How to submit a register

The register is submitted electronically within five working days from the date of receipt of the request for explanations.

The form of the register of documents confirming the taxpayer’s right to VAT benefits was approved by Order of the Federal Tax Service of Russia dated May 24, 2021 No. ED-7-15 / [email protected] The procedure for filling it out and the Electronic submission format are given in Appendices No. 3, 5 to this Order .

Having received explanations in the form of such a register, the inspection will determine the volume of documents that will be required from you using an algorithm. Based on this register, the Federal Tax Service selectively requests the necessary supporting documents (clause 6 of article 6.1, clause 6 of article 88 of the Tax Code of the Russian Federation).

Questions and answers – SPS ConsultantPlus information bank, containing answers from government agencies and independent experts to private questions from taxpayers.

Unified register forms for confirming tax benefits from 07/01/2021

Presentation Formats

of these registers are given in Appendices 5 and 6, respectively.

And Appendix 7 provides the procedure for submitting registers to the Federal Tax Service in electronic form.

Before the publication of letter No. EA-4-15/ [email protected], the tax service had already recommended (letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589) the form and format for submitting the register of documents for VAT benefits, which applies from 11/23 .2020. This register was developed in order to improve the quality of VAT administration within the framework of a risk-based approach when conducting a desk tax audit of a VAT tax return, which reflects transactions that are not subject to taxation (exempt from taxation) VAT (clauses 2 and 3 of Article 149 of the Tax Code RF) and falling under the concept of “tax benefit” (clause 1 of Article 56 of the Tax Code of the Russian Federation). The register is still submitted only in electronic form.

VAT document register form

The new register form contains 10 columns. But compared to the form used before 07/01/2021, the names of individual columns (2, 3, 7) have been slightly adjusted.

In the header of the new register form, in addition to the tax period code, reporting year and adjustment number, you will need to indicate information about the taxpayer (TIN, KPP, name (full name). If the register is submitted by the successor organization for the reorganized organization, in the “name” field it will be necessary to indicate the name of the reorganized organization, TIN/KPP (before reorganization) and code of the form of reorganization or liquidation:

1 - transformation;

2 —

merger;

3

- separation;

5

— accession;

6

— division with simultaneous accession;

0

- liquidation.

The codes are given in the appendix to the procedure for filling out the register of documents.

Form of register of documents on property tax

Now the register of documents confirming the validity of property tax benefits has been added to the register of documents on VAT benefits.

The structure and procedure for filling out the header of the register is similar to the structure of the header of the register of documents confirming the VAT benefit described above.

In the register of documents confirming property tax benefits, column 5. The first two columns:

- tax benefit code (column 1);

- information about the real estate property in respect of which a tax benefit for the corporate property tax has been declared (column 2).

Three more columns are intended to reflect the details of documents confirming the taxpayer’s right to tax benefits:

- name of the document (column 3);

- number (group 4);

- date (column 5).

In relation to real estate, the tax base for which is calculated as the average annual cost

, in column 2 you will need to indicate:

- cadastral number specified in the Unified State Register of Real Estate (USRN) (if available);

- conditional number specified in the Unified State Register (in the event that the object does not have a cadastral number indicated in the Unified State Register, and if there is a conditional number specified in the Unified State Register);

- inventory number (in the absence of cadastral and conditional numbers specified in the Unified State Register of Real Estate and the presence of an inventory number);

- identification number (vessel registration number assigned by the International Maritime Organization, registration number of a classification society) assigned to a sea-going vessel, inland navigation vessel (if such numbers are available) - in case of filling out the column in relation to a water vehicle;

- serial (identification) number of the aircraft - in case of filling out the column in relation to the aircraft.

If column 2 is filled out in relation to a real estate property, the tax base for which is calculated as the cadastral value

, the cadastral number specified in the Unified State Register is indicated.

The procedure for filling out the register of documents

The procedure for filling out the register is given in Appendix No. 3 to the Order of the Federal Tax Service of Russia dated May 24, 2021 No. ED-7-15 / [email protected]

First of all, fill in the lines “Tax period (code)”, “Reporting year”. They transfer the values of similar fields on the title page of the VAT declaration, to which explanations are submitted in the form of a register (items “a”, “b” of the Procedure for filling out the register of documents).

In the line “Adjustment number” are placed (clause “c” of the Procedure for filling out the register of documents):

- “0” - if you fill out the register for the primary VAT return;

- serial number of the adjustment, for example “1” - if it is filled out for the updated declaration.

In the line “Taxpayer” it is indicated (clause “d” of the Procedure for filling out the register of documents):

- if a Russian organization - TIN, KPP and name of the organization;

- if a foreign organization - INN, KPP and the name of the organization or its representative office (branch), other separate division through which it operates in the Russian Federation;

- if individual entrepreneur - TIN, last name, first name and patronymic (if available).

The line “File name of the request for explanations” contains the name of the electronic file (without extension), in connection with the receipt of which the register is provided (clause “h” of the Procedure for filling out the register of documents).

Typical situations in SPS ConsultantPlus will allow an accountant to quickly resolve issues that he encounters on a daily basis.

Registers of customs declarations

Starting from the fourth quarter of 2015, instead of transport and shipping documents, exporters can submit their electronic registers to the tax inspectorates. The forms, formats and procedure for compiling such registers are approved by Order of the Federal Tax Service of Russia dated September 30, 2015 No. MMV-7-15/427 (hereinafter referred to as the Order) (Part 4 of Article 3 of Federal Law dated December 29, 2014 No. 452-FZ).

“Electronic” registers do not replace all documents that must be submitted to confirm the application of the zero VAT rate. In particular, a contract with a foreign company for the supply of goods must be submitted on paper (Clause 19, Article 165 of the Tax Code of the Russian Federation).

In addition, during a desk audit, the tax inspectorate has the right to request transportation documents, information from which is included in the registers. And also request the necessary documents if the information on export operations received from customs authorities does not correspond to the data contained in the “electronic” registers. Documents will need to be submitted within 20 calendar days after receiving the request. They must have Russian customs marks (clauses 15–18 of Article 165 of the Tax Code of the Russian Federation). If the exporter has not fulfilled the inspection requirement (in whole or in part), the justification for applying a 0 percent tax rate in the relevant part is considered unconfirmed.

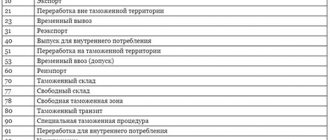

At the moment, 14 registers have been approved, depending on the type of export transactions performed (clause 15 of article 165 of the Tax Code of the Russian Federation, clause 1 of the Order). Each register is “linked” to the corresponding subparagraph or paragraph of Article 165 of the Tax Code of the Russian Federation, as one of the documents confirming the right to apply the zero VAT rate.

The “electronic” register must contain information about the size of the tax base to which the zero VAT rate applies. The tax base is determined for each transaction, confirmed by documents, the details of which are reflected in the register.

How the successor of a reorganized organization fills out the register

- The legal successor of the reorganized organization, when submitting explanations on preferential transactions, also fills out the following lines in the register (clauses “f”, “g” of the Procedure for filling out the register of documents):

- “Form of reorganization (liquidation) (code)” - indicate the code from the Appendix to the Procedure for filling out the register of documents;

- “TIN/KPP of the reorganized organization” - reflects the TIN and KPP of the reorganized legal entity, which were assigned by the inspectorate at its location or at the place of registration as the largest taxpayer before its reorganization.

At the top in the “Taxpayer” line, the legal successor provides his TIN and KPP, and then indicates the name of the reorganized legal entity (clause “d” of the Procedure for filling out the register of documents).

When filling out the table, the basic principle is this: documents confirming benefits are listed, they are grouped first by their transaction codes, then by type of transaction, and then by counterparty.

The table (items “and” - “y” of the Procedure for filling out the register of documents) indicates:

- in column 1 - the operation code, which is reflected in section. 7 VAT returns;

- in column 2 - the type of operation within the operation code;

- in column 3 for each type of transaction specified in column 2 - the total amount of revenue for the quarter;

Revenue for each type of operation within one code is added up and the total amount is indicated in column 3 in the line “Total by code”. The amount “Total by code” must coincide with the amount for the same code in section. 7 VAT returns;

- in columns 4, , - name (or last name, first name and patronymic, if available), INN and KPP of the counterparty (if the counterparty is an individual, column 5 may not be filled in, the data in column 6 will be missing);

- in columns 7, , - the type of document confirming the benefit (agreement, payment order, etc.), its number and date;

- in column 10 - the cost of goods, works, services sold for each counterparty (for several counterparties, if the contract is standard), as well as their total cost for each transaction code (indicate the total cost in the “Total by code” line in column 10).

Sample of filling out the register of documents confirming VAT benefits.

Unique analytical materials of SPS ConsultantPlus will help you when difficult situations arise.

Register No. 5

Registry form No. 5 is given in Appendix No. 5 to the Order. Here is the tabular part of the register:

| N p/p | Registration number of the customs declaration (full customs declaration) | Tax base for the corresponding transaction for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented (in rubles and kopecks) | Code of the type of vehicle by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation | Transport, shipping and (or) other document confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation | Note | ||

| Document type | Number | date | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Section VI of Appendix No. 15 to the Order is devoted to filling out register No. 5. The following information is indicated in register columns No. 5:

- in column 1 - the serial number of the corresponding operation for the sale of goods (works, services);

- in column 2 - registration number of the customs declaration (full customs declaration) for the corresponding operation for the sale of goods (work, services);

- in column 3 - the tax base for the sale of goods (work, services), the validity of applying a tax rate of 0 percent for VAT for which is documented;

- in column 4 - codes of types of vehicles by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation;

- in column 5 - types of transport, shipping or other documents (CMR, bill of lading, railway waybill, air waybill, TIR Carnet, shipping order, sea waybill, other document) confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation for the corresponding sale goods (works, services);

- in column 6 - the numbers of the documents indicated in column 5. If the number is missing, “b/n” is indicated;

- in column 7 - the dates of the documents indicated in column 5;

- in column 8 - other information related to the transaction, the details of the documents for which are reflected in register line No. 5. This is the type, number and date of the document submitted simultaneously with the VAT return, with the exception of the documents specified in columns 2, 5 - 7 For example, agreement (contract) No. 5-VAM-1991 dated May 21, 2015. If several documents are indicated, column 8 reflects the type, number and date of each document, separated by the sign “;”.

How to fill out Section 7 of the VAT return and the register of supporting documents

The organization has exercised the exclusive right to a computer program. How can I reflect this transaction, which is not subject to VAT, in “1C: Accounting 8” edition 3.0, so that Section 7 of the VAT return and the register of supporting documents are automatically filled in?

The video was made in the program “1C: Accounting 8” version 3.0.51.22.

Taxpayers who apply VAT benefits have the right, along with the declaration (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ), to submit a register of supporting documents in the recommended form (letter of the Federal Tax Service of Russia dated January 26, 2017 No. ED -4-15/ [email protected] ).

Starting from version 3.0.51, 1C:Accounting 8 provides automatic completion of Section 7 of the declaration and the register of supporting documents for organizations that maintain separate VAT accounting by accounting methods. To do this, go to the VAT

forms

Taxes and reports

(section

Main - Settings

) you need to set the flags

Separate accounting of incoming VAT

and

Separate accounting of VAT by accounting methods is

.

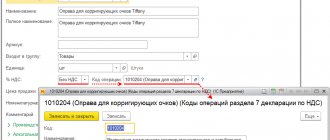

To store transaction codes used to fill out Section 7 of the VAT return, as well as to fill out the register of documents confirming VAT benefits, the reference book Transaction codes of Section 7 of the VAT return

. When creating a new directory element, the operation code can be selected from the classifier.

The directory is available both from the contract card and from the item card ( operation code

).

Transaction code field

can be filled out from the form of the directory element

Contracts

(from the collapsible

VAT

), if only VAT-free transactions are reflected under the contract with the buyer.

Otherwise, the Transaction Code

must be filled out from the

Nomenclature

- for those items that are sold at the rate

Without VAT.

When filling out the Transaction code

Operation codes of Section 7 of the VAT Declaration

opens , where you need to put the following flags for the corresponding code:

- The operation is not subject to taxation (Article 149 of the Tax Code of the Russian Federation)

- if this operation is not subject to taxation (exempt from taxation) in accordance with Article 149 of the Tax Code of the Russian Federation. In this case, when filling out Section 7 of the declaration, indicators will be generated in columns 3 and 4 (clause 44.2 of the Procedure for filling out a VAT declaration, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ); - Included in the register of supporting documents

- if a transaction that is not subject to taxation (exempt from taxation) falls under the concept of a tax benefit (clauses 2, 3 of Article 149 of the Tax Code of the Russian Federation, clause 1 of Article 56 of the Tax Code of the Russian Federation, clause 14 of the Resolution of the Plenum Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33) and is included in the register of supporting documents.

In this case, you additionally need to indicate the value of the Type of non-taxable transaction

to fill out column 2

Type (group, direction) of the non-taxable transaction

of the register.

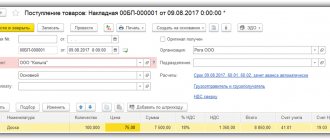

To reflect transactions in Section 7 of the VAT return, the document Formation of entries in Section 7 of the VAT return

(section

Operations - Regular VAT operations

)

.

The document should be generated after completing the regulatory operation

VAT Distribution

.

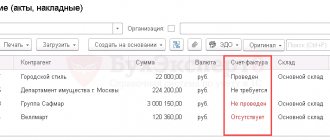

To create a register of documents confirming the VAT tax benefit, the Register report is intended for section 7 of the declaration

(section

Reports - VAT

).

The register is filled in automatically by clicking the Create

.

By clicking the Print

, you can print the register for sending to the tax authority. The electronic format for the register of supporting documents is not currently approved.

Explanations on preferential transactions carried out

If the Federal Tax Service's request concerns data on the preferences used, the explanations should be prepared in the form of a list of documents certifying the right to apply the VAT benefit. There is no need to attach documentary evidence at this stage, since later the Federal Tax Service will request a specific list of documents generated on the basis of the assigned risk level according to the reconciliation of the ASK VAT-2 RMS.

A similar algorithm of actions is enshrined in the letter of the Federal Tax Service dated January 26, 2017 No. ED-4-15 / [email protected] , and the form of the register of documents is in Appendix No. to this letter. Submitting the register not in the approved form (or failing to submit it at all) threatens the company with requiring documents confirming the use of the benefit in full, but taking into account the reconciliation with the ASK VAT-2 RMS, the request for documentation for confirmation will be significantly less. The completed registry form looks like this:

Explanations on the VAT return to the tax office about errors made in the report are grouped by their category codes (Letter of the Federal Tax Service of Russia dated December 3, 2018 No. ED-4-15 / [email protected] ):

- 0000000001 - discrepancies with partners’ reports;

- 0000000002 - discrepancy between the data of the 8th and 9th sections of the declaration;

- 0000000003 - inconsistency of information in sections 10 and 11;

- 0000000004 — error in a certain column of the report (indicating the column number in brackets);

- 0000000005 - error in specifying the invoice date (IF) in sections 8-12;

- 0000000006 - exceeding the three-year period for tax refund (date);

- 0000000007 - the date of the Federation Council for which the VAT refund was claimed is earlier than the date of state registration of the taxpayer;

- 0000000008 - incorrect transaction code in sections 8-12 (the list of codes is presented in the Federal Tax Service order dated March 14, 2016 No. ММВ-7-3/ [email protected] );

- 0000000009 - incorrect recording of cancellation entries in section 9.

If the Federal Tax Service's request contains a specific error code, then the responsible person must re-check the declaration in part:

- reliability of data obtained from source and primary documents;

- calculations, including amounts of accrued tax at applicable rates;

- correct reflection of information of interest to tax authorities (dates, amounts, Federation Council No., etc.).

Depending on the result of the internal audit, the company takes the following actions:

| In the explanation for the Federal Tax Service, you will have to explain the reason for the detected discrepancies, where to indicate that there are no errors in the report, but there are grounds that allow not to consider the identified discrepancies as an error, according to the Rules, enshrined in the letter of the Federal Tax Service dated December 3, 2018 No. ED-4-15 / [email protected] |

| You can imagine: a) explanations with corrected data; b) an updated declaration; c) at the same time clarification and “clarification”. Any option in this case is acceptable. |

| It is necessary to prepare and submit an updated declaration, accordingly paying additionally the resulting VAT arrears. |

For example, in response to the Federal Tax Service Inspectorate’s request for clarification on identified inconsistencies between the company’s SF data and information about the SF in the sales book (code 0000000001), the explanation for the VAT return (sample) may be as follows: