Content

The Unified State Register contains basic information about an individual (including information about the address, founders, status - is it in the process of liquidation or reorganization, director, types of activities, etc.). Data on individual entrepreneurs is contained in the register of the Federal Tax Service Unified State Register of Individual Entrepreneurs, and on legal entities - in the Unified State Register of Legal Entities. The owner of both documents is the Russian Federation. The Federal Tax Service of the Russian Federation is responsible for their organizational and methodological formation.

It is to this service that a request for information must be sent, since the Unified Register of Taxpayers in the part established by law (and this is the majority, in particular, all of the above) is a public document. Let's talk about this in more detail.

What was approved

According to the law, in a camera room, inspectors have the right to demand that the taxpayer provide, within 5 days, the necessary explanations about the transactions (property) for which tax benefits have been applied, and/or request from them documents confirming their right to such benefits.

From July 1, 2021, explanations can be replaced by an electronic register of supporting documents (Law No. 374-FZ dated November 23, 2020). This right applies to tax returns and calculations for VAT and corporate property tax submitted after July 1, 2021.

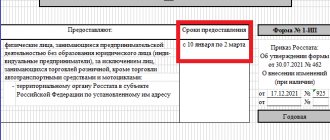

The corresponding forms, procedures for filling out and submitting, as well as electronic formats of registers were approved from July 30, 2022 by the order of the Federal Tax Service dated May 24, 2021 No. ED-7-15/513. Namely:

- two forms of registers - benefits for VAT (KND 1155127) and property tax (KND 1155218);

- procedures for filling each;

- electronic formats for sending to the tax office;

- the procedure for submitting registers (it is common for VAT and property tax).

Everything about tax audits is in the legendary Clerk course. The author, a former employee of the Department for Economic Crimes, tells how to protect yourself and your company during all types of tax audits. Take the course online and receive a Russian IPB certificate.

Procedure for providing data

What needs to be done to obtain the information of interest from the Unified State Register of Real Estate:

- formulate a written request in any form indicating the necessary identifying information about the applicant. It is advisable to indicate the method of receipt: by mail or in person;

- pay a state fee of 200 rubles (in this case, the document will be received in 5 days; you can create an urgent request by paying 400 rubles, then the data will be issued on the next business day). Details for paying state duty can be found on the official website of the Federal Tax Service of the Russian Federation or obtained from specialists of any inspection;

- send a request by mail or courier to any division of the Federal Tax Service. You can also submit an application electronically when using special services, for example, through your personal account on the website.

The data will be provided in the agreed manner in the form of an extract on forms approved by the executive body.

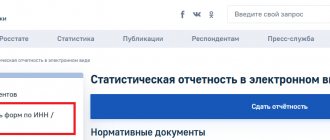

You can receive an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs in the form of an electronic document signed with an electronic signature, free of charge on the tax website in a special service (login through your personal account).

We also recall that since August 2022, the Federal Tax Service of Russia began to publicly publish tax information about companies: such as information on the applied tax regime and the average number of employees. By December, the list of open data will become even larger.

Registry information

Filling out information in the registry begins by adding the code of the operation for which the registry is being created. The required code is selected from the corresponding directory and the following information is indicated:

- serial number of the transaction for the sale of goods (works, services);

- registration number of the customs declaration for the relevant operation;

- the tax base for the relevant transaction, the validity of applying a 0% tax rate for which is documented;

- codes of types of vehicles by which goods were exported (imported) from the territory of the Russian Federation;

- information on transport, shipping and (or) other documents confirming the export (import) of goods outside the Russian Federation: codes of types of documents, their numbers and dates of preparation.

Attention! This information may not be indicated if pipeline transport and power lines are selected “Vehicle type code”

“Note” field indicates other information related to the transaction (for example, the number and date of the agreement (contract) with a foreign partner).

The total tax base for the corresponding transaction is automatically calculated in the final line. This line is generated according to the transaction code and must correspond to the total amount of indicators in lines 020 of section 4 of the VAT tax return for the corresponding operation.

Contour-Focus

The Kontur.Focus system allows the accountant to carry out a preliminary comprehensive check of the counterparty to reduce the risks of withdrawing VAT deductions. In this case, the accountant himself selects a list of criteria (from 1 to 12) to check his potential partners for their reliability.

These criteria include, in particular:

- the fact that the company was recently registered;

- the organization is at the stage of bankruptcy or liquidation;

- its managers include disqualified persons;

- she acts as a defendant/plaintiff in legal disputes involving a large amount;

- a number of enforcement proceedings have been opened against her;

- the company shows no signs of activity;

- has negative financial indicators;

If, as a result of the inspection, it turns out that the company received a negative assessment according to several criteria at once, then the inspection organization will always have the opportunity to refuse to enter into questionable contracts.

