About legal entities

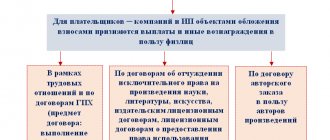

A GPC agreement is an agreement between the contractor and the customer within the framework of the Civil Code, while

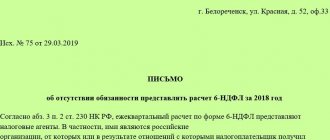

All organizations and individual entrepreneurs paying income to individuals are required to withhold personal income tax from this income,

From July 2022, most companies selling retail and providing services to citizens will have to

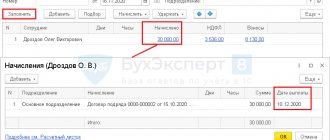

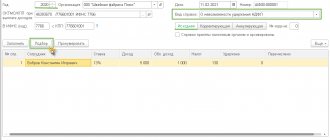

5253 10/04/2021 What is 6-NDFL? How to fill out 6-NDFL correctly? What are the penalties when filling out 6-NDFL?

The essence of balance sheet profit and its calculation Balance sheet profit can be briefly described as profit from

Form 3-F for Rosstat Since 2022, a new form of Form 3-F has been introduced

Why pay insurance premiums Before telling where, who, when and for

Why is the KS-2 form needed? The information from Rosstat indicates what the KS-2 form is and

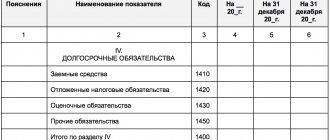

Hello, Vasily Zhdanov is here, in this article we will look at long-term liabilities on the balance sheet. All available

Property deductions have no statute of limitations. In principle, you don’t have to write any further. On this