best to conduct a reconciliation every quarter. But at the request of the payer, this can be done more often or less often. In any case, the reconciliation must be successful, otherwise you can earn penalties, and considerable ones.

When sending reports to the FSS, the message “The validity period of the certificate for the FSS has expired” appears.

To correct this situation:

- Go to the Subscriber Support Forum in the section “Certificates for EDF with FSS have been updated”;

- Download the archive with FSS certificates;

- Install the F4_FSS_RF_2016_qualified certificate in the “Other users” store:

- open the downloaded certificate;

- click the “Install certificate” button;

- click "Next";

- in the “Place all certificates in the following store” window, select “Other users”;

- Click "Ok" and "Done".

- Install the GUC_FSS_RF_2016 certificate in a similar way in the “Trusted Root Certification Authorities” store;

- Set up 1C-Sprinter for reporting to the Social Insurance Fund.

VLSI is not only tax reporting!

VLSI is a complete functional set of services for business development!

- With the help of VLSI you will be able to carefully analyze your finances and avoid unnecessary attention from government agencies. The system will offer its recommendations to reduce risks and the likelihood of a new inspection.

- Receive in VLSI a calculation of the profitability of your business, as well as detailed financial and economic analysis in a convenient summary, generated in accessible language. Assess the value of your business, dependence on creditors, asset structure and much more. Compare your financial performance with other similar companies.

- Our specialists will answer all your questions, and VLSI technical support specialists will provide round-the-clock assistance.

Free consultation

New scheme of interaction between organizations, Social Insurance Fund and medical institutions

FSS specialists presented a simplified diagram of the new procedure for interactions between the insurer, policyholders and medical institutions.

In general, the chain of events for payment of benefits will look like this:

- The medical institution opens the employee's personal health insurance policy, and information about him immediately goes to the Social Insurance Fund.

- The FSS requests information about the employer from the Pension Fund.

- The Social Insurance Fund sends a notification to the employing organization about the opening of an electronic tax record for the employee. This is advance notice and does not require a response from the organization.

- After the ELN is closed, the FSS, through the EDMS, sends the organization a request for the missing information for payment of benefits - these are proactive payments, the fund itself initiates the payment of benefits.

- Within 3 working days, the organization is obliged to respond to the FSS request - to send information for calculating benefits.

- The Social Insurance Fund pays benefits to the employee.

From January 1, 2022, employers will also have an additional obligation to transmit information about insured persons to their employees. This will need to be done in at least 2 cases:

- when hiring an employee

- in case of changes in information about the employee

The described scheme should be operational from January 1, 2022. But at the moment there are no data exchange formats. 1C, for its part, plans to implement only the most critical changes by January 1, 2022. We will look at what has been implemented now below. As ZUP 3.1 updates with new functionality are released, we will notify you about them in new publications.

A transition period is provided for proactive payments - FSS specialists have announced a deadline until July 1, 2022. This means that from January 1 to June 30 inclusive, it will continue to be possible to send to the FSS the usual registers of direct payments to the FSS (Reporting, certificates - Transfer of information about benefits in the FSS). The only thing you need to take into account is that the period for sending Registers has now been reduced to 3 days.

Where to go for verification

From January 1, 2017, the functions of monitoring the receipt of insurance premiums were transferred to the Federal Tax Service. From 2022, social insurance contributions are transferred to the accounts of the tax service.

Accordingly, an application for reconciliation of settlements with the Federal Tax Service is submitted to the Federal Tax Service at the place of registration of the business entity.

Reconciliation can be initiated by a business entity at any time. As practice shows, it is optimal to conduct reconciliation once a quarter.

Advantages of submitting electronic reporting to the FSS via SbiS

Saving working time

All information is sent from the policyholder’s office at almost any time of the day.

No duplication

Submission of financial statements in electronic form through SBiS does not require duplication of these documents on paper.

Error Control

When generating reports in SBIS, the policyholder is given the opportunity to prepare and generate them in a standard format, with control over the correct completion of the fields of the reporting forms. At the same time, the version of the form being filled out is checked to ensure that it is up to date.

Guarantee of prompt updating of formats for presenting information in electronic form

In case of changes in the forms of accounting statements, other documents or the introduction of new forms of reporting, the policyholder automatically receives new versions of the formats for its presentation in electronic form through the SBS before the deadline for submitting information.

Confirmation of delivery of reports

After sending the information to the control body, the policyholder is guaranteed to receive confirmation of its receipt, which has legal force in controversial situations.

Confidentiality

The system for presenting financial statements in electronic form through SbiS involves protecting the information contained in sent documents from viewing and adjustments.

Increasing the efficiency of information processing, eliminating technical errors

Reports sent to the control body in electronic form via SbiS undergo input control and are posted according to registration numbers.

Types of reconciliations in VLSI

- VAT reconciliation

- allows you to reconcile the data of your invoices with the information of counterparties who generate reports in VLSI.

It can be performed within one report or you can check all your VAT documents at once in the “VAT Reconciliation” service. Penalties for uncorrected discrepancies

— verifies data from reports RSV, SZV-M, SZV-STAZH and SZV-KORR. Checks whether all employees are included in the report, whether everyone has up-to-date personal data, and whether the DAM amounts are calculated correctly. Performed within the DAM report or in the “Employee Reconciliation” service.

- allows you to control whether you have paid all taxes and fines to NI, check the details of employees in the Pension Fund, and also check whether they have rights to benefits and social support. You can generate requests manually or set up automatic reconciliation with the tax office to receive up-to-date information weekly or monthly.

- checks whether the amount of taxes paid is correctly indicated in the report. You can correct errors before submitting the report to NI. This will reduce the likelihood that the government agency will reject the report. Performed within the 6-NDFL report or in the “NDFL Reconciliation” service.

— checks all reports generated in VLSI, including data for previous periods.

How to set up receiving notifications from the FSS in 1C:ZUP 8

To configure the functionality for receiving notifications from the Social Insurance Fund about the need to submit missing documents, you need to go to the “Personnel” menu and select “FSS Notifications.”

In the “Organization” column, you need to indicate the company for which you are setting up to receive notifications. This is done in a situation where the information base is used for several subjects.

In the “Notifications in progress” column, check the box when you need to hide those notifications that have already been processed. They are reflected in the list of notices via a green flag.

To receive a notification from the FSS, use the “Receive from FSS” button.

Through the “Open FSS Notice” button or through the “FSS Notice” document, the user can open a document sent by the fund. First you need to read the text of the notification, and then click the “Confirm receipt” button.

The employer is obliged to confirm receipt of the electronic notice within 1 business day from the date of its receipt. If he does not confirm receipt of the document, then the FSS, within 3 working days from the date of expiration of the confirmation period, will send the same notice to the employer, but only by registered mail.

When the employer confirms receipt of the electronic document, he must send a register with the missing information to the Social Insurance Fund. This must be done within 5 working days in accordance with Government Decree No. 2375 dated December 30, 2020. Upon receipt of the notification, it is indicated that confirmation of its receipt has been sent and how many days are left to provide information at the request of the FSS.

Important! If the employer does not send confirmation to the Social Insurance Fund of receipt of the notice, the fund has the right to disconnect him from the EDMS.

In the document “FSS Notification” in the column “Type, No., from:” the type of document and its details are indicated.

The column “Previously submitted information that requires clarification” contains information about which documents need to be clarified.

When the missing information is prepared and sent in 1C:ZUP 8 (when forming a new register in the FSS), the sent information is automatically indicated in the “Information prepared by notification” section. In addition, the “Notification processed, information sent to the FSS” checkbox is automatically selected.

If you do not need to automatically fill in this information, then the user unchecks the “Detect automatically” checkbox.

To improve the efficiency of users, you can connect convenient services to the 1C: Salary and Personnel Management 8 program:

- 1C-Reporting - for the preparation and submission of regulated reporting from 1C programs to all regulatory authorities: Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, Rosalkogolregulirovanie, Rosprirodnadzor and Federal Customs Service;

- Information system 1C:ITS - for obtaining reference information on maintaining personnel records, calculating wages and working in the program “1C: Salaries and personnel of a government institution 8”. The 1C:ITS information system contains: “Human Resources Directory”, news, comments and advice from specialists on personnel accounting issues, step-by-step instructions on maintaining personnel records and settlements with personnel in 1C programs, drawing up and sending reports to regulatory authorities;

- 1C:DirectBank - for direct exchange of information on salary projects in electronic form with banks. You can generate application files for opening and closing personal accounts, and registers of salaries transferred to employees. In the standard delivery, the formation of such files is provided according to a universal standard that is supported by many banks.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

The direction of exchange with the FSS is connected, but the settings are not loaded

In this situation, check whether your exchange direction is connected to the FSS and whether the settings synchronization period has passed (2-3 hours from the moment you receive the certificate).

If you have connected an exchange direction with the FSS and the regulated period for synchronizing settings after receiving the certificate has passed, please provide information about this situation to us.

To do this, choose any method convenient for you:

- leave a message in the web chat on any page of our website or on the Subscriber support forum;

- by mail;

- by phone (495) 730–73–45.

We will do our best to resolve your issue as quickly as possible.

Submit reports on time and without errors

Go