Another advantage of the resource is the ability to track the dynamics of assessment according to all specified criteria for the most important parameters.

You can also automate the reconciliation of data on issued and received invoices through the “Kontur.Sverka” system. This system monitors that the documents do not contain errors in details, discrepancies in amounts, dates and numbers of issued invoices. But in order to use the “Kontur.Sverka” service, both counterparties must be registered in the system, which is not always possible to achieve.

Thus, checking an organization to determine whether it transfers VAT to the budget is not the direct responsibility of taxpayers. But it is required in order to avoid possible losses associated with the refusal to accept VAT for deduction. The range of available resources for preliminary verification of a counterparty is limited for an organization and none of them can guarantee the fact that the supplier will transfer the VAT received from the buyer to the budget.

Dear readers, the information in this article may be out of date. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free!

How to find out the necessary information from a counterparty

To obtain information about a partner, to clarify whether the counterparty pays contributions to the budget, or is a bona fide taxpayer, use services or request all the necessary information directly from the counterparty - an organization or an individual entrepreneur.

The request may cause difficulties for the counterparty, since there is no established form of document confirming payment of the fee. Enterprises and individual entrepreneurs can request such papers using the simplified tax system - copies of the latest VAT return, registration data, and the taxation system used.

These documents show tax status, but not all individuals provide detailed information. For example, almost no one will give a customer a copy of a sales book. The information is provided by the counterparty voluntarily with his consent; it cannot be required.

Unified register of Russian programs, how to get there, why and what does VAT have to do with it

Let's start with the question “why, and what does VAT have to do with it?”

As many have probably heard, from January 1, 2022, in Russia the so-called "tax maneuver" As a result of this maneuver, the software is subject to a value added tax of 20%. The exception is software included in the Unified Register of Russian Programs for Electronic Computers and Databases.

VAT is collected at all stages of the supply chain of a separate non-exclusive license to use the software from the original licensor to the final licensee. With an important caveat: if the participant in this chain is a VAT payer.

The majority of software developers reading this article, most likely, like me, are not payers of income tax due to the use of a simplified or patent tax system, or even registered as newfangled self-employed citizens. But there is one important nuance that concerns us: our software is not sold directly to the end user, but through marketplaces, for example, Infostart. And marketplaces, being rather large organizations, apply a general taxation system and pay VAT. This is where it appears, they are forced to either add 20% to your price, so that you receive the same amount as before, or deduct 20% for VAT, so that the end user pays the same as before before these maneuvers .

Our users for the most part are also not VAT payers. It turns out to be a very sad story, VAT simply increases the cost of software by 20% without the possibility of presenting it for offset. With the “why” question sorted out, let’s move on to the “how” question.

It's actually not difficult. First, test yourself by answering simple questions:

- Who is the copyright holder?

- What is the form of the copyright holder (private person, individual entrepreneur or legal entity)?

- For a physicist/IP - what citizenship? We need something Russian.

- For a Russian legal entity it is more difficult. It is necessary to answer the question who are its beneficiaries (founders, shareholders) and what their citizenship status is. We need something Russian. A foreign legal entity will not be able to enter its software into the register.

We've sorted out citizenship, now let's sort out the software. You need to prepare the following:

- A copy of the software without technical means of copyright protection or with means of legally eliminating restrictions on the use of software established through the use of technical means of copyright protection. This is the distribution kit + security PIN codes, if any, demo logins/passwords, if you need to log in somewhere, etc.

- Documentation containing a description of the functional characteristics of the software and information necessary to install and operate the software. If you don't have user documentation, get some. I did everything on DokuWiki, not for the registry, but for real users. To submit an application to the registry, all I had to do was export it to PDF to attach the document to the application. And the root page of the documentation fit perfectly into the statement column “Website of the copyright holder with description.”

- Documentation containing a description of the processes that ensure the maintenance of the software life cycle, including troubleshooting problems identified during the operation of the software, improving the software, as well as information about the personnel required to provide such support. This is what caused me some difficulties. I have attached the result to this article. If you don’t have this, download it, change the name of the copyright holder and product - it’s already happened a couple of times, it should work for you too.

- Installation instructions for expert verification purposes. According to the regulations, before the expert council votes on whether or not to allow you into the register, it must be examined. Here you need to describe how an expert can install your software and how to enter a pin, login, password, etc. I understand that many people install software on top of the 1C platform. Just in case, write in these instructions where to get the free version of the training platform and how to install it. I don't know whether they will install your software or just look at the documentation. My software was cloud-based and the account submitted for examination was twitching once. They didn’t do anything, they came in, looked, and left.

- Information on the grounds for the copyright holder to have an exclusive right to software throughout the world and for the entire period of validity of the exclusive right. Further we will talk only about our own development. If you registered the rights to a computer program with the Federal Service for Intellectual Property, it will be enough to attach a certificate of state registration of the right; it is not necessary, but this is generally the best option. In my case, there was no such certificate, it would take a long time to do (I did 6 months for other software, I submitted the application through State Services), so I attached the internal documents of the organization: - Order to start the project - Order to put into operation the intangible asset - Intangible asset card-1

Next, we will need a qualified electronic signature and a verified account on the State Services portal (and if you have a CEP, then verifying your account on State Services is not a problem). Go here https://reestr.digital.gov.ru, click “Personal Account” at the top, log in through the State Services portal, open the “My Applications” tab, click “Submit an Application” and start filling out

Software Name and Previous and/or Alternative Software Names - This is where it is important to list all names. You need to submit the name of the product both in the marketplace and in the agreements between you and the marketplace, they may differ slightly, the registry must contain all the names down to the symbol.

The main class of software to which the software corresponds, the Class (classes) of software to which the software corresponds and the Product Code(s) in accordance with the All-Russian Classifier of Products by Type of Economic Activity. Choose according to meaning. If in doubt, rummage through the registry and look for products similar to yours.

Next, fill out information about the copyright holder, there’s nothing complicated there. Please note that there is no “individual entrepreneur” option; if you are an individual entrepreneur, you need to select “citizen of the Russian Federation”.

Fill in information about beneficiaries. In the case of an LLC, these are the founders.

At the last step, attach all prepared documents, fill out the fields, download the application, open it in Acrobat Reader, add your digital signature and upload it back. Done, you can send.

If, according to formal criteria, everything is filled out correctly, the application will hang in the “New” status for a long time. If something is completely wrong, the robot will respond quickly, literally within 24 hours. After the robot is finished, it must be checked by a human expert. More than a month passed before my application changed its status to “Verification of application”, then another 3 days went into the statuses “Application registered” and “Application posted on the website”. Then another 2 weeks until “A responsible expert has been appointed” (but it should be noted that there were New Year holidays) and “Submitted for examination.” It took another month for the examination, a couple of weeks to eliminate the examination’s comments, and another couple of weeks for “Preparing the vote” and “Voting”.

And now “Cloud TSD”, published here on Infostart, entered the register: https://reestr.digital.gov.ru/reestr/310561/

We are writing a happy letter to the marketplace manager indicated in your profile and asking you to note that the development is included in the Unified Register of Russian Programs for Electronic Computers and Databases and there is no longer a need to charge 20% VAT on its sales.

Write questions in the comments, I will try to answer them all.

Why do you need to check?

Before cooperating with a new counterparty, you need to check its reliability. First of all, you need to make sure that the potential partner is not a fly-by-night company. It is important to confirm that the counterparty pays taxes correctly.

The law does not oblige the company to carry out verification. This is the right of every company, not an obligation. However, it must be taken into account that the invoice provided by the supplier is invalid if he is deprived of a taxpayer certificate. That is, it will not be possible to receive a deduction for input VAT. Therefore, the company will have a loss.

The law does not provide for any liability for a company that has entered into an agreement with an unscrupulous taxpayer. There are no sanctions imposed on her. However, in practice, the firm has responsibilities. In particular, these are the following negative consequences:

- Deprivation of the right to deduct input tax.

- Special attention from the Federal Tax Service.

- The need to prove your case in court if the company does not agree with the Federal Tax Service.

That is, the company has reasons to exercise caution.

Self-check of VAT payer

There are some ways to find out whether an organization is a VAT payer on its own. There are criteria that you pay attention to when choosing a partner company.

It is necessary to clarify the correctness of the details in the invoice and establish the veracity of the registration information. It is checked whether the person is included in the register of companies or individual entrepreneurs with VAT, whether the organization is included in the list of those subject to liquidation, whether the management of the legal entity has been disqualified. You should check which taxation system is applied.

Signs of a one-day existence of an organization, the presence of delays in paying taxes and other payments are a negative sign, and it is advisable to refuse to work with such a company.

The necessary information can be obtained using the Federal Tax Service service. There are other services that allow you to check the reliability of your counterparty. A service with information on state registration of legal entities and individual entrepreneurs is used.

The invoice is also checked by entering the TIN and KPP data. In the register of disqualified persons, based on the legal entity and full name, you can determine whether the person is a manager of the company.

To identify whether a legal entity has debts, a service with a database of legal entities by debt is used. This is how it is determined whether the counterparty has a debt to the fiscal authorities. If the answer is yes, there is a high probability of developing a problem with deductions